Macro Theme:

Key dates ahead:

- 2/6: NFP

- 2/11: CPI

SG Summary:

Update 2/5: As always, we remain neutral to short of equities as long as the SPX is below our Risk Pivot, which holds at 6,950. If we remain under 6,900 then we think a washout remains a viable outcome, and we’d eye 6,675 as major downside support. 7k remains major upside resistance due to positive gamma at that strike.

2/3: Short term now appear to be subsiding (Iran, MN, etc), and correlation metrics shifted higher after last weeks spasms (Sunday night futures traded to 6,875 before rallying to 7k). Further, we’ve uncovered a signal wherein the wild intraday swings vs overnight stability suggests positive SPX returns on a 3 to 5 day forward window. Given this, and the close back above 6,950, we will be long of stocks and looking to sell intraday calls against that position. Further, on the single stock side, we see TSLA has a IV Rank near 1, and so we will look to get into some longer dated TSLA calls for upside exposure. A break back <6,950 flips us back to risk-off.

Key SG levels for the SPX are:

- Resistance: 6,900, 6,950, 7,000,

- Pivot: 6,950 (bearish <, bullish >) UPDATED 1/28

- Support: 6,800, 6,750, 6,675

Founder’s Note:

Futures are 50bps higher with no major data on deck for today.

6,900 is resistance, with support at 6,800, 6,740, then we start to look at that 6,600’s “wash out” level (see y’day note). TLDR: the smoke hasn’t cleared, and we see no reason to get long this market for anything outside of a day trade. we want to see negative gamma reduce before dipping our toes in the water. Should SPX trade down in the 6,600’s we may change our tune on that, as that area is where vol premium would become interesting.

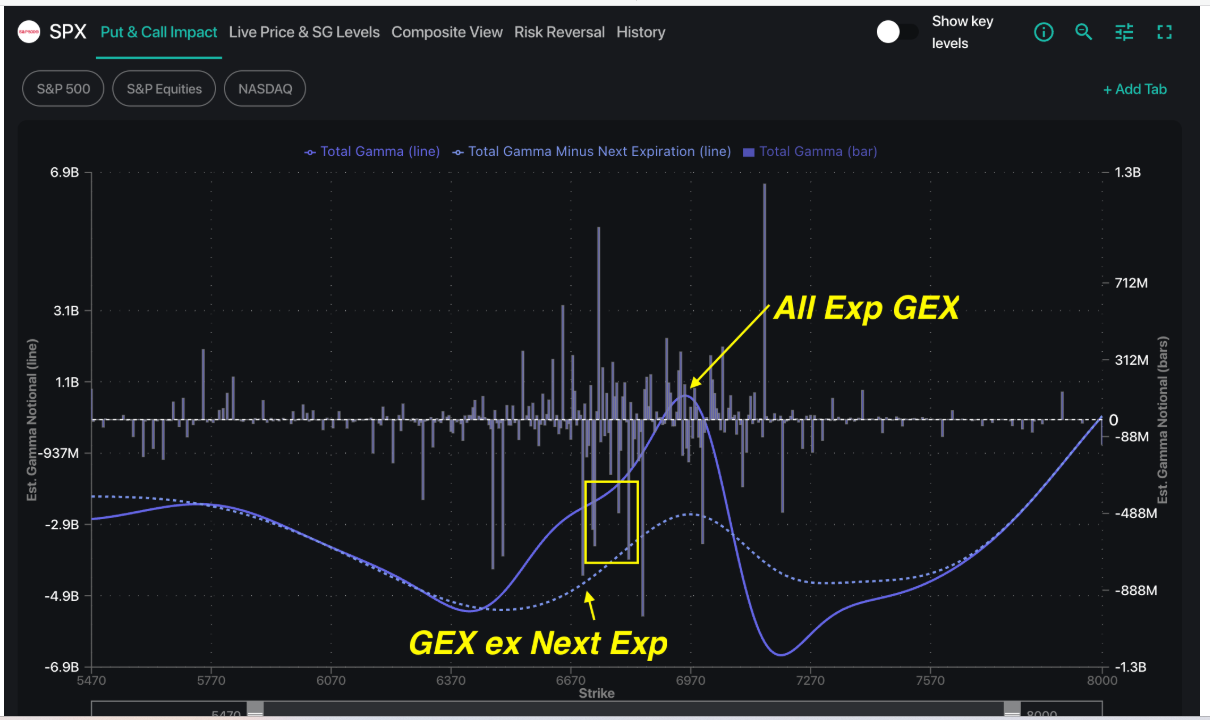

Gamma (solid line) starts off in a flag to negative stance, but if you remove the 0DTE options sellers you see GEX (dashed line) is rather sharply negative across the board. Given this, it’s key to note the AM rally feels nice, but is no signal of forward stability. Further, you can see that the gamma lines trough to 6,650-ish area (vs 6,675 we saw y’day). This lower troughing area is the result of more traders buying put protection. IVs are about 1/2 a vol point lower vs yesterday, which syncs with higher equity futures. That offers some relief, but its hardly a state change in bearish dynamics.

On the put-buying topic, we see names “going convex”. Compass here is set to IV Rank (Y axis) vs Put Skew (x axis). Those names in the top right corner are therefore either in the throes of death (MSTR) or traders are bracing for impact.

To place this into context, the SPX is 3% off of all time highs which were set just 4 days ago. But, suddenly, the world is a disaster and we see certain sub sectors getting absolutely wrecked (software, crypto, etc). Given this we are still viewing this whole saga as a re-normalization of vols. Just as stuff had to over-travel to the upside (i.e. calls getting too bid), it seems we have to drive those put values to extremes, too. Some stuff seems to be getting on objectively fat risk premium, which should start to draw out some vol sellers. If and when that happens more broadly, it will offer some stability to markets.

For SPX we suspect that area is 6,675 (if it gets there), which would likely have VIX near 30. Software, we think, is starting to offer some large premiums, with IGV now off 30% YTD. It is quite possible though that this ends with a “correlation slam” which means that more stuff catches fully down to tech/software/metals etc.

Putting this into context, here is the 3-month performance of various sector ETF’s. Software is infecting XLK (tech), and Mags are quite frankly not offering a bid. Losing the leaders, so to speak has not yet impacted the indices, but that is the concern.

On the topic of MSTR, wow….

This feels almost like Captain Condor in that the whole street knows your position and price, and they are coming for you. For reference BTC is 67k this AM…

©2025 TenTen Capital LLC DBA SpotGamma

All TenTen Capital LLC DBA SpotGamma materials, information, and presentations are for educational purposes only and should not be considered specific investment advice nor recommendations. Futures, foreign currency and options trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing one’s financial security or lifestyle. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results. VIEW FULL RISK DISCLOSURE https://spotgamma.com/model-faq/disclaimer/

|

|

/ESH26 |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$6820.85 |

$6798 |

$677 |

$24548 |

$597 |

$2577 |

$255 |

|

SG Gamma Index™: |

|

-3.036 |

-0.737 |

|

|

|

|

|

SG Implied 1-Day Move: |

|

0.67% |

0.67% |

|

|

|

|

|

SG Implied 5-Day Move: |

|

1.47% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

|

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

|

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$6962.85 |

$6940 |

$687 |

$25075 |

$620 |

$2630 |

$262 |

|

Absolute Gamma Strike: |

$7022.85 |

$7000 |

$680 |

$25550 |

$600 |

$2600 |

$250 |

|

Call Wall: |

$7122.85 |

$7100 |

$700 |

$25550 |

$630 |

$2800 |

$270 |

|

Put Wall: |

$6822.85 |

$6800 |

$675 |

$24000 |

$600 |

$2600 |

$250 |

|

Zero Gamma Level: |

$6883.85 |

$6861 |

$686 |

$24857 |

$614 |

$2670 |

$269 |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [7000, 6000, 6900, 6800] |

|

SPY Levels: [680, 675, 670, 685] |

|

NDX Levels: [25550, 24000, 25000, 24500] |

|

QQQ Levels: [600, 620, 610, 590] |

|

SPX Combos: [(7098,96.26), (7077,83.87), (7050,91.93), (7023,91.07), (7002,93.87), (6975,68.18), (6968,72.88), (6948,82.79), (6900,82.98), (6887,71.79), (6873,81.42), (6853,89.36), (6832,87.03), (6826,94.21), (6819,67.08), (6812,88.50), (6805,68.54), (6798,98.43), (6792,87.87), (6785,72.01), (6778,94.39), (6771,96.10), (6758,90.93), (6751,96.85), (6744,72.01), (6737,94.92), (6730,87.36), (6724,96.99), (6717,85.34), (6710,69.21), (6703,98.63), (6683,82.05), (6676,90.61), (6662,82.02), (6649,94.73), (6642,82.24), (6622,94.51), (6601,97.21), (6574,88.04), (6547,90.66), (6526,67.80), (6520,82.82), (6513,76.47), (6499,97.02), (6472,92.82)] |

|

SPY Combos: [708.08, 677.89, 702.59, 717.68] |

|

NDX Combos: [24671, 24254, 23837, 24009] |

|

QQQ Combos: [600.17, 589.87, 621.37, 580.18] |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

0.708 |

0.452 |

0.666 |

0.479 |

0.405 |

0.393 |

|

Gamma Notional (MM): |

‑$843.74M |

‑$2.023B |

‑$8.891M |

‑$1.084B |

‑$88.107M |

‑$1.17B |

|

25 Delta Risk Reversal: |

-0.073 |

-0.057 |

-0.087 |

-0.072 |

-0.058 |

-0.043 |

|

Call Volume: |

737.433K |

1.901M |

10.866K |

1.379M |

17.116K |

319.233K |

|

Put Volume: |

1.066M |

2.533M |

10.632K |

1.704M |

29.798K |

943.12K |

|

Call Open Interest: |

7.462M |

5.108M |

60.63K |

3.878M |

228.23K |

2.924M |

|

Put Open Interest: |

12.402M |

11.155M |

100.827K |

5.745M |

430.72K |

7.245M |

0 comentarios