Macro Theme:

Short Term SPX Resistance: 5,510 (SPY 550)

Short Term SPX Support: 5,450

SPX Risk Pivot Level: 5,400

Major SPX Range High/Resistance: 5,510 (SPY 550)

Major SPX Range Low/Support: 5,000

- NVDA 10-1 split Friday night has the potential for relative top the week of 6/10. After OPEX, our prime catalyst (unwinding of long stock hedges) is gone, and we will be forced to take a “stop” on our NVDA short thesis.

- We like 1-month QQQ 90-95% put spreads into the close of 6/18, and holding them through next week, due to potential OPEX weakness.

- Upside scenario:

- 5,500 – 5,510 (SPY 550 Call Wall) is major initial resistance. If the Call Wall(s) roll higher, our “top” does, too

- The major high level for SPX on 6/28 (end-of-quarter OPEX) is 5,570

- Downside scenario:

- 5,400 is strong support

- A break of 5,400 likely leads to a test of 5,300

- <5,300 the market fully loses positive gamma support, allowing for higher implied volatility (i.e. VIX 20) and a move down into 5,000

- 5,000 is massive support into June OPEX 6/21 & June Quarterly OPEX 6/28

Founder’s Note:

ES futures are +10 bps to 5,540. NQ futures are flat to 19,970.

Key SG levels for the SPX are:

- Support: 5,450, 5437, 5400

- Resistance: 5,462, 5,492, 5,500, 5,510

- 1 Day Implied Range: 0.54%

For QQQ:

- Support: 480, 475, 470

- Resistance: 485, 490

IWM:

- Support: 200, 198, 195

- Resistance: 204, 205

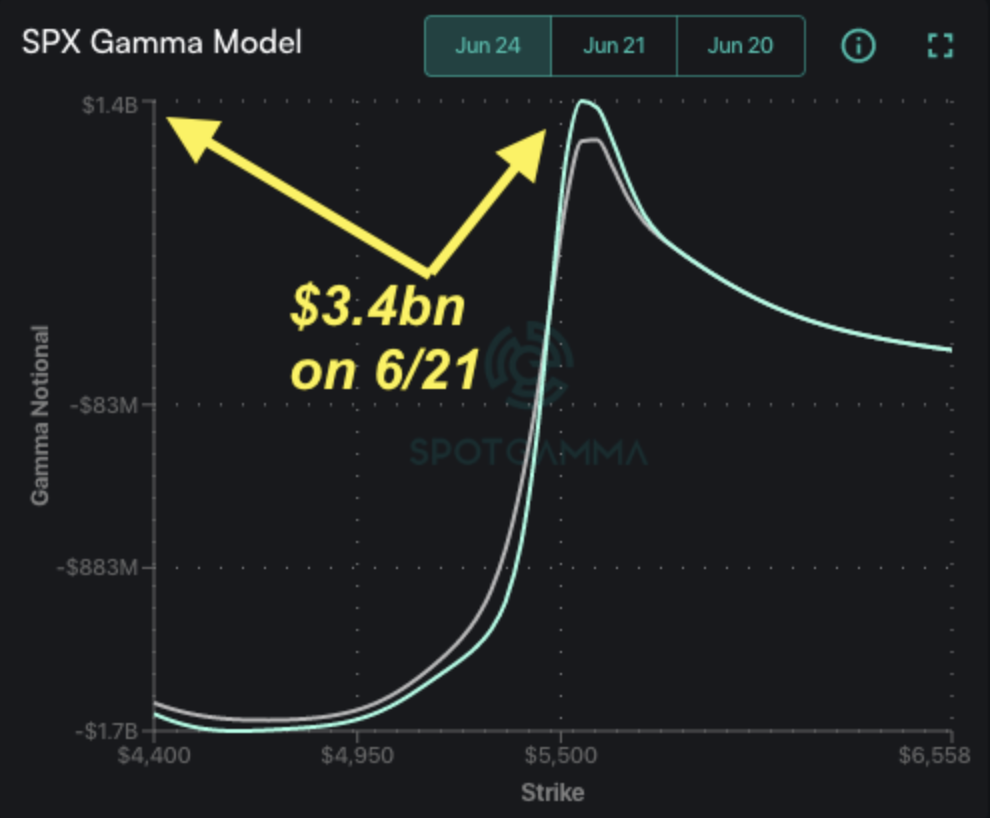

We start off post-OPEX with key levels much the same from pre-OPEX, but at a much reduced size. You can see this in the SPX gamma curve below, wherein the positive gamma peaked near 5,500, but with a large $3.4bn in gamma. This morning we see that peak at $1.4bn in positive gamma, suggesting that dealers have much less hedging flow. This hedging flow, we believe, has been serving to pin down the S&P500. Said another way, volatility (movement up or down in the S&P) should increase.

We’re of the view this volatility should first express itself via downside in the S&P, and single stocks. This is due to the very heavy call:put imbalance (9:1) into OPEX.

That leaves us with a neutral zone around 5,450 – 5,460 in the SPX, with prices fluid down to 5,400 or up to 5,500.

Downside:

-We think 5,400 would serve as large support, and would anticipate that being a low. If 5,400 were to break, it implies a test of 5,300, along with a large jump in IV/VIX.

Upside:

-With a close >5,500, we would anticipate the

Call Wall

rolling to a higher strike. Further, if the SPX can close>5,500 trader attention would likely focus on the 5,570 JPM collar strike that expires on 6/28.

Our rather benign volatility expectations for the SPX is not the same for single stocks, particularly those that have been having the strongest performance (i.e. NVDA + semis). We expect volatility to remain high in those names, just with a correction at hand.

Its been no secret that we are negative on NVDA. On Friday we posted our Put/Call Impact chart for NVDA, showing a lack of positions <130, except for a bit of positioning at 120. The positions <=120 have increased post OPEX, suggesting more downside momentum is now available, with 120 as a major first downside level.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5530.73 | $5464 | $544 | $19700 | $480 | $2022 | $200 |

| SG Gamma Index™: |

| 0.707 | -0.227 |

|

|

|

|

| SG Implied 1-Day Move: | 0.00% | 0.00% | 0.00% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5511.73 | $5445 | $544 | $19680 | $479 | $2015 | $204 |

| Absolute Gamma Strike: | $5066.73 | $5000 | $545 | $19750 | $480 | $2000 | $200 |

| Call Wall: | $5566.73 | $5500 | $550 | $19750 | $490 | $2200 | $210 |

| Put Wall: | $5366.73 | $5300 | $542 | $17000 | $460 | $2000 | $195 |

| Zero Gamma Level: | $5499.73 | $5433 | $543 | $19650 | $479 | $2032 | $204 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.115 | 0.764 | 1.144 | 0.943 | 0.713 | 0.510 |

| Gamma Notional (MM): | $272.142M | ‑$388.978M | $3.344M | ‑$21.493M | ‑$26.583M | ‑$794.179M |

| 25 Delta Risk Reversal: | -0.024 | 0.001 | -0.025 | -0.014 | -0.017 | 0.005 |

| Call Volume: | 610.757K | 1.133M | 19.402K | 579.359K | 29.811K | 255.144K |

| Put Volume: | 1.064M | 1.656M | 15.993K | 794.50K | 33.139K | 303.93K |

| Call Open Interest: | 6.113M | 4.427M | 53.926K | 2.741M | 266.636K | 3.551M |

| Put Open Interest: | 13.008M | 12.144M | 106.18K | 5.584M | 452.183K | 7.062M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 5400, 5550, 5500] |

| SPY Levels: [545, 540, 544, 550] |

| NDX Levels: [19750, 20000, 19800, 19700] |

| QQQ Levels: [480, 475, 485, 470] |

| SPX Combos: [(5727,79.67), (5700,96.56), (5672,84.07), (5650,92.43), (5623,83.32), (5618,78.37), (5601,98.63), (5579,76.73), (5574,91.99), (5568,96.91), (5563,78.01), (5558,87.26), (5552,97.89), (5541,88.57), (5530,83.55), (5525,93.30), (5519,95.49), (5514,76.06), (5508,95.07), (5503,77.59), (5497,99.71), (5492,89.38), (5486,72.16), (5481,83.48), (5470,80.22), (5443,76.70), (5437,94.43), (5432,84.59), (5426,93.67), (5421,84.71), (5388,73.10), (5383,72.96), (5377,90.86), (5372,77.75), (5350,88.08), (5323,79.99), (5317,78.91), (5301,94.07), (5251,78.32), (5224,70.91), (5219,76.43), (5202,88.38)] |

| SPY Combos: [546.85, 549.03, 556.64, 551.75] |

| NDX Combos: [19760, 19897, 20094, 20508] |

| QQQ Combos: [483.44, 498.32, 488.72, 472.4] |

0 comentarios