Macro Theme:

Key dates ahead:

- 1/14: Supreme Court Tariffs

- 1/16: OPEX

- 1/21: VIX Exp

- 1/29: FOMC

SG Summary:

Update 1/7: While we now look for a move to 7k in the coming days, with COR1M at ~8.3 we have elected to add a small number of Feb/March index puts. <6,900 we would increase short positions. See the 1/7 note for details.

1/2: SPX is below our Risk Pivot at 6,890, and we see SPX IV’s being anchored higher into the start of ’26. Given that we have a neutral to short-leaning stance as non-0DTE gamma is negative down into 6,600, and higher SPX IV’s could also work to pressure SPX lower. A close back >6,900 into the week of 1/5 would remove the short bias.

Key SG levels for the SPX are:

- Resistance: 6,950, 7,000

- Pivot: 6,890 (bearish <, bullish >) UPDATED 12/26

- Support: 6,925, 6,900, 6,850

Founder’s Note:

Futures were weaker overnight: ES -35bps.

Today the Supreme Court is anticipated to remark on tariffs.

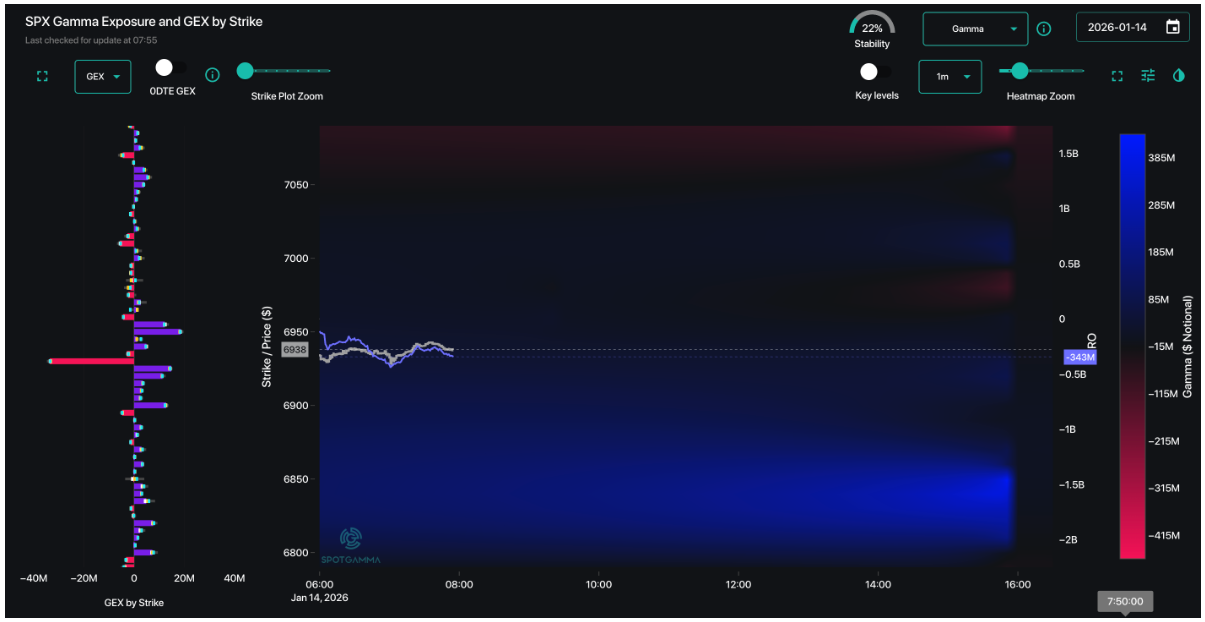

You can see in TRACE that overnight futures bounced off of the 6,925 positive gamma zone – this zone marks the start of a large swatch of positive gamma which extends down into 6,800. While none of these strikes are in and of themselves large (+99th %’ile) their summation creates net positive gamma below, which should be supportive of the S&P. While the map does show positive gamma down (purple) through 6,800, we continue to hold our view that <6,890 is a risk-off signal. Ideally bears would prefer to see negative gamma <6,900, as that infers dealers need to short into downside. In this case a large portion of this positive gamma is 0DTE, and therefore less stable. There is one large negative gamma bar (red) at 6,930 which is a non-0DTE short straddle.

While the SPX remains >6,900 we think traders have to keep assuming buy-the-dip/mean reversion is the trade, as that has been the form for weeks. What was most interesting from yesterday’s session was the AM test of 7k was met with heavy risk reversal flow: call selling, and put buying. In particular this looked like traders hammer ing 0DTE calls to buy non-0DTE puts – sort of a calendarized risk reversal. We think that price action was important, as it suggests that 7k could be strong resistance into FOMC.

We’ve been covering the bid to >1-week IVs, and that idea started to make its way into the various bank publications and then fintwit. The general idea is that there is a bid building to put skew and/or the VIX complex, as VIX was in the 15s vs 1-month SPX realized vol at 9%. Today we see the VIX sniffing 17, and other vol metrics picking up. Below is VVIX which is popping off ~1 year lows. This bid is not limited to non-0DTE’s either, as today all short-dated ATM IVs are below 11% whereas yesterday there were several <5DTE ATM marks <11%. The takeaway here is that there seems to be a positioning for increased vol, now for the short term as well as >= a month out. Also we need to clear up the idea that this VIX up into highs is a “stock up, vol up” move, in the framing that its call demand & related SPX upside driving VIX higher…SPX has done nothing over the last 10 days with 5-day realized vol at ~6%.

The takeaway from all of this is that the SPX upside is looking increasingly stuck until/unless we clear the FOMC & maybe get some positive earnings catalysts. That said, we are compelled to continue leaning with bulls while the SPX is >6,900. Below 6,890 we would get more aggressively short. The recent bid to vol increases our confidence that <6,890 is a risk-off level.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESH26 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$7001.23 |

$6963 |

$693 |

$25741 |

$626 |

$2633 |

$261 |

|

SG Gamma Index™: |

|

0.187 |

-0.334 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.60% |

0.60% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.48% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6983.23 |

$6945 |

$692 |

$25240 |

$625 |

$2580 |

$259 |

|

Absolute Gamma Strike: |

$7038.23 |

$7000 |

$690 |

$25250 |

$620 |

$2600 |

$260 |

|

Call Wall: |

$7038.23 |

$7000 |

$700 |

$25250 |

$627 |

$2700 |

$265 |

|

Put Wall: |

$6938.23 |

$6900 |

$690 |

$24000 |

$610 |

$2450 |

$245 |

|

Zero Gamma Level: |

$6961.23 |

$6923 |

$692 |

$25293 |

$625 |

$2587 |

$259 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [7000, 6900, 6950, 6850] |

|

SPY Levels: [690, 680, 695, 685] |

|

NDX Levels: [25250, 25800, 25600, 25500] |

|

QQQ Levels: [620, 625, 630, 610] |

|

SPX Combos: [(7298,92.51), (7277,75.19), (7249,90.46), (7228,77.83), (7201,97.40), (7194,68.04), (7173,76.58), (7152,97.46), (7124,86.47), (7117,67.57), (7103,98.46), (7082,81.17), (7075,91.96), (7068,83.80), (7061,82.66), (7054,75.30), (7047,99.04), (7040,80.42), (7033,93.42), (7026,97.33), (7019,93.38), (7012,94.95), (7006,87.66), (6999,99.74), (6992,92.17), (6985,91.00), (6978,97.46), (6971,74.68), (6964,73.29), (6950,92.01), (6943,86.02), (6936,79.95), (6929,94.97), (6922,97.23), (6915,82.87), (6908,86.56), (6901,96.63), (6894,83.80), (6887,88.10), (6880,76.42), (6873,95.22), (6866,84.09), (6859,87.46), (6852,95.21), (6845,81.11), (6838,89.82), (6831,73.59), (6824,93.48), (6818,69.41), (6797,97.25), (6790,67.64), (6783,77.39), (6776,87.21), (6769,76.70), (6762,76.12), (6748,91.95), (6727,89.83), (6699,94.19), (6678,79.35), (6650,81.20), (6623,80.23)] |

|

SPY Combos: [697.25, 702.11, 700.03, 707.67] |

|

NDX Combos: [25253, 25896, 25768, 25073] |

|

QQQ Combos: [627.19, 629.7, 614.02, 639.73] |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.016 |

0.754 |

1.388 |

0.947 |

1.381 |

1.019 |

|

Gamma Notional (MM): |

$386.931M |

‑$241.075M |

$14.056M |

$150.413M |

$27.544M |

$103.842M |

|

25 Delta Risk Reversal: |

-0.053 |

-0.034 |

-0.057 |

0.00 |

-0.03 |

-0.015 |

|

Call Volume: |

613.401K |

1.442M |

8.136K |

826.866K |

12.794K |

249.488K |

|

Put Volume: |

1.088M |

1.932M |

9.91K |

1.008M |

25.448K |

544.289K |

|

Call Open Interest: |

7.471M |

5.146M |

58.405K |

3.68M |

218.664K |

2.926M |

|

Put Open Interest: |

12.591M |

11.691M |

90.685K |

5.608M |

392.785K |

6.975M |

0 comentarios