Macro Theme:

Key dates ahead:

- 11/13 CPI

- 11/14: PPI

- 11/19: NVDA ER

SG Summary:

UPDATE 11/10: With the government shudown apparently ending we are adjusting our risk-on pivot from 6,900 to 6,800. We think the week of 11/10 is setting up to be a bullish one, with more eyes now on 11/19 NVDA ER.

11/7: We hate being alarmists after a 3% drop, but suddenly there is a sneaky bid to vol, and we see nothing but negative gamma for ±50-100 handles. The difference today is that we suddenly see some non-0DTE put buying, and that has largely been absent the last several days. For this reason we are now quite cautious, as this feels like a place wherein things could get “crashy”.

Key SG levels for the SPX are:

- Resistance: 6,850, 6,900

- Pivot: 6,800 (bearish <, bullish >)

- Support: 6,700, 6,600

Founder’s Note:

Futures are of 20bps, with no major data on tap for today.

TLDR: SPX closed back above our Risk Pivot at 6.800, and so we are again holding a core long equity position. Further, traders are now pushing back into calls which adds a bullish tailwind. Lastly implied volatility is mildly contracting, but vol should release lower as we move through economic data points later this week (assuming the data is benign). Vol contraction would add an additional vanna-based equity tailwind. <6,800 we’d flip back to a neutral to risk-off stance.

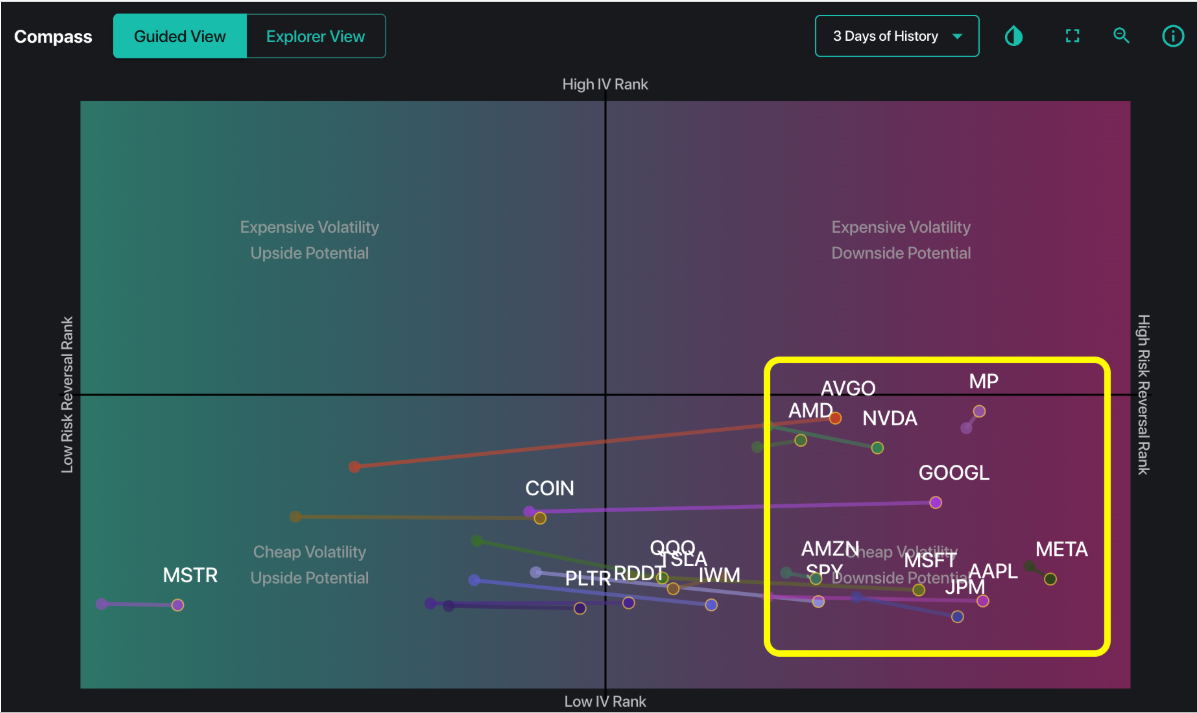

Welcome to the re-bid, where traders took the clearing of the gov’t shutdown to pile back into calls. This results in top stocks moving from the middle of the Compass chart to the right, and the danger is is that are too quickly moving back into a place where calls are again expensive. We’ve seen this before into 10/10 and 10/27, but we also have to recognize that this part of the cycle is where big upside gains are made.

To be clear, we are not yet back at those “Risk Alert” levels, but one can’t help but feel like that is our destination, which culminates in COR1M going <8. Low readings in COR1M are the result of heavy single stock call demand, generally brought above by crowing into the AI trade. We distill this signal into one word: “overbought”, and the way that overbought resolves is through volatility spasms.

COR1M <8 has timed very well with the aforementioned volatility spasms seen through October. Should we clear the upcoming economic data without issue, and NVDA earnings are good, that could allow “stock up, vol up” to press into overbought territory (i.e. COR1M <8, stocks fully to the right in the Compass map above).

Where there has been a collapse is in VVIX (below), which indicates that VIX call buyers flushed from Friday afternoon into today. No one wants hedges.

Bulls now appear to have things lined up (call buyers, seasonality, vol sellers), they just need to make sure NVDA doesn’t miss on 11/19. 11/19 is obviously a lifetime-away for the 0DTE crew, which should be actively selling options in through then and that should be supportive of markets.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESZ25 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6855.27 |

$6832 |

$681 |

$25611 |

$623 |

$2455 |

$244 |

|

SG Gamma Index™: |

|

2.503 |

0.010 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.63% |

0.63% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.38% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6818.27 |

$6795 |

$679 |

$25490 |

$622 |

$2465 |

$244 |

|

Absolute Gamma Strike: |

$7023.27 |

$7000 |

$680 |

$24500 |

$625 |

$2450 |

$240 |

|

Call Wall: |

$7023.27 |

$7000 |

$700 |

$24600 |

$650 |

$2600 |

$250 |

|

Put Wall: |

$6523.27 |

$6500 |

$660 |

$23000 |

$600 |

$2440 |

$240 |

|

Zero Gamma Level: |

$6764.27 |

$6741 |

$680 |

$25165 |

$622 |

$2505 |

$249 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [7000, 6800, 6000, 6900] |

|

SPY Levels: [680, 670, 700, 685] |

|

NDX Levels: [24500, 25500, 24600, 25600] |

|

QQQ Levels: [625, 630, 600, 610] |

|

SPX Combos: [(7147,90.04), (7126,76.98), (7099,96.54), (7078,81.36), (7051,94.67), (7024,76.03), (7017,89.24), (7003,99.80), (6983,80.35), (6976,93.44), (6969,84.47), (6962,83.76), (6955,70.64), (6949,98.54), (6942,85.54), (6928,96.63), (6921,92.83), (6914,80.68), (6908,94.29), (6901,99.74), (6894,73.47), (6887,96.61), (6880,97.66), (6873,95.81), (6867,96.57), (6860,90.35), (6853,99.24), (6846,80.34), (6839,87.00), (6832,88.96), (6826,71.77), (6819,84.72), (6798,90.65), (6778,73.69), (6771,80.14), (6750,74.09), (6730,80.93), (6723,68.93), (6716,70.00), (6703,90.93), (6682,72.69), (6668,80.77), (6662,75.07), (6648,89.72), (6627,73.06), (6621,73.62), (6607,70.92), (6600,77.30), (6552,76.78), (6518,75.14), (6498,91.22)] |

|

SPY Combos: [697.76, 687.69, 678.3, 683] |

|

NDX Combos: [24664, 25612, 24587, 25689] |

|

QQQ Combos: [600, 590.25, 598.78, 584.76] |

0 comentarios