Macro Theme:

Key dates ahead:

- 1/8: Jobless Claims

- 1/9: NFP

- 1/13: CPI

- 1/16: OPEX

- 1/21: VIX Exp

- 1/29: FOMC

SG Summary:

Update 1/7: While we now look for a move to 7k in the coming days, with COR1M at ~8.3 we have elected to add a small number of Feb/March index puts. <6,900 we would increase short positions. See the 1/7 note for details.

1/2: SPX is below our Risk Pivot at 6,890, and we see SPX IV’s being anchored higher into the start of ’26. Given that we have a neutral to short-leaning stance as non-0DTE gamma is negative down into 6,600, and higher SPX IV’s could also work to pressure SPX lower. A close back >6,900 into the week of 1/5 would remove the short bias.

Key SG levels for the SPX are:

- Resistance: 6,950, 6,985, 7,000

- Pivot: 6,890 (bearish <, bullish >) UPDATED 12/26

- Support: 6,900, 6,850, 6,800

Founder’s Note:

Futures are off 20 bps with Jobless Claims at 8:30AM ET.

This is becoming (excruciatingly) repetitive: major support remains at 6,900. Below there, we look to be short due to negative gamma which feeds into a likely increase in vols. However, above that, everything looks “a-ok”. In fact, todays 0DTE straddle is a bottom-basement $28.5/41bps which is nearly as low as it gets. This very low 0DTE IV juxtaposes against a move higher in longer dated IV: VIX is 15.75 (a ~2 week high).

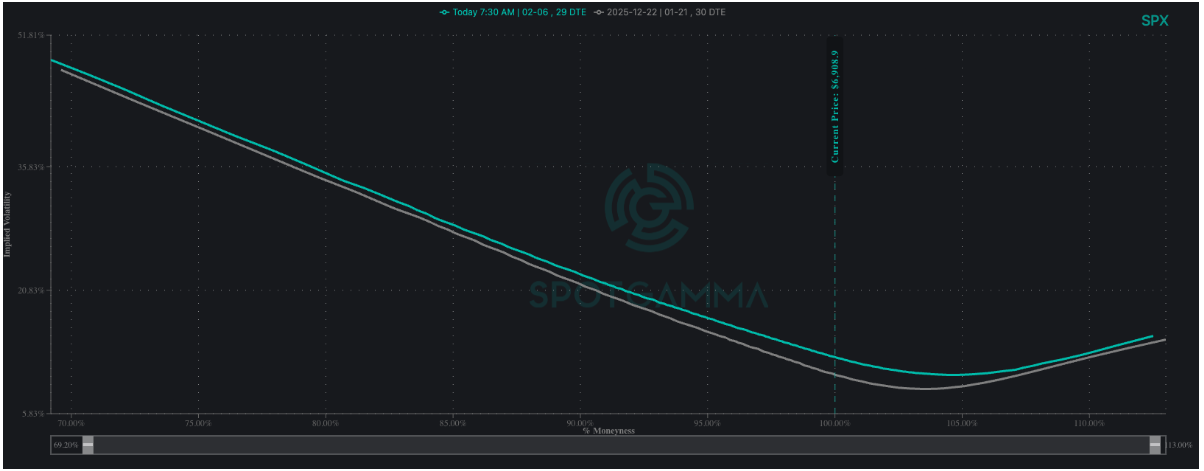

The >=1-month vol bid vs “no IV 0DTE” clearly depicts a lot of catalysts that traders are positioning for post-OPEX and into EOM, not just with FOMC, but also major earnings kicking off. Note the reflation in >=1-month IVs by comparing 1-month SPX IV for today (teal) vs 1-month IV from 2 weeks ago (gray). The skewness of this is also interesting: SPY call skew is +72nd %’ile while put skew is 28th %’ile. Traders being bulled-up is not terribly surprising, given we are at ATH.

So, what’s the takeaway? No one is positioned for any type of material weakness before OPEX/FOMC. That makes this the interesting trade, in our read. Does lack of positioning make a decline <6,900 probable? Not necessarily – but it is quite cheap to bet on. Certainly selling 0DTE options with those IVs in the gutter seems not worth the risk/reward.

The more interesting trades may well be in the memory-related stocks, which have been on fire. Below we highlighted just a few, which are catching a tailwind from MU’s strength and NVDA @ CES. These are “stock up, vol up” names, and their rate-of-change over the last few days has been amazing: LRCK +23%, SNDK +40%, AEVA +25%. We’re not suggesting these stocks have made all-time highs – but the rate of change, and their IVs feel unsustainable. These types of moves, in addition to some upcoming ER, have COR1M sniffing the 8 area which is a big risk signal (info on that idea here).

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

| /ESH26 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6961.02 | $6920 | $689 | $25653 | $624 | $2575 | $255 |

| SG Gamma Index™: |

| 0.722 | -0.17 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.63% | 0.63% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.48% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6966.02 | $6925 | $690 | $25240 | $623 | $2520 | $252 |

| Absolute Gamma Strike: | $7041.02 | $7000 | $680 | $25250 | $620 | $2550 | $250 |

| Call Wall: | $7041.02 | $7000 | $693 | $25250 | $627 | $2700 | $260 |

| Put Wall: | $6741.02 | $6700 | $680 | $24000 | $610 | $2450 | $245 |

| Zero Gamma Level: | $6921.02 | $6880 | $688 | $25206 | $622 | $2550 | $255 |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [7000, 6900, 6950, 6850] |

| SPY Levels: [680, 690, 693, 685] |

| NDX Levels: [25250, 25500, 25600, 26000] |

| QQQ Levels: [620, 610, 625, 630] |

| SPX Combos: [(7253,90.22), (7225,69.81), (7198,97.79), (7177,79.37), (7156,88.35), (7149,91.97), (7122,85.73), (7101,97.96), (7073,93.22), (7059,72.54), (7052,98.36), (7046,70.30), (7039,79.86), (7032,91.89), (7025,96.39), (7018,93.13), (7011,81.10), (7004,84.12), (6997,99.84), (6990,87.13), (6983,97.50), (6976,98.13), (6969,88.89), (6962,96.69), (6956,96.03), (6949,96.28), (6942,89.20), (6935,82.06), (6914,68.33), (6900,92.58), (6893,91.73), (6886,80.49), (6879,68.81), (6872,95.10), (6866,86.07), (6859,77.54), (6852,94.18), (6845,78.28), (6838,87.77), (6831,76.86), (6824,97.80), (6817,78.13), (6810,69.18), (6803,95.31), (6789,70.68), (6783,77.26), (6776,83.41), (6769,73.40), (6762,87.28), (6748,93.75), (6741,76.38), (6727,91.90), (6699,94.96), (6693,67.52), (6672,80.35), (6651,86.43), (6623,78.45), (6603,88.63)] |

| SPY Combos: [697.34, 694.58, 696.65, 695.96] |

| NDX Combos: [25910, 25090, 25243, 25782] |

| QQQ Combos: [627.2, 625.95, 624.71, 614.11] |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.074 | 0.870 | 1.534 | 0.990 | 1.275 | 0.891 |

| Gamma Notional (MM): | $167.215M | ‑$366.345M | $14.108M | $51.526M | $24.273M | ‑$40.867M |

| 25 Delta Risk Reversal: | -0.041 | -0.025 | -0.049 | -0.033 | -0.028 | -0.012 |

| Call Volume: | 763.809K | 1.47M | 11.333K | 847.26K | 17.40K | 279.459K |

| Put Volume: | 941.786K | 1.972M | 12.875K | 988.235K | 32.065K | 540.236K |

| Call Open Interest: | 7.054M | 4.982M | 57.25K | 3.564M | 214.438K | 2.874M |

| Put Open Interest: | 11.912M | 10.899M | 83.452K | 5.46M | 380.039K | 6.648M |

0 comentarios