Macro Theme:

Short Term SPX Resistance: 4,260 (SPY 425)

Short Term SPX Support: 4,200

SPX Risk Pivot Level: 4,300

Major SPX Range High/Resistance: 4,300

Major SPX Range Low/Support: 4,200

‣ We look for the S&P to hold 4,200 – 4,300 into Nov 1st FOMC*

‣ Nov 1st FOMC is a major turning point for equities*

*updated 10/25

Founder’s Note:

ES Futures are -14pts to 4,257. Key SG levels for the SPX are:

- Support: 4,222, 4,209 & 4,200

- Resistance: 4,250, 4,300

- 1 Day Implied Range: 0.83% (SPX open/close range)

In QQQ support is at 355, with major resistance at 360.

Key earnings reactions: MSFT +3.6% to $342. GOOGL -6.6% to $129.

For today we look for equities to remain in a tight range, much like yesterday. The S&P

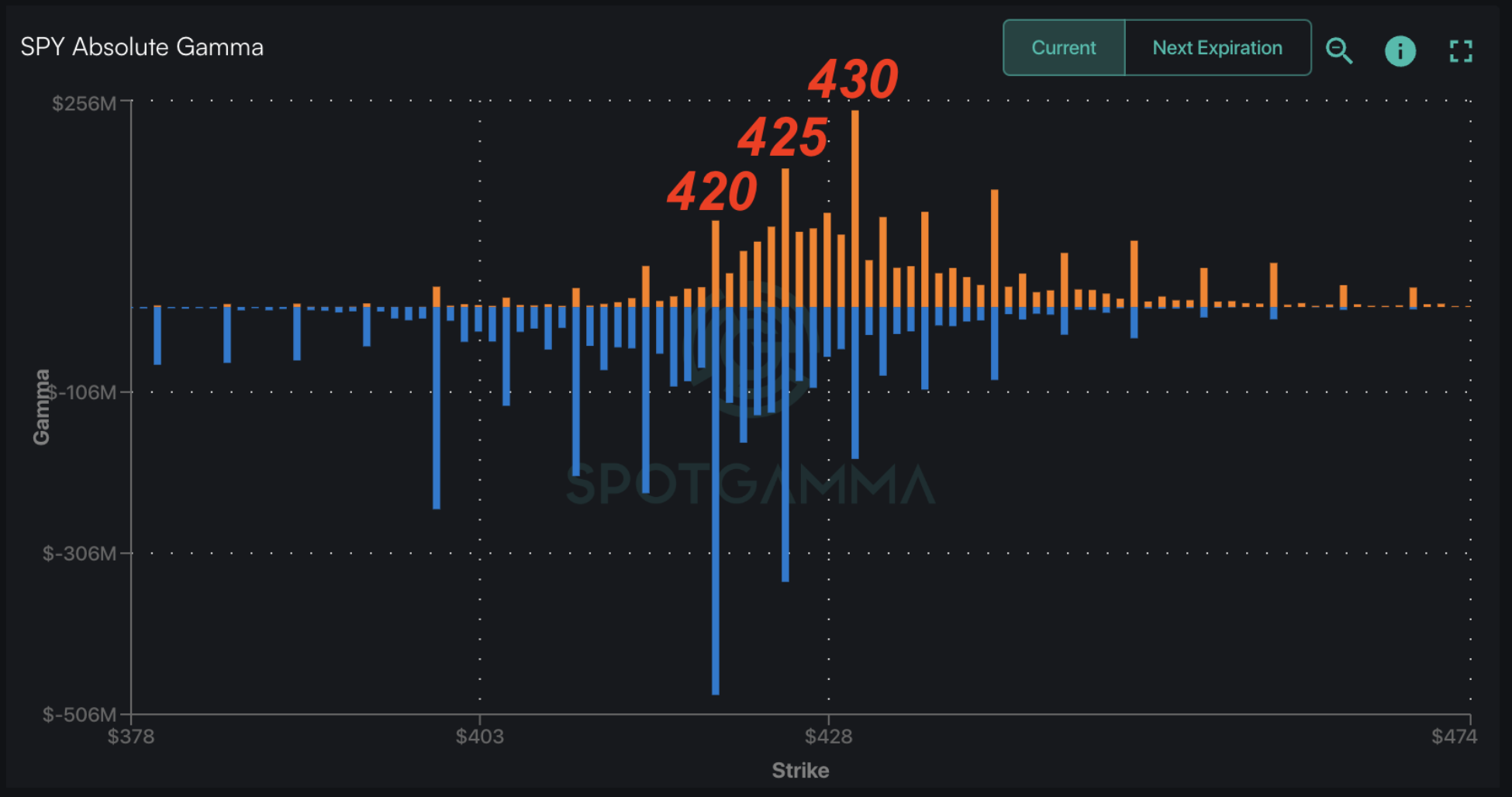

Put Wall

support continues to sit at 420SPY/4,200 SPX, and we now see size building at SPY 425 (SPX 4,260). This adds to short term resistance.

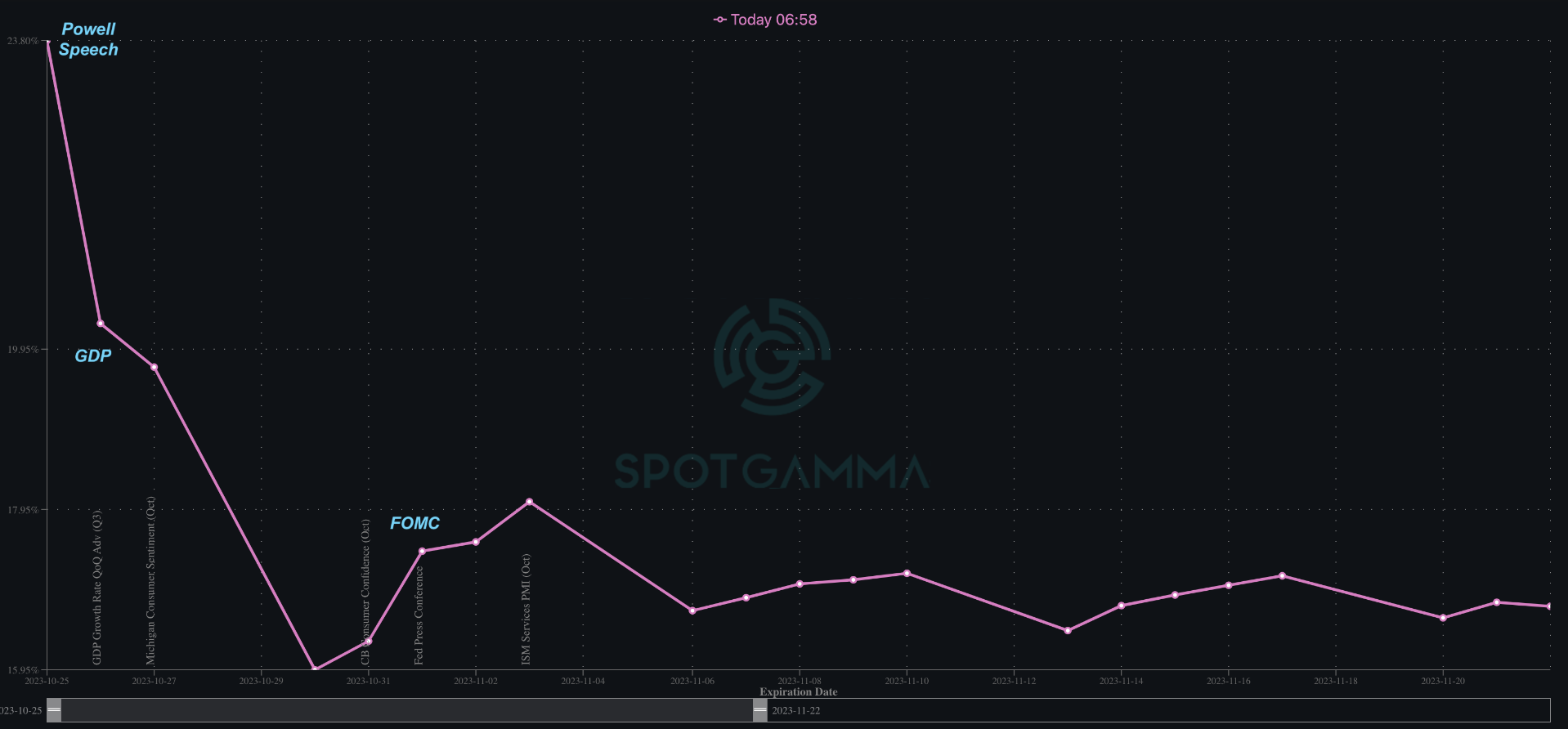

Tomorrow may lead to a bit more action, as traders digest Powell’s 4:30PM ET remarks, PM META earnings, and tomorrow’s 8:30AM ET GDP. This is followed by PCE on Friday, 10/27. As you can see below, the SPX term structure remains in backwardation as traders price out the impact of these short term events.

Baring a tail print from one of these data points, we do not see the SPX breaking the 4,200 – 4,300 range before Friday – and likely not before next Wednesday’s FOMC.

Further, as these data points tick past, it likely leads to a short term release in IV’s which is light support for equities. However a full release in IV/VIX is unlikely before FOMC, and weekend conflict hedging (due to Middle East circumstances) also keeps a bid under IV/VIX into Friday.

We can look at these factors as leading to an “IV/VIX pin” for this week, which serves to stall out the major equity indexes near current levels.

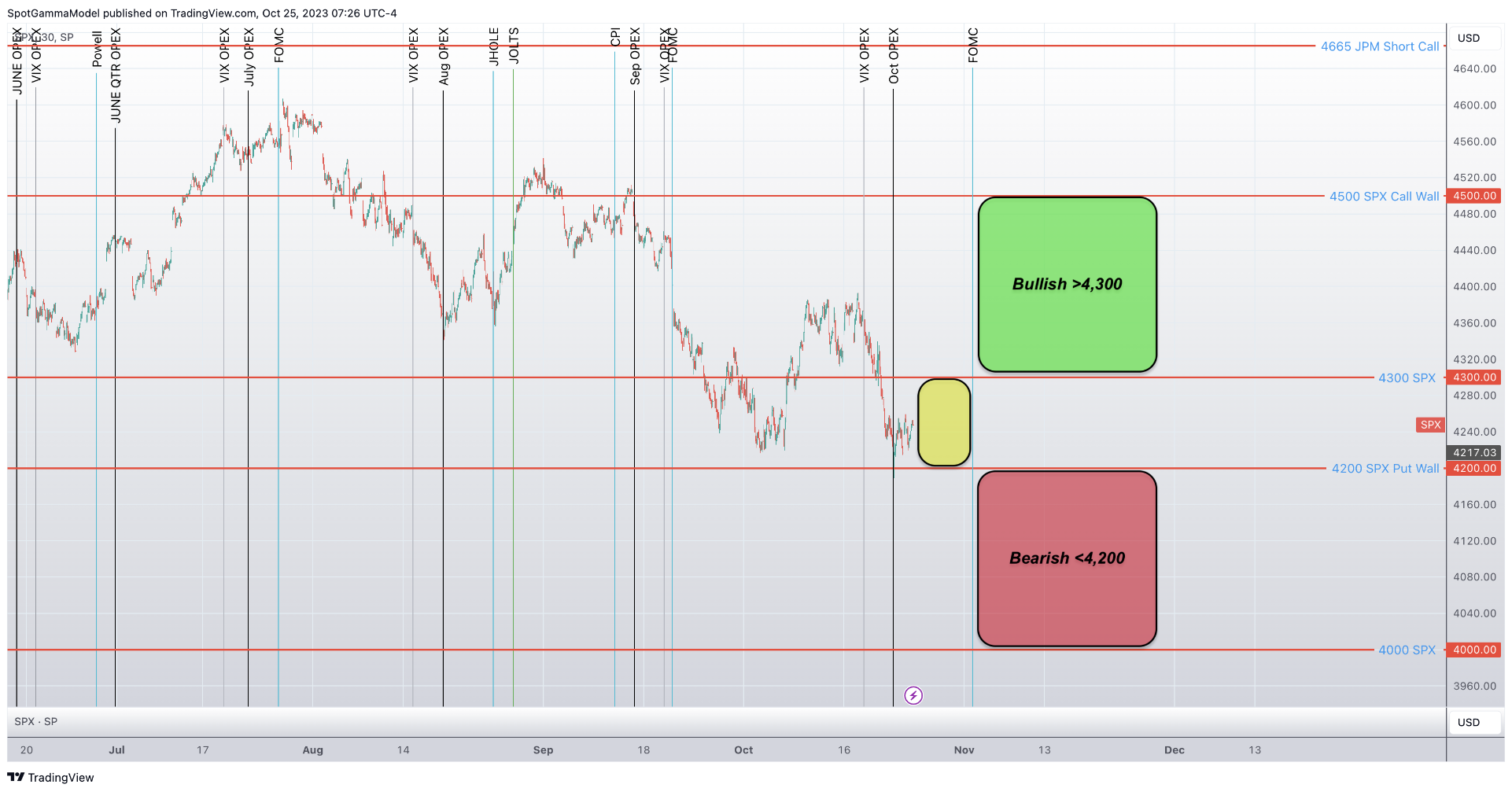

Mapping the key levels, as stated above, we continue to look for the SPX to hold current prices into out of 11/1 FOMC (yellow box). Out of 11/1 we have very clear lines of demarcation, with a bullish break occurring on a close >4,300. This would coincide with a sharp, longer term decline in IV/VIX. To the downside, the bearish grip increases on a close <4,200. In this situation we would see IV/VIX ratchet higher, which adds to downside pressure. In this scenario we would look for a test of the very large options area of 4,000.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $4247 | $423 | $14745 | $359 | $1679 | $166 |

| SpotGamma Implied 1-Day Move: | 0.83% | 0.83% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 2.13% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $4300 | $427 | $14475 | $360 | $1760 | $180 |

| Absolute Gamma Strike: | $4300 | $420 | $14600 | $360 | $1700 | $165 |

| SpotGamma Call Wall: | $4400 | $428 | $14600 | $380 | $1690 | $190 |

| SpotGamma Put Wall: | $4200 | $420 | $14000 | $350 | $1700 | $165 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $4319 | $429 | $14380 | $366 | $1848 | $179 |

| Gamma Tilt: | 0.748 | 0.603 | 1.21 | 0.739 | 0.594 | 0.384 |

| SpotGamma Gamma Index™: | -1.53 | -0.394 | 0.022 | -0.119 | -0.03 | -0.124 |

| Gamma Notional (MM): | ‑$867.999M | ‑$1.837B | $2.075M | ‑$696.313M | ‑$32.699M | ‑$1.444B |

| 25 Day Risk Reversal: | -0.059 | -0.043 | -0.068 | -0.046 | -0.04 | -0.038 |

| Call Volume: | 504.382K | 1.756M | 10.547K | 1.153M | 21.667K | 330.988K |

| Put Volume: | 830.835K | 2.169M | 10.004K | 1.005M | 40.611K | 1.062M |

| Call Open Interest: | 6.494M | 7.061M | 52.419K | 4.645M | 230.448K | 3.743M |

| Put Open Interest: | 12.281M | 12.094M | 65.478K | 8.097M | 382.392K | 7.077M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [4400, 4300, 4200, 4000] |

| SPY Levels: [430, 425, 420, 415] |

| NDX Levels: [15500, 15000, 14600, 14500] |

| QQQ Levels: [365, 360, 355, 350] |

| SPX Combos: [(4452,81.73), (4401,77.01), (4396,78.42), (4371,78.04), (4345,84.12), (4324,81.88), (4299,76.37), (4269,79.21), (4260,79.29), (4256,80.03), (4252,85.55), (4248,87.91), (4231,78.75), (4226,78.79), (4222,89.87), (4218,85.62), (4209,95.52), (4201,95.97), (4197,97.85), (4192,74.48), (4188,74.71), (4175,78.66), (4171,90.30), (4167,72.74), (4163,84.36), (4158,76.80), (4150,90.72), (4146,92.09), (4141,72.56), (4124,85.77), (4112,85.21), (4099,98.25), (4074,73.57), (4052,81.40), (4048,93.38)] |

| SPY Combos: [419.38, 421.93, 411.76, 416.84] |

| NDX Combos: [14584, 14377, 14171, 14569] |

| QQQ Combos: [353.25, 348.22, 358.99, 358.27] |

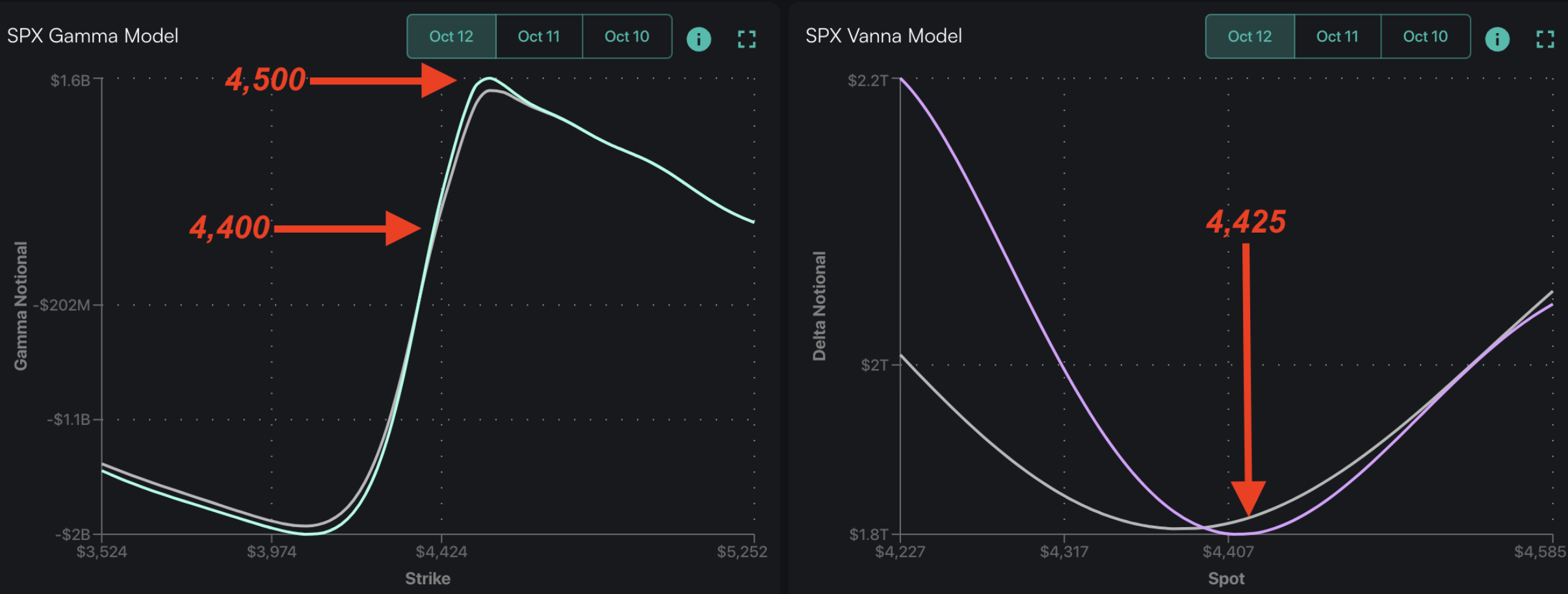

SPX Gamma Model

$3,420$3,870$4,320$5,097Strike-$1.9B-$1.1B-$395M$931MGamma NotionalPut Wall: 4200Call Wall: 4400Abs Gamma: 4300Vol Trigger: 4300Last Price: 4247

Strike: $4,553

- Next Expiration: $899,756,184

- Current: $930,701,801

View All Indices Charts

0 comentarios