Macro Theme:

Short Term SPX Resistance: 5,331

Short Term SPX Support: 5,285

SPX Risk Pivot Level: 5,300

Major SPX Range High/Resistance: 5,400

Major SPX Range Low/Support: 5,000

- Into the end of May, we look for implied volatility/VIX to continue sliding lower, which supports equities.*

- 5,300-5,320 (SPY 530) is the largest gamma area on the board, and a support/pinning area into 5/31**

- Starting on 5/31 traders are likely to focus on rate narratives into early June, due to ISM inflation data & FOMC.*

- 5,400 is the top end of our trading range.**

- 5,200 is a large, long term support zone. <5,200 we see a test of 5,000*

*updated 5/23

** updated 5/28

Founder’s Note:

ES futures are +12bps at 5,238. NQ futures are +25bps to 18,925.

Key SG levels for the SPX are:

- Support: 5,300,, 5,295,5,285, 5,275, 5,250

- Resistance: 5,321, 5,336, 5,350, 5,365

- 1 Day Implied Range: 0.57%

For QQQ:

- Support: 450, 440

- Resistance: 460, 465

IWM:

- Support: 205, 200, 190

- Resistance: 210

Fed Kashkari 9:50 AM ET. 3 & 6 month T-Bill auction 10 AM, 2 year note auction 11:30 AM, 5 year note 1PM.

Heading into this holiday-shortened week, our forecast was for low volatility as traders attention would shift to early June, and several rate-related data points.

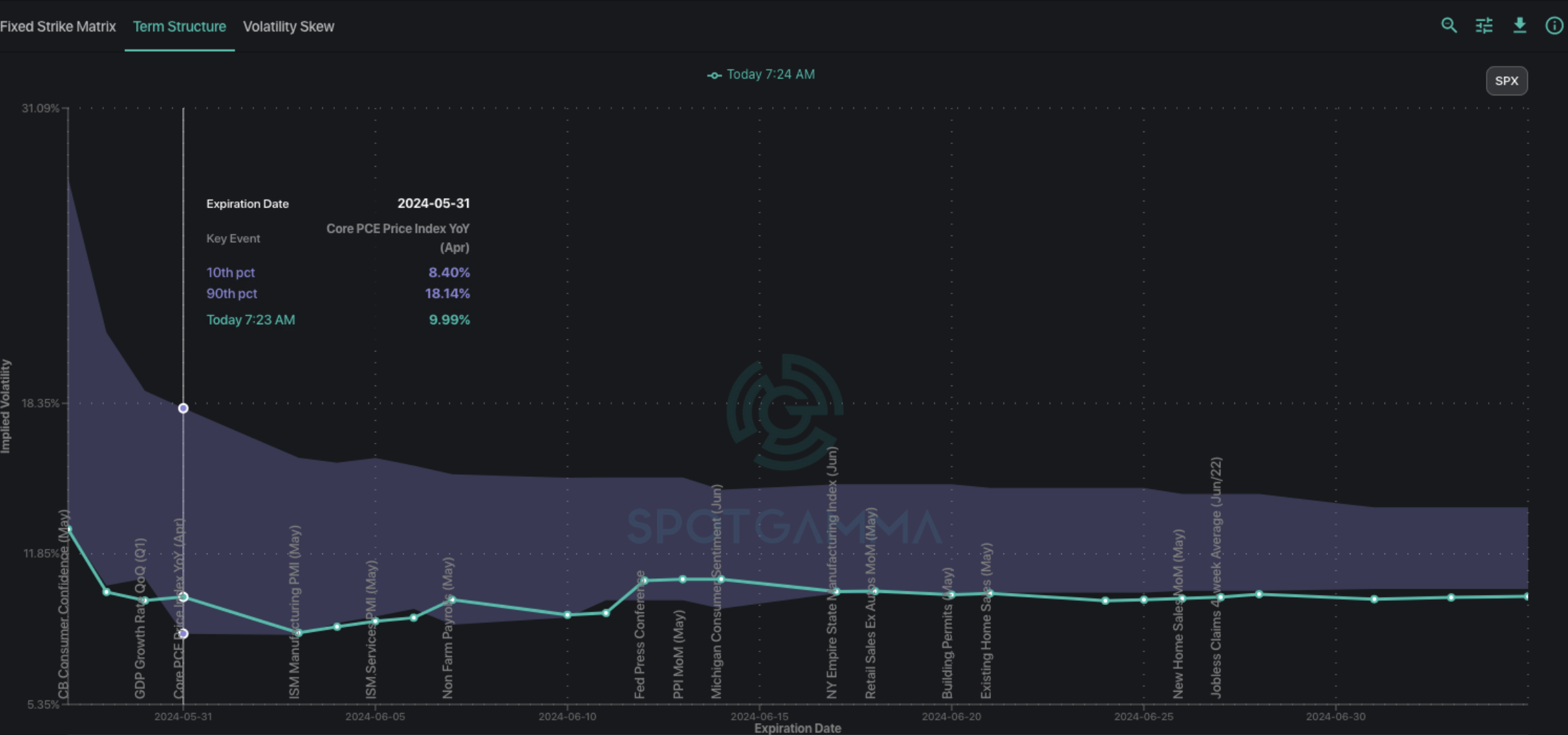

The market appears line up with this forecast, as seen in the SPX term structure, below. By-and-large IV’s are quite low, suggesting traders see little risk ahead.

You can see there is a small bump in IV’s for the 5/31 Core PCE on Friday, and then the following week (first week of June) we see ISM data + NonFarms, which then feeds into 6/10 FOMC.

That leaves options flows to be a primary driver this week, and those flows should be invoking tight trading ranges, and mean-reverting order flow. Dips are likely to be bought, and rallies sold.

The biggest strikes on the board are SPX 5,300, and SPY 530 (~5,320 SPX). A fair number of positions filled in around 5,275 during last Thursday’s equity dip <5,300, and so we think that 5,380 area offers good support in through Friday. Above 5,300 there are layers of positive gamma into 5,350, which should offer a slowing of upside momentum (aka SPX can grind higher, its unlikely to jump higher).

While the major Indices are being gripped by large positive gamma (which suppresses volatility), top single stocks are still free to run. This morning we see AAPL +2% from Chinese IPhone data, and NVDA +3%.

Below is a plot of SMH, which is showing in the premarket at all-time-highs of $247 this morning (read our long SMH thesis from 5/17 here). If you are looking for movement we think single stocks (or sector ETF’s) will be where all the action is this week, before eyes turn more towards “the macro” and rates >= 5/31.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5320.66 | $5304 | $529 | $18808 | $457 | $2069 | $205 |

| SG Gamma Index™: |

| 0.373 | -0.224 |

|

|

|

|

| SG Implied 1-Day Move: | 0.57% | 0.57% | 0.57% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | $5360.24 | $5343.58 | $533.21 |

|

|

|

|

| SG Implied 1-Day Move Low: | $5299.67 | $5283 | $527.17 |

|

|

|

|

| SG Volatility Trigger™: | $5311.66 | $5295 | $529 | $18590 | $457 | $2090 | $205 |

| Absolute Gamma Strike: | $5316.66 | $5300 | $530 | $18600 | $450 | $2100 | $200 |

| Call Wall: | $5416.66 | $5400 | $535 | $18600 | $465 | $2100 | $220 |

| Put Wall: | $5301.66 | $5285 | $525 | $18830 | $450 | $2000 | $200 |

| Zero Gamma Level: | $5290.66 | $5274 | $528 | $18480 | $453 | $2080 | $206 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.044 | 0.790 | 1.494 | 1.063 | 0.808 | 0.641 |

| Gamma Notional (MM): | $377.777M | ‑$139.617M | $13.559M | $333.178M | ‑$22.882M | ‑$482.774M |

| 25 Delta Risk Reversal: | -0.025 | 0.00 | -0.03 | -0.009 | -0.024 | -0.018 |

| Call Volume: | 492.965K | 1.241M | 18.188K | 1.235M | 53.50K | 624.09K |

| Put Volume: | 906.898K | 1.708M | 25.206K | 1.664M | 53.256K | 1.049M |

| Call Open Interest: | 7.043M | 5.75M | 57.58K | 3.835M | 315.982K | 3.926M |

| Put Open Interest: | 14.15M | 13.468M | 81.352K | 6.592M | 549.35K | 8.149M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5300, 5000, 5200, 5350] |

| SPY Levels: [530, 528, 525, 520] |

| NDX Levels: [18600, 18700, 18500, 19000] |

| QQQ Levels: [450, 455, 460, 465] |

| SPX Combos: [(5549,87.70), (5528,75.06), (5512,70.74), (5501,98.33), (5459,75.07), (5448,96.37), (5427,86.30), (5421,75.76), (5411,81.05), (5400,99.59), (5390,74.92), (5379,86.29), (5374,91.07), (5368,86.33), (5363,90.53), (5358,81.11), (5352,97.27), (5347,75.67), (5342,93.61), (5337,80.12), (5331,96.37), (5326,92.67), (5321,92.46), (5315,72.71), (5310,81.84), (5305,71.09), (5299,89.55), (5289,84.33), (5284,94.55), (5278,95.41), (5273,90.46), (5268,84.18), (5262,92.26), (5252,84.79), (5241,79.42), (5230,70.48), (5225,80.30), (5209,87.72), (5199,91.57), (5177,75.96), (5161,79.64), (5151,85.92), (5124,76.67), (5108,71.65), (5098,87.41), (5050,83.17)] |

| SPY Combos: [542.74, 552.8, 522.62, 532.68] |

| NDX Combos: [18601, 19090, 19504, 19297] |

| QQQ Combos: [457.55, 454.35, 469.46, 464.42] |

0 comentarios