Macro Theme:

Key dates ahead:

- 1/5: ISM PMI

- 1/7: ISM/JOLTS

- 1/9: NFP

SG Summary:

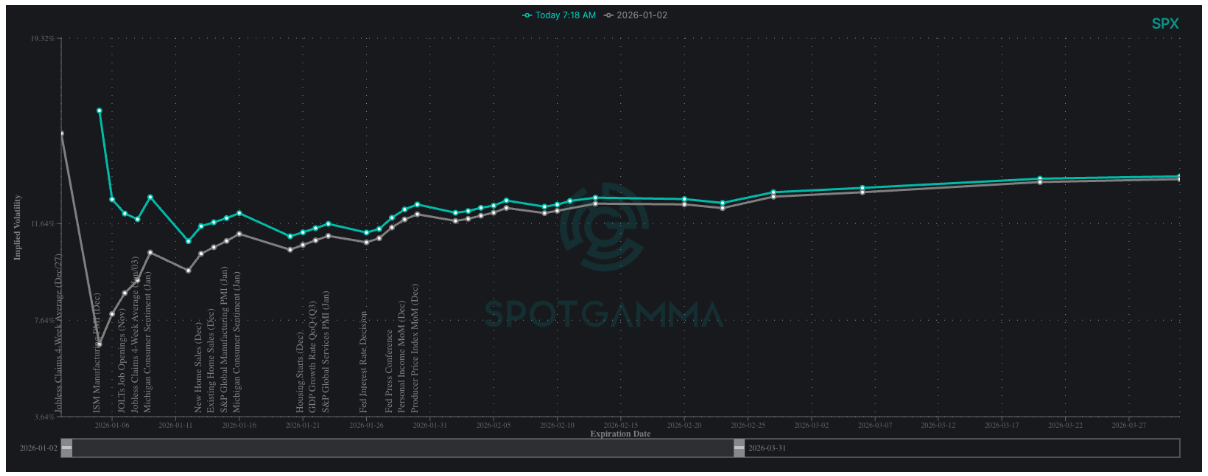

Update 1/2: SPX is below our Risk Pivot at 6,890, and we see SPX IV’s being anchored higher into the start of ’26. Given that we have a neutral to short-leaning stance as non-0DTE gamma is negative own into 6,600, and higher SPX IV’s could also work to pressure SPX lower. A close back >6,900 into the week of 1/5 would remove the short bias.

12/26: The Risk Pivot is now 6,900. As the bullish OPEXMas closes today, we also shift to a generally more neutral stance vs bullish. IVs are now at lows, suggesting vanna as a fuel for higher stocks is gone. If SPX trades <6,890 we’d look to shift from a neutral to bearish stance. We will maintain some cheap call spreads and or call flies into the 7k strike for expirations into 12/31, based on the JPM Call.

Key SG levels for the SPX are:

- Resistance: 6,900, 6,920, 6,950

- Pivot: 6,890 (bearish <, bullish >) UPDATED 12/26

- Support: 6,850, 6,800

Founder’s Note:

Futures are up +35 bps into the first full week of the new year. ISM PMI is at 10AM ET.

Oil stocks like CVX are bid after the US/Venezuela military operation.

Resistance is at 6,900, then 6,920. Support is at 6,850 & 6,800. Gamma is fairly flat across the board, with 0DTE providing positive gamma against non-0DTE negative gamma. We continue to lean neutral to short if the SPX is below the Risk Pivot at 6,900. If 6,900 is reclaimed through this weeks macro data, then we start to look at 7,000 into Jan OPEX 1/16. Conversely, a slide lower likely keeps vol bid in through that date, and possibly even end-of-month with FOMC.

While futures are higher, we see SPX IV higher, too. This is part of the IV “reflation” that was predicted coming out of the very quiet holiday period, and into this data-laden week. ISM PMI today, ISM Svc + JOLTS on Wed, Claims Thu, NFP Fri.

With SPX 1-month realized vol (RV) at 8.8%, one can make the case that these 12-13% ATM IVs for SPX are pretty fairly valued. Yes, these data points carry some event vol, but we think that RV is likely to shift a bit higher, too, after the lack of holiday movement (SPX essentially pinned 6900 for 10 days). If SPX regains 6,900, then we’d flip back to a long stance, and look for these IVs to contract just slightly. This implies that any upside may not be explosive, but more of a grind.

To the downside, any bad news would shift IVs higher, and non-0DTE negative gamma increases down into 6,500. We’re not saying we project a move to 6,500 – it would take something pretty material to spark a 5% shock to the SPX. We are saying that there isn’t clear material support for the SPX at this time. If downside momentum does start, and IVs slide higher, then a move into the 6,700s seems quite viable.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

| /ESH26 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6901.6 | $6858 | $683 | $25206 | $613 | $2508 | $248 |

| SG Gamma Index™: |

| -0.605 | -0.19 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.65% | 0.65% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.48% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6918.6 | $6875 | $682 | $25240 | $615 | $2500 | $250 |

| Absolute Gamma Strike: | $7043.6 | $7000 | $680 | $25250 | $610 | $2520 | $250 |

| Call Wall: | $7043.6 | $7000 | $690 | $25250 | $627 | $2520 | $260 |

| Put Wall: | $6843.6 | $6800 | $680 | $24000 | $610 | $2485 | $245 |

| Zero Gamma Level: | $6861.6 | $6818 | $681 | $24953 | $616 | $2502 | $252 |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [7000, 6900, 6850, 6800] |

| SPY Levels: [680, 685, 670, 690] |

| NDX Levels: [25250, 25000, 25500, 25400] |

| QQQ Levels: [610, 620, 600, 615] |

| SPX Combos: [(7195,67.81), (7153,95.19), (7126,76.05), (7099,96.28), (7078,79.49), (7051,93.99), (7030,75.11), (7023,82.25), (7002,98.27), (6982,83.38), (6975,91.37), (6968,82.75), (6954,78.84), (6948,94.42), (6941,71.77), (6927,93.71), (6920,83.56), (6913,87.94), (6906,86.71), (6900,94.65), (6893,77.35), (6886,69.19), (6879,71.79), (6872,80.93), (6852,88.84), (6845,79.81), (6838,84.98), (6831,85.28), (6824,97.10), (6817,78.07), (6810,78.91), (6804,74.72), (6797,97.95), (6790,80.47), (6783,80.04), (6776,89.44), (6769,79.52), (6762,81.45), (6756,67.13), (6749,94.95), (6742,79.80), (6728,94.78), (6708,69.07), (6701,95.38), (6687,71.73), (6673,85.39), (6653,90.66), (6625,82.71), (6598,91.51), (6577,77.06), (6550,70.74), (6522,81.39)] |

| SPY Combos: [697.52, 677.02, 679.75, 707.08] |

| NDX Combos: [25257, 25080, 24677, 24248] |

| QQQ Combos: [614.35, 610.05, 600.24, 589.82] |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.931 | 0.822 | 1.156 | 0.739 | 0.760 | 0.588 |

| Gamma Notional (MM): | ‑$87.11M | ‑$235.288M | $3.67M | ‑$493.303M | ‑$21.791M | ‑$511.002M |

| 25 Delta Risk Reversal: | -0.038 | -0.023 | -0.047 | -0.034 | -0.028 | -0.014 |

| Call Volume: | 583.147K | 1.526M | 10.022K | 1.234M | 22.218K | 283.486K |

| Put Volume: | 833.159K | 1.359M | 11.155K | 961.906K | 40.617K | 385.938K |

| Call Open Interest: | 6.645M | 4.724M | 52.511K | 3.492M | 203.065K | 2.694M |

| Put Open Interest: | 11.275M | 9.048M | 72.80K | 5.114M | 361.99K | 5.99M |

0 comentarios