Macro Theme:

Short Term SPX Resistance: 5,510 (SPY 550)

Short Term SPX Support: 5,450

SPX Risk Pivot Level: 5,400

Major SPX Range High/Resistance: 5,510 (SPY 550)

Major SPX Range Low/Support: 5,000

- Upside scenario:

- 5,500 – 5,510 (SPY 550 Call Wall) is major initial resistance. If the Call Wall(s) roll higher, our “top” does, too

- The major high level for SPX on 6/28 (end-of-quarter OPEX) is 5,570

- Downside scenario:

- 5,400 is strong support

- A break of 5,400 likely leads to a test of 5,300

- <5,300 the market fully loses positive gamma support, allowing for higher implied volatility (i.e. VIX 20) and a move down into 5,000

- 5,000 is massive, long term support

Founder’s Note:

ES futures are flat at 5,540. NQ futures are +20 bps to 20,010.

Key SG levels for the SPX are:

- Support: 5,462, 5,450, 5442, 5,420, 5400

- Resistance: 5,500, 5,510

- 1 Day Implied Range: 0.67%

For QQQ:

- Support: 475

- Resistance: 480, 485

IWM:

- Support: 200, 195

- Resistance: 202, 205

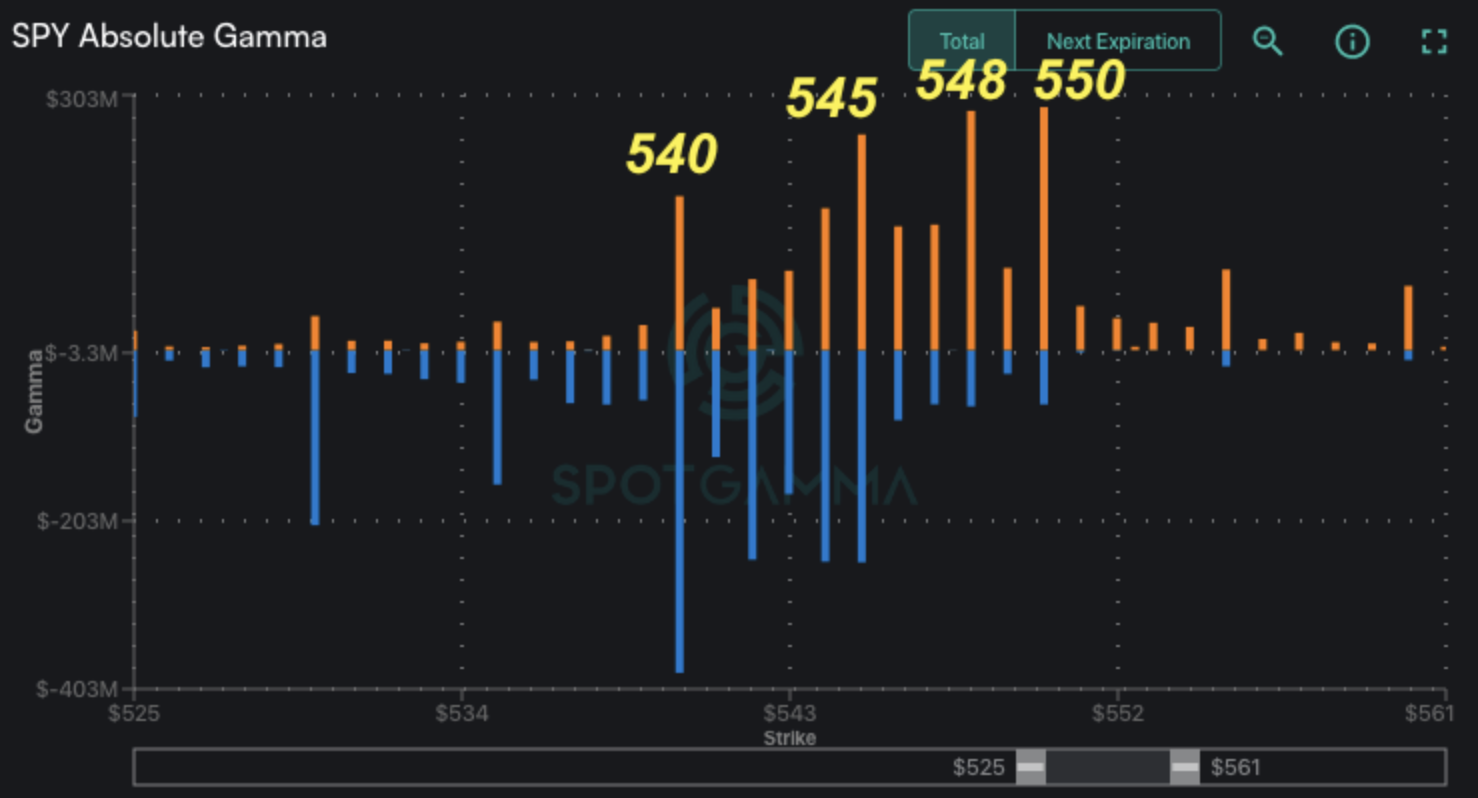

After getting a bit of post-OPEX volatility on Monday, the S&P has quickly ground back to a halt, as gamma is filling in around at-the-money strikes. The gamma is largest for SPY strikes, as shown below. This is reinforcing the resistance band above at 5,500, but also filling in support at 5,460 (SPY 545) – 5,450, as well as down below at SPY 540 (SPX ~5,415).

While there are likely some various non-options end-of-month/quarter flows that enter on Friday, we see little else on the docket to shift direction until ISM PMI & Powell next week. That, however, is a holiday shortened week (4th of July) which limits traders desire to carry long vol positions.

You can see this wave of calm below, with the SPX term structure very flat, and near the bottom of its 90-day range (gray shaded cone).

This low IV extends out in strike and across expirations, too. Shown here is our Fixed Strike Matrix, and its a sea of red indicating very low volatility expectations out until the US Elections in November. 1-month, 25 delta puts trading at an 11% IV is about as dull as it gets.

Baring some impact from big rebalancing flows Friday, this low IV is a recipe for positive equity-index drift, with the big short-term pull at 5,500. Should that level come into play, we’d expect a quick roll of the

Call Wall

to 5,550, which would raise our upside target to 5,550.

One could argue these low IV’s are warranted, as realized volatility [RV] grinds lower. Currently we have 1-month SPX RV at 7.5%, which is just off of post-Covid lows (Dec ’23 RV was 7%). Again, with the upcoming holiday week, we see little reason for this low index movement (and forward volatility expectations) to change.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5534.49 | $5469 | $544 | $19701 | $479 | $2022 | $200 |

| SG Gamma Index™: |

| 0.840 | -0.224 |

|

|

|

|

| SG Implied 1-Day Move: | 0.67% | 0.67% | 0.67% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5510.49 | $5445 | $544 | $19730 | $479 | $2015 | $202 |

| Absolute Gamma Strike: | $5565.49 | $5500 | $540 | $19750 | $480 | $2000 | $200 |

| Call Wall: | $5565.49 | $5500 | $550 | $19750 | $485 | $2200 | $210 |

| Put Wall: | $5365.49 | $5300 | $540 | $17000 | $475 | $2000 | $190 |

| Zero Gamma Level: | $5502.49 | $5437 | $543 | $19503 | $478 | $2032 | $205 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.132 | 0.780 | 1.271 | 0.911 | 0.746 | 0.558 |

| Gamma Notional (MM): | $335.074M | ‑$303.28M | $7.886M | ‑$18.679M | ‑$29.412M | ‑$764.704M |

| 25 Delta Risk Reversal: | -0.024 | 0.00 | -0.025 | -0.00 | -0.018 | 0.007 |

| Call Volume: | 424.927K | 1.122M | 8.436K | 644.194K | 11.869K | 281.496K |

| Put Volume: | 783.55K | 1.315M | 12.256K | 928.243K | 23.061K | 317.678K |

| Call Open Interest: | 6.264M | 4.512M | 54.264K | 2.982M | 275.907K | 3.723M |

| Put Open Interest: | 13.304M | 12.64M | 107.895K | 5.868M | 471.256K | 7.202M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5500, 5550, 5000, 5400] |

| SPY Levels: [540, 545, 544, 550] |

| NDX Levels: [19750, 20000, 19975, 19800] |

| QQQ Levels: [480, 475, 470, 485] |

| SPX Combos: [(5726,79.73), (5699,96.73), (5677,74.72), (5650,93.00), (5622,91.85), (5601,98.68), (5579,75.61), (5573,93.61), (5568,91.25), (5562,92.82), (5551,98.05), (5540,88.97), (5529,87.17), (5524,94.12), (5519,95.16), (5513,87.80), (5508,97.36), (5502,99.73), (5497,80.23), (5491,86.76), (5486,74.16), (5480,90.99), (5469,74.16), (5453,73.04), (5447,80.99), (5442,92.59), (5431,82.30), (5426,90.63), (5420,89.32), (5415,73.04), (5393,84.15), (5376,84.91), (5371,81.24), (5349,87.88), (5333,72.64), (5322,81.23), (5300,94.98), (5272,81.19), (5251,80.06), (5223,70.28), (5218,79.73), (5201,89.10)] |

| SPY Combos: [550.24, 560.04, 555.14, 569.85] |

| NDX Combos: [19741, 20135, 19938, 19307] |

| QQQ Combos: [486.06, 475.52, 485.58, 465.45] |

0 comentarios