Macro Theme:

Key dates ahead:

- 9/11: CPI

- 9/17: VIX Exp, FOMC

- 9/19: OPEX

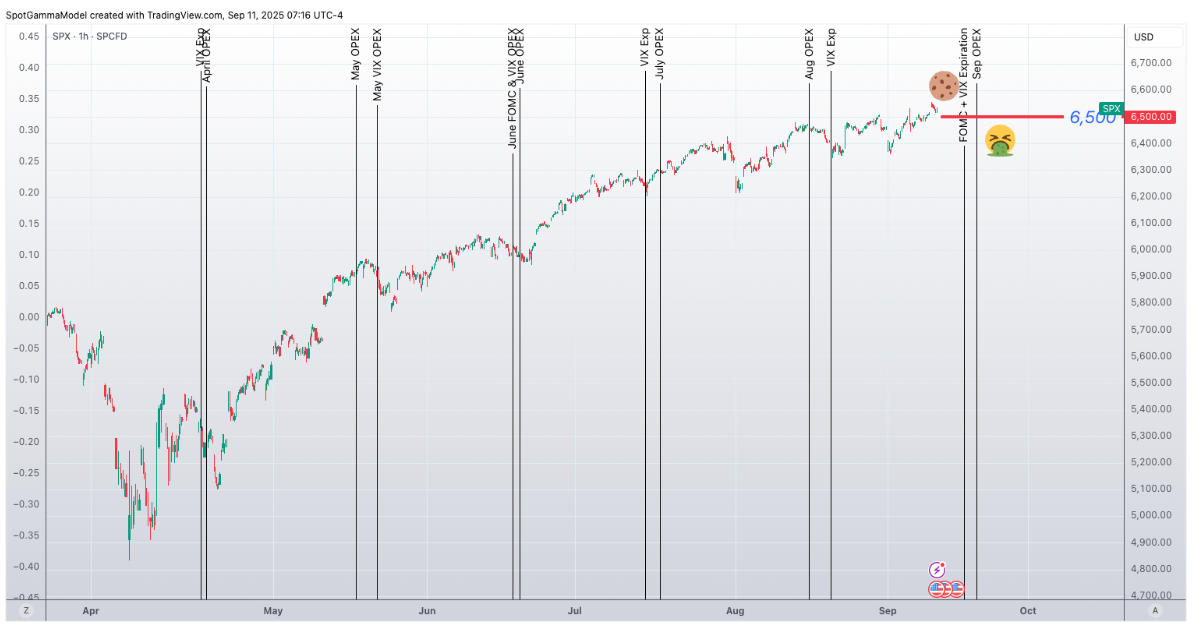

Update: 9/11: Our key pivot is now 6,500. While SPX is >6,500, we favor of test of 6,600 into 9/17. <6,500, pre or post 9/17, we will flip to risk off.

9/3: We move back to a bullish stance if the SPX is >6,400, and look to enter calls in SPY/QQQ/IWM playing for >=2% upside into Sep 19th OPEX as a way to express upside. Should the SPX break back below 6,400, we would look to short stocks, with a target area of 6,300. Additionally, we like rolling wide OTM put flies in the SPX, as they can be structured for quite cheap.

Key SG levels for the SPX are:

- Resistance: 6,550, 6,578, 6,600

- Pivot: 6,500 (bearish <, bullish >)

- Support: 6,500, 6,400

Founder’s Note:

Futures are up 20bps ahead of 8:30 AM ET CPI. Major support remains at 6,500, with light positive gamma all the way up through 6,580. First resistance is 6,552, then 6,578, with major resistance is at the 6,600

Call Wall.

The 0DTE straddle check for today is 33/50 bps (ref 6,545 IV19.6%) vs ~30-35 bps for the last 2 days. If this is indeed a hugely important CPI that is not being reflected in 0DTE options pricing.

We touched last night on a lot of bearish flags that went up through yesterday’s session: longer dated index put buying, a huge intraday equity delta fade, and a slight bid to IV’s in the face of fresh SPX ATH’s.

Assuming CPI is a non-event, then the 0DTE dynamic which has been so supportive of this market should continue in through next Wednesday.

As long as the SPX maintains 6,500, then we should favor the SPX landing near 6,600 by Tuesday night (go get the cookie), although 6,600 is certainly achievable into Friday PM. However, if at any point we break <6,500 (pre-post 9/17) then we see sharp downside, and quite frankly there is a gamma-based hole all the way through to 6,100. I am not saying that a break of 6,500 brings a test of 6,100, more that we quite frankly see no obvious support below, and 6,100 would be an exhaustion point.

What drives the emoji-chart above? This is SPX GEX for today (purple line) and ex-0DTE options (dashed). You can see that without the 0DTE positions, gamma now flips negative <6,500, and doesn’t trough until ~6,100. A few sessions ago this non-0DTE flip point was <6400, then 6,450. So – support is decaying below. That support is historically driven by put sellers of the non-0DTE variety. With the rise of 0DTE, and the quite low IV, we see no >=1 week put sellers sticking their necks out.

If/when markets are calm, those 0DTE folks generally show up to play again. If we are served up with some type of “known unknown”/risk event, then 0DTE flow fades, as should support.

|

| /ESU25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6538.56 | $6532 | $652 | $23849 | $580 | $2378 | $236 |

| SG Gamma Index™: |

| 2.232 | -0.153 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.59% | 0.59% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.76% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6501.56 | $6495 | $649 | $23720 | $579 | $2370 | $234 |

| Absolute Gamma Strike: | $6506.56 | $6500 | $650 | $23725 | $580 | $2300 | $235 |

| Call Wall: | $6606.56 | $6600 | $655 | $23725 | $585 | $2500 | $240 |

| Put Wall: | $6306.56 | $6300 | $640 | $23450 | $560 | $2330 | $225 |

| Zero Gamma Level: | $6451.56 | $6445 | $651 | $23610 | $579 | $2372 | $236 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.249 | 0.886 | 1.317 | 0.905 | 0.890 | 0.870 |

| Gamma Notional (MM): | $816.621M | ‑$8.948M | $12.589M | ‑$26.83M | ‑$7.872M | ‑$64.248M |

| 25 Delta Risk Reversal: | -0.048 | -0.044 | -0.056 | -0.045 | -0.031 | -0.028 |

| Call Volume: | 565.874K | 1.216M | 9.939K | 653.794K | 15.639K | 287.355K |

| Put Volume: | 962.212K | 1.803M | 16.851K | 1.058M | 22.039K | 609.466K |

| Call Open Interest: | 7.855M | 5.767M | 70.713K | 3.609M | 316.282K | 3.944M |

| Put Open Interest: | 14.051M | 13.853M | 94.525K | 6.337M | 507.99K | 8.948M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6500, 6000, 6450, 6400] |

| SPY Levels: [650, 640, 645, 630] |

| NDX Levels: [23725, 24000, 23800, 23450] |

| QQQ Levels: [580, 575, 560, 570] |

| SPX Combos: [(6852,89.86), (6826,74.72), (6800,96.87), (6748,96.10), (6728,72.43), (6708,71.43), (6702,98.93), (6676,84.22), (6663,85.81), (6650,98.99), (6643,90.65), (6630,86.33), (6623,94.76), (6617,93.49), (6610,93.82), (6604,77.86), (6597,99.95), (6591,92.91), (6584,83.49), (6578,99.68), (6571,93.57), (6565,86.64), (6558,98.36), (6552,99.37), (6545,86.09), (6539,93.59), (6532,90.26), (6526,92.48), (6512,68.69), (6506,96.86), (6499,93.94), (6493,88.64), (6486,75.33), (6473,86.60), (6460,75.29), (6447,95.43), (6441,77.86), (6428,86.39), (6421,75.96), (6408,92.24), (6401,89.77), (6388,70.86), (6382,84.53), (6375,67.88), (6362,88.40), (6349,85.63), (6310,80.06), (6297,93.09), (6277,82.42), (6258,79.47), (6251,86.28), (6212,76.07)] |

| SPY Combos: [658.78, 654.23, 656.83, 652.28] |

| NDX Combos: [23444, 23730, 24016, 24231] |

| QQQ Combos: [577.61, 582.25, 585.15, 589.8] |

0 comentarios