Macro Theme:

Key dates ahead:

- 1/7: ISM/JOLTS

- 1/9: NFP

- 1/13: CPI

- 1/16: OPEX

- 1/21: VIX Exp

- 1/29: FOMC

SG Summary:

Update 1/7: While we now look for a move to 7k in the coming days, with COR1M at ~8.3 we have elected to add a small number of Feb/March index puts. <6,900 we would increase short positions. See the 1/7 note for details.

1/2: SPX is below our Risk Pivot at 6,890, and we see SPX IV’s being anchored higher into the start of ’26. Given that we have a neutral to short-leaning stance as non-0DTE gamma is negative down into 6,600, and higher SPX IV’s could also work to pressure SPX lower. A close back >6,900 into the week of 1/5 would remove the short bias.

Key SG levels for the SPX are:

- Resistance: 6,950, 6,985, 7,000

- Pivot: 6,890 (bearish <, bullish >) UPDATED 12/26

- Support: 6,920, 6,900, 6,850, 6,800

Founder’s Note:

Futures are flat with ISM & JOLTS at 10 AM ET.

Fresh ATH for SPX, yet vol remains mildly bid.

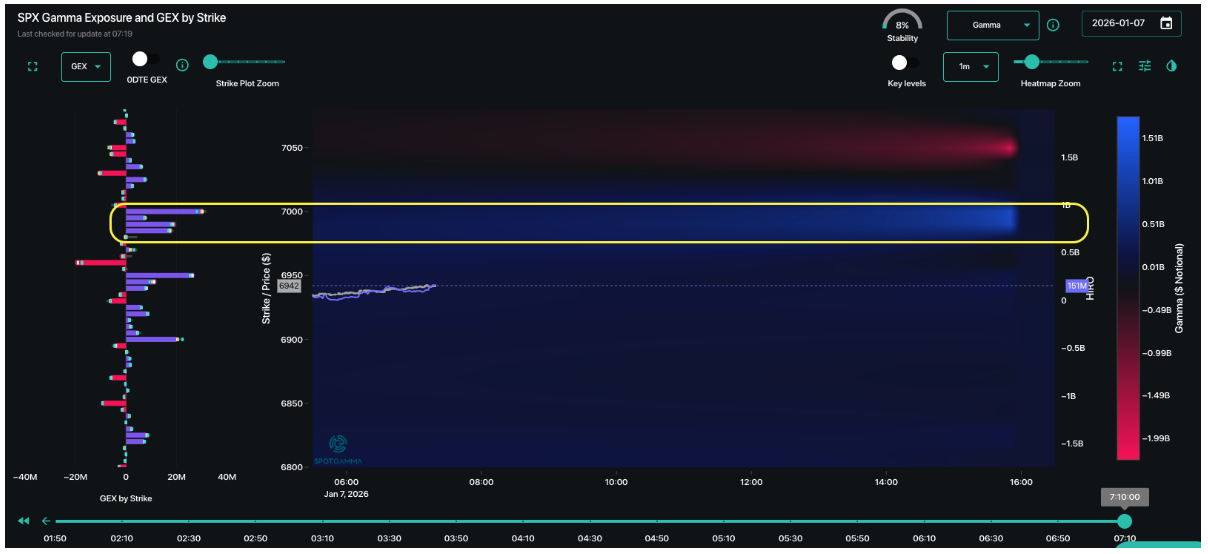

6,900 to 6,950 is now layered with positive gamma, and positioning is a mix of 0DTE and non-0DTE. This implies that range should be fairly stable. Further, we see that non-0DTE call sellers are stepping up into the 7k strike (yellow box). This all projects that 6,900-7,000 should be fairly stable, and lines up with the idea that 7k may be heavy resistance into Friday’s NFP – if not next week’s OPEX.

Here we have SPX fixed strike vols (FSV) comparing this AM vs Monday’s close, and you can see FSV is up. Thats atypical – normally vol would be sinking into fresh ATHs. Again, we think the “vol up” is related to upcoming data, but the longer we hold >6,900 the more likely vol is going to contract. Being clear: the vol “bid” is hardly a jump higher. Short dated SPX ATM IVs are only around 10%. That said, VIX is at 15, which is a bit rich to the ~9% 1-month SPX realized vol (VIX average is 3.5pts over realized).

What’s the takeaway? Short dated vols can contract a bit if econ data Friday (NFP) and next week (CPI) are ok. Its not that people have major expectations for this data, its just that there is enough event vol to offer a light tailwind. Clean data then likely places a grind into 7k as the likely path into OPEX. VIX 15 suggests there seems to be a bit of hedging in play, and the soft underbelly of SPX remains <6,900. Any hedging would likely surge if that level is broken.

Finally, COR1M. We spent a lot of time on this yesterday – the idea that correlation & a single stock bid is getting over its skis (i.e. too bullish). <8 we have learned to buy 1-2 month puts solely on this indicator, and we are now at ~8.3. At the moment the stars seem to be lining up for something more of an OPEX-induced correction, but we’ve learned not to get too cute with timing here. Recall in October it just took a Trump tweet to plunge the SPX 3%. Given this, our rough plan is to play for upside with short dated options, and start adding some Feb or March downside. We opt for longer dated protection to reduce carry costs.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

| /ESH26 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6985.77 | $6944 | $691 | $25639 | $623 | $2582 | $256 |

| SG Gamma Index™: |

| 3.131 | 0.085 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.67% | 0.67% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.48% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6941.77 | $6900 | $691 | $25240 | $622 | $2565 | $251 |

| Absolute Gamma Strike: | $7041.77 | $7000 | $690 | $25600 | $620 | $2600 | $250 |

| Call Wall: | $7041.77 | $7000 | $693 | $25250 | $627 | $2600 | $260 |

| Put Wall: | $6741.77 | $6700 | $680 | $24000 | $610 | $2450 | $245 |

| Zero Gamma Level: | $6945.77 | $6904 | $690 | $25192 | $622 | $2557 | $255 |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [7000, 6900, 6950, 6850] |

| SPY Levels: [690, 680, 692, 693] |

| NDX Levels: [25600, 25250, 25500, 25800] |

| QQQ Levels: [620, 610, 625, 630] |

| SPX Combos: [(7278,74.86), (7250,90.77), (7209,67.95), (7202,97.33), (7195,68.90), (7153,97.36), (7125,88.65), (7098,98.78), (7077,92.34), (7070,77.76), (7063,79.71), (7049,98.90), (7042,85.48), (7035,89.90), (7028,99.21), (7021,90.71), (7014,81.04), (7007,97.32), (7000,99.92), (6993,99.44), (6986,99.29), (6980,98.41), (6973,99.79), (6966,95.74), (6959,99.13), (6952,99.27), (6945,96.28), (6938,88.42), (6931,79.70), (6903,84.66), (6896,79.15), (6889,69.04), (6875,82.67), (6868,82.68), (6861,72.20), (6848,92.73), (6827,96.70), (6813,72.65), (6799,93.69), (6778,87.69), (6757,80.41), (6750,90.47), (6743,73.82), (6723,87.74), (6702,93.73), (6674,73.98), (6653,84.67), (6625,72.58)] |

| SPY Combos: [697.36, 695.3, 707.67, 689.79] |

| NDX Combos: [25794, 25742, 25691, 25255] |

| QQQ Combos: [609.92, 614.24, 600.03, 590.14] |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.351 | 1.075 | 2.00 | 1.056 | 1.404 | 0.950 |

| Gamma Notional (MM): | $869.135M | $333.069M | $22.993M | $131.129M | $35.322M | $20.606M |

| 25 Delta Risk Reversal: | -0.036 | -0.021 | -0.046 | -0.029 | -0.026 | -0.011 |

| Call Volume: | 799.775K | 1.357M | 9.952K | 736.212K | 25.976K | 482.28K |

| Put Volume: | 987.682K | 2.725M | 13.396K | 964.48K | 24.735K | 689.811K |

| Call Open Interest: | 6.96M | 4.877M | 55.785K | 3.515M | 211.956K | 2.828M |

| Put Open Interest: | 11.764M | 10.604M | 80.181K | 5.39M | 375.455K | 6.499M |

0 comentarios