Macro Theme:

Short Term SPX Resistance: 5,550

Short Term SPX Support: 5,465 (SPY 545)

SPX Risk Pivot Level: 5,450

Major SPX Range High/Resistance: 5,550

Major SPX Range Low/Support: 5,000

- Upside scenario:

- 5,500 – 5,510 (SPY 550 Call Wall) was major initial resistance. We see this level rolling up on 6/28 to 5,550

- The major high level for SPX on 6/28 (end-of-quarter OPEX) is 5,570

- Downside scenario:

- 5,450 is our initial risk off (6/28), with 5,400 is strong support

- A break of 5,400 likely leads to a test of 5,300

- <5,300 the market fully loses positive gamma support, allowing for higher implied volatility (i.e. VIX 20) and a move down into 5,000

- 5,000 is massive, long term support

Founder’s Note:

ES futures are +35bps to 5,565. NQ futures are +40bps to 20,125.

Key SG levels for the SPX are:

- Support: 5,465, 5,450, 5400

- Resistance: 5,500, 5,510, 5,528, 5,550

- 1 Day Implied Range: 0.65%

For QQQ:

- Support: 480, 479

- Resistance: 490

IWM:

- Support: 200, 190

- Resistance: 204, 210

Core PCE 8:30AM ET

Today we have an hunch that markets could move, as ES futures test

Call Wall

resistance at 5,500-5,510 (SPY 550).

Yesterday we highlighted the lowly 37bps, 14% 0DTE SPX straddle, and today we see that 0DTE straddle at $28/50bps with an 18% IV (ref 5,505). That means traders are pricing in a bit more range for today, but not a lot given the CORE PCE number, and possible month/quarter end flows set to enter the market, today.

These are not only various fund inflow/outflows, but also the large JPM collar position that should come in, too. This position will need to sell ~45k Sep 30th SPX call contracts 2-3% north of current SPX prices, and buy a downside put spread. Associated with this are several large broker hedges, which could push markets around a bit. We think that is particularly true when the options market is pricing in very tight markets, like today. These hedging flows often involve the trade of a deep in the money, 0DTE call which should be visible in

HIRO.

Following that there are a series of end-of-day prints which shuffle around various exposures, leaving the client (JPM Fund JHEQX) with their collar, and brokers with offsetting hedges (read more here).

Zooming out, we see a high likelihood that the S&P

Call Wall

roll up to 5,550, and we flag QQQ 500 as a big upside level, too. Should the PCE number today come in <=expectations, we think these levels will come into play today or Monday. Should the SPX close >5,500 this level should function as strong support.

To the downside, 5,450 is now our initial risk-off level, as a break of that level likely leads to a test of 5,400.

In addition to the Core PCE today, there are some PMI data points next week, along with a Powell panel discussion on Tuesday….but volatility markets do not care.

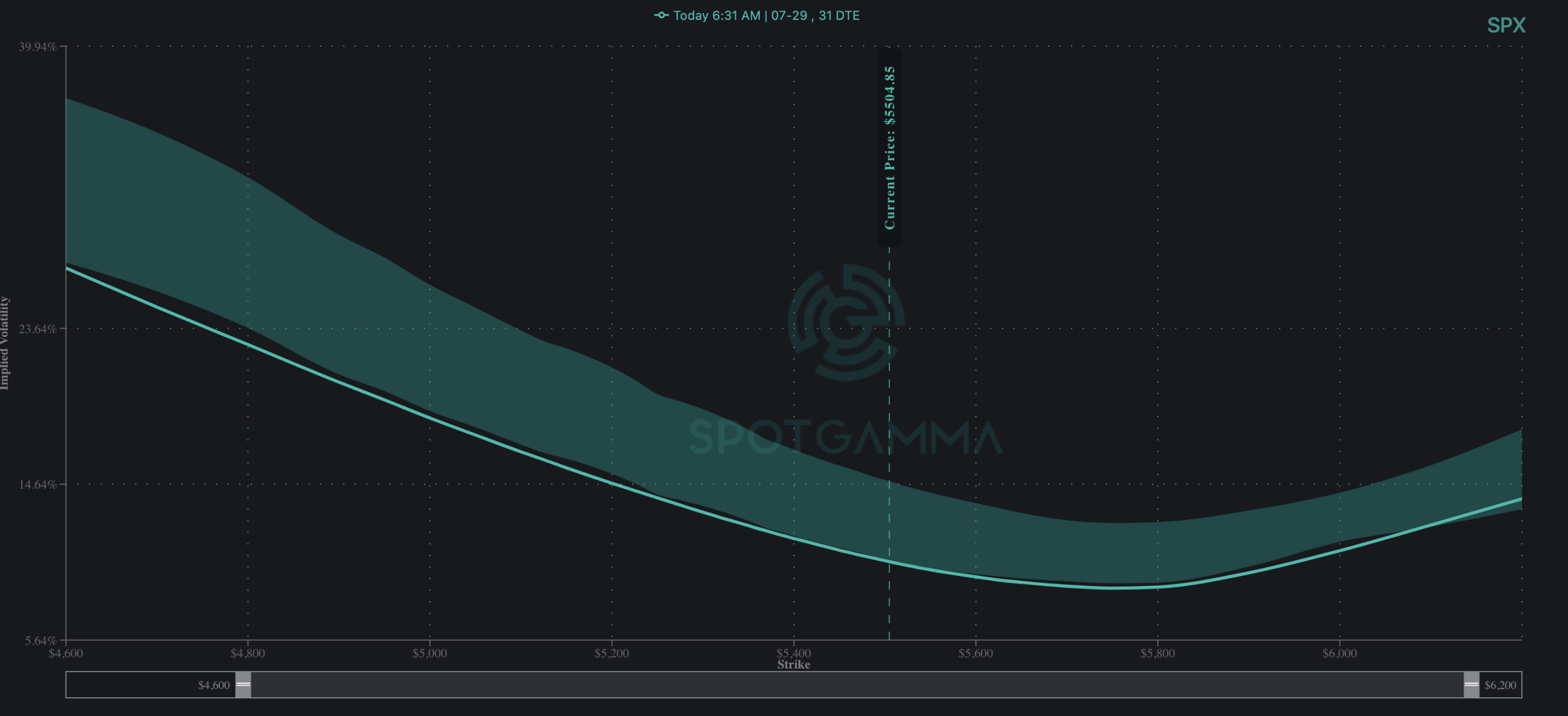

This is shown in the anemic 1-month SPX skew, which is at 90 lows (green shaded cone). This low skew implies SPX vol sellers are out there, across the board. Add in the upcoming July 4th holiday, and its a recipie for sinking vol, which adds a vanna-tailwind to equities.

Where things are a bit more interesting is in the QQQ’s, which have a noticeable lift in upside call skew (teal IV line up off of shaded cone bottom). This implies faster upside vs SPX due to more long QQQ calls, which is beneficial if you want to play for upside (as we do). Of course, vol works both ways, and so those playing downside are likely going to get more out of QQQ puts, too.

The problem with downside, is there is a lot of long dealer gamma below, down to 5,400, which is supportive of the SPX.

This can be seen in the chart below, with calls (orange) and puts (blue) large and balanced to 5,400. Even <5,400 there isn’t a large net-put position, suggesting not much need for downside dealer hedges. You put all of this together (large positive gamma, sinking vols, stocks at highs) and you have momentum that is hard to stop.

|

|

/ES |

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|---|

|

Reference Price: |

$5546.11 |

$5482 |

$546 |

$19789 |

$481 |

$2038 |

$202 |

|

SG Gamma Index™: |

|

1.064 |

-0.15 |

|

|

|

|

|

SG Implied 1-Day Move: |

0.65% |

0.65% |

0.65% |

|

|

|

|

|

SG Implied 5-Day Move: |

1.95% |

1.95% |

|

|

|

|

|

|

SG Implied 1-Day Move High: |

After open |

After open |

After open |

|

|

|

|

|

SG Implied 1-Day Move Low: |

After open |

After open |

After open |

|

|

|

|

|

SG Volatility Trigger™: |

$5529.11 |

$5465 |

$545 |

$19690 |

$481 |

$2015 |

$201 |

|

Absolute Gamma Strike: |

$5564.11 |

$5500 |

$545 |

$19750 |

$480 |

$2050 |

$200 |

|

Call Wall: |

$5564.11 |

$5500 |

$550 |

$19750 |

$490 |

$2200 |

$204 |

|

Put Wall: |

$5364.11 |

$5300 |

$540 |

$17000 |

$478 |

$2000 |

$190 |

|

Zero Gamma Level: |

$5515.11 |

$5451 |

$545 |

$19590 |

$480 |

$2033 |

$202 |

|

|

SPX |

SPY |

NDX |

QQQ |

RUT |

IWM |

|---|---|---|---|---|---|---|

|

Gamma Tilt: |

1.168 |

0.851 |

1.387 |

0.929 |

0.851 |

0.801 |

|

Gamma Notional (MM): |

$460.563M |

$104.813M |

$10.229M |

$44.28M |

‑$9.905M |

‑$101.132M |

|

25 Delta Risk Reversal: |

-0.023 |

0.002 |

-0.024 |

0.001 |

-0.014 |

0.009 |

|

Call Volume: |

390.415K |

1.192M |

7.437K |

551.164K |

20.199K |

418.781K |

|

Put Volume: |

693.299K |

1.56M |

11.07K |

1.018M |

15.803K |

218.19K |

|

Call Open Interest: |

6.348M |

4.622M |

54.006K |

3.007M |

282.034K |

4.02M |

|

Put Open Interest: |

13.477M |

13.124M |

110.634K |

6.037M |

475.536K |

7.31M |

|

Key Support & Resistance Strikes |

|---|

|

SPX Levels: [5500, 5550, 5000, 5400] |

|

SPY Levels: [545, 540, 548, 550] |

|

NDX Levels: [19750, 20000, 19975, 19800] |

|

QQQ Levels: [480, 475, 470, 485] |

|

SPX Combos: [(5752,91.91), (5724,79.52), (5702,97.02), (5675,72.51), (5653,93.75), (5625,86.85), (5620,78.41), (5603,99.16), (5587,70.44), (5582,83.03), (5576,93.26), (5571,92.84), (5565,83.04), (5560,89.41), (5549,98.24), (5543,91.37), (5538,79.63), (5532,89.69), (5527,96.17), (5521,96.85), (5516,85.43), (5510,96.97), (5505,89.02), (5499,99.72), (5488,86.21), (5483,70.07), (5466,85.55), (5461,86.68), (5455,82.67), (5444,74.48), (5439,87.39), (5428,91.04), (5417,89.07), (5390,72.67), (5373,85.27), (5368,78.68), (5351,87.20), (5340,70.10), (5324,70.51), (5318,82.85), (5302,94.84), (5253,79.62), (5220,77.73)] |

|

SPY Combos: [548.54, 558.37, 553.45, 568.75] |

|

NDX Combos: [19749, 19928, 20125, 20007] |

|

QQQ Combos: [481.55, 486.37, 491.18, 470.96] |

0 comentarios