Macro Theme:

Key dates ahead:

- 1/9: NFP, potential Supreme Court Tariff

- 1/13: CPI

- 1/16: OPEX

- 1/21: VIX Exp

- 1/29: FOMC

SG Summary:

Update 1/7: While we now look for a move to 7k in the coming days, with COR1M at ~8.3 we have elected to add a small number of Feb/March index puts. <6,900 we would increase short positions. See the 1/7 note for details.

1/2: SPX is below our Risk Pivot at 6,890, and we see SPX IV’s being anchored higher into the start of ’26. Given that we have a neutral to short-leaning stance as non-0DTE gamma is negative down into 6,600, and higher SPX IV’s could also work to pressure SPX lower. A close back >6,900 into the week of 1/5 would remove the short bias.

Key SG levels for the SPX are:

- Resistance: 6,950, 6,985, 7,000

- Pivot: 6,890 (bearish <, bullish >) UPDATED 12/26

- Support: 6,900, 6,850, 6,800

Founder’s Note:

Futures are +15bps ahead of NFP and a possible ruling from the Supreme Court on tariffs.

Today’s straddle is $42/60bps, implying mild risk into today’s data points. This is quite a bit richer relative to the 40bps straddle from yesterday, which speaks to today’s data having more impact vs Jobless Claims.

Given this, we continue to see a grinding/chopping market if the SPX holds >6,900. This grind is driven by positive gamma in the 6,900-7,000 range. With the passing of NFP, vol may contract a bit, and that could add positive drift which may push SPX toward 7,000.

<6,890 we would flip to a risk-off stance.

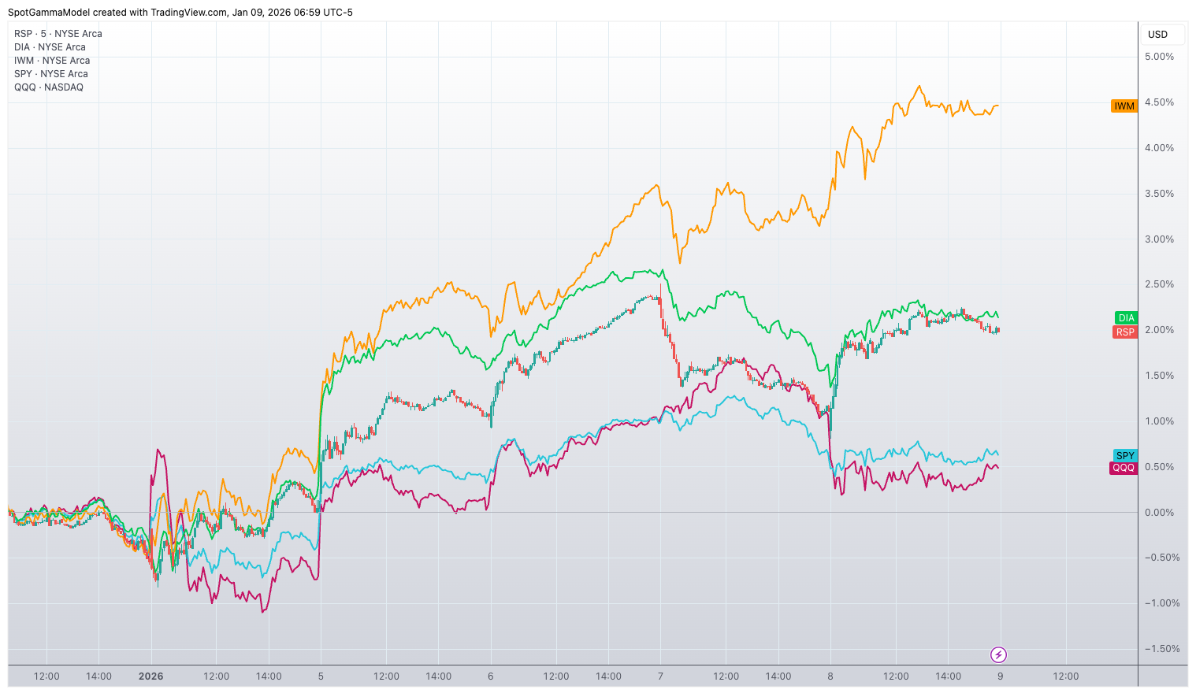

While the SPX has stalled, small caps, DJIA, and equal-weighted SPX (RSP) have performed strongly over the last week. You can see the outperformance below, with IWM surging 4.5% in the first 9 days of Jan. This of course speaks to rotation, as investors allocate amongst equities to best position. This, vs allocating across assets. You can tie this rotation idea into our low equity correlation (i.e. COR1M) environment – this environment is about an alpha-chase, not a risk-protection/mitigation regime.

Our concern with this low equity correlation is the potential for a volatility spasm, which would correct the imbalance between single stock and index vol. The trouble with this, is timing. A benign passing of NFP likely leads to a “risk-on” Friday, as traders head into the weekend. When you turn to something like the potential Supreme Court ruling, we have little view on potential impact but that feels like a potential curve ball that could catch traders off guard. We can’t help but recall Trump’s 10/10 tweet(s) that sparked a 1-day 2-3% decline (from a very low vol position).

That said, we’re simply not going to bet on “upset” until/unless SPX <6,890.

If you look at something like SNDK, which we highlighted yesterday AM, its +75% Skew Rank and +75% IV Rank scream instability, as traders bid calls. The stock went into yesterday AM +40% on the year, purged -15% into mid-day, then rallied 8% from lows. Other related stocks saw similar volatility, and it speaks to the instability of this environment, which is cloaked by the real lack of movement of the SPX over the last week (i.e. SPX stuck in 6,900-6,950).

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESH26 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6961.6 |

$6921 |

$689 |

$25507 |

$620 |

$2603 |

$258 |

|

SG Gamma Index™: |

|

0.521 |

-0.211 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.61% |

0.61% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.48% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6940.6 |

$6900 |

$688 |

$25240 |

$620 |

$2520 |

$253 |

|

Absolute Gamma Strike: |

$7040.6 |

$7000 |

$680 |

$25250 |

$620 |

$2500 |

$260 |

|

Call Wall: |

$7040.6 |

$7000 |

$693 |

$25250 |

$627 |

$2650 |

$260 |

|

Put Wall: |

$6740.6 |

$6700 |

$680 |

$24000 |

$610 |

$2450 |

$245 |

|

Zero Gamma Level: |

$6921.6 |

$6881 |

$688 |

$25251 |

$619 |

$2558 |

$256 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [7000, 6900, 6950, 6850] |

|

SPY Levels: [680, 690, 685, 693] |

|

NDX Levels: [25250, 25500, 25600, 25000] |

|

QQQ Levels: [620, 610, 625, 600] |

|

SPX Combos: [(7247,90.21), (7226,69.47), (7198,97.72), (7178,79.07), (7157,89.85), (7150,92.32), (7122,85.44), (7101,98.11), (7081,68.75), (7074,86.35), (7067,81.69), (7060,80.55), (7053,98.44), (7039,78.89), (7032,93.85), (7025,96.42), (7018,92.10), (7011,80.56), (7005,83.74), (6998,99.84), (6991,93.40), (6984,87.15), (6977,98.71), (6970,87.72), (6963,88.39), (6956,93.06), (6949,96.58), (6942,80.86), (6935,71.04), (6928,77.13), (6901,90.44), (6894,68.12), (6887,88.19), (6880,89.65), (6873,94.00), (6866,83.82), (6859,87.32), (6852,92.24), (6845,77.90), (6838,92.38), (6831,77.00), (6825,96.71), (6818,73.33), (6797,96.12), (6790,67.00), (6783,73.04), (6776,84.56), (6769,77.70), (6762,90.30), (6755,70.92), (6748,95.59), (6742,69.27), (6735,67.11), (6728,91.80), (6700,95.58), (6693,71.25), (6672,72.58), (6652,85.78), (6624,76.93), (6603,89.75)] |

|

SPY Combos: [697.18, 702.69, 695.11, 707.52] |

|

NDX Combos: [25252, 25073, 25788, 25890] |

|

QQQ Combos: [630.28, 610.31, 614.06, 627.16] |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.053 |

0.830 |

1.297 |

0.856 |

1.632 |

1.014 |

|

Gamma Notional (MM): |

$187.524M |

‑$385.942M |

$8.519M |

‑$166.849M |

$42.334M |

$96.272M |

|

25 Delta Risk Reversal: |

-0.043 |

-0.027 |

-0.053 |

-0.037 |

-0.026 |

-0.011 |

|

Call Volume: |

646.552K |

1.218M |

7.794K |

842.898K |

20.709K |

471.731K |

|

Put Volume: |

865.015K |

1.48M |

9.108K |

1.004M |

28.969K |

840.903K |

|

Call Open Interest: |

7.183M |

5.047M |

55.413K |

3.604M |

220.16K |

2.992M |

|

Put Open Interest: |

12.096M |

10.939M |

83.811K |

5.499M |

390.013K |

6.797M |

0 comentarios