Macro Theme:

Short Term SPX Resistance: 5,350

Short Term SPX Support: 5,265

SPX Risk Pivot Level: 5,265

Major SPX Range High/Resistance: 5,320 (SPY 530)

Major SPX Range Low/Support: 5,000

- For the week of 5/20*:

- 5,300 is a large base of support, with large upside targets at 5,350, 5,365 (SPY 535) and 5,400*

- Monday & Tuesday are likely to have smaller relative movement, with trading ranges increasing on Wednesday & Thursday*

- Wednesday is VIX Exp, FOMC Mins & NVDA ER

- We like 1-month, ~25 delta SMH calls at IV of ~25% as a way to play current bullish market dynamics and a positive market reaction to NVDA earnings on 5/22. SMH IV’s are near statistical lows despite upcoming NVDA earnings.*

- 5,265 is our risk-off. A break <5,265 pushes the S&P into a more fluid, risk-off zone, with 5,200 becoming the downside target.*

*updated 5/20

Founder’s Note:

ES futures are flat at 5,333. NQ futures are -8bps to 18,747.

Key SG levels for the SPX are:

- Support: 5,300, 5,265

- Resistance: 5,320, 5,329, 5,350

- 1 Day Implied Range: 0.60%

For QQQ:

- Support: 454, 450, 440

- Resistance: 455, 460

IWM:

- Support: 205, 200

- Resistance: 210

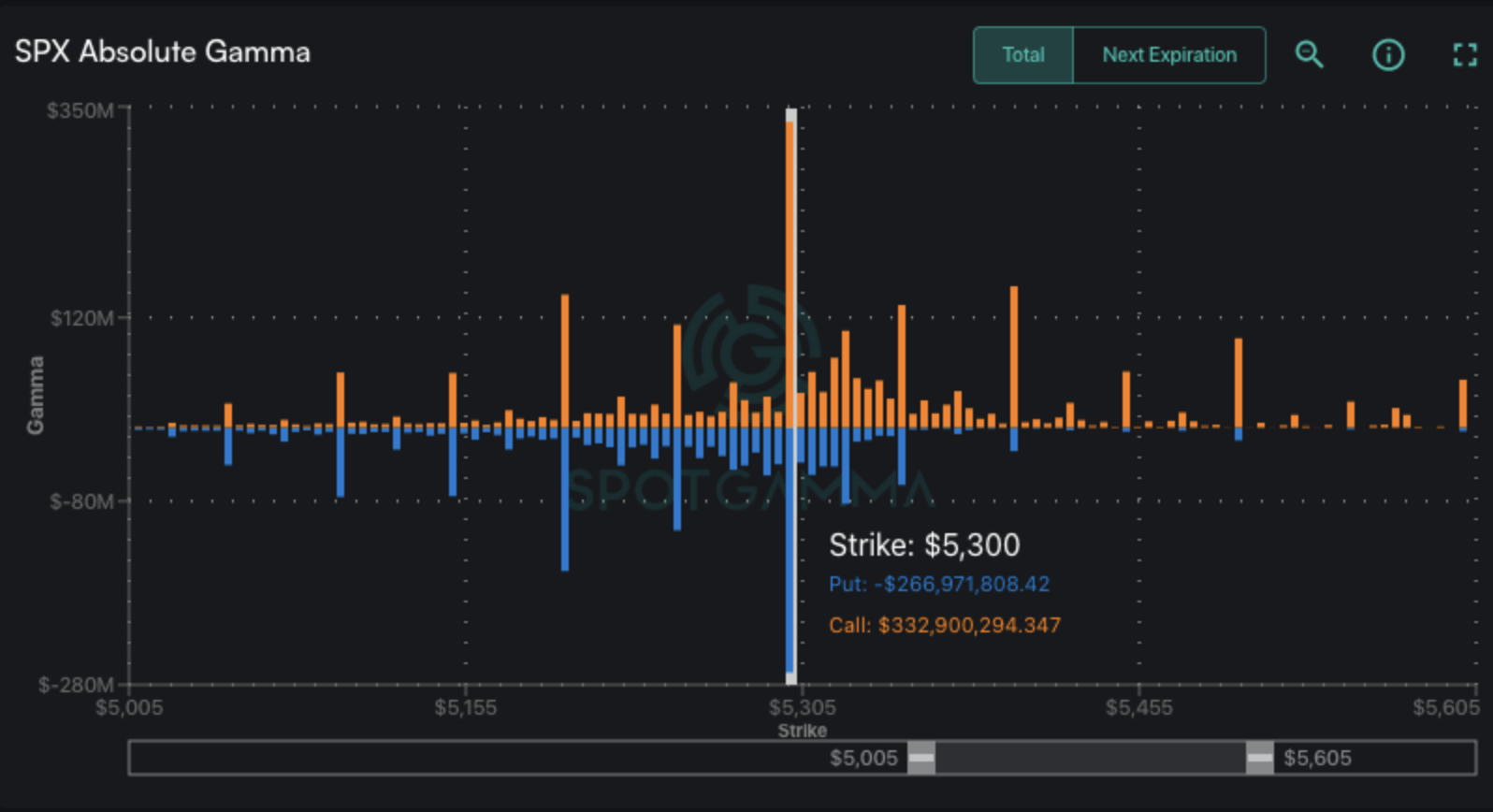

The 5,300 to 5,320 (SPY 530) pin held yesterday, and may likely hold again, today. Shown below is the very large 5,300 SPX gamma strike, which supplies a lot of SPX range-reducing positive gamma to dealers.

Further, options prices are absolutely anemic, suggesting no one is looking for any movement. Consider today’s 0DTE SPX straddle (ref 3,510, IV 12%): its $17. $17!

That $17 is pricing in ~35bps of movement in the SPX today, which is almost shockingly low, and something we have not seen in recent memory.

SPX implied vol is at similar lows for tomorrow’s VIX exp & FOMC mins, but higher for Thursday as that is post NVDA earnings (NVDA is as after Wed close).

Looking out past 1 week, those anemic IV’s persist. One can flag a myriad of narratives as to why the market is incorrect in expecting such low vol, but, post-NVDA, what’s the catalyst? At least into May month-end, US equities are closed Monday for Memorial day, and traders are likely to not want to pay theta bills over a long weekend. Further, looking out past month end we see SPX IV’s at 90-day lows (shaded cone).

Additionally, this crushing implied vol is seen across assets. Consider the MOVE Index, which measures Treasury IV aka Bond VIX:

The risk in these very low IV’s, are the very low IV’s themselves. If traders are pricing in 30bps of movement for a given trading day, any move that pushes the market past 30bps (up or down) could lead to a short vol cover and a jumpy stock move. This suggests to us that while you maybe can’t find a reason to buy short dated SPX options, shorting them at these IV levels seems like a poor risk-reward (we’re looking at you 0DTE traders!). On that note we think that a cleaner way here for basic “short vol” trades may be owning puts/short call spreads in VXX/UVXY or long SVXY calls/short put spreads. This is because you catch some of the roll decay, and you don’t have the strike-risk in 0DTE.

Looking forward, as we have outlined recently, SMH calls are our preferred way to play market upside into & out of NVDA earnings (read Friday’s note).

That being said, when looking at 1-month SPX skew, we see that slightly OTM call IV is really slumping (red arrow). Consider the 5,400 strike, which is a lowly 9.7% IV. This seems like a fairly inexpensive way to play a positive general equity response to NVDA, and it would benefit if the numbers are a “blowout” and we get a gappy move higher (to the point above on the short vol cover). This 5,400 strike is currently the zone of peak positive gamma, and the

Call Wall.

Conversely, puts are at low IV levels here, too. However, we prefer to wait for a “shot across the bow” before diving into large hedges/downside bets in order to avoid carry costs. “Waiting”, is because there is a lot of positive gamma that would have to be worn away before the SPX could move more freely, and so we would look for a solid move <5,300 before seeking to play for a large, extended jump in implied vol (and lower equity prices). See yesterday’s note for more on this.

Lastly, we wanted to touch on VIX expiration, which we don’t think will change current market dynamics. As you can see below, there are a great deal of puts (blue bars) down into VIX 12, and we think these contracts have served to help squash volatility.

We see the biggest impact of VIX expiration comes when the VIX Index is >=15 as the notional value (of contracts & “greeks”) of expiration is higher. Note today is the last day that VIX contracts for May OPEX can trade, even though those contracts expire tomorrow at 9:30AM ET. We see ~50% of notional VIX contracts expiring tomorrow, which while large, we again don’t think it will have a material impact.

That being said we always suggest to be aware that if some “head scratching” SPX movement occurs today, it could be related to shifting VIX flows.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5330.1 | $5308 | $530 | $18674 | $454 | $2102 | $208 |

| SG Gamma Index™: |

| 1.159 | -0.079 |

|

|

|

|

| SG Implied 1-Day Move: | 0.60% | 0.60% | 0.60% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Volatility Trigger™: | $5317.1 | $5295 | $529 | $18590 | $454 | $2090 | $208 |

| Absolute Gamma Strike: | $5322.1 | $5300 | $530 | $18600 | $450 | $2100 | $210 |

| Call Wall: | $5422.1 | $5400 | $535 | $18600 | $460 | $2200 | $220 |

| Put Wall: | $4972.1 | $4950 | $525 | $18690 | $430 | $2000 | $200 |

| Zero Gamma Level: | $5299.1 | $5277 | $529 | $18348 | $450 | $2081 | $208 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.16 | 0.918 | 1.653 | 1.175 | 1.043 | 0.884 |

| Gamma Notional (MM): | $421.978M | $108.214M | $14.528M | $424.241M | $6.775M | ‑$19.036M |

| 25 Delta Risk Reversal: | 0.00 | 0.00 | -0.023 | 0.002 | 0.00 | -0.005 |

| Call Volume: | 1.751M | 1.094M | 8.896K | 474.304K | 9.915K | 822.916K |

| Put Volume: | 3.242M | 1.992M | 11.173K | 836.898K | 17.149K | 1.006M |

| Call Open Interest: | 6.822M | 5.675M | 58.745K | 3.719M | 305.237K | 3.80M |

| Put Open Interest: | 13.479M | 13.073M | 77.079K | 6.243M | 519.473K | 7.748M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5300, 5000, 5200, 5250] |

| SPY Levels: [530, 531, 525, 529] |

| NDX Levels: [18600, 18500, 18700, 18000] |

| QQQ Levels: [450, 455, 453, 460] |

| SPX Combos: [(5568,84.73), (5552,88.16), (5526,74.61), (5499,98.67), (5473,73.27), (5451,96.48), (5425,86.64), (5420,70.95), (5409,83.13), (5398,99.69), (5388,80.92), (5382,88.70), (5377,92.71), (5372,86.43), (5367,83.63), (5361,88.80), (5356,92.52), (5351,97.92), (5345,90.12), (5340,96.23), (5335,89.36), (5329,95.20), (5324,85.54), (5319,94.77), (5308,70.70), (5298,90.55), (5292,82.43), (5287,82.28), (5282,70.87), (5271,76.25), (5266,78.80), (5260,79.61), (5255,86.84), (5239,75.67), (5207,77.13), (5202,71.40), (5160,79.48), (5149,80.63), (5128,77.59), (5101,78.82), (5048,78.47)] |

| SPY Combos: [539.57, 529.5, 549.64, 534.8] |

| NDX Combos: [18599, 18880, 19085, 18674] |

| QQQ Combos: [456.28, 463.11, 458.1, 473.12] |

0 comentarios