Macro Theme:

Short Term SPX Resistance: 5,320 (SPY 530)

Short Term SPX Support: 5,265

SPX Risk Pivot Level: 5,265

Major SPX Range High/Resistance: 5,320 (SPY 530)

Major SPX Range Low/Support: 5,000

- For the week of 5/13 we see several catalysts, which should lead to expanding volatility:

- 5,260 is all-time SPX highs, and a major gamma bar at SPY 525. This is resistance into 5/15 CPI.*

- 5,300 is our target max high into Friday OPEX, 5/17.*

- 5,200 is major short term support. A break <5,200 pushes the S&P into a more fluid, risk-off zone, with 5,000 becoming the downside target.*

- 5/22 NVDA earnings/VIX exp, which follows 5/17 OPEX, should be a final major turning point for equities into May month end.*

- We like 1-month, ~25 delta SMH calls at IV of ~25% as a way to play a bullish market reaction to NVDA earnings on 5/22. SMH IV’s are near statistical lows despite upcoming NVDA earnings.**

*updated 5/13

*updated 5/17

Founder’s Note:

ES futures are flat at 5,320. NQ futures are +10bps to 18,670.

Key SG levels for the SPX are:

- Support: 5,300, 5,265

- Resistance: 5,320, 5,324, 5,329, 5,351

- 1 Day Implied Range: 0.59%

For QQQ:

- Support: 450, 444, 440

- Resistance: 455, 460

IWM:

- Support: 205, 200

- Resistance: 210, 212

Futures are churning just below the SPX 5,300

Call Wall

ahead of todays options expiration. We see approximately 25% of index gamma expiring today, and with that volatility has the opportunity to increase next week – regardless of market direction. We note the SPY

Call Wall

did shift to 535 (from 530) as traders added puts (likely short) to the 530 strike, and sold calls (likely short) up at 535. This rolling of positions would potentially remove overbought conditions should the market rally next week.

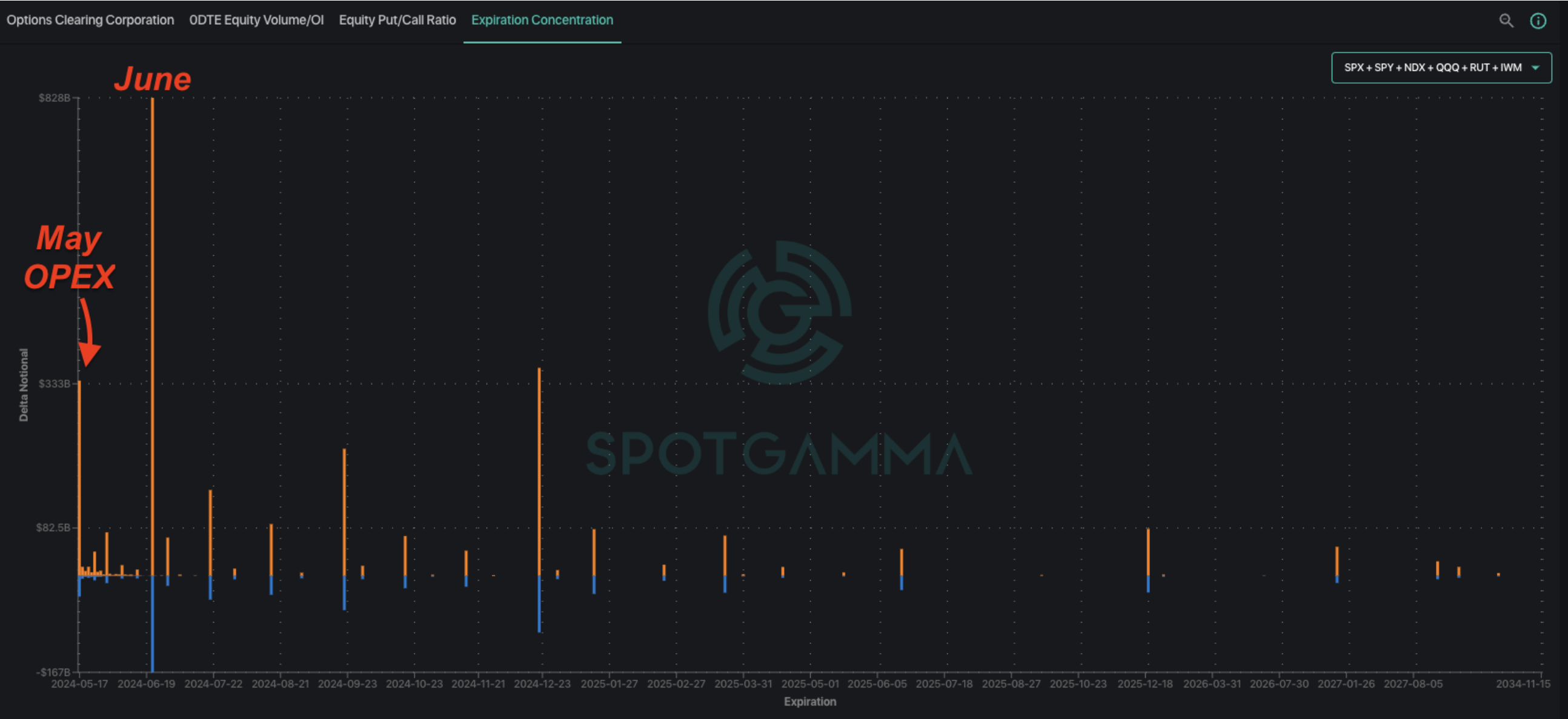

To be clear, this is not a massive expiration (compare May, below, to the massive June OPEX), but we think its enough to loosen up the 5,300 pin. We are not expecting a material shift in volatility until Wednesday’s NVDA earnings & VIX expiration.

The plan heading into this week was that if CPI/PPI/Powell were benign/bullish (which they were), the S&P would shift to 5,300 and stall out. Second, volatility should contract as the S&P pushed into larger pockets of positive gamma. Both happened.

We see this volatility contraction in realized volatility, with 1-month SPX realized/historical volatility[RV] at 11.5% (green), and 5-day at 7.7% (red). The 1-month figure still has some of the large April moves in its rolling window, and as we move forward in time, RV should drop towards 10%, which is near long term lows. Why does this matter? Because the lower RV goes, the lower implied volatility can go.

In this case, traders already seem to be in front of this bet in lower RV ahead. This reflects in implied volatility being at major lows, as we’ve been discussing. What is interesting here is there is a little bump in IV’s for next Thursday’s (5/23, red arrow), which seems to only be related to either NVDA earnings, and/or VIX expiration (both of which are the previous day). Obviously 5/22 IV’s wouldn’t capture NVDA ER (they are after the close), and VIX exp is the AM of 5/22. So, we’re leaning to that bump being due to NVDA ER’s…

What is interesting about these IV’s is that at 8-9%, they are pricing in ~50bps daily moves in the SPX. Thats not much. Therefore, if we get soft-talk from Powell & Yellen early next week, and a home run ER from NVDA, its possible equities have a scramble higher, as traders betting on 8% IV have to cover. On the first order, it suggests we do not love being short S&P options/vol here because the implied vols are so low. Obviously if this upside scenario plays out, it would be a post-OPEX vol expansion.

To the downside, we have decent gamma-padding until 5,200, and so we’d think it would be several days of moving lower before a big vol spike. Looking ahead, if 5,200 gives way (which we think is unlikely), then we shift to a “risk-off” stance, and would be looking for equities to move down toward 5,000. This, too, would be a post-OPEX vol expansion.

So, whats the play here?

We were flagging the lack of NVDA call skew in recent notes, and on yesterday’s Member Q&A. Still, buying options into earnings is always tough, because IV’s invariably come down post-event. However, as one of our members (h/t Cristal) pointed out in the Q&A, SMH’s (the semi-ETF) are not reflecting higher IV’s, despite 20% of its holdings being NVDA.

You can see that below with the current 1-month SMH skew at 90 day lows (green shaded cone).

SMH calls may therefore line up as a nice way to play not only an NVDA pop, but a market rally, in general.

Here we think something like the June 21st, 245 calls (~25 delta), with an IV of 25% are interesting (last trade $3.7). The idea being that there are clear catalysts ahead, and IV’s seem relatively low. A 1-month option has plenty of time to let a potentially bullish move into end-of-May play out. Further, if we are wrong and equities/NVDA tanks next week, you can close out the position to hopefully recover some premium. You could obviously turn this into a call spread to lower the initial cost (or go with a shorter dated option/spread), but the hope here is that we get a bit of “stock up, vol up” for SMH (which would further benefit calls), if NVDA comes up big.

|

|

/ES |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$5319.51 |

$5297 |

$528 |

$18557 |

$451 |

$2096 |

$207 |

|

SG Gamma Index™: |

|

2.303 |

-0.008 |

|

|

|

|

|

SG Implied 1-Day Move: |

0.59% |

0.59% |

0.59% |

|

|

|

|

|

SG Implied 5-Day Move: |

1.95% |

1.95% |

|

|

|

|

|

|

SG Volatility Trigger™: |

$5267.51 |

$5245 |

$529 |

$18490 |

$449 |

$2090 |

$205 |

|

Absolute Gamma Strike: |

$5322.51 |

$5300 |

$530 |

$18500 |

$450 |

$2100 |

$210 |

|

Call Wall: |

$5322.51 |

$5300 |

$535 |

$18700 |

$455 |

$2200 |

$210 |

|

Put Wall: |

$5022.51 |

$5000 |

$525 |

$18490 |

$430 |

$2000 |

$200 |

|

Zero Gamma Level: |

$5249.51 |

$5227 |

$527 |

$18234 |

$444 |

$2075 |

$206 |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.297 |

0.992 |

1.436 |

1.367 |

1.081 |

1.117 |

|

Gamma Notional (MM): |

$854.431M |

$222.039M |

$12.866M |

$735.936M |

$9.248M |

$321.234M |

|

25 Delta Risk Reversal: |

-0.017 |

0.006 |

-0.02 |

0.003 |

-0.012 |

-0.002 |

|

Call Volume: |

1.252M |

1.434M |

18.321K |

613.735K |

42.352K |

268.931K |

|

Put Volume: |

2.186M |

1.884M |

12.765K |

833.461K |

72.812K |

473.035K |

|

Call Open Interest: |

7.377M |

6.159M |

63.349K |

4.428M |

330.537K |

4.419M |

|

Put Open Interest: |

14.796M |

15.499M |

86.656K |

7.123M |

559.034K |

9.144M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [5300, 5000, 5250, 5200] |

|

SPY Levels: [530, 525, 529, 520] |

|

NDX Levels: [18500, 18600, 18650, 18700] |

|

QQQ Levels: [450, 453, 452, 455] |

|

SPX Combos: [(5551,86.74), (5525,72.23), (5498,98.55), (5477,74.44), (5461,72.28), (5451,96.04), (5424,84.16), (5408,79.54), (5398,99.53), (5392,78.17), (5382,79.08), (5377,91.05), (5371,90.09), (5366,76.77), (5361,93.42), (5355,73.53), (5350,99.51), (5345,89.39), (5339,91.92), (5334,88.60), (5329,94.26), (5324,99.10), (5318,94.05), (5313,90.11), (5308,94.32), (5302,99.82), (5276,92.83), (5260,78.45), (5249,94.66), (5149,78.67), (5128,77.63), (5101,80.37), (5048,79.64)] |

|

SPY Combos: [527.59, 532.88, 537.64, 530.24] |

|

NDX Combos: [18688, 18892, 18595, 19096] |

|

QQQ Combos: [459.19, 451.96, 454.22, 449.25] |

0 comentarios