Macro Theme:

Key dates ahead:

- 12/31: Jobless Claims, year end exp (JPM)

- 1/1: New Years

- 1/2: NFP

SG Summary:

Update 12/26: The Risk Pivot is now 6,900. As the bullish OPEXMas closes today, we also shift to a generally more neutral stance vs bullish. IVs are now at lows, suggesting vanna as a fuel for higher stocks is gone. If SPX trades <6,890 we’d look to shift from a neutral to bearish stance. We will maintain some cheap call spreads and or call flies into the 7k strike for expirations into 12/31, based on the JPM Call.

Update 12/18: Risk Pivot holds at 6,800 – if that level is recovered then we think it’s a signal of our previously discussed “Xmas rally”. Above 6,800 we would look to add 12/31 6,900 area call spreads/flies. Sub 6,800 the favor remains with downside, and quite frankly there is no material positive gamma below. Further, with vol also low we are hesitant to lower the Risk Pivot (vs if there was a big fat vol risk premium & some positive gamma). For downside plays, we like Feb and/or March options which avoid a heavy time decay from the upcoming holiday period. Plus those >=60 day puts are fairly priced since put skew has been muted on this recent drawdown.

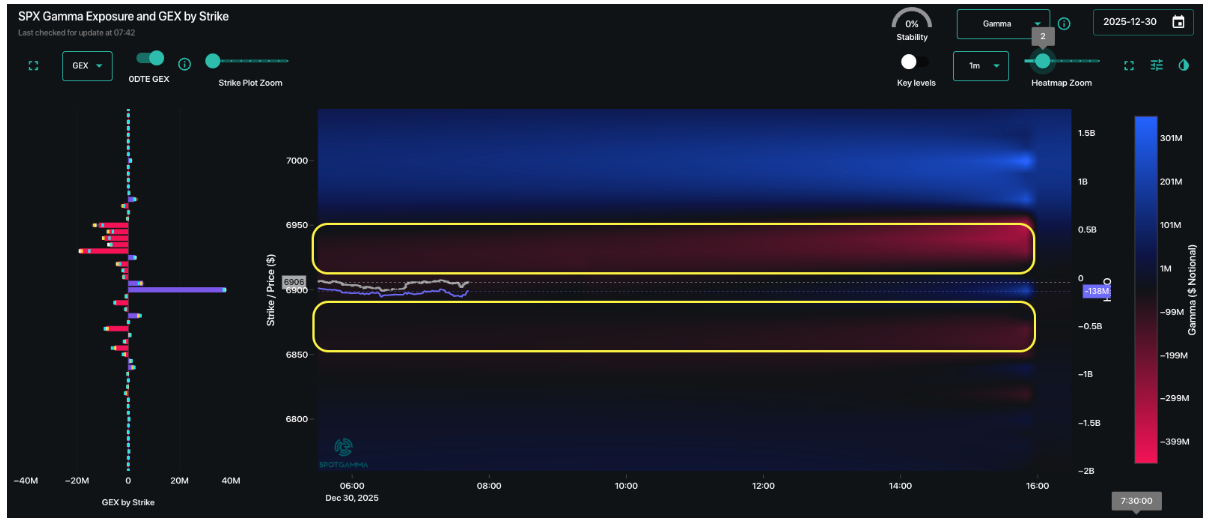

Key SG levels for the SPX are:

- Resistance: 6,950, 7,000

- Pivot: 6,890 (bearish <, bullish >) UPDATED 12/26

- Support: 6,900, 6,850, 6,800

Founder’s Note:

Futures are flat with FOMC Mins at 2pm ET.

Support remains at 6,900, then 6,850. Resistance is at 6,920 & 6,950. <6,890 remains our Risk Pivot.

There is negative gamma for 50 handles above and below current SPX prices (6,900), which suggests some potential movement is on tap for today. That being said, there was a similar look yesterday but the quiet holiday-adjacent session brought a flat SPX session and only 40bps of intraday range.

That tight range has been a feature of this market for several weeks now. Below is 1-month SPX realized vol at 8.6%, and 5-day at 5.6%. Both are lower bounds for the SPX, suggesting that market movement is as dull as it gets – but its hard to bet for a violent increase just before a big holiday. In the larger context the implication is that being short of options here is pushing your luck, as its more likely volatility expands.

Options volumes, too, have really fallen off of a cliff. Below is total US options volume from record volumes in Q3/Q4. Put this together with vols and you come to this simple conclusion: nothing is going on.

That leaves us to talk SLV, which is arguably the only interesting thing in play for this week. Here we compare March SLV Skew from last night (teal) vs 1-week ago (gray), and its undeniable that there is a steepening in call skew >75.

SLV 1-mo realized vol is now 53%, and the term structure is in steep contango with short dated ATM options holding vols near 100%! This obviously signals that options are prohibitively expensive – its very hard for upside calls to pay off in a 100% IV, stock up, vol up scenario. This means puts are likely to lose IV if SLV corrects, making long puts tricky, too.

This type of contango usually comes with big volumes: volumes have been huge at >1mm (top panel). On the bottom is OI, and you can see that while its increasing, the size volume is not making its way its massive OI changes. This is a hallmark of a chasey, speculative market.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESH26 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6953.07 |

$6905 |

$687 |

$25525 |

$620 |

$2519 |

$249 |

|

SG Gamma Index™: |

|

2.085 |

-0.073 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.58% |

0.58% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.48% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6943.07 |

$6895 |

$689 |

$25240 |

$620 |

$2520 |

$250 |

|

Absolute Gamma Strike: |

$7048.07 |

$7000 |

$690 |

$25250 |

$620 |

$2500 |

$250 |

|

Call Wall: |

$7048.07 |

$7000 |

$690 |

$25250 |

$630 |

$2530 |

$260 |

|

Put Wall: |

$6748.07 |

$6700 |

$684 |

$24000 |

$615 |

$2500 |

$240 |

|

Zero Gamma Level: |

$6913.07 |

$6865 |

$686 |

$25080 |

$619 |

$2532 |

$251 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [7000, 6900, 6850, 6950] |

|

SPY Levels: [690, 688, 689, 687] |

|

NDX Levels: [25250, 25600, 25500, 26000] |

|

QQQ Levels: [620, 615, 625, 610] |

|

SPX Combos: [(7203,96.75), (7175,74.70), (7147,90.98), (7127,85.47), (7099,97.42), (7078,87.94), (7051,97.33), (7037,72.67), (7030,91.78), (7023,91.03), (7009,84.33), (7002,99.85), (6996,69.07), (6989,90.79), (6982,95.21), (6975,98.49), (6968,97.80), (6961,92.51), (6954,95.20), (6947,99.91), (6940,96.68), (6933,97.47), (6926,99.67), (6913,90.21), (6906,83.45), (6899,93.49), (6892,85.36), (6885,75.66), (6878,95.73), (6871,79.50), (6864,93.66), (6857,89.20), (6850,70.59), (6844,78.75), (6837,94.23), (6830,91.24), (6823,86.50), (6802,88.30), (6775,74.08), (6768,72.71), (6747,90.81), (6726,87.99), (6699,94.17), (6678,76.07), (6650,80.70), (6602,83.60)] |

|

SPY Combos: [697.21, 695.14, 693.07, 692.38] |

|

NDX Combos: [25296, 25245, 25066, 24658] |

|

QQQ Combos: [625.14, 615.16, 614.53, 630.13] |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.226 |

0.947 |

1.534 |

0.856 |

0.577 |

0.642 |

|

Gamma Notional (MM): |

$542.464M |

‑$65.028M |

$13.325M |

‑$223.436M |

‑$47.269M |

‑$419.80M |

|

25 Delta Risk Reversal: |

-0.036 |

0.00 |

-0.042 |

0.00 |

-0.03 |

0.00 |

|

Call Volume: |

491.013K |

1.257M |

7.777K |

694.307K |

15.094K |

172.069K |

|

Put Volume: |

715.026K |

1.428M |

8.246K |

1.038M |

24.842K |

240.975K |

|

Call Open Interest: |

6.873M |

5.349M |

55.287K |

3.471M |

193.191K |

2.791M |

|

Put Open Interest: |

11.562M |

9.766M |

76.752K |

5.612M |

346.784K |

5.998M |

0 comentarios