Macro Theme:

Short Term SPX Resistance: 5,290

Short Term SPX Support: 5,250

SPX Risk Pivot Level: 5,320

Major SPX Range High/Resistance: 5,400

Major SPX Range Low/Support: 5,000

- Starting on 5/31 Core PCE traders are likely to focus on rate narratives into early June, due to ISM inflation data, NonFarms & FOMC on 6/12.

- 5,300 – 5,320 is major resistance into the close of Friday, 5/31

- A break of 5,250 likely leads to a test of 5,200

- <5,200 the market fully loses positive gamma support, allowing for higher implied volatility (i.e. VIX) and a move down into 5,000

Founder’s Note:

ES futures are -30 bps to 5,237. NQ futures are -45 bps to 18,521.

Key SG levels for the SPX are:

- Support: 5,209, 5,200

- Resistance: 250, 5,265, 5,275, 5,290, 5,300, 5,311

- 1 Day Implied Range: 0.56%

For QQQ:

- Support: 450, 440

- Resistance: 453, 455, 457

IWM:

- Support: 200

- Resistance: 205, 210

CORE PCE 8:30AM ET.

This mornings PCE data is the key short term data point, which likely determines direction for today. To the downside, 5,200 looms as large support. To the upside, the 5,275 area looms as large, short term resistance.

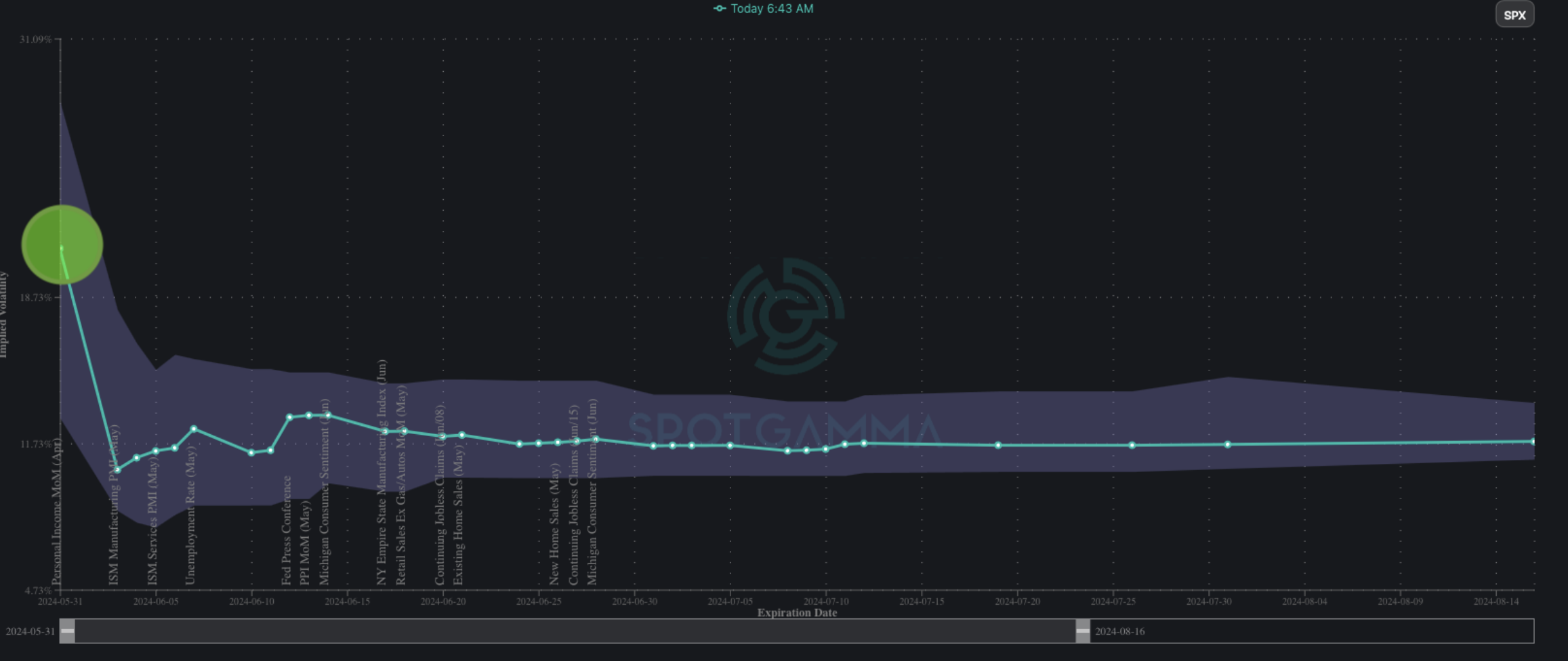

You can see the elevated 0DTE IV, below. While this is certainly elevated, its very far from panicked. On this point the 0DTE straddle is priced at a meager $29 or 55bps (ref 5,230, IV 20%). You may recall last week that the 0DTE straddle was amazingly low at $17/32 bps – so comparatively today is “rich”. The reality is this is the market doesn’t really care that much about PCE.

The buzz in the options world is the re-appearance of put skew, which is something we highlighted in yesterday’s AM note. You can see this skew change in the chart below, which compares 1-month SPX skew from last week (gray) to last night (teal). The lift implies that there is indeed a bid to puts which ties into the worries on rates, and the need for updates in upcoming data. Accordingly, many seem to think that volatility is finally set to emerge from a long slumber. We’re not sold on this idea.

There is another key element here, in that implied vols 5-10 days ago were about as low as you can reasonably get. This was reflected in that $17 straddle referenced above, but also in the idea that 1-month skew (gray line) was below the 90-day statistical range (shaded teal). In other words – vol (both realized and implied) really couldn’t go any lower, and so the path of least resistance was higher. Several economic prints have recently given traders a bit of worry, and so being short IV at some low level like 10% was just no longer worth it. The point is you can argue there is simply just some “vol normalization” at hand.

The other issue for the long vol crowd here is that realized volatility continues to be very sleepy. Below you can see that 1-month SPX realized vol is just 9% (green), which is at 5 year lows. You can also see 5-day realized (red) at only ~8%, which is quite low considering the SPX is down ~2% over the last 5 days. This has simply been a grind down, which is nice for being short stock or at-the-money puts “short delta”, but it doesn’t really benefit “long vol” aka out-of-the-money puts (recall that vol “underperforming” was a key theme both in ’22 and in April of this year).

What we need for some decent market movement and for long vol to perk up is a break from the large, supporting gamma that has been smothering volatility. We’ve highlighted 5,250 as our “risk off” line, as it implied a test of 5,200 would come quickly. Futures are now implying an open near 5,230 ahead of PCE, with large 5,200 support easily in reach.

Should we break <5,200 you can see that the size of SPX gamma positions decreases meaningfully, all the way down to the very large 5,000 strike. This implies to us that volatility, both realized and implied, should increase meaningfully if 5,200 is broken. The addition of long downside puts would add negative gamma, which should fuel more volatility. In the April drawdown we saw the VIX sniff 20, and that is they type of move we’d expect <5,200 this time as well.

Where does all this leave us?

We’ve boiled down our outlook in the map below. To the upside, barring incredibly dovish inflation prints over the next week, we think 5,300 is going to offer stiff pinning/resistance into 6/12.

To the downside, as we just mentioned, a break <5,200 opens the door for vol to increase. In an ideal scenario we see the SPX pull down into the massive 5,000 strike into FOMC (which could clear out an IV bid), followed by a huge June OPEX (6/21). Interestingly, if we are near 5,000 into the end of June, we’ll see the very large JPM put strike come into play. The rolling of that position could also relieve downside pressure.

|

|

/ES |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$5251.64 |

$5235 |

$522 |

$18538 |

$451 |

$2056 |

$204 |

|

SG Gamma Index™: |

|

-1.561 |

-0.444 |

|

|

|

|

|

SG Implied 1-Day Move: |

0.56% |

0.56% |

0.56% |

|

|

|

|

|

SG Implied 5-Day Move: |

1.95% |

1.95% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

After open |

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

After open |

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$5276.64 |

$5260 |

$525 |

$18590 |

$453 |

$2060 |

$205 |

|

Absolute Gamma Strike: |

$5316.64 |

$5300 |

$520 |

$18600 |

$450 |

$2100 |

$200 |

|

Call Wall: |

$5416.64 |

$5400 |

$535 |

$18600 |

$465 |

$2100 |

$220 |

|

Put Wall: |

$5216.64 |

$5200 |

$520 |

$18500 |

$450 |

$2000 |

$200 |

|

Zero Gamma Level: |

$5260.64 |

$5244 |

$525 |

$18491 |

$454 |

$2082 |

$207 |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

0.840 |

0.634 |

1.017 |

0.739 |

0.750 |

0.619 |

|

Gamma Notional (MM): |

‑$560.96M |

‑$1.368B |

$381.142K |

‑$485.476M |

‑$35.539M |

‑$653.937M |

|

25 Delta Risk Reversal: |

-0.036 |

-0.026 |

-0.037 |

-0.02 |

-0.029 |

-0.02 |

|

Call Volume: |

1.572M |

1.499M |

8.746K |

727.753K |

8.523K |

492.36K |

|

Put Volume: |

2.556M |

1.958M |

11.507K |

894.125K |

17.414K |

972.224K |

|

Call Open Interest: |

7.211M |

6.16M |

60.376K |

4.075M |

322.792K |

4.08M |

|

Put Open Interest: |

14.595M |

13.915M |

86.682K |

6.901M |

566.865K |

8.414M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [5300, 5000, 5200, 5250] |

|

SPY Levels: [520, 525, 530, 515] |

|

NDX Levels: [18600, 18500, 18700, 18400] |

|

QQQ Levels: [450, 455, 440, 445] |

|

SPX Combos: [(5450,93.27), (5424,79.99), (5408,77.80), (5398,98.71), (5377,90.85), (5361,82.29), (5351,91.45), (5340,73.02), (5330,78.19), (5319,80.24), (5309,71.79), (5298,93.91), (5277,71.04), (5256,87.52), (5246,80.02), (5241,88.05), (5235,76.81), (5230,88.45), (5225,84.28), (5220,80.20), (5215,85.51), (5209,97.73), (5204,88.37), (5199,98.80), (5194,78.02), (5188,88.87), (5183,77.47), (5178,87.14), (5173,88.93), (5167,90.53), (5162,71.04), (5157,90.40), (5152,98.64), (5141,80.06), (5131,77.92), (5126,89.66), (5110,80.64), (5099,95.06), (5073,71.94), (5047,90.70), (5010,79.87), (5000,94.71)] |

|

SPY Combos: [535.69, 545.62, 533.6, 515.83] |

|

NDX Combos: [18483, 18594, 19095, 18261] |

|

QQQ Combos: [448.39, 460.13, 445.23, 457.87] |

0 comentarios