Macro Theme:

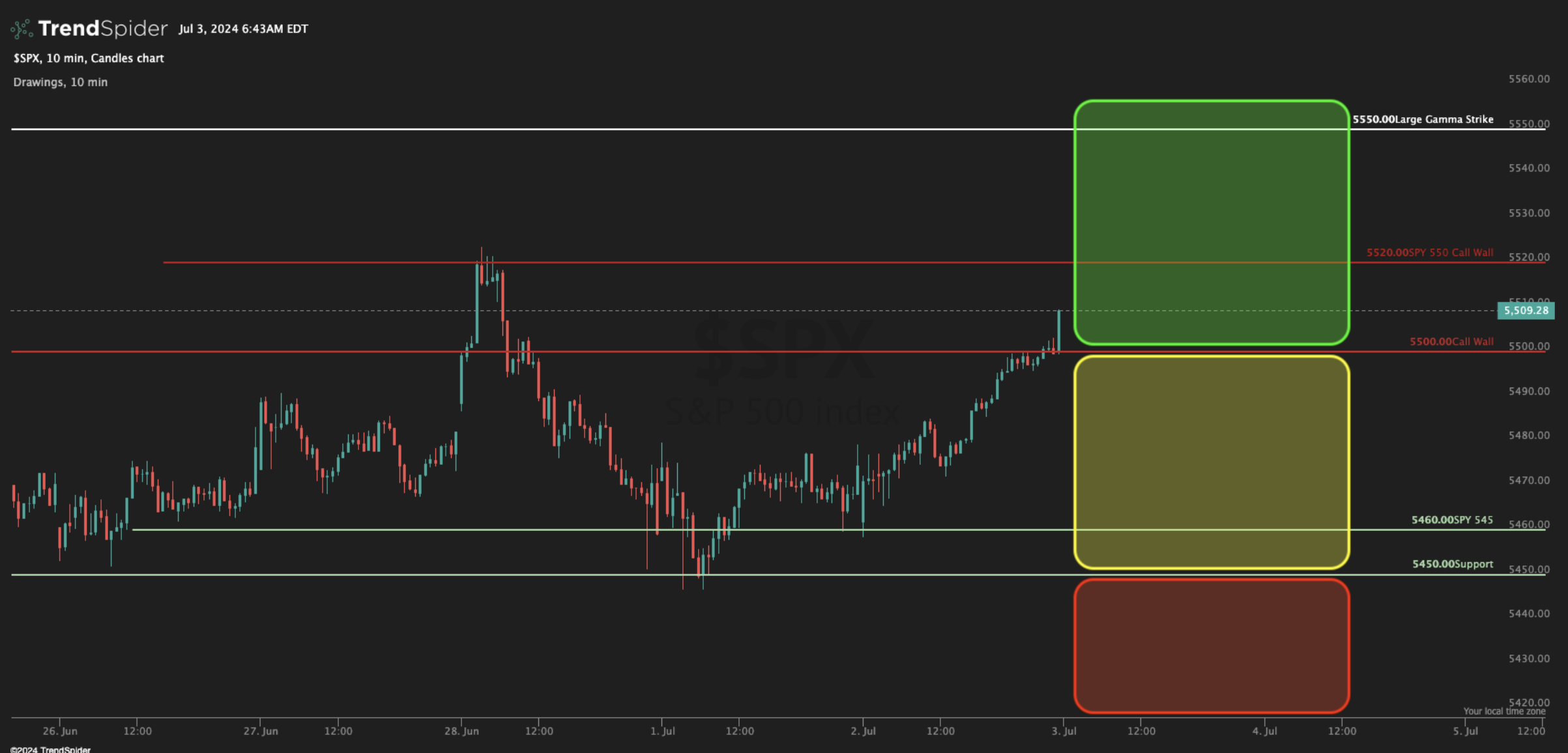

Short Term SPX Resistance: 5,550

Short Term SPX Support: 5,500

SPX Risk Pivot Level: 5,490

Major SPX Range High/Resistance: 5,600

Major SPX Range Low/Support: 5,000

- Upside scenario:

- 5,550 is now initial resistance, after move to 5,500

- 5,600 is the target high into July OPEX

- Downside scenario:

- 5,490 is our initial risk off (7/3), with 5,450 first support

- A break of 5,400 likely leads to a test of 5,300

- <5,300 the market fully loses positive gamma support, allowing for higher implied volatility (i.e. VIX 20) and a move down into 5,000

- 5,000 is massive, long term support

Founder’s Note:

Key SG levels for the SPX are:

- Support: 5,492, 5,460 (SPY 545), 5,450

- Resistance: 5,520 (SPY 550), 5,550

- 1 Day Implied Range: 0.65%

For QQQ:

- Support: 480

- Resistance: 485, 490

IWM:

- Support: 200, 190

- Resistance: 204, 210

ISM PMI 10AM ET, FOMC Mins 2PM ET

Note: Today is an early stock market close: 1PM ET. Tomorrow the market is closed for July 4th.

“The Force” of positive gamma & vanna worked to pull equities up into 5,500 yesterday – the path of least resistance (see y’days note). This morning we see ISM PMI as a small road bump, but should that pass without event it will lead to a small drop in event-vol, which plays into an early close today, and holiday tomorrow.

If the SPX holds 5,500, it picks up a material amount of positive gamma, which is even more supportive that what we had in the 5,450 – 5,500 range. Further, we see large positions up at 5,550 which serves as an attractant or draw for SPX prices.

With that, we remain long of SPX while >5,500, with an upside target of 5,550. Should 5,500 break down, we would look for a quick test of 5,450, eyeing a bounce there. <5,450, equity prices would likely remain negative until July OPEX, with 5,400 first support.

We continue to favor upside with that 5,550 first target, and 5,600 “in play” for 7/19 OPEX.

Shifting back to the vol space & vanna impact, short dated vols just went on vacation. You can see this in SPX term structure (shown below), which is now well below its 90-day range. Recall that this 90-day range is about as low as vol has been post the March 20 Covid Crash, and so current levels are about as low as it can get. We believe when vol sinks like this it generally serves to push equity markets up – thats the “vanna impact”.

What’s interesting about this is that today’s 0DTE straddle is $13/24 bps (ref 5,515) with an 11.8% IV (really, really low). You in all likelihood do not want to short vol here, as, again, its about as low as possible. Does that mean you want to get long?

Well, do not forget that vol “works both ways”, and so sneaky SPX upside movement is as much a destroyer of short vol as is a sharp drop (or in this case, even a mild SPX price drop). With this in mind, a cheap 0DTE long options spread/fly play could be interesting, and maybe some want to play longer dated options (>=Aug OPEX) due to these low IV’s.

As far as short term puts, those are fighting decay and a lot of positive gamma. This likely makes a short term market “release” to the downside quite tricky/unlikely.

Also, do not forget about correlation dynamics. We’ve covered them extensively, and it matters here for your “weapon of choice” in expressing both longs & shorts. To wit, note the QQQ’s +1.05% sharply outperformed the SPX +0.67%, as the SPX has a lot of vol-suppressing positive gamma that the QQQ’s and megacap/semis do not.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5567.29 | $5509 | $549 | $20011 | $486 | $2033 | $201 |

| SG Gamma Index™: |

| 1.812 | -0.164 |

|

|

|

|

| SG Implied 1-Day Move: | 0.65% | 0.65% | 0.65% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5553.29 | $5495 | $547 | $19730 | $484 | $2040 | $201 |

| Absolute Gamma Strike: | $5608.29 | $5550 | $550 | $20000 | $485 | $2050 | $200 |

| Call Wall: | $5658.29 | $5600 | $550 | $19750 | $490 | $2200 | $210 |

| Put Wall: | $5553.29 | $5495 | $545 | $17000 | $440 | $2000 | $190 |

| Zero Gamma Level: | $5494.29 | $5436 | $548 | $19662 | $482 | $2044 | $203 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.284 | 0.840 | 1.665 | 1.022 | 0.766 | 0.659 |

| Gamma Notional (MM): | $850.375M | $230.843M | $19.545M | $301.98M | ‑$28.262M | ‑$493.754M |

| 25 Delta Risk Reversal: | -0.025 | -0.001 | -0.026 | -0.001 | -0.016 | 0.010 |

| Call Volume: | 492.257K | 1.31M | 10.263K | 591.248K | 11.60K | 259.779K |

| Put Volume: | 973.464K | 1.594M | 11.965K | 941.661K | 21.855K | 357.235K |

| Call Open Interest: | 6.308M | 4.605M | 54.899K | 2.952M | 275.238K | 3.755M |

| Put Open Interest: | 13.244M | 12.308M | 111.008K | 5.951M | 474.503K | 7.181M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5550, 5500, 5000, 5400] |

| SPY Levels: [550, 545, 548, 540] |

| NDX Levels: [20000, 19750, 19975, 19900] |

| QQQ Levels: [485, 480, 490, 470] |

| SPX Combos: [(5773,69.93), (5751,97.13), (5724,82.61), (5702,97.46), (5674,73.71), (5652,96.79), (5625,90.54), (5619,81.69), (5608,72.41), (5603,99.59), (5592,77.57), (5581,89.18), (5575,96.66), (5570,93.72), (5564,77.07), (5559,92.83), (5553,69.89), (5548,99.58), (5542,94.36), (5537,92.84), (5531,98.40), (5526,99.47), (5520,98.91), (5515,93.02), (5509,95.96), (5504,78.07), (5498,99.01), (5492,98.27), (5481,75.72), (5476,74.31), (5470,87.97), (5459,70.67), (5448,80.94), (5437,81.50), (5426,83.27), (5421,84.15), (5377,80.53), (5366,80.52), (5349,85.67), (5316,79.95), (5300,93.71), (5278,71.29), (5250,79.59)] |

| SPY Combos: [558.34, 552.85, 550.66, 547.91] |

| NDX Combos: [19752, 20132, 19992, 20552] |

| QQQ Combos: [480.65, 489.9, 486.49, 500.13] |

0 comentarios