Macro Theme:

Short Term SPX Resistance: 5,460

Short Term SPX Support: 5,400

SPX Risk Pivot Level: 5,400

Major SPX Range High/Resistance: 5,500

Major SPX Range Low/Support: 5,000

- NVDA 10-1 split Friday night has the potential for relative top the week of 6/10. After OPEX, our prime catalyst (unwinding of long stock hedges) is gone, and we will be forced to take a “stop” on our NVDA short thesis.

- OPEX is supportive of equities into Wednesday’s Juneteenth Holiday, and then a window for weakness opens into early next week.

- Upside scenario:

- 5,460 is major resistance into Monday 6/17

- 5,500 is our target high for 6/21 OPEX, should CPI + FOMC meet expectations

- Downside scenario:

- A break of 5,400 likely leads to a test of 5,350

- <5,300 the market fully loses positive gamma support, allowing for higher implied volatility (i.e. VIX 20) and a move down into 5,000

- 5,000 is massive support into June OPEX 6/21 & June Quarterly OPEX 6/28

Founder’s Note:

ES futures are flat at 5,550. NQ futures are +20bps at 20,230

Key SG levels for the SPX are:

- Support: 5,462, 5,450, 5400

- Resistance: 5,490, 5,500, 5.510

- 1 Day Implied Range: 0.58%

For QQQ:

- Support: 480, 469

- Resistance: 490

IWM:

- Support: 200, 195

- Resistance: 202, 205

Retail Sales 8:30AM ET, VIX Exp 9:30 AM ET, 20 Year Auction 1PM ET

6 Fed speakers today, starting at 10AM – 2PM (see lower right quadrant of SG Dashboard)

Traders should watch for jumpy equity futures move around 9-9:30 AM ET as the VIX settles this morning. While VIX options for this AM expiration do not trade, traders are active in SPX options and often shifting futures around the VIX print.

Yesterday was a rally that was strong, as single stock call buyers stepped in to push equities to new all-time-highs (see last nights note). This led to a close that was 20bps outside of our estimated one day range, leaving the SPX at a major positive gamma zone between the 5,500

Call Wall

and the big SPY 545 (SPX 5,560) – 5,500 area. We think this 5,450-5,500 range sticks for today, ahead of the market holiday, tomorrow.

We are looking for equity markets to consolidate starting this afternoon and into early next week.

Why?

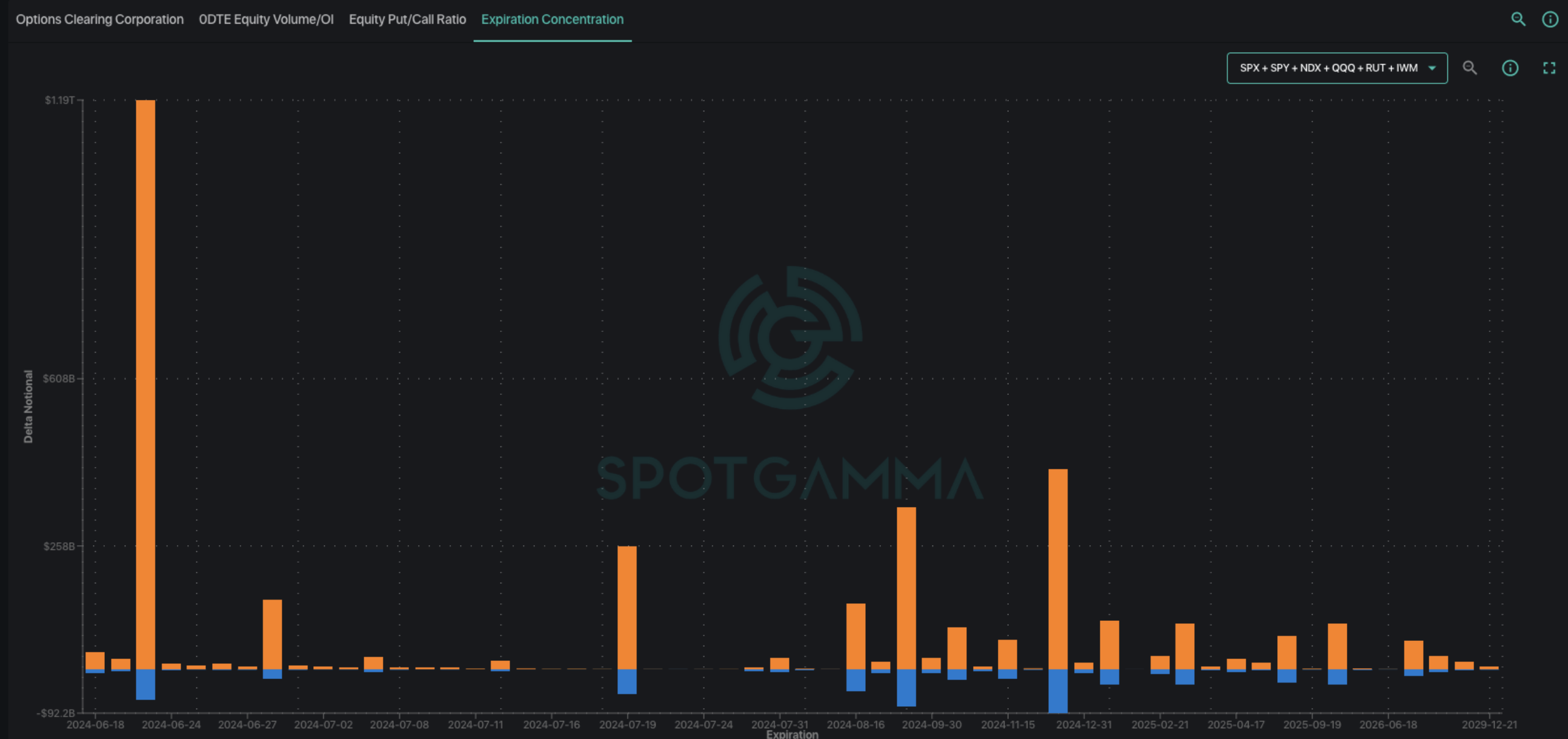

The QQQ’s are up a staggering 7.4% just in June, which is a signal that call values are ripping into the big, upcoming OPEX. You can see the size of call positions (orange) relative to non-existent puts (blue) into this big quarterly OPEX. We’d note that this June OPEX is ~3x that of May, but in line with March.

As tomorrow is a holiday, we would anticipate some demand to start monetizing June OPEX call positions into the afternoon. Action could also increase into Thursday, through Friday OPEX, and into Monday as options position close and/or roll.

Turning to VIX & the volatility complex: the VIX is remaining stubbornly high. As a baseline, we mark 1-month realized SPX vol at 8%, which implies a fair value of 11.5 in the VIX. This morning its hovering around 12.5. We do wonder if the clearing of OPEX allows for a short term (1-2 day) “release” in VIX. We suggest short term, as we are looking for some equity weakness Thursday/Friday into early next week.

If we dig into 1-month SPX skew, the options for which the VIX is based on, we can see that today’s at-the-money IV (teal) is much below that of March OPEX (gray), the last quarter which also saw a big equity rally. We’re today also below that of May (yellow), another pre-OPEX period which also saw strong equity returns. If you look out at the tails, you can see -10% today is >= May, suggesting that put skew is a bit higher than a month ago. The reality is the market is pricing in hardly any risk in the next month, and so if we do get a bit of downside equity volatility the next few days, we would expect that to be bought (and higher vol to be sold).

This low IV is also shown in the SPX term structure, which is at the bottom of its statistical range (gray cone) over the next month. There is a little kink this Friday, which we attribute to VIX Exp/OPEX & the holiday (i.e. we see no event), but the key takeaway is the market sees no risk over 30 days.

This lack of risk being priced in suggests that playing equity market downside via short dated put spreads may have some good risk reward, with the catalyst being OPEX. While we do not think this is a “5-alarm fire” situation, its clear that equities are quite stretched to the upside, and need to re-base before likely heading higher into July. Why likely? Because we believe that volatility is likely to remain low over the summer as rates shift out of focus and eyes turn to the election.

To play downside, we like something like the long ~95% 1-month QQQ puts and short the ~90% QQQ puts. This may allow traders to get long statistically low IV, well selling a further downside leg that has a bit more skew.

|

|

/ES |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$5543.92 |

$5473 |

$547 |

$19902 |

$485 |

$2022 |

$200 |

|

SG Gamma Index™: |

|

3.739 |

0.211 |

|

|

|

|

|

SG Implied 1-Day Move: |

0.56% |

0.56% |

0.56% |

|

|

|

|

|

SG Implied 5-Day Move: |

1.95% |

1.95% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

After open |

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

After open |

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$5465.92 |

$5395 |

$543 |

$19190 |

$469 |

$2030 |

$202 |

|

Absolute Gamma Strike: |

$5570.92 |

$5500 |

$550 |

$20000 |

$480 |

$2050 |

$200 |

|

Call Wall: |

$5570.92 |

$5500 |

$550 |

$20000 |

$490 |

$2200 |

$210 |

|

Put Wall: |

$5370.92 |

$5300 |

$520 |

$19625 |

$424 |

$2000 |

$200 |

|

Zero Gamma Level: |

$5470.92 |

$5400 |

$542 |

$19263 |

$477 |

$2047 |

$204 |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.595 |

1.259 |

1.891 |

1.445 |

0.761 |

0.504 |

|

Gamma Notional (MM): |

$1.138B |

$881.082M |

$14.973M |

$594.11M |

‑$47.134M |

‑$1.316B |

|

25 Delta Risk Reversal: |

-0.021 |

0.00 |

-0.022 |

0.00 |

-0.02 |

0.004 |

|

Call Volume: |

791.461K |

1.598M |

13.117K |

945.001K |

20.779K |

515.777K |

|

Put Volume: |

1.393M |

2.372M |

15.948K |

1.35M |

27.485K |

759.428K |

|

Call Open Interest: |

7.876M |

5.929M |

64.981K |

4.256M |

363.645K |

4.512M |

|

Put Open Interest: |

15.832M |

14.914M |

100.133K |

7.736M |

596.652K |

9.369M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [5500, 5400, 5450, 5000] |

|

SPY Levels: [550, 548, 545, 540] |

|

NDX Levels: [20000, 19500, 19950, 19900] |

|

QQQ Levels: [480, 475, 485, 470] |

|

SPX Combos: [(5725,79.83), (5698,96.97), (5676,79.47), (5648,94.10), (5626,87.35), (5599,99.54), (5583,85.01), (5577,97.07), (5572,98.85), (5566,83.17), (5561,86.61), (5550,99.38), (5544,80.46), (5539,91.45), (5533,82.22), (5528,94.30), (5522,99.86), (5517,96.79), (5512,98.35), (5506,92.04), (5501,100.00), (5495,93.64), (5490,97.55), (5484,96.67), (5479,96.65), (5473,97.62), (5468,91.14), (5462,92.82), (5451,99.17), (5424,82.31), (5402,93.41), (5325,72.49), (5298,88.51)] |

|

SPY Combos: [554.16, 548.69, 543.77, 564.01] |

|

NDX Combos: [20102, 20520, 19903, 20301] |

|

QQQ Combos: [490.87, 486.02, 480.68, 496.21] |

0 comentarios