Macro Theme:

Key dates ahead:

- 11/4: JOLTS

- 11/5: ISM

- 11/6: Jobs

- 11/18: NVDA ER

SG Summary:

10/31: Yesterday’s meager 1% decline started to ease the “risk alert” positioning we flagged on 10/29, with call skews shifting to “rich” vs “screaming overbought”. Thats good news for bulls, as we think there is less spasm risk (a la 10/10). On the flip side, we are not seeing any obvious long opportunities, either. Bottom line: We hold the VIX call spread hedges we bought earlier this week, but with a close back >6.900 we’re back into a risk-on stance.

10/29: RISK ALERT – COR1M and the over-bid Index calls have us quite nervous at these levels. Given that we are going to be rolling up call positions, and adding to downside protection. The trick is maintaining long exposure while legging into some ~1-month protection. We will look to get more aggressive if/when downside starts to flare.

Key SG levels for the SPX are:

- Resistance: 6,900, 7,000

- Pivot: 6,900 (bearish <, bullish >)

- Support: 6,800, 6,700

Founder’s Note:

Futures are -1%, with the SPX breaking 6,800. There is no one clear single trigger here, more just a loss of upside aspiration. VIX is sniffing 20, with SPX IV’s generally up a fairly mild 1 vol point.

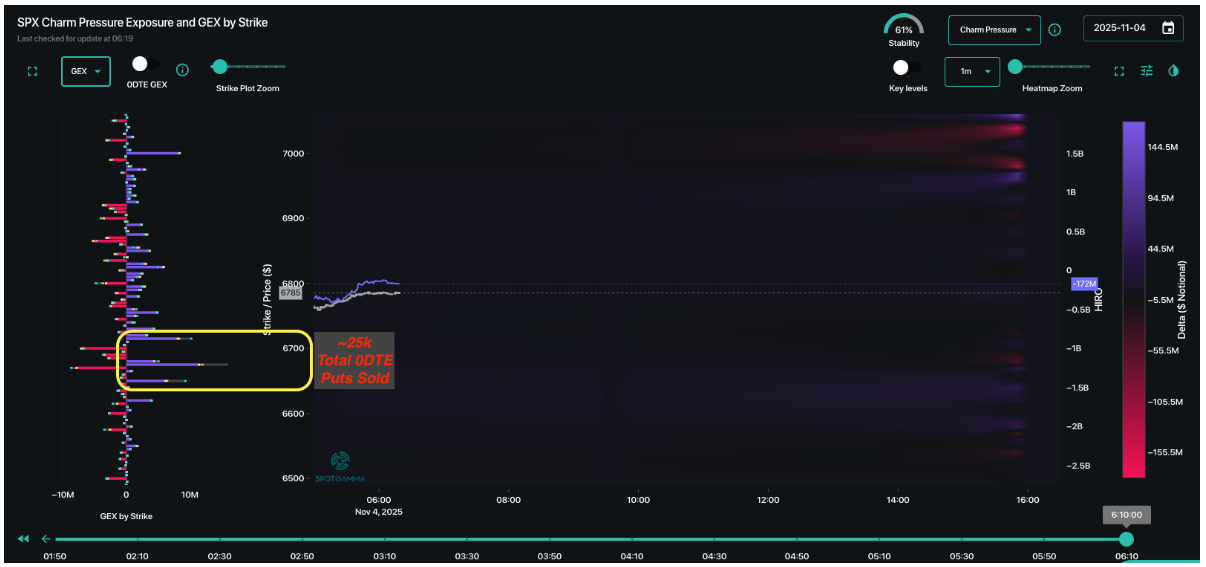

TLDR: Stirred, not shaken. We’re watching to see the market response on open. Put sales via HIRO, particularly non-Next Exp are a sign that this dip is buyable. Ultimately we view any dip trade as an intraday swing until/unless SPX moves back >6,900. On this point what we think people will try to monetize here is the vol pop more-so than SPX upside (i.e. delta). Relatedly, puts are now a bit expensive, and so anyone looking to add protection after the move should look at put spreads or put flies.

The early signal here is 0DTE put sellers attempting to establish a floor, with ~25-30k of 0DTE puts sold around the 6,700 strike. That 6,700 area is where we highlighted net positive GEX yesterday, and so the critical bounce signal to watch this AM is if HIRO reflects put selling, which would suggest that traders are still keep to sell this mildly elevated vol.

SPX Vols are up a decent 1 vol point, as seen in the day-over-day change in SPX skew. We also see a slight put skew lift for downside, as highlighted with the blue arrow. This suggests protection is a bit bid, which makes sense given the somewhat unsuspected downside (i.e. traders were generally not positioned for 1% SPX downside). As we mentioned yesterday VIX calls were bid (as seen via VVIX elevated), which highlights that there was some hedging in place, and that may lead to some quick monetization VIX upside. In this case there is no expiration near, which may limit hedge monetization (into the 10/10 decline expiration may have incentivized some quicker hedge selling into high IV’s).

Lastly, a note on the credit market. Credit market problems are often the source of the biggest equity vol, as bond holders scramble to buy puts to hedge out defaults. There are a few credit market headlines percolating, but the bigger thing for the immediate term was the move higher in rates post-FOMC. You see that here with the 10Y going 3.9% to 4.1%.

Bond/rate sensitive ETF’s were heavily call-bid into FOMC, and flipped to put-bid post FOMC, as you can see with the historical trail in Compass. Now, though, we are seeing a flip back to calls in these assets. This suggests either a tone change back to thinking rate cuts are coming in Dec (and implied market support). This call-skewed look is better for equity bulls, at least for now.

©2025 TenTen Capital LLC DBA SpotGamma

|

|

/ESZ25 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6880.56 |

$6851 |

$683 |

$25972 |

$632 |

$2471 |

$245 |

|

SG Gamma Index™: |

|

1.554 |

-0.138 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.65% |

0.65% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.39% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6874.56 |

$6845 |

$681 |

$25850 |

$631 |

$2470 |

$246 |

|

Absolute Gamma Strike: |

$7029.56 |

$7000 |

$685 |

$24500 |

$630 |

$2450 |

$240 |

|

Call Wall: |

$7029.56 |

$7000 |

$690 |

$26200 |

$640 |

$2600 |

$250 |

|

Put Wall: |

$6529.56 |

$6500 |

$670 |

$24000 |

$630 |

$2380 |

$240 |

|

Zero Gamma Level: |

$6790.56 |

$6761 |

$682 |

$25519 |

$630 |

$2502 |

$252 |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.196 |

0.879 |

1.583 |

0.893 |

0.654 |

0.534 |

|

Gamma Notional (MM): |

$449.88M |

‑$163.706M |

$13.42M |

‑$117.584M |

‑$41.556M |

‑$767.035M |

|

25 Delta Risk Reversal: |

-0.048 |

0.00 |

-0.051 |

0.00 |

-0.04 |

-0.023 |

|

Call Volume: |

463.448K |

1.166M |

8.711K |

652.264K |

25.223K |

273.818K |

|

Put Volume: |

720.077K |

2.172M |

14.354K |

1.148M |

42.722K |

756.388K |

|

Call Open Interest: |

7.91M |

5.242M |

70.128K |

3.716M |

267.072K |

3.373M |

|

Put Open Interest: |

13.203M |

13.369M |

96.285K |

6.319M |

482.091K |

8.209M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [7000, 6000, 6900, 6800] |

|

SPY Levels: [685, 670, 680, 640] |

|

NDX Levels: [24500, 26000, 25900, 26200] |

|

QQQ Levels: [630, 625, 635, 600] |

|

SPX Combos: [(7147,87.56), (7126,72.47), (7119,68.56), (7099,96.84), (7078,83.45), (7051,93.14), (7023,88.99), (7016,82.30), (7003,99.79), (6989,77.08), (6982,73.29), (6975,91.79), (6968,88.82), (6962,79.97), (6948,98.48), (6941,79.90), (6934,74.49), (6927,95.76), (6920,91.09), (6907,92.04), (6900,99.50), (6893,94.22), (6886,81.88), (6879,89.74), (6873,96.91), (6866,82.10), (6859,86.86), (6852,94.94), (6845,72.43), (6838,86.11), (6818,89.40), (6811,68.70), (6797,82.99), (6777,83.15), (6770,83.54), (6763,70.70), (6749,74.48), (6742,70.39), (6729,72.43), (6722,75.05), (6715,83.59), (6708,68.06), (6701,86.50), (6688,68.32), (6667,80.77), (6653,81.98), (6550,68.72)] |

|

SPY Combos: [697.75, 688.2, 692.97, 690.24] |

|

NDX Combos: [26311, 26207, 26103, 26700] |

|

QQQ Combos: [639.76, 644.8, 649.83, 632.84] |

0 comentarios