Macro Theme:

Key dates ahead:

- 1/22: GDP, PCE

- 1/28: FOMC

SG Summary:

Update 1/20: Based on current positioning (1/20 AM), we eye 6,700 as a negative gamma “troughing” low. Until then, we are concerned that elevated volatility premium keeps markets unstable at least through 1/28 FOMC. Given this, we hold the Risk-Pivot at 6,890, but we actively look to shift that lower if the positioning and sentiment improves.

1/7: While we now look for a move to 7k in the coming days, with COR1M at ~8.3 we have elected to add a small number of Feb/March index puts. <6,900 we would increase short positions. See the 1/7 note for details.

Key SG levels for the SPX are:

- Resistance: 6,800, 6,900

- Pivot: 6,890 (bearish <, bullish >) UPDATED 12/26

- Support: 6,700

Founder’s Note:

Futures are up 50bps, which places them back above our SPX 6,890 Risk Pivot.

TLDR: The chase is clearly back on, after vols have mildly reset. Of particular note: IWM made new-all time highs yesterday, as did SMH – that’s not something that happens in the midst of a risk-off spasm. If SPX moves back <6,890 we flip back to risk-off. We note both GDP and PCE are today, which could have macro/FOMC implications.

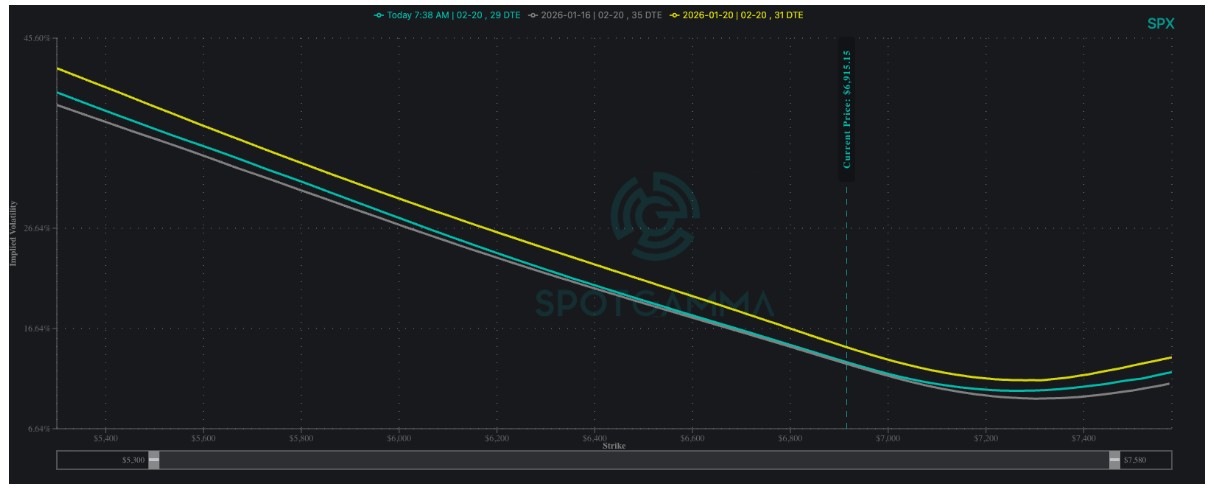

Vols are now back to where they were on Friday night, as we show by comparing SPX 2/20 Exp skew from this AM (teal) vs Friday’s close (gray). Tuesday’s closing skews, when SPX closed at 6,800 & VIX +20, is marked in yellow.

This basically marks the resolution of the Greenland issue – a problem that didn’t really exist before last week. Interestingly, the SPX is now back into the 6,900-6,950 box, which was the same place we were in before the Greenland issue was an issue.

None of this resolves the event vol tied to 1/28 FOMC. That event is going to hold up vols as you can see by comparing our Forward IV (light teal) to the SPX (teal). Essentially what we have here is a window for traders to smack down 0-3 DTE vol, but they are likely to stay off of exp >1/28. This means that we can have some light, local vol selling which now helps to keep SPX >6,900, but we aren’t going to marry equity long positions until post FOMC.

Lastly, on the single-stock front the situation is now a bit healthier for bulls. Recall we threw the risk flag on 1/7 noting that call buying had gone too far. Yesterday, too, we showed a skew to puts vs calls via our Compass. This now gives traders just a bit more room to move into calls as they are trading at prices that are a bit more reasonable.

We now see COR1M (CBOE correlation) is at 10 and some of this COR1M “low” is being driven by earnings coming up for most stocks. We suspect that a clean FOMC and some decent earnings next week could easily push this metric back into overbought, and that likely syncs with SPX at 7k. Pre-FOMC we suspect the single stock chase will be on.

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

| /ESH26 | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $6908.02 | $6875 | $685 | $25326 | $616 | $2698 | $267 |

| SG Gamma Index™: |

| -0.521 | -0.414 |

|

|

|

|

| SG Implied 1-Day Move: |

| 0.66% | 0.66% |

|

|

|

|

| SG Implied 5-Day Move: |

| 1.48% |

|

|

|

|

|

| SG Implied 1-Day Move High: |

| After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: |

| After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $6933.02 | $6900 | $685 | $25290 | $615 | $2630 | $264 |

| Absolute Gamma Strike: | $7033.02 | $7000 | $680 | $25550 | $620 | $2700 | $260 |

| Call Wall: | $7033.02 | $7000 | $695 | $25550 | $630 | $2700 | $270 |

| Put Wall: | $6833.02 | $6800 | $680 | $24000 | $600 | $2600 | $250 |

| Zero Gamma Level: | $6920.02 | $6887 | $689 | $25072 | $619 | $2651 | $267 |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [7000, 6900, 6950, 6000] |

| SPY Levels: [680, 690, 685, 670] |

| NDX Levels: [25550, 25400, 25500, 25600] |

| QQQ Levels: [620, 610, 600, 615] |

| SPX Combos: [(7199,96.26), (7192,67.58), (7178,72.13), (7158,89.08), (7151,92.43), (7123,82.35), (7103,97.78), (7075,85.54), (7061,71.63), (7048,96.50), (7027,92.53), (7020,81.34), (7013,79.41), (7006,67.62), (6999,98.23), (6993,89.00), (6986,91.68), (6979,83.30), (6972,96.46), (6965,74.05), (6958,83.95), (6951,97.83), (6944,83.59), (6938,84.33), (6931,85.42), (6924,69.59), (6917,84.50), (6869,76.38), (6862,79.77), (6855,68.40), (6848,98.05), (6841,91.87), (6827,88.43), (6821,92.22), (6814,73.94), (6807,87.96), (6800,98.62), (6793,94.28), (6786,71.75), (6779,78.96), (6772,95.70), (6766,79.12), (6759,77.19), (6752,96.77), (6738,79.73), (6731,74.19), (6724,91.56), (6717,74.50), (6697,97.34), (6676,70.53), (6669,82.45), (6649,90.74), (6642,73.42), (6628,77.54), (6621,73.49), (6601,93.87), (6573,84.03), (6552,81.75)] |

| SPY Combos: [677.61, 668.12, 670.16, 672.87] |

| NDX Combos: [25555, 24668, 24238, 25073] |

| QQQ Combos: [600.18, 622.08, 589.85, 605.05] |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.946 | 0.670 | 1.393 | 0.792 | 1.33 | 0.906 |

| Gamma Notional (MM): | ‑$184.634M | ‑$1.059B | $8.966M | ‑$328.337M | $25.339M | ‑$16.809M |

| 25 Delta Risk Reversal: | -0.053 | -0.035 | -0.064 | -0.047 | -0.04 | -0.027 |

| Call Volume: | 108.791K | 272.101K | 1.347K | 175.489K | 1.619K | 48.035K |

| Put Volume: | 246.077K | 302.731K | 1.147K | 150.556K | 2.03K | 206.714K |

| Call Open Interest: | 6.917M | 4.553M | 53.556K | 3.083M | 221.495K | 2.632M |

| Put Open Interest: | 11.51M | 10.497M | 90.188K | 4.918M | 397.663K | 6.339M |

0 comentarios