Macro Theme:

Key dates ahead:

- 1/21: VIX Exp

- 1/22: GDP, PCE

- 1/28: FOMC

SG Summary:

Update 1/20: Based on current positioning (1/20 AM), we eye 6,700 as a negative gamma “troughing” low. Until then, we are concerned that elevated volatility premium keeps markets unstable at least through 1/28 FOMC. Given this, we hold the Risk-Pivot at 6,890, but we actively look to shift that lower if the positioning and sentiment improves.

1/7: While we now look for a move to 7k in the coming days, with COR1M at ~8.3 we have elected to add a small number of Feb/March index puts. <6,900 we would increase short positions. See the 1/7 note for details.

Key SG levels for the SPX are:

- Resistance: 6,900

- Pivot: 6,890 (bearish <, bullish >) UPDATED 12/26

- Support: 6,800, 6,775, 6,700

Founder’s Note:

Futures are off -1.5% after Friday’s OPEX and into renewed trade/geopolitical tension. The VIX is at 20.

Gold and silver both hit highs this AM, with gold at $4,700 and silver $95.

This futures move pushed the indicative SPX price below our 6,890 Risk Pivot, and we now, based on ES we see the SPX near 6,832.

Key support is now at 6,800. Resistance is at 6,900. The Risk Pivot remains at 6,890, but will quite possibly shift to 6,800 for tomorrow if we see material positive gamma form below.

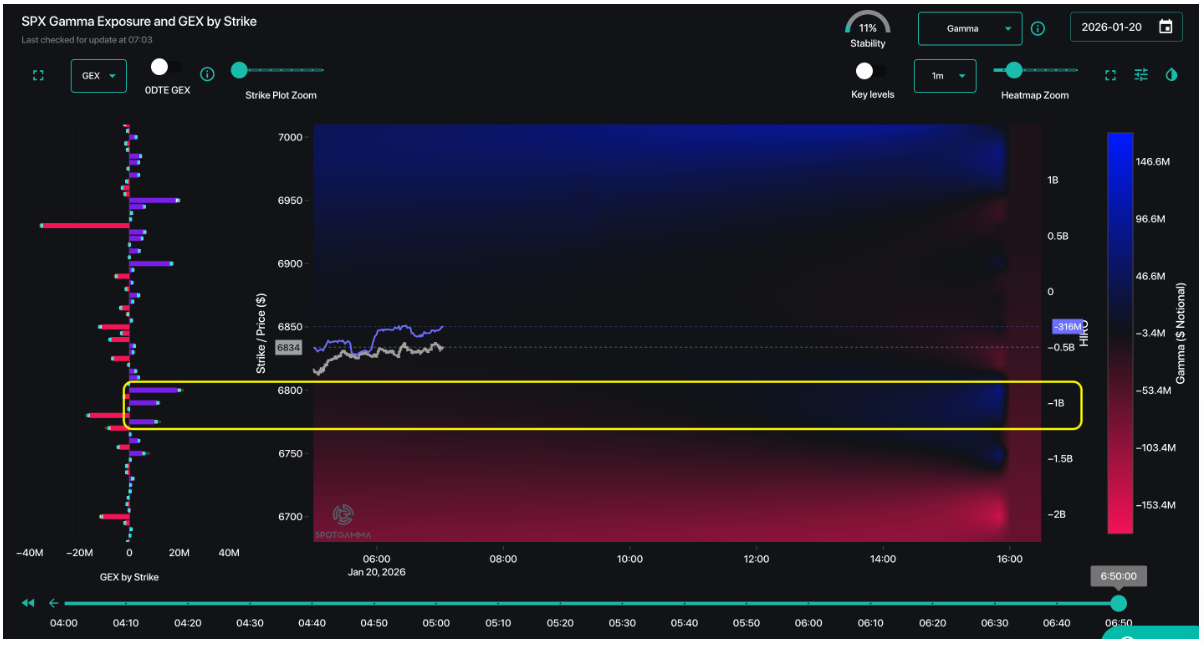

At 6,800 there are some light put sellers showing up from 6,775 to 6,800 (yellow box, blue bars). Below 6,775 is negative gamma (red), which suggests <6,775 equities face another leg down into 6,700.

Normally in these situations 0DTE traders step up, generally selling options which provides local positive gamma. In this case that flow is a bit less dependable. We say this because we now have a clear “known unknown” related to the Greenland/tariff situation. Should Trump take to tweeting, for example, it could quickly inject risk.

With this in mind, we currently see SPX negative gamma troughing near ~6,700 (yellow arrow), which is where we’d start to look for more stability in SPX. Obviously this is an active market, and so if we see large put sellers (0DTE or other tenors) then we’d look for support at higher levels. Both TRACE and HIRO will be helpful for navigating in this situation. If HIRO shows positive delta flows in S&P + equities, it will be a sign that traders are simply seeing this as a “buyable dip” vs something more material.

Gamma is only part of the story here. In risk-off moves it’s IV which is just as, if not more critical to monitor. From Friday’s close we are generally seeing a +2 vol point pop across the SPX surface. Below is the 1-day change in Feb Exp skew, which shows this is generally a parallel shift in skew. We don’t really see a bigger relative jump in downside strike IV as of yet.

It’s important to frame this situation, as we went into Friday’s OPEX with COR1M having flagged a risk-trigger on 1/7, while 1-month realized SPX vol was very quiet at 9%. OPEX is a turning point as the flows that pinned SPX in the 6,900’s were reset, and we made the case that after this turning point vol was likely to pin higher until FOMC next week. Given this new situation, vol likely holds an even higher premium until/unless a deal is made with Europe. This “sticky premium” means we will view any rally as simply short covering, and lacking stability (vol likely has to be sold off for a stock rally persist).

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESH26 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6976.1 |

$6940 |

$691 |

$25529 |

$621 |

$2677 |

$265 |

|

SG Gamma Index™: |

|

-0.235 |

-0.285 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.69% |

0.69% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.48% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6976.1 |

$6940 |

$692 |

$25490 |

$621 |

$2620 |

$264 |

|

Absolute Gamma Strike: |

$7036.1 |

$7000 |

$690 |

$25550 |

$620 |

$2700 |

$260 |

|

Call Wall: |

$7136.1 |

$7100 |

$695 |

$25550 |

$630 |

$2700 |

$270 |

|

Put Wall: |

$6936.1 |

$6900 |

$680 |

$24000 |

$615 |

$2590 |

$250 |

|

Zero Gamma Level: |

$6935.1 |

$6899 |

$690 |

$25273 |

$624 |

$2631 |

$267 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [7000, 6900, 6950, 6000] |

|

SPY Levels: [690, 695, 680, 685] |

|

NDX Levels: [25550, 25600, 25500, 25800] |

|

QQQ Levels: [620, 625, 615, 610] |

|

SPX Combos: [(7273,76.83), (7252,90.44), (7225,76.17), (7197,98.14), (7176,81.23), (7155,89.84), (7148,93.84), (7127,85.76), (7120,69.57), (7100,98.33), (7072,92.74), (7058,87.64), (7051,98.09), (7037,80.34), (7030,83.18), (7023,97.50), (7016,78.17), (7009,82.60), (7002,99.02), (6996,91.36), (6989,69.42), (6982,94.13), (6975,95.72), (6968,88.36), (6961,82.36), (6947,92.60), (6933,89.06), (6926,96.63), (6919,83.87), (6912,95.36), (6898,98.85), (6891,84.93), (6878,90.31), (6871,89.22), (6864,70.69), (6857,85.49), (6850,96.44), (6843,92.03), (6822,94.44), (6808,76.44), (6801,97.17), (6787,81.59), (6780,72.79), (6773,89.62), (6753,90.13), (6732,71.22), (6725,87.51), (6697,95.60), (6669,69.40), (6649,84.33), (6628,69.01), (6621,66.67), (6600,90.59)] |

|

SPY Combos: [697.71, 707.4, 712.94, 702.55] |

|

NDX Combos: [25555, 25274, 25478, 24661] |

|

QQQ Combos: [619.79, 627.25, 614.82, 627.88] |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

0.974 |

0.740 |

1.367 |

0.782 |

1.297 |

0.824 |

|

Gamma Notional (MM): |

‑$102.874M |

‑$682.943M |

$6.996M |

‑$334.272M |

$20.588M |

‑$125.565M |

|

25 Delta Risk Reversal: |

-0.046 |

-0.033 |

-0.06 |

-0.044 |

-0.035 |

-0.022 |

|

Call Volume: |

601.245K |

1.099M |

13.733K |

741.258K |

42.647K |

284.387K |

|

Put Volume: |

866.773K |

1.624M |

8.208K |

922.168K |

54.10K |

506.474K |

|

Call Open Interest: |

6.60M |

4.188M |

48.389K |

2.868M |

213.978K |

2.537M |

|

Put Open Interest: |

11.117M |

10.009M |

86.322K |

4.643M |

372.726K |

6.015M |

0 comentarios