Macro Theme:

Short Term SPX Resistance: 4,900 (SPX Call Wall)

Short Term SPX Support: 4,850

SPX Risk Pivot Level: 4,800

Major SPX Range High/Resistance: 4,900 (SPX Call Wall)

Major SPX Range Low/Support: 4,700

‣ 4,900 – 4,915 is our target high into 1/31 FOMC.*

‣ A downside break of 4,800 is our interim “risk off” level.*

‣ Traders, and SG models, are pricing in low volatility/risk into 1/31 FOMC*

*updated 1/24

Founder’s Note:

ES Futures are flat to 4,900. Key SG levels for the SPX are:

- Support: 4,865 (SPY 485), 4,850, 4,826, 4,815, 4,800

- Resistance: 4,873, 4,900

- 1 Day Implied Range: 0.68%

For QQQ:

- Support: 421, 420, 400

- Resistance: 425, 430

IWM:

- Support: 195, 190, 187

- Resistance: 200

Today traders are watching the GDP print at 8:30 AM ET & INTC ER after the bell.

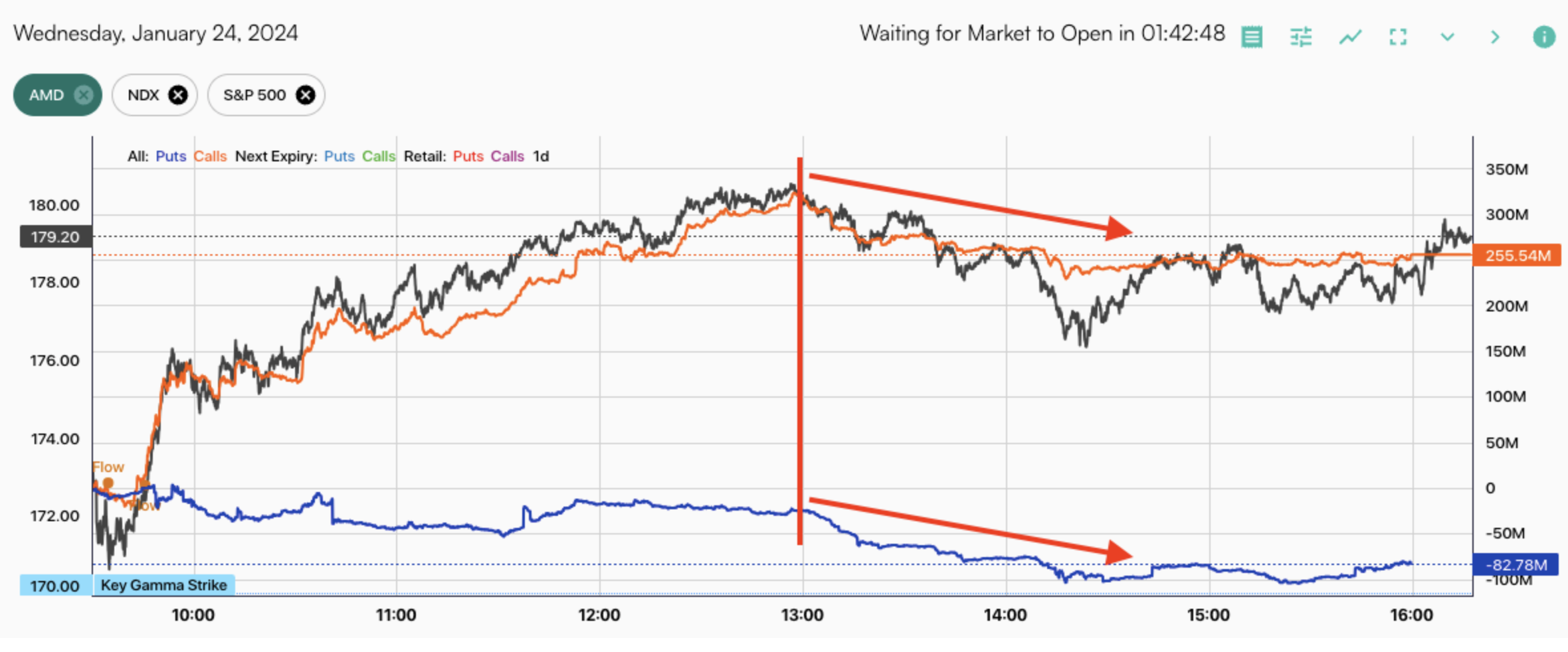

Equities were on pace to break even higher yesterday (4 ATH’s in a row), before a poor bond auction cooled off sentiment. Interestingly the 1pm ET auction took place just as the SPX was at its 4,900

Call Wall

resistance point, resulting in a heavy amount of call selling (orange) which sent the SPX down 75bps to close at key stated support of SPY 485 (SPX = 4,865). As we flagged in last nights note, this also led to a reversal in the red-hot tech sector which recorded both call selling, and put buying.

We also draw attention to the overall large put flows in the S&P over the course of the day, as seen in blue. While these flows netted out vs bullish calls in the AM, there was a second PM round of meaningful put buying.

To be clear, as shown with AMD here, this was generally not huge put demand (blue, right of red line) when weighted against the massive AM call buying (orange, left or red line), but it may be a first warning shot that warrants attention.

The moves are important to watch today in respect to the low volatility and low correlation that we discussed in yesterdays note (see here).

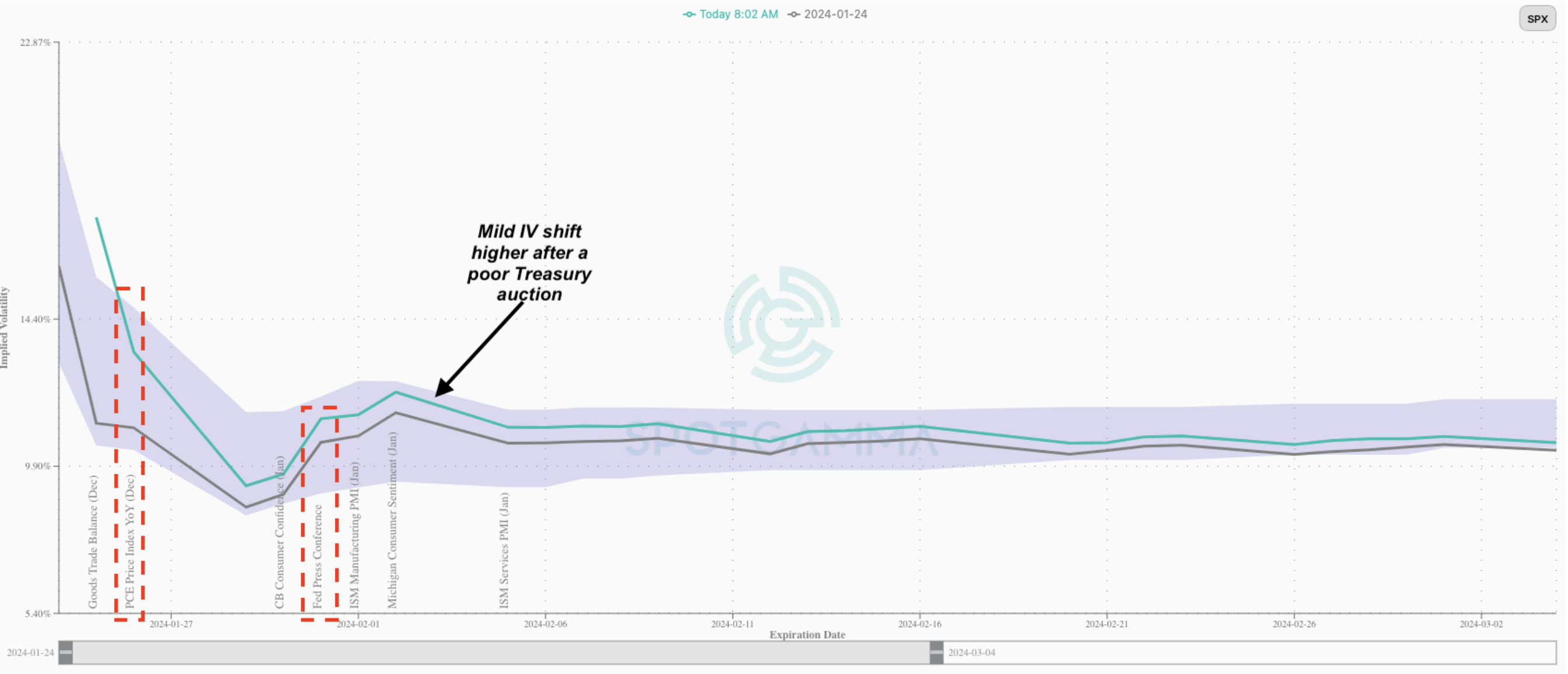

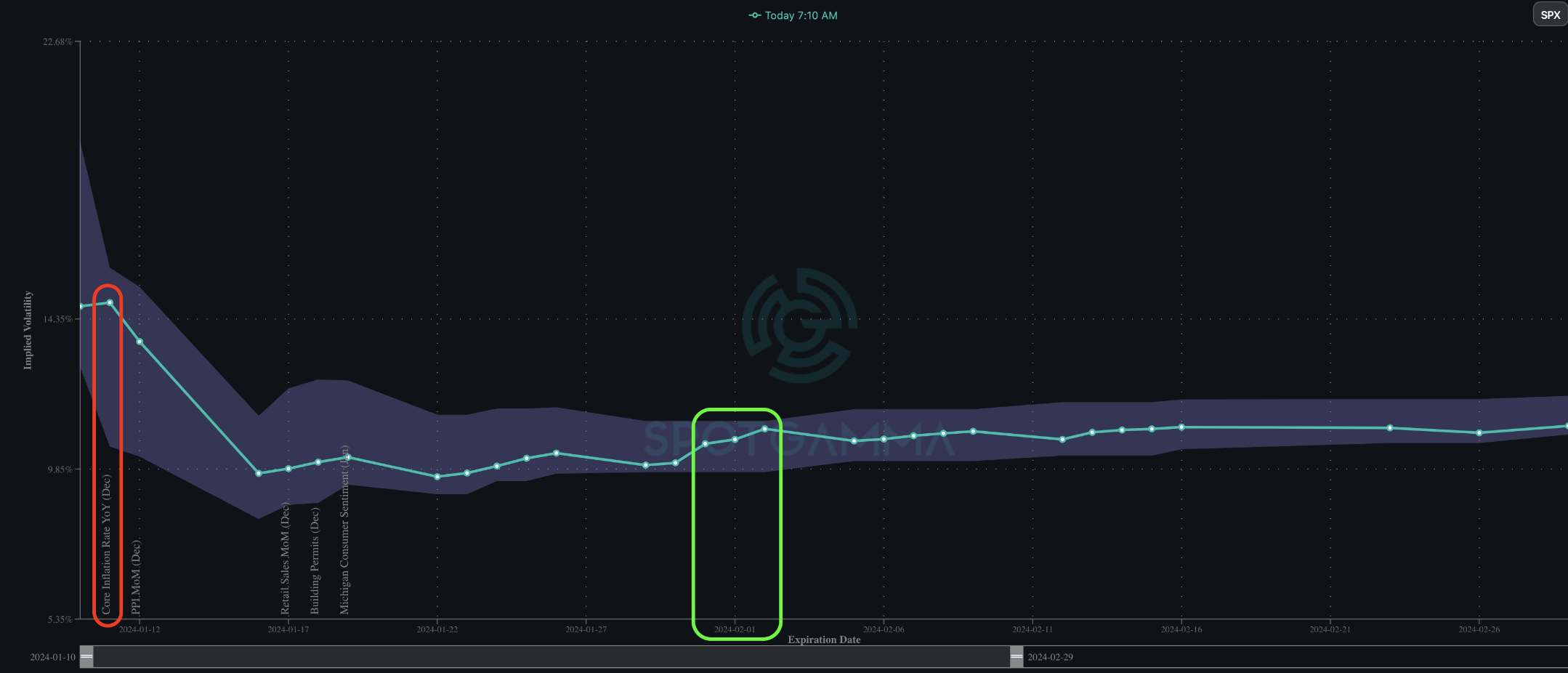

Additionally, in line with yesterdays comments on IV’s, we that SPX IV’s are mildly up from yesterday, with post-FOMC IV’s up only to the tune of 1/2 – 3/4 a vol pt. The takeaway here is that traders are now watching for more confirmatory rate signals (seen in higher IV’s into today’s GDP/PCE data points), but we think the major effect of this rate perturbance is that the 4,900-4,915 resistance area has more strength into 1/31 FOMC. This is mainly due to the single stocks up/vol up momentum may take a breather. Should today’s data for some reason mark meaningfully higher rates, then 4,815 – 4,800 comes into play today, but that should be strong support.

As a reminder, those of you wanting to know about treasury auctions in the future, you can do that via our dashboard:

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $4868 | $485 | $17499 | $425 | $1961 | $194 |

| SpotGamma Implied 1-Day Move: | 0.68% | 0.68% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 1.87% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $4845 | $484 | $16900 | $421 | $1915 | $194 |

| Absolute Gamma Strike: | $5000 | $487 | $17100 | $424 | $2000 | $190 |

| SpotGamma Call Wall: | $4900 | $487 | $17100 | $430 | $1920 | $200 |

| SpotGamma Put Wall: | $4500 | $470 | $15700 | $420 | $1800 | $185 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $4804 | $481 | $16434 | $425 | $1987 | $198 |

| Gamma Tilt: | 1.153 | 1.169 | 1.746 | 1.096 | 0.891 | 0.738 |

| SpotGamma Gamma Index™: | 0.923 | 0.175 | 0.064 | 0.039 | -0.008 | -0.051 |

| Gamma Notional (MM): | $532.613M | $493.081M | $8.239M | ‑$2.559M | ‑$6.395M | ‑$469.253M |

| 25 Delta Risk Reversal: | -0.03 | -0.024 | -0.035 | -0.033 | -0.013 | -0.011 |

| Call Volume: | 653.421K | 2.453M | 13.237K | 975.963K | 19.301K | 549.721K |

| Put Volume: | 1.119M | 3.306M | 14.319K | 1.596M | 24.049K | 820.624K |

| Call Open Interest: | 6.088M | 6.164M | 47.491K | 3.549M | 223.177K | 4.075M |

| Put Open Interest: | 12.252M | 13.64M | 58.242K | 7.664M | 402.217K | 7.527M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 4800, 4900, 4850] |

| SPY Levels: [487, 486, 485, 480] |

| NDX Levels: [17100, 17000, 16500, 16000] |

| QQQ Levels: [424, 422, 420, 430] |

| SPX Combos: [(5102,96.92), (5073,75.19), (5049,90.50), (5024,88.85), (5015,94.56), (5000,99.20), (4976,91.94), (4971,76.26), (4966,84.64), (4956,74.77), (4951,99.15), (4946,75.19), (4937,74.54), (4927,94.36), (4917,92.41), (4912,90.49), (4903,73.47), (4898,99.53), (4893,77.74), (4883,91.23), (4873,99.16), (4854,75.04), (4849,93.34), (4844,93.53), (4839,74.35), (4834,87.14), (4830,82.98), (4815,86.03), (4800,79.75), (4776,87.95), (4752,80.28), (4698,81.90), (4649,85.47)] |

| SPY Combos: [489.16, 486.73, 494.5, 499.36] |

| NDX Combos: [17674, 17097, 17587, 17254] |

| QQQ Combos: [419.51, 433.17, 427.2, 428.48] |

0 comentarios