Macro Theme:

Key dates ahead:

- 9/19: OPEX

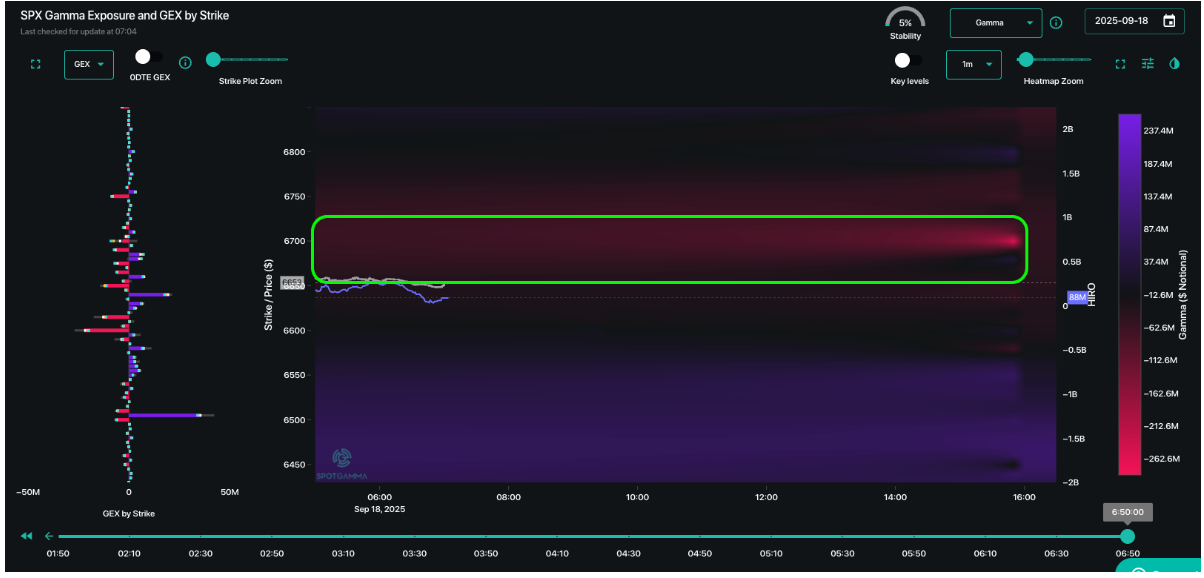

Update 9/18: We look for the rally to continue into Friday OPEX, and then look for a correction next week. 9/30 is circled as potentially a more destabilizing expiration.

9/16: Our core view one is vol is cheap. We like short term put structures >=1week to 1-month out. For bears a break of <6,600 gives bears the edge, and we’d look for a test of 6,500 (JPM EOM strike). Longer dated calls also make sense >=1-month to Dec – but we prefer to wait for post-FOMC to play these (i.e. we can “wait and see” to play upside), but we can’t argue with traders who buy some upside calls as 10-11% IV

Key SG levels for the SPX are:

- Resistance: 6,700

- Pivot: 6,600 (bearish <, bullish >)

- Support: 6,600, 6,500

Founder’s Note:

Futures are +80bps higher, sitting on the 6,650

Call Wall.

Vols are down across the board, with the VIX -2 pts from pre-FOMC to 14.7.

TLDR: We still think sneaky move into Friday to 6,700 is possible, then correction next week (i.e. reversion from overbought). We look stay risk-on with SPX >6,600. The possibility for a larger down move post-9/30.

We still have net negative gamma above, which implies a chase dynamic into 6,700. Further, the overnight move of 80 bps in SPX is a 13-14% implied vol, with all ATM/near the money IV’s at 10-11% (yes, all pre-9/30 ATM IVs are 10%’s). So negative gamma + IV’s underpricing the catch-up may keep 6,700 on as a short term target (1-2 days). We’re also looking for 1-2 days of meme-mania/thematic single stock chasing: TSLA +430, IWM +1.5% premarket, BTC +1.3%, etc.

If the “chase into Friday PM” plays, then we’d have a pretty stretched market into Friday’s OPEX (up 4-5% in 2 weeks) with IV’s dead. That is a recipe for short term consolidation next week.

SPX fixed strike vol, while low, is curious. All pre-9/30 expiration IV’s are off more that 1 vol point vs Tuesday night (pre-FOMC), while post 9/30 are more flat. 9/30 is month end, but it also holds the massive JPM collar position, which in theory has dealers loaded up in gamma. We need to keep eyes on 9/30 as a destabilizing date as this positioning could roll off.

|

| /ESZ25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6660.77 | $6600 | $659 | $24223 | $590 | $2407 | $238 |

| SG Gamma Index™: |

| 2.496 | 0.089 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.59% | 0.59% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.59% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6560.77 | $6500 | $656 | $23720 | $588 | $2370 | $236 |

| Absolute Gamma Strike: | $6660.77 | $6600 | $640 | $23725 | $590 | $2400 | $240 |

| Call Wall: | $6710.77 | $6650 | $660 | $23725 | $600 | $2500 | $240 |

| Put Wall: | $6360.77 | $6300 | $640 | $22500 | $575 | $2330 | $228 |

| Zero Gamma Level: | $6572.77 | $6512 | $653 | $23445 | $588 | $2401 | $238 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.264 | 1.076 | 1.835 | 1.084 | 1.062 | 0.979 |

| Gamma Notional (MM): | $694.412M | $357.479M | $20.389M | $155.591M | ‑$899.055K | ‑$135.487M |

| 25 Delta Risk Reversal: | -0.042 | -0.037 | -0.049 | -0.035 | -0.022 | -0.005 |

| Call Volume: | 648.625K | 1.68M | 10.914K | 862.881K | 26.446K | 912.571K |

| Put Volume: | 1.074M | 2.388M | 10.918K | 1.332M | 32.362K | 2.445M |

| Call Open Interest: | 8.333M | 6.156M | 74.962K | 3.968M | 326.602K | 3.988M |

| Put Open Interest: | 14.856M | 14.91M | 95.121K | 6.847M | 530.349K | 9.742M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6600, 6650, 6500, 6000] |

| SPY Levels: [640, 660, 650, 655] |

| NDX Levels: [23725, 24000, 24400, 24500] |

| QQQ Levels: [590, 580, 575, 585] |

| SPX Combos: [(6897,95.30), (6878,77.96), (6851,93.75), (6825,81.10), (6812,69.94), (6798,98.80), (6772,86.53), (6759,73.67), (6752,98.28), (6732,72.30), (6726,91.13), (6719,71.27), (6713,83.49), (6706,88.91), (6699,99.70), (6693,86.53), (6686,80.09), (6680,91.42), (6673,98.37), (6666,84.42), (6660,95.59), (6653,99.86), (6647,80.18), (6640,97.31), (6633,71.68), (6627,99.14), (6620,92.66), (6614,87.85), (6607,94.30), (6600,99.53), (6587,74.58), (6581,69.47), (6574,87.88), (6561,72.19), (6548,73.17), (6508,82.04), (6501,69.14), (6488,77.51), (6449,84.82), (6442,72.46), (6422,72.13), (6409,90.40), (6402,89.73), (6350,83.42), (6310,73.30), (6297,92.15), (6277,75.36)] |

| SPY Combos: [664.62, 669.24, 659.34, 679.14] |

| NDX Combos: [24635, 24417, 23715, 24393] |

| QQQ Combos: [594.73, 600.05, 577.58, 591.77] |

0 comentarios