Macro Theme:

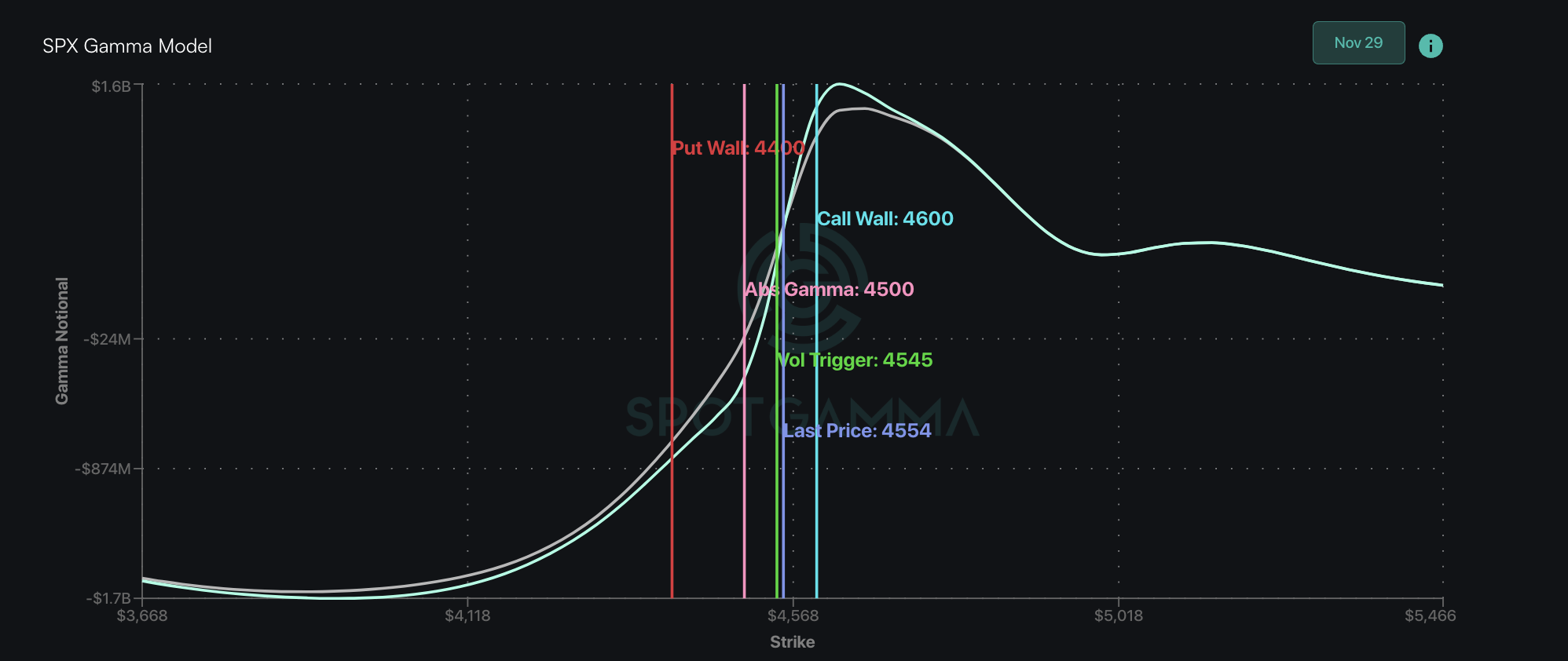

Short Term SPX Resistance: 4,574

Short Term SPX Support: 4,550

SPX Risk Pivot Level: 4,500

Major SPX Range High/Resistance: 4,600

Major SPX Range Low/Support: 4,200

‣ IV levels are anemic (~8%), which suggests that a pop higher in IV/equity downside is due. A break of 4,500 is our “risk off” level.*

‣ 4,600 is our current max upside target, as call positions are not yet building above that level.*

*updated 11/30

Founder’s Note:

ES Futures are down 30bps to 4,555. Key SG levels for the SPX are:

- Support: 4,550, 4,515, & 4,500

- Resistance: 4,574, 4,600, 4,613

- 1 Day Implied Range: 0.68%

In QQQ, support is at 385, 383 & 380. Resistance is at 390.

For IWM, the

Call Wall

resistance has today rolled to 190 (from 185). We do not see the

Call Wall

rolling higher before 12/15 OPEX. Support is now 185, then 180.

With yesterday hanging around in the 4,550 – 4,575 area, traders added to short dated positions in that range. For example +25k puts were added to the SPX at 4,550, and we believe those were short positions. This all helps to add gamma to at-the-money prices, which makes this current range all-the-more sticky. This positioning is particularly large in SPY from 455 to 460, as shown below.

Given this data, our 1-day daily range is a tight 68bps, and we see little reason for this to be violated, today. Further, data today is anticipated to be light with just JOLTS & some ISM 10AM. We’d expect any reaction to this data to mean revert back into

large gamma strikes

.

With the SPX holding a tight range, forward volatility measurements remain in the gutter. Yes, we’re off of the Thanksgiving holiday volatility lows, but traders are still pricing in little risk, and we think there is little to provoke them until next weeks CPI (12/12) and FOMC (12/23).

Away from the SPX/QQQ & MegaCaps, there are a few interesting opportunities. We think the IWM should be less “sticky” than S&P, with 190 the major overhead

Call Wall

level. We’d prefer long IWM vs SPY.

There are also heavy call skews in crypto names like COIN & MARA, and our thought it that crypto may be in a cooling off period as the sector both digests current gains, and starts to focus on FOMC. Consider the skew for COIN, below, which shows us that current IV’s are skewed toward calls (i.e. 20% OTM call IV is higher than 80% put IV), and those upside strikes are also at peaks vs recent IV readings (this is informed by the skew lines being at the top of their shaded cones, see green box). We do not think one should have naked upside exposure in this sector, but short call spreads and/or calendar spreads could be interesting.

|

SpotGamma Proprietary Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Reference Price: |

$4569 |

$456 |

$15839 |

$386 |

$1882 |

$186 |

|

SpotGamma Implied 1-Day Move: |

0.68% |

0.68% |

|

|

|

|

|

SpotGamma Implied 5-Day Move: |

2.01% |

|

|

|

|

|

|

SpotGamma Volatility Trigger™: |

$4545 |

$454 |

$15490 |

$383 |

$1790 |

$180 |

|

Absolute Gamma Strike: |

$4550 |

$455 |

$15825 |

$385 |

$1800 |

$185 |

|

SpotGamma Call Wall: |

$4600 |

$460 |

$15825 |

$400 |

$1880 |

$190 |

|

SpotGamma Put Wall: |

$4400 |

$450 |

$14000 |

$360 |

$1700 |

$170 |

|

Additional Key Levels |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Zero Gamma Level: |

$4509 |

$456 |

$15101 |

$385 |

$1822 |

$178 |

|

Gamma Tilt: |

1.247 |

1.134 |

1.912 |

0.981 |

1.202 |

1.994 |

|

SpotGamma Gamma Index™: |

1.529 |

0.124 |

0.108 |

-0.008 |

0.017 |

0.118 |

|

Gamma Notional (MM): |

$578.048M |

$332.538M |

$12.686M |

$7.003M |

$18.654M |

$1.235B |

|

25 Day Risk Reversal: |

-0.024 |

-0.03 |

-0.027 |

-0.028 |

-0.009 |

-0.016 |

|

Call Volume: |

583.113K |

1.744M |

16.323K |

896.749K |

43.273K |

852.604K |

|

Put Volume: |

937.681K |

2.262M |

16.378K |

1.218M |

48.554K |

717.296K |

|

Call Open Interest: |

7.415M |

7.548M |

61.446K |

4.529M |

298.356K |

5.594M |

|

Put Open Interest: |

13.548M |

13.824M |

73.633K |

8.353M |

469.469K |

8.125M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [4600, 4550, 4500, 4400] |

|

SPY Levels: [460, 457, 455, 450] |

|

NDX Levels: [16000, 15825, 15800, 15500] |

|

QQQ Levels: [390, 385, 380, 370] |

|

SPX Combos: [(4775,78.49), (4748,95.81), (4725,85.33), (4702,71.98), (4698,98.61), (4675,93.11), (4661,74.55), (4652,99.08), (4643,73.42), (4638,91.35), (4634,78.75), (4629,80.75), (4625,98.75), (4620,77.92), (4611,94.19), (4606,76.77), (4602,99.95), (4597,77.83), (4593,85.61), (4588,93.40), (4583,89.21), (4579,84.17), (4574,97.78), (4570,76.59), (4561,77.17), (4552,84.77), (4547,79.82), (4538,82.30), (4533,89.04), (4529,77.86), (4515,97.46), (4501,89.82), (4474,87.85), (4451,89.64), (4401,97.36), (4373,72.55), (4350,88.21)] |

|

SPY Combos: [456.29, 459.03, 461.31, 466.32] |

|

NDX Combos: [15824, 16394, 16188, 15998] |

|

QQQ Combos: [381.01, 395.27, 390.26, 385.25] |

SPX Gamma Model

View All Indices Charts

0 comentarios