Macro Theme:

Key dates ahead:

- 11/14: PPI

- 11/19: NVDA ER

SG Summary:

UPDATE 11/7: We hate being alarmists after a 3% drop, but suddenly there is a sneaky bid to vol, and we see nothing but negative gamma for ±50-100 handles. The difference today is that we suddenly see some non-0DTE put buying, and that has largely been absent the last several days. For this reason we are now quite cautious, as this feels like a place wherein things could get “crashy”.

10/31: Yesterday’s meager 1% decline started to ease the “risk alert” positioning we flagged on 10/29, with call skews shifting to “rich” vs “screaming overbought”. Thats good news for bulls, as we think there is less spasm risk (a la 10/10). On the flip side, we are not seeing any obvious long opportunities, either. Bottom line: We hold the VIX call spread hedges we bought earlier this week, but with a close back >6.900 we’re back into a risk-on stance.

10/29: RISK ALERT – COR1M and the over-bid Index calls have us quite nervous at these levels. Given that we are going to be rolling up call positions, and adding to downside protection. The trick is maintaining long exposure while legging into some ~1-month protection. We will look to get more aggressive if/when downside starts to flare.

Key SG levels for the SPX are:

- Resistance: 6,800, 6,900

- Pivot: 6,900 (bearish <, bullish >)

- Support: 6,700, 6,600

Founder’s Note:

Futures are off 15 bps with no major news on the tape for today. NFP was scheduled for today but we understand that its canceled due to the shutdown.

With futures again lower here, we see the SPX decline at ~3% vs 10/29 highs, and quite frankly it feels a lot uglier than that. That 3% is the same decline that we saw into 10/10, but this has definitely been a lot less violet – so far. We hate being alarmists after a 3% drop, but suddenly there is a sneaky bid to vol, and we see nothing but negative gamma for ±50-100 handles. The difference today is that we suddenly see some non-0DTE put buying, and that has largely been absent the last several days. For this reason we are now quite cautious, as this feels like a place wherein things could get “crashy”.

It seems we’ll need some concrete news (i.e. “shutdown over”) or an OPEX to clear out what ails the S&P. OPEX is not for another 2 weeks…

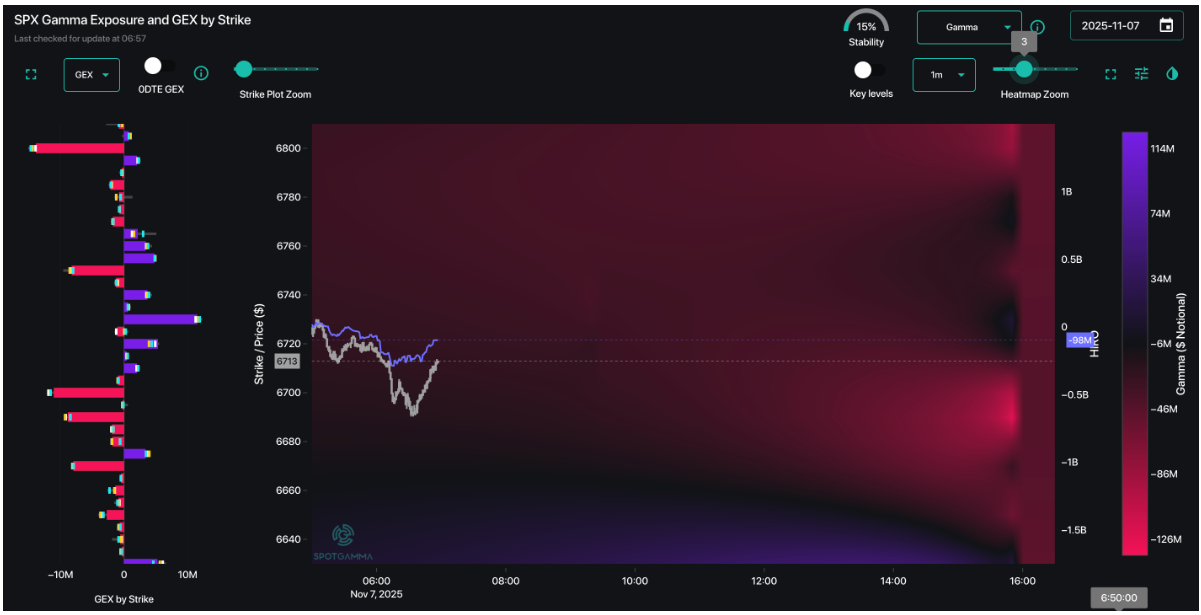

Zooming in, you can see SPX gamma is negative (red) all around current levels, with yesterday’s implied support near 6,700 having faded to 6,600. There is no material positive gamma from non-0DTE contracts at any SPX level (both higher and lower).

The 0DTE crew seems to have layered in some 6,600 area short puts, giving dealers positive gamma into 6,600, but that faces off against large non-0DTE long puts from 6,650 – 6,700 (dealers short/negative gamma). The end result of this is that 6,700 is a very unstable price floor, and we don’t believe much in 6,600 as a floor past today given its primarily 0DTE.

Watching HIRO remains critical for live reads on flow. With negative/positive HIRO ‘s downside/upside has the edge.

As mentioned at the top, while VIX is still holding 20, we are starting to notice a bid for tails here, and that is a departure vs recent sessions. Here is day-over-day 11/21 SPX skew, with that put wing widening out vs ATM.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESZ25 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6745.84 |

$6720 |

$670 |

$25130 |

$611 |

$2418 |

$240 |

|

SG Gamma Index™: |

|

-0.66 |

-0.438 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.65% |

0.65% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.39% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6795.84 |

$6770 |

$674 |

$25310 |

$619 |

$2440 |

$243 |

|

Absolute Gamma Strike: |

$6025.84 |

$6000 |

$670 |

$24500 |

$600 |

$2450 |

$240 |

|

Call Wall: |

$7025.84 |

$7000 |

$680 |

$24600 |

$650 |

$2445 |

$250 |

|

Put Wall: |

$6725.84 |

$6700 |

$670 |

$25000 |

$600 |

$2400 |

$240 |

|

Zero Gamma Level: |

$6756.84 |

$6731 |

$674 |

$25255 |

$624 |

$2486 |

$249 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [6000, 6800, 6700, 7000] |

|

SPY Levels: [670, 640, 660, 675] |

|

NDX Levels: [24500, 24600, 25000, 25500] |

|

QQQ Levels: [600, 610, 615, 620] |

|

SPX Combos: [(7050,89.96), (7023,70.41), (7016,75.07), (7003,99.30), (6976,82.21), (6969,77.26), (6949,95.19), (6922,88.11), (6915,68.30), (6902,98.46), (6888,74.22), (6882,86.91), (6875,83.13), (6868,75.56), (6848,95.01), (6828,92.05), (6821,83.11), (6801,93.96), (6747,81.90), (6727,91.83), (6720,91.65), (6707,92.06), (6700,96.44), (6693,74.09), (6687,93.40), (6680,80.99), (6673,92.95), (6667,82.19), (6660,85.20), (6653,94.85), (6646,79.97), (6640,77.99), (6633,83.46), (6626,79.51), (6620,88.03), (6613,79.76), (6599,92.27), (6593,71.13), (6586,72.52), (6572,77.26), (6552,81.44), (6525,67.91), (6519,81.29), (6499,94.88), (6472,80.67), (6465,76.92), (6452,78.49), (6425,68.58), (6418,78.35), (6398,91.14)] |

|

SPY Combos: [697.82, 687.66, 693.08, 682.92] |

|

NDX Combos: [24653, 25055, 24250, 24602] |

|

QQQ Combos: [620.27, 598.45, 640.22, 615.29] |

0 comentarios