Macro Theme:

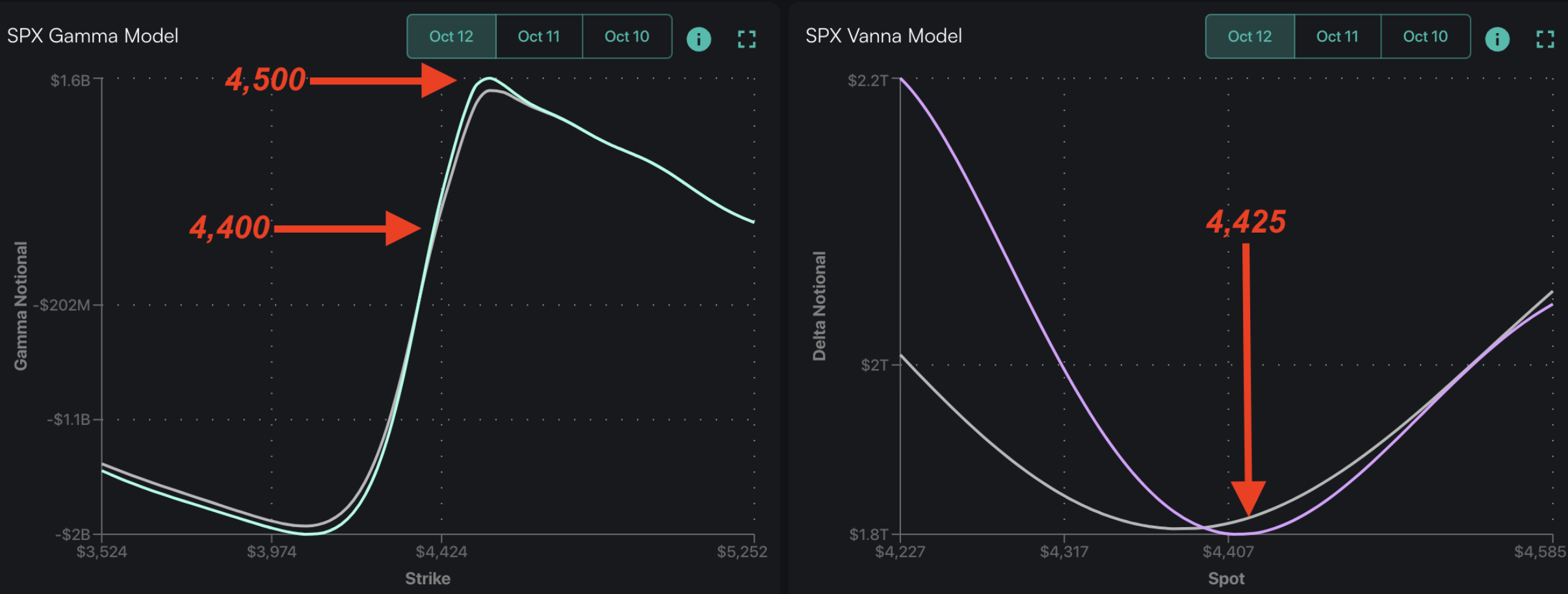

Short Term SPX Resistance: 4,400

Short Term SPX Support: 4,300

SPX Risk Pivot Level: 4,315

Major SPX Range High/Resistance: 4,400

Major SPX Range Low/Support: 4,200

‣ We look for a range pin in the 4,300 – 4,400 into 10/18 VIX exp.*

‣ A window for equity weakness opens on Wed 10/18*

‣ 4,400 SPX is likely max upside into OPEX*

‣ 4,200 SPX is the Oct OPEX downside target if 4,300 is breached*

*updated 10/16

Founder’s Note:

ES Futures are flat at 4,342. Key SG levels for the SPX are:

- Support: = 4,300 (SPX

Put Wall

), 4,275, 4,250

- Resistance: 4,322, 4,350, 4,375 & 4,400 (SPX

Call Wall

)

- 1 Day Implied Range: 0.76%

For QQQ, support is at 360 (

Put Wall

), then 355. Resistance is at 365-366 (Vol Trigger).

Premarket earnings: TSLA is -5%, NFLX +13%

Powell speaks today at 12PM ET. That’s followed by Fed Goolsbee at 1:20 and Barr at 1:30.

Yesterday’s AM VIX expiration did seem to trigger some unpinning in equities, as the equity market was under pressure all day yesterday, closing just above SPY 430 (SPX 4,315). This led to a somewhat mild increase in the VIX, to 19.24 (+.9pts, from 18.35).

Shown here is our Fixed Strike Vol matrix for the SPX. This is comparing the IV change from Wednesdays close, to this AM. As you can see the bulk of ATM strikes (i.e around 4,315) are mild-green which suggests just a small increase in IV’s for this strikes over the last session. This, despite the SPX -1%. You may also notice that pocket of red for strikes < 4200 over expirations 10/23 – 10/26, which reads as traders selling these OTM puts. This is something to consider if the SPX does indeed breach 4,300 today – those short dated put IV’s may jump.

The takeaway here is that there is not a meaningful bid for downside options despite lower equity prices (and there are signs of short dated put selling per above). This is not a new story, but it continues to suggest traders/investors are just selling stock rather than trying to hedge positions (a la 2022). If vol were to suddenly pop because of geopolitics or rates breaking things, then the pace of equity market declines could pick up significantly.

This brings us around to today’s session. We’re unsure of what Powell will say, or how the market will react. We do feel that he would have to be rather dovish in order to spark a meaningful equity market rally. This is because even if a bit of event-vol comes off after he speaks, we think IV is unlikely to materially drop due to the escalating tensions overseas and demand for weekend hedges. Therefore, vanna as a core component of equity upside is “on ice”. Even if Powell does drive a rally, the change of the SPX

Call Wall

to 4,400 reinforces that strike as a market high into tomorrows expiration.

To the downside, 430 SPY (SPX 4,310) and 4,300 have a large amount of size with 20-30% of S&P gamma expiring tomorrow. The high level of gamma expiring suggests positions could shift quickly, making the support more transient. The other thing to note here, is that <430 SPY (shown below) & <4,300 there are predominantly put positions (blue bars). This implies that if 4,300 is broken, realized volatility may increase which likely comes in with VIX >20. This means that vanna can assist in a downside equity slide.

In this scenario, we would be looking for support in the 4,200 – 4,250 area into tomorrow’s expiration. As you can see in the gamma model below, the gamma curve starts to flatten out <4,200 which suggests downside dealer hedging pressure may ease into 4,200 (for a previous discussion on this model, please see this Founder’s note).

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $4313 | $430 | $14909 | $363 | $1728 | $171 |

| SpotGamma Implied 1-Day Move: | 0.76% | 0.76% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 2.11% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $4345 | $435 | $15030 | $366 | $1770 | $176 |

| Absolute Gamma Strike: | $4300 | $430 | $15250 | $365 | $1700 | $175 |

| SpotGamma Call Wall: | $4400 | $440 | $15250 | $380 | $1825 | $190 |

| SpotGamma Put Wall: | $4300 | $425 | $14800 | $360 | $1700 | $170 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $4353 | $436 | $14760 | $371 | $1777 | $180 |

| Gamma Tilt: | 0.767 | 0.602 | 1.164 | 0.699 | 0.530 | 0.402 |

| SpotGamma Gamma Index™: | -1.625 | -0.472 | 0.025 | -0.151 | -0.046 | -0.128 |

| Gamma Notional (MM): | ‑$849.141M | ‑$2.084B | $3.142M | ‑$722.199M | ‑$47.229M | ‑$1.407B |

| 25 Day Risk Reversal: | -0.051 | -0.05 | -0.053 | -0.052 | -0.049 | -0.054 |

| Call Volume: | 598.109K | 2.114M | 9.284K | 1.247M | 18.472K | 343.504K |

| Put Volume: | 1.172M | 3.024M | 12.194K | 1.496M | 28.693K | 1.817M |

| Call Open Interest: | 7.054M | 7.609M | 61.012K | 4.929M | 247.704K | 3.854M |

| Put Open Interest: | 13.079M | 13.828M | 86.781K | 8.843M | 388.952K | 7.176M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [4400, 4350, 4300, 4000] |

| SPY Levels: [435, 430, 425, 420] |

| NDX Levels: [15500, 15250, 15100, 15000] |

| QQQ Levels: [370, 365, 360, 350] |

| SPX Combos: [(4525,75.66), (4512,84.81), (4499,94.77), (4447,97.85), (4430,74.73), (4426,91.83), (4408,80.30), (4400,99.55), (4378,76.74), (4374,93.73), (4370,74.85), (4339,83.26), (4335,82.32), (4322,98.21), (4318,88.18), (4314,85.90), (4309,93.40), (4305,74.84), (4301,99.69), (4288,94.28), (4279,94.65), (4275,96.80), (4270,95.23), (4258,95.45), (4249,99.09), (4240,81.91), (4227,80.99), (4223,91.80), (4219,78.86), (4210,91.43), (4197,99.01), (4180,77.37), (4158,81.42), (4150,93.30), (4124,76.16), (4111,79.63)] |

| SPY Combos: [437.96, 432.8, 422.91, 413.01] |

| NDX Combos: [15237, 14775, 14358, 14566] |

| QQQ Combos: [365.99, 345.3, 355.1, 359.82] |

SPX Gamma Model

View All Indices Charts

0 comentarios