Macro Theme:

Key dates ahead:

- 9/23: Home Sales, Powell Speaking

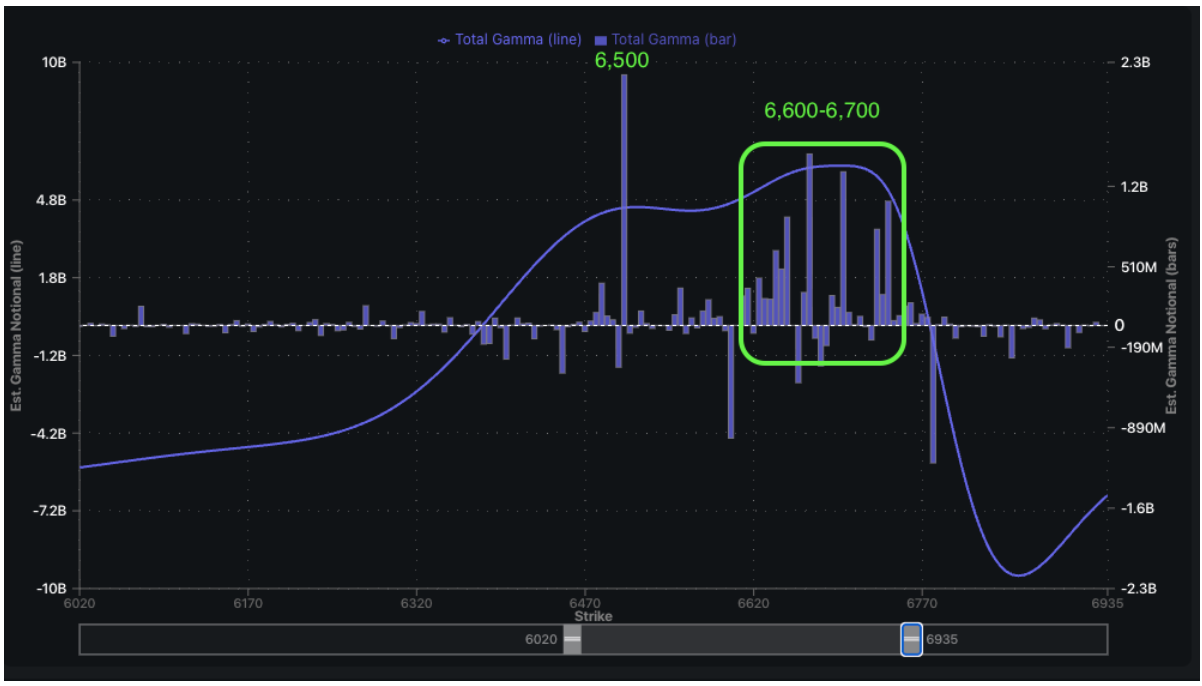

Update 9/19: We remain bullish with SPX >6,600, but we will be adding put spreads and/or put flies for expirations near 9/30, playing a potential move to the massive 6,505 JPM strike.

9/18: We look for the rally to continue into Friday OPEX, and then look for a correction next week. 9/30 is circled as potentially a more destabilizing expiration.

9/16: Our core view one is vol is cheap. We like short term put structures >=1week to 1-month out. For bears a break of <6,600 gives bears the edge, and we’d look for a test of 6,500 (JPM EOM strike). Longer dated calls also make sense >=1-month to Dec – but we prefer to wait for post-FOMC to play these (i.e. we can “wait and see” to play upside), but we can’t argue with traders who buy some upside calls as 10-11% IV

Key SG levels for the SPX are:

- Resistance: 6,650, 6,675, 6,700

- Pivot: 6,600 (bearish <, bullish >)

- Support: 6,600, 6,500

Opt-in to receive FlowPatrol™ — our daily AM report detailing the most significant options trades and their impact on the stock market

Founder’s Note:

Futures are 30bps lower, after putting in all time highs on Friday. No major data is on tap for today.

TLDR: >6,600 bulls remain in control, with upside available into 6,700. <6,600 we look for a test of 6,500.

We’re on mild pullback watch after the +2% rally over the last 5-10 days. From 6,600 – 6,700 there is a lot of positive gamma, which should keep upside sticky. That positive gamma positioning decays <=6,600, and <6,600 the market likely looks to sync up with the big 9/30 EXP 6,505 strike. We quite frankly see very little chance that 6,500 is breached before 9/30.

Single stock skews are also getting a bit call heavy, as you can see via Compass. Nearly all major stocks are crowded into this right quadrant, suggesting calls are quite rich vs puts compared to values over the past the last year. This suggests buying calls here is not the value. This backs the idea of stocks needing a cooling off before resuming a larger rally.

Turning to the vol complex, there has been an interesting dislocation between SPX IV & VIX. The former has been quite low, near 10%, while VIX has been 15-16. Further the VIX term structure contango been quite steep, as longer dated VIX futures carry a large premium to VIX index. BofA posited a few weeks ago that this steepness was due to crowding in vol ETP’s – we quite have no idea if that is right or not. But we do think that the folks that are long those expensive VIX futures have to make up the carry, and have been doing so by pounding short dated S&P vol (at least thats our theory). Pounding short dated (<=5 DTE) SPX IV, which is at bottom basement levels, helps to support stocks.

Here is a chart of the front month VIX future – 2nd month VIX future. What you see here is that spread has now reverted back to where it was pre-tariffs. We wonder if this is a signal that the VIX term structure is set to flatten, and if that means these very cheap short dated SPX IV’s will find a bit of a higher level and/or VIX Index may normalize to SPX IV’s. Our TLDR on this is that equities could be a bit less stable going forward, as the VIX complex loses some premium to SPX realized, but we’re really just ruminating on potential implications, if this steep contango dynamic is indeed change. We’ll definitely be keeping an eye on this…

|

| /ESZ25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6722.7 | $6664 | $663 | $24626 | $599 | $2448 | $242 |

| SG Gamma Index™: |

| 2.013 | -0.177 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.60% | 0.60% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.81% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6678.7 | $6620 | $662 | $23890 | $596 | $2410 | $239 |

| Absolute Gamma Strike: | $6058.7 | $6000 | $660 | $24525 | $600 | $2450 | $240 |

| Call Wall: | $6758.7 | $6700 | $670 | $24525 | $600 | $2500 | $250 |

| Put Wall: | $6458.7 | $6400 | $650 | $24440 | $560 | $2390 | $231 |

| Zero Gamma Level: | $6634.7 | $6576 | $662 | $23835 | $593 | $2443 | $244 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.306 | 0.840 | 1.817 | 1.075 | 0.975 | 0.803 |

| Gamma Notional (MM): | $676.633M | ‑$229.322M | $19.916M | $248.738M | ‑$1.962M | ‑$182.345M |

| 25 Delta Risk Reversal: | -0.041 | 0.00 | -0.047 | -0.036 | -0.019 | -0.005 |

| Call Volume: | 734.224K | 1.132M | 16.524K | 727.781K | 26.631K | 344.709K |

| Put Volume: | 1.108M | 1.90M | 11.18K | 1.004M | 54.825K | 765.973K |

| Call Open Interest: | 6.717M | 4.643M | 57.647K | 3.079M | 237.445K | 3.101M |

| Put Open Interest: | 12.246M | 11.60M | 74.059K | 5.346M | 420.918K | 7.398M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [6000, 6700, 6600, 6650] |

| SPY Levels: [660, 640, 663, 650] |

| NDX Levels: [24525, 24600, 24500, 24400] |

| QQQ Levels: [600, 598, 590, 595] |

| SPX Combos: [(6978,72.43), (6951,86.16), (6924,70.22), (6904,96.28), (6878,81.67), (6851,95.44), (6831,69.43), (6824,89.16), (6804,99.21), (6791,69.35), (6784,90.20), (6778,90.81), (6771,71.37), (6764,85.01), (6751,98.40), (6744,91.14), (6738,72.64), (6731,89.13), (6724,98.57), (6718,80.95), (6711,90.93), (6704,99.81), (6698,89.07), (6691,87.67), (6684,97.22), (6678,97.89), (6671,90.60), (6664,87.84), (6658,79.84), (6651,93.77), (6618,74.43), (6604,77.71), (6584,87.66), (6578,82.58), (6564,70.00), (6551,74.32), (6524,85.31), (6484,73.61), (6478,75.49), (6464,73.47), (6451,78.11), (6424,85.11), (6404,88.64), (6384,67.82), (6351,77.68)] |

| SPY Combos: [664.25, 668.88, 666.23, 678.82] |

| NDX Combos: [24651, 24528, 24602, 24848] |

| QQQ Combos: [600.08, 586.99, 594.13, 584.01] |

0 comentarios