Macro Theme:

Key dates ahead:

- 12/31: Jobless Claims, year end exp (JPM)

- 1/1: New Years

- 1/2: NFP

SG Summary:

Update 12/26: The Risk Pivot is now 6,900. As the bullish OPEXMas closes today, we also shift to a generally more neutral stance vs bullish. IVs are now at lows, suggesting vanna as a fuel for higher stocks is gone. If SPX trades <6,890 we’d look to shift from a neutral to bearish stance. We will maintain some cheap call spreads and or call flies into the 7k strike for expirations into 12/31, based on the JPM Call.

Update 12/18: Risk Pivot holds at 6,800 – if that level is recovered then we think it’s a signal of our previously discussed “Xmas rally”. Above 6,800 we would look to add 12/31 6,900 area call spreads/flies. Sub 6,800 the favor remains with downside, and quite frankly there is no material positive gamma below. Further, with vol also low we are hesitant to lower the Risk Pivot (vs if there was a big fat vol risk premium & some positive gamma). For downside plays, we like Feb and/or March options which avoid a heavy time decay from the upcoming holiday period. Plus those >=60 day puts are fairly priced since put skew has been muted on this recent drawdown.

Key SG levels for the SPX are:

- Resistance: 6,950, 7,000

- Pivot: 6,890 (bearish <, bullish >) UPDATED 12/26

- Support: 6,900, 6,850, 6,800

Founder’s Note:

Futures are flat with no major data on tap.

The big story from Xmas Eve was the apparent destruction of Captain Condor, and his crew. Wednesday PM marked their 6th daily loss in a row, and with that we hear rumors of catastrophic losses for many in Captains paid community. The only thing we know for fact is that there was no doubling down from the 90k-contract loss on Wednesday to a ~180k contract position for today. This is the proof that Condor is gone.

There is one last, but very interesting element on the trade: Our data showed that the liquidity providers for Wednesday’s 90k lot was 1/2 market maker, and 1/2 banks. We can’t recall having seen the liquidity being provided by two entities like that, and it suggests that the size was so large it was having to be laid off amongst liquidity providers. That, in turn, implies that had Captain even had the capital to go another round to 180k contracts, that they may not have been able to source the counterparty for that trade. Maybe the casino would have cut them off…

Turning to current positioning:

Resistance: 6,950, 6,975, 7,000

Support: 6,900

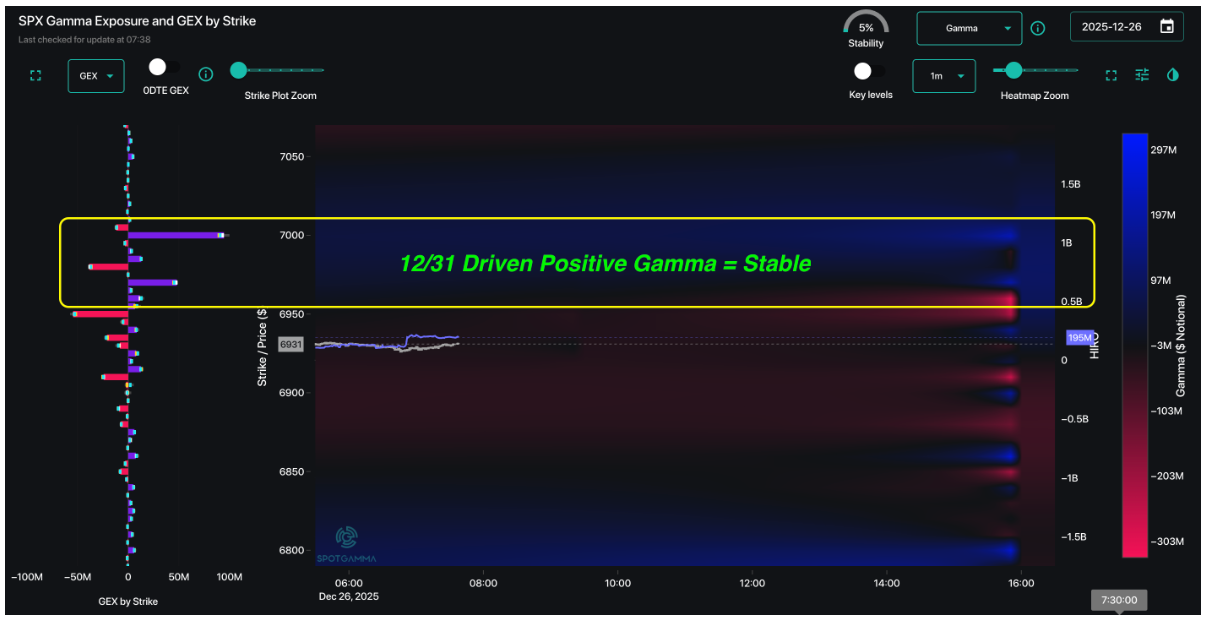

We don’t expect much from markets for today. The key level here now for the SPX is 6,950. Above that level we think the JPM 7,000 strike, 12/31 exp gamma will “grab hold” and pin the market in. Below that strike, as shown in TRACE, is negative gamma. For this reason, we raise our Risk Pivot to 6,890.

If the SPX breaks <6,900, we’d look for a test of 6,850. While that expected gap down is only ~1% (to start), we’d start to be wary of a regime shift in equities wherein the supportive OPEXMas flows are gone. So taking a “stability check” from an opening selling salvo would be critical.

Remember too that IV is now at an absolute lower bound (we’ve seen 4% IVs !), which signals that “vol up” has a faster path than “vol down”. That doesn’t mean vol has to jump today, but it does mean that downside could be a bit quicker if vol reprices to something more normal.

On the topic of OPEXMas, today does mark the closing of the bullish period we marked into last weeks expiration(s). You can see below that the SPX made a low on VIX Exp, and has subsequently traded higher each day, realizing +3% & new SPX all time highs. The closing of this window, which unironically syncs with extreme IV lows, removes our desire to lean bullish. We will still look to have some cheap exposure on to play a move into the JPM 7k strike for 12/31, but our positioning will start to look much more neutral in price direction into Monday. At any point if SPX breaks <6,900, we’ll look to lean to the downside.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESH26 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6983.1 |

$6932 |

$690 |

$25656 |

$623 |

$2548 |

$252 |

|

SG Gamma Index™: |

|

4.927 |

0.285 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

1.15% |

1.15% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.48% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6946.1 |

$6895 |

$689 |

$25020 |

$622 |

$2525 |

$251 |

|

Absolute Gamma Strike: |

$7051.1 |

$7000 |

$690 |

$25700 |

$625 |

$2500 |

$250 |

|

Call Wall: |

$7051.1 |

$7000 |

$692 |

$25250 |

$625 |

$2530 |

$260 |

|

Put Wall: |

$6751.1 |

$6700 |

$689 |

$24000 |

$590 |

$2500 |

$240 |

|

Zero Gamma Level: |

$6891.1 |

$6840 |

$683 |

$25019 |

$618 |

$2561 |

$252 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [7000, 6900, 6950, 6850] |

|

SPY Levels: [690, 689, 688, 692] |

|

NDX Levels: [25700, 25250, 25500, 25600] |

|

QQQ Levels: [625, 620, 623, 630] |

|

SPX Combos: [(7251,89.98), (7202,97.31), (7147,91.74), (7126,86.16), (7098,98.12), (7078,88.57), (7057,67.38), (7050,98.05), (7029,94.70), (7022,93.75), (7015,70.74), (7008,96.28), (7001,99.98), (6994,77.58), (6988,98.54), (6981,99.39), (6974,99.01), (6967,99.69), (6960,99.70), (6953,99.98), (6946,99.64), (6939,99.55), (6932,98.54), (6925,99.70), (6911,94.65), (6897,95.64), (6863,71.49), (6842,78.78), (6835,81.79), (6828,94.26), (6800,73.32), (6773,74.76), (6752,83.48), (6724,85.69), (6703,91.90), (6676,71.44), (6648,80.89), (6627,79.09), (6599,82.61)] |

|

SPY Combos: [688.6, 689.29, 685.85, 685.16] |

|

NDX Combos: [25707, 25246, 25913, 25784] |

|

QQQ Combos: [624.7, 622.21, 614.12, 627.19] |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.562 |

1.213 |

1.80 |

1.074 |

0.824 |

0.827 |

|

Gamma Notional (MM): |

$1.575B |

$1.648B |

$20.529M |

$390.919M |

‑$13.859M |

‑$79.336M |

|

25 Delta Risk Reversal: |

-0.035 |

-0.017 |

-0.041 |

-0.025 |

-0.026 |

-0.011 |

|

Call Volume: |

383.677K |

1.121M |

5.47K |

476.262K |

5.123K |

143.381K |

|

Put Volume: |

569.975K |

1.123M |

6.302K |

485.596K |

12.338K |

354.356K |

|

Call Open Interest: |

6.875M |

5.375M |

54.909K |

3.469M |

193.529K |

2.815M |

|

Put Open Interest: |

11.517M |

9.711M |

75.153K |

5.339M |

354.699K |

5.94M |

0 comentarios