Macro Theme:

Key dates ahead:

- 10/30: AAPL/AMZN ER

SG Summary:

Update 10/29: RISK ALERT – COR1M and the over-bid Index calls have us quite nervous at these levels. Given that we are going to be rolling up call positions, and adding to downside protection. The trick is maintaining long exposure while legging into some ~1-month protection. We will look to get more aggressive if/when downside starts to flare.

10/27: We are going to be monetizing/rolling our longs from the last week, and add some VIX call spreads due to the decline in COR1M to <8. The key here is to maintain long exposure, but also hedge out 10/10/25-like spasm risks that have snuck back in. We also raise our bull/bear Pivot to 6,800, from 6,700.

Key SG levels for the SPX are:

- Resistance: 6,950, 7,000

- Pivot: 6,850 (bearish <, bullish >)

- Support: 6,850, 6,800, 6,700

Founder’s Note:

Futures are up +10bps after the Trump/Xi meeting, after FOMC, and after round 1 of Mag earnings:

GOOGL: +8.5%

META: -8.8%

MSFT: -1.8%

This leaves SPX just under 6,900 pre-open, and bulls need that >6,900 or else the decay of expensive calls could bring the correction we’re on alert for. If SPX is <6,900 then we weary of the soft underbelly in this market, per yesterdays note.

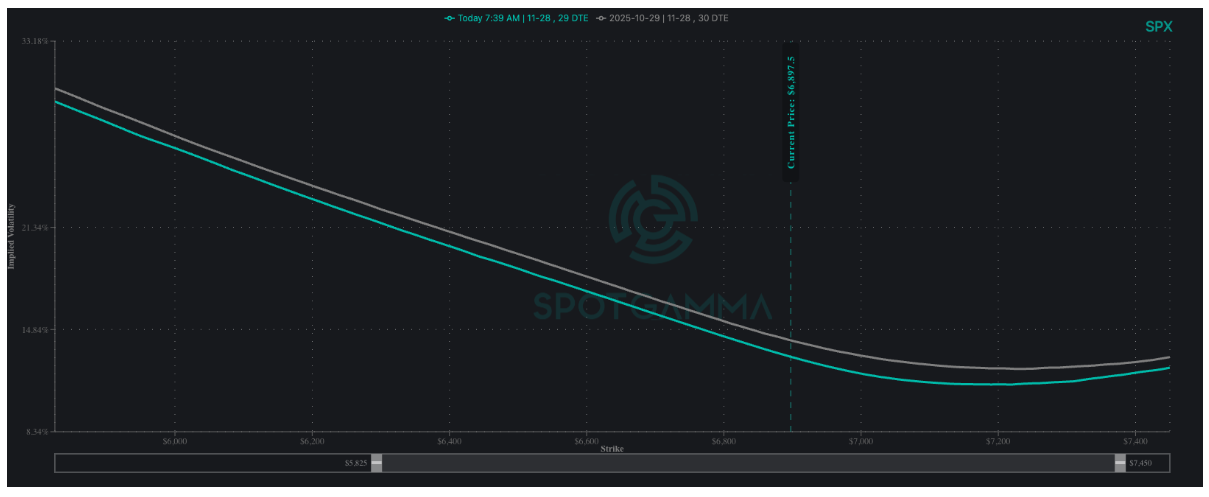

The lack of price movement is the interesting part here, particularly given that vols have come in 1-2 points vs yesterday (below is 1-month SPX skew today (teal) vs yesterday), after trending higher for most of this week. We also note bond yields are on the move higher post-FOMC – which is of course interesting given the rate cut yesterday.

SPX positions are site light today – no Condors, with notable negative gamma to the upside, and some light positive gamma into 6,850, which remains our “strike of last resort”(i.e. we

Pivot

to bearish <6,850). This signals that prices may move a decent amount today with our eyes on 6,950 to the upside and first support at 6,850. Obviously if vol continues coming down it should add a vanna kicker for upside SPX, and 7,000 is the giant overhead target into tomorrow if stocks re-start upside momentum.

The prevailing question here is this: if you are currently long calls with call values in the +90th %’ile (i.e. expensive!), are you getting the upside thrust from these events that you need? Expensive calls need big upside to justify high prices. Thus far FOMC/Trump Xi/Mag earnings are all not showing to be a boost, and those calls are paying out the FOMC/Trump Xi event vol, and so if the upside action doesn’t form then those expensive calls are going to start bleeding out, which could weigh on things.

©2025 TenTen Capital LLC DBA SpotGamma

|

| /ESZ25 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6921.74 | $6890 | $687 | $26119 | $635 | $2484 | $246 |

| SG Gamma Index™: |

| 2.117 | -0.101 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.63% | 0.63% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.41% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6876.74 | $6845 | $687 | $26050 | $631 | $2495 | $248 |

| Absolute Gamma Strike: | $7031.74 | $7000 | $670 | $26000 | $630 | $2450 | $240 |

| Call Wall: | $7031.74 | $7000 | $700 | $27000 | $650 | $2600 | $255 |

| Put Wall: | $6531.74 | $6500 | $670 | $26000 | $590 | $2440 | $235 |

| Zero Gamma Level: | $6779.74 | $6748 | $686 | $24903 | $630 | $2516 | $252 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.282 | 0.908 | 1.338 | 1.057 | 0.666 | 0.535 |

| Gamma Notional (MM): | $769.044M | $208.629M | $10.067M | $259.332M | ‑$28.935M | ‑$607.717M |

| 25 Delta Risk Reversal: | -0.043 | -0.024 | -0.043 | -0.026 | -0.031 | -0.015 |

| Call Volume: | 621.589K | 1.457M | 11.267K | 1.043M | 16.086K | 470.832K |

| Put Volume: | 749.813K | 2.385M | 12.842K | 1.536M | 28.401K | 880.576K |

| Call Open Interest: | 7.938M | 5.612M | 74.996K | 3.923M | 264.964K | 3.383M |

| Put Open Interest: | 13.532M | 14.422M | 98.471K | 6.707M | 470.39K | 8.177M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [7000, 6000, 6800, 6900] |

| SPY Levels: [670, 685, 690, 700] |

| NDX Levels: [26000, 24500, 26025, 25975] |

| QQQ Levels: [630, 625, 640, 600] |

| SPX Combos: [(7201,97.13), (7173,69.35), (7152,90.01), (7125,75.05), (7118,71.85), (7097,97.68), (7077,88.14), (7049,95.57), (7028,90.61), (7015,87.82), (7008,85.06), (7001,99.92), (6987,88.40), (6980,89.45), (6973,96.42), (6966,73.14), (6959,85.06), (6953,99.19), (6946,71.10), (6939,88.89), (6932,85.70), (6925,96.42), (6918,95.06), (6911,70.43), (6897,99.47), (6877,83.97), (6849,95.65), (6822,69.79), (6808,69.53), (6801,85.61), (6767,77.46), (6718,83.76), (6698,85.85), (6677,88.43), (6670,70.57), (6615,73.63)] |

| SPY Combos: [698.05, 687.75, 693.24, 690.5] |

| NDX Combos: [26694, 26277, 25989, 27008] |

| QQQ Combos: [627.22, 637.35, 637.98, 639.88] |

0 comentarios