Macro Theme:

Short Term SPX Resistance: 5,265 (SPY 525)

Short Term SPX Support: 5,200

SPX Risk Pivot Level: 5,200

Major SPX Range High/Resistance: (5,265 SPY 525)

Major SPX Range Low/Support: 5,000

‣ 5,265 is the upside target.*

‣ 5,200 is critical support, up from 5,100 on 3/20. Below 5,200 is our risk off indicator.*

‣ 5,300 is our target into March month end.*

‣ NVDA’s event on 3/18 failed to renew the call bid in the chip sector, likely triggering longer term consolidation in the space (ref: 216 in SMH).**

*updated 3/22

**updated 3/19

Founder’s Note:

ES are +30bps to 5,287. NQ futures are +35bps to 18,210.

Key SG levels for the SPX are:

- Support: 5,210, 5,200

- Resistance: 5,230, 5,250, 5,265 (SPY

Call Wall

)

- 1 Day Implied Range: 0.73%

For QQQ:

- Support: 440

- Resistance: 446, 450

IWM:

- Support: 200

- Resistance: 210

Call Wall

11:30 AM EDT 2-Year FRN Auction & 17-Week Bill Auction, 1:00 PM 7-Year Note Auction

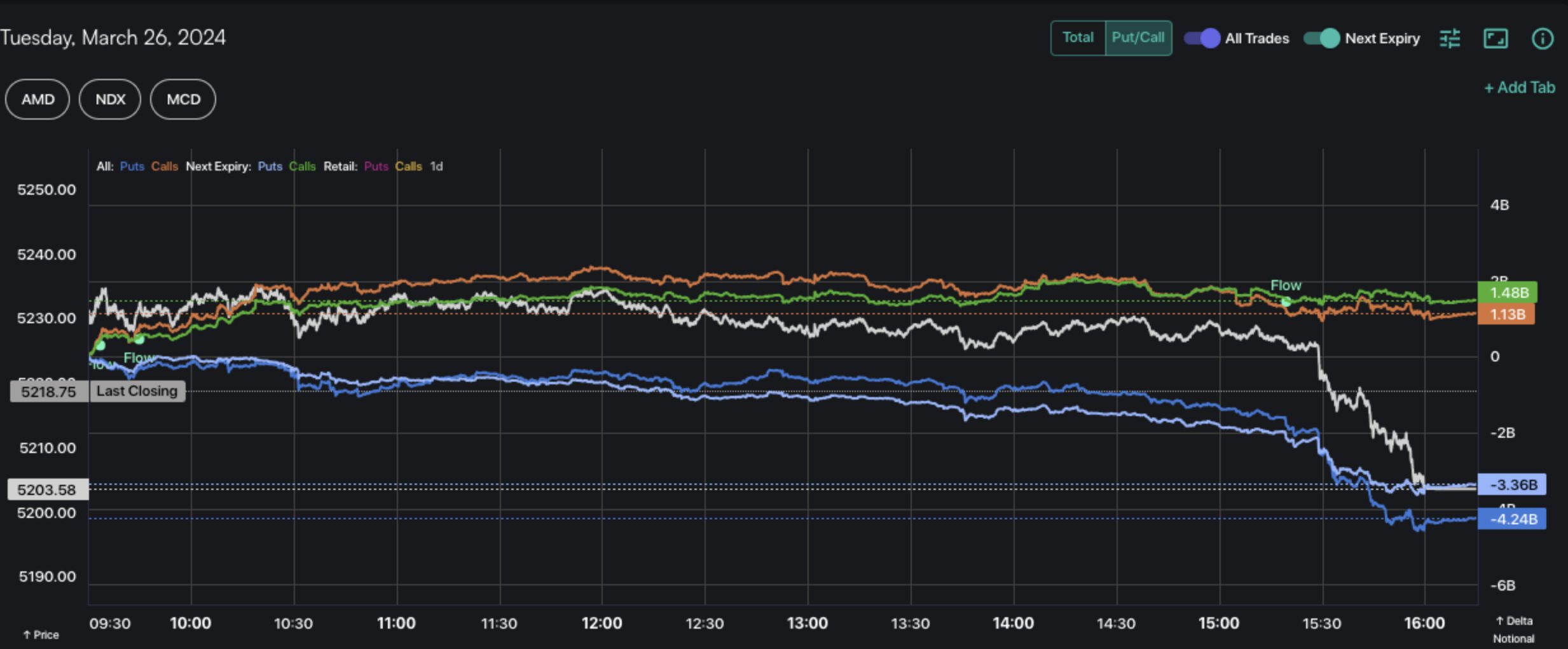

Pension rebalancing, per GS, is being blamed for yesterday’s 50bps sell off into yesterday’s close which pushed the SPX to 5,200. For the six 6 hours of the sessions action was absolutely anemic (high-low range of 15bps), with options flows being dominated by 0DTE trading. You can see this in the chart below, wherein 0DTE calls (green) and puts (light blue) are aligned tightly with the all expiration calls (orange) and puts (dark blue). Even into the teeth of the late-day selling, there was almost no effort made to buy longer dated downside protection. This backs the idea that rebalancing was a trigger, and also that yesterday’s move did not spark any longer term fears.

We suspect fairly dull price action again today as long as the SPX holds >5,200. Below 5,200 we do think that volatility can start to increase. On this point our 1-day SG implied move expanded to 73bps (from 53, yesterday), which suggests our models see the potential for higher movement. This would be most likely true on <5,200.

Unfortunately for our weekly forecast, that last minute SPX selling may take away the chance of the SPX closing near 5,300 by Thursday. With no obvious catalysts, its very unlikely the SPX can put together consecutive 1% return days today + tomorrow, which is what’s needed to tag 5,300.

While the SPX is quiet, the speculative vector of attack has been pointed at the “alt-social” sector. We’re using alt-social as a bucket for names like DWAC/DJT, RDDT and RUM. These names were flying yesterday, with large options volumes across the board. DWAC’s option volume is the 9th highest single stock this week, and RDDT traded an impressive +200k contracts this week, as well. This is evidence that speculation is alive and well, which we generally consider a positive signal for equities writ-large.

In yesterday’s note we discussed how low volatility has been in the SPX, and how that related to correlation. As part of a larger study we are conducting around 0DTE & option-ETF’s, we found that this current period is the 3rd largest streak of sessions without a 1 day <-2% decline (close to close) in the SPX. The highest streak was part-way into the 2007 pre-GFC rally (the GFC kicked off summer ’07), and the #2 streak ended with Volmegeddon.

What’s more, 2/22/24 marked the 4th longest streak of sessions without a >2% rally.

And, since that day, we’ve had 0 +2% sessions.

This suggests that we’re unambiguously in the midst of a very low volatility environment. This, we believe, provides a stable index base from which more speculative stocks to rally. Further, reflexive flows, like 0DTE, vol contraction (vanna), call overwriting (gamma), etc, gain in size, which reinforce this low volatility dynamic. We think this environment persists until an “unknown” is delivered, which forces long vol demand – something like a credit event or significant geopolitical escalation.

| SpotGamma Proprietary Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Reference Price: | $5203 | $518 | $18210 | $443 | $2070 | $205 |

| SpotGamma Implied 1-Day Move: | 0.73% | 0.73% |

|

|

|

|

| SpotGamma Implied 5-Day Move: | 1.95% |

|

|

|

|

|

| SpotGamma Volatility Trigger™: | $5095 | $520 | $17850 | $444 | $2025 | $205 |

| Absolute Gamma Strike: | $5000 | $520 | $17900 | $440 | $2100 | $205 |

| SpotGamma Call Wall: | $5400 | $522 | $17900 | $450 | $2040 | $215 |

| SpotGamma Put Wall: | $4600 | $515 | $17500 | $440 | $1900 | $200 |

| Additional Key Levels | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Zero Gamma Level: | $5096 | $517 | $17362 | $446 | $2080 | $206 |

| Gamma Tilt: | 1.185 | 0.803 | 1.527 | 0.770 | 0.910 | 0.818 |

| SpotGamma Gamma Index™: | 1.073 | -0.251 | 0.052 | -0.11 | -0.006 | -0.035 |

| Gamma Notional (MM): | $377.854M | ‑$969.667M | $5.546M | ‑$430.245M | ‑$6.647M | ‑$247.62M |

| 25 Delta Risk Reversal: | 0.00 | 0.00 | 0.00 | 0.004 | 0.00 | 0.012 |

| Call Volume: | 223.109K | 2.597M | 7.642K | 1.21M | 6.814K | 331.065K |

| Put Volume: | 454.926K | 3.245M | 9.319K | 1.816M | 27.664K | 381.15K |

| Call Open Interest: | 7.795M | 6.113M | 39.315K | 3.607M | 214.186K | 4.086M |

| Put Open Interest: | 14.303M | 15.17M | 57.988K | 6.744M | 400.28K | 7.498M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 5200, 5300, 5150] |

| SPY Levels: [520, 521, 522, 515] |

| NDX Levels: [17900, 18000, 18500, 17500] |

| QQQ Levels: [440, 445, 444, 430] |

| SPX Combos: [(5448,95.46), (5422,80.58), (5401,99.34), (5375,86.00), (5349,97.08), (5323,84.88), (5318,81.00), (5308,71.72), (5297,99.47), (5287,76.30), (5276,93.95), (5266,82.73), (5250,96.13), (5235,89.37), (5230,93.47), (5224,81.26), (5219,85.07), (5209,81.53), (5198,95.59), (5188,77.53), (5178,77.09), (5172,73.92), (5167,81.38), (5115,74.45), (5100,75.72), (5016,83.30), (5001,86.05), (4949,80.51)] |

| SPY Combos: [526.97, 536.82, 519.71, 521.78] |

| NDX Combos: [17883, 18083, 18192, 18283] |

| QQQ Combos: [444.63, 443.74, 433.99, 452.61] |

0 comentarios