Macro Theme:

Key dates ahead:

- 12/24: Xmas Eve 1/2 Day

- 12/25: Xmas

SG Summary:

Update 12/18: Risk Pivot holds at 6,800 – if that level is recovered then we think its a signal of our hereto over-talked “Xmas rally”. Above 6,800 we would look to add 12/31 6,900 area call spreads/flies. Sub 6,800 the favor remains with downside, and quite frankly there is no material positive gamma below. Further, with vol also low we are hesitant to lower the Risk Pivot (vs if there was a big fat vol risk premium & some positive gamma). For downside plays, we like Feb and/or March options which avoid a heavy time decay from the upcoming holiday period. Plus those >=60 day puts are fairly prices since put skew has been muted on this recent drawdown.

Update: 12/16: The SPX tested and held 6,800. Given this, we’ve re-adjusted the Risk Pivot to 6,790. We continue to favor holding a cheap 7k area Call Fly into end of year (>=7k strike IV’s are still 9%), as we think this window of 12/16 to 12/26 is favorable for bulls. That being said, should SPX break the Risk Pivot, we will look to enter short trades.

12/9: FOMC 12/10 + ORCL ER 12/10 + AVGO ER 12/11 make this week the directional trigger into end-of-year. We lean to the bullish side, as the benign passing of events may allow SPX to rally, with 7,000 the major upside target. To express this view, we are evaluating trades like 12/19 call flies (more speculative), or 12/31 call flies (less speculative):

12/19 SPX call fly 7,000 x 7,100 x 7,200 marked at $9.212/31 7,000 x 7,100 x 7,200 marked at $13.5

We may look to pair this off with a downside hedge like:

12/17 exp VIX call spreads: 43 cents

Key SG levels for the SPX are:

- Resistance: 6,900, 7,000

- Pivot: 6,790 (bearish <, bullish >) UPDATED 12/16

- Support: 6,865, 6,800

Founder’s Note:

Futures are 50bps higher as we enter Xmas week.

As we have been emphasizing for at least a week, we see the holiday period here as offering a bullish tailwind after a huge OPEX, and with Xmas/Xmas Eve shortening the week. This should allow short-dated vol sellers to step up, which buoys equities.

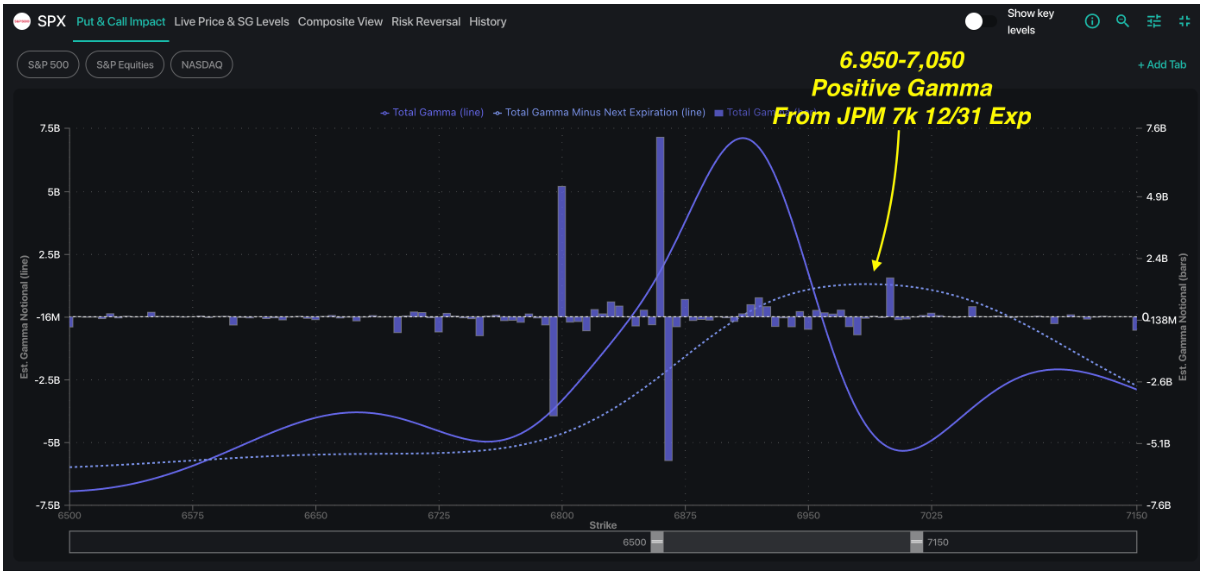

Gamma from 0DTE options appears to be positive from the big Condor strike(s) at 6,865, which is support for today. You can see the top call spread of that 0DTE Condor strikes in the map below (large vertical bars). More critically, we see that gamma appears to be positive for SPX prices >6,850 (solid curved line), however most of that is supplied by 0DTE. If you remove 0DTE, you see that the gamma is only really positive if the SPX moves >6,900 (dashed line). Further, the only real supply of non-0DTE gamma is from the JPM strike, which is at 7,000 for 12/31 OPEX.

The distinction here is that if the SPX was more in the area of non-0DTE gamma then we’d think SPX price ranges would contract (i.e. less volatility). As the 0DTE flow is transient, it allows for a bit more movement. This means to us that the 7k strike is still in play possibly for this week, but certainly into 12/31.

Pivot

ing to the vol landscape, we pointed out last week the lack of bid for downside protection (as seen in VVIX, etc), and that narrative was picked up in recent bank research notes and is now common knowledge. That implies that everyone is on the same page in terms of “lack of fear”. We see lack of fear manifesting in SPX term structure, which sees this week’s IV sinking into the 8’s. This week’s IV’s probably sniffs 7’s. Note Jan is relatively higher at 12%, and that probably sticks. This highlights the key dynamics of price & time: equities are supported by the holiday and by the JPM strike which suppresses vol, particularly at higher strikes. After this week, those same supportive forces are not aligned, which, we think, makes equities more susceptible to downside into possibly next week + Jan.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

| /ESH26 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6887.35 | $6834 | $680 | $25346 | $617 | $2529 | $250 |

| SG Gamma Index™: |

| 0.910 | -0.154 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.50% | 0.50% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.48% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| $6901.94 | $687.32 |

|

|

|

|

| SG Implied 1-Day Move Low: |

| $6833.26 | $680.48 |

|

|

|

|

| SG Volatility Trigger™: | $6888.35 | $6835 | $680 | $25170 | $615 | $2520 | $251 |

| Absolute Gamma Strike: | $7053.35 | $7000 | $680 | $25250 | $620 | $2500 | $250 |

| Call Wall: | $7053.35 | $7000 | $700 | $25470 | $620 | $2530 | $260 |

| Put Wall: | $6853.35 | $6800 | $680 | $25150 | $590 | $2490 | $240 |

| Zero Gamma Level: | $6847.35 | $6794 | $679 | $25092 | $616 | $2542 | $252 |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [7000, 6850, 6800, 6900] |

| SPY Levels: [680, 685, 675, 670] |

| NDX Levels: [25250, 25150, 25470, 25480] |

| QQQ Levels: [620, 615, 610, 600] |

| SPX Combos: [(7149,85.96), (7128,76.42), (7101,94.66), (7053,93.61), (7033,85.56), (7026,70.60), (7012,69.76), (6999,99.56), (6992,74.98), (6978,95.98), (6971,84.15), (6958,87.38), (6951,97.98), (6937,86.29), (6930,90.25), (6923,98.39), (6917,89.64), (6910,82.70), (6903,99.30), (6896,85.94), (6889,85.64), (6882,93.01), (6876,90.71), (6869,89.99), (6862,99.94), (6848,96.45), (6834,79.25), (6828,95.68), (6807,78.83), (6800,98.95), (6793,98.67), (6787,89.96), (6780,85.12), (6773,86.64), (6766,67.33), (6759,75.55), (6752,91.04), (6732,69.69), (6725,92.77), (6718,79.56), (6698,94.60), (6677,87.63), (6650,91.28), (6629,83.14), (6623,74.10), (6602,87.40), (6575,72.52), (6547,77.81), (6527,84.14), (6500,94.92)] |

| SPY Combos: [679.18, 698.79, 681.21, 683.91] |

| NDX Combos: [25473, 25143, 24231, 25245] |

| QQQ Combos: [599.97, 590.23, 613.37, 620.07] |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.104 | 0.867 | 1.461 | 1.009 | 0.674 | 0.712 |

| Gamma Notional (MM): | $454.551M | ‑$103.941M | $15.958M | $128.131M | ‑$25.155M | ‑$254.359M |

| 25 Delta Risk Reversal: | -0.042 | -0.024 | -0.05 | -0.043 | -0.033 | -0.015 |

| Call Volume: | 686.918K | 1.421M | 14.21K | 815.854K | 15.394K | 210.902K |

| Put Volume: | 902.786K | 2.018M | 10.092K | 936.376K | 33.634K | 628.131K |

| Call Open Interest: | 6.76M | 5.189M | 54.507K | 3.345M | 183.636K | 2.742M |

| Put Open Interest: | 11.115M | 9.053M | 73.927K | 5.185M | 341.647K | 5.836M |

0 comentarios