Macro Theme:

Short Term SPX Resistance: 5,620

Short Term SPX Support: 5,550

SPX Risk Pivot Level: 5,620

Major SPX Range High/Resistance: 5,700

Major SPX Range Low/Support: 5,500

Positions changes for 7/17 VIX-exp and 7/19 OPEX open a window for volatility shifts, and a break from the extreme equity calm.

With 7/17-7/19 OPEX we are looking for a pullback in IWM to 210.

- Upside scenario:

- SPX 5,665 shows as a major high into 7/19 OPEX

- Downside scenario:

- 5,600 is our major risk off level as of 7/15

- A break of 5,600 likely leads to a test of 5,550.

- 5,500 is our major, long term support level.

Founder’s Note:

ES are flat to 5,640, NQ futures are +30 bps to 20,061. RTY futures are flat at 2,260.

Key SG levels for the SPX are:

- Support: 5,560, 5,550, 5,500

- Resistance: 5,600, 5,620

- 1 Day Implied Range: 0.59%

For QQQ:

- Support: 480, 470

- Resistance: 484, 490, 500

IWM:

- Support: 220, 210, 208, 200

- Resistance: 225

Yesterday’s AM VIX Exp appeared to release volatility, as the SPX declined -1.4%, and NDX -2.9%. This was the largest NDX decline since Dec ’22. The semi-ETF SMH was -7%, with NVDA -6.6%. As we have stated many times over the past few weeks – the major indexes are driven by a few select names (read here). Case in point: yesterday’s NVDA’s -6.6% drop meant at least 45 bps of decline for the SPX/NDX.

Meanwhile the call-frothy IWM was only -1%, with RSP -40bps ( RSP is the equal weighted SPX, see our trade idea of long RSP short SPY from Tue).

These concentration dynamics add an interesting dynamic to forecasting SPX/NDX levels. You can have a lot of gamma support/resistance at various index levels, but if NVDA goes -7% again, that is a big drag on the respective indexes. This makes watching those big 3 components of NVDA, AAPL & MSFT critical.

Related to this is the impending earnings season, which has dispersion indexes at major highs (DSPX, shown below). This dispersion index is based from 1-month options, and it “measures expected 30-day idiosyncratic movements in S&P 500 stocks” (for a primer on this watch this video). This current, high dispersion reading, implies traders are expecting large single stock movements into this upcoming earnings season, which is a critical dynamic in this market with high concentration and low correlation. In other words: big earnings moves could continue to wag the index-dog. These concepts are all laid out here in our “Correlation Spasms” video.

With that, we note TSM, a major NVDA/AAPL supplier, reports today, with GOOG & TSLA on 7/23.

Pivot

ing to the current S&P setup, we were looking for a quick test of 5,550 if the SPX broke <5,600. As the SPX closed at 5,588 yesterday, we are still looking for a move to 5,550, today into Friday. We see solid support at 5,550, with major long term support at 5,500. We think these levels could come into play early next week, and we would early next week be looking to play long positions from those levels.

To the upside, 5,600 – 5,620 is major resistance into Friday. If the SPX regains 5,620 next week, we would flip back to a “risk on” stance.

For the tech heavy QQQ’s we see 480 as large short term support, with 470 the major support level into next week. In our behind-the-scenes beta model (coming soon!), we actually see dealers holding a negative gamma stance at current levels, but that position trending to a positive gamma position if the index was to decline toward 450. I.E. dealer pressure wanes <475, which could slow downside momentum.

To the upside positive dealer QQQ gamma shows up again over 500 – that is our upside resistance level.

Finally, the small caps.

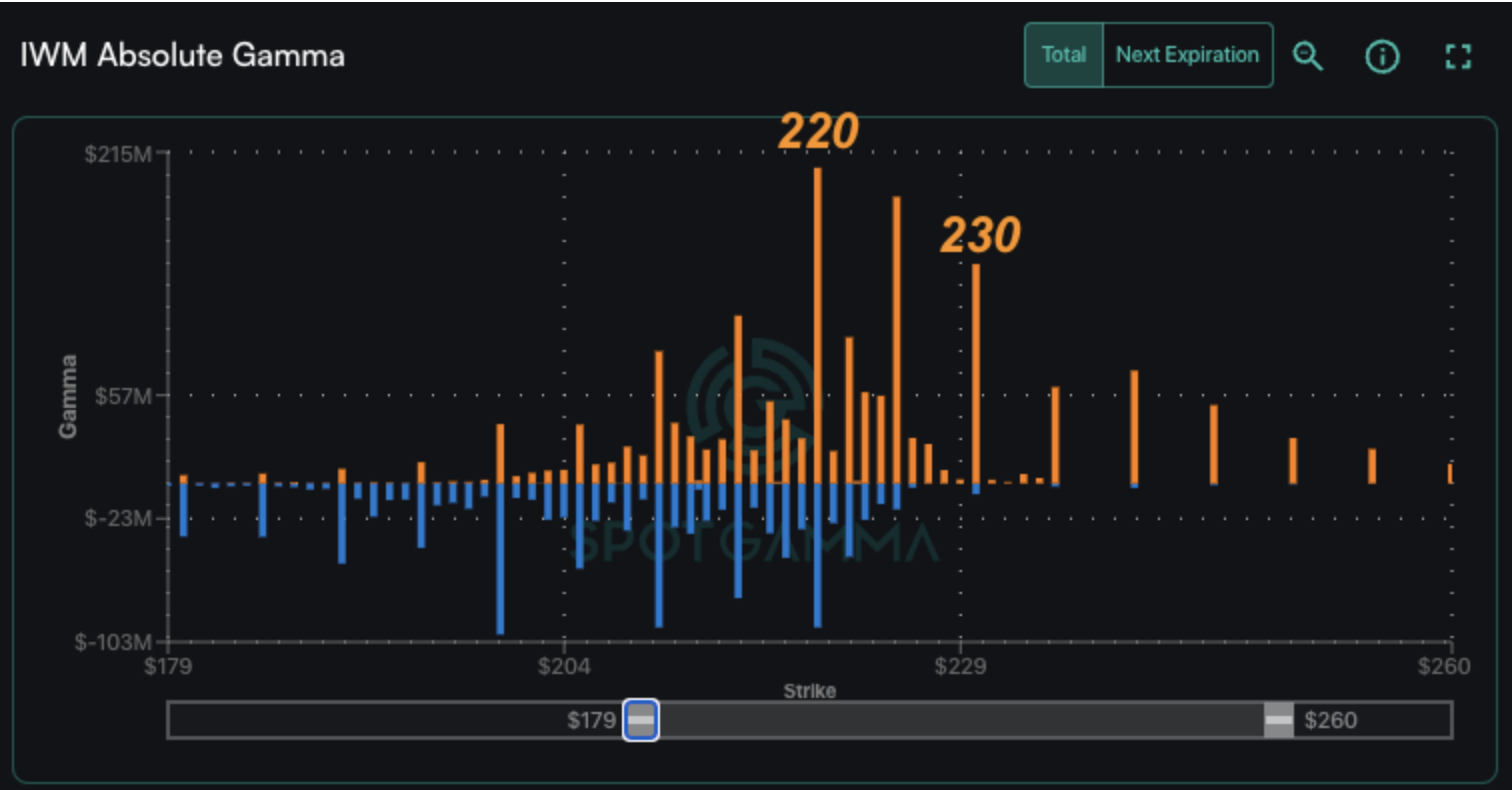

Our view from yesterday was that IWM was due for a big pullback – and that is true for today, too. There are a lot of long calls in IWM, and as the index sputters those calls should quickly lose value. This suggests that dealer selling pressure should pick up. With that, we see 220 as the big level into tomorrow, and are watching for a possible probe to 210 next week.

If we are wrong on our call for downside, the upside 230 looks like the upside exhaustion level for next week. This is based on there being a large drop in

call gamma

>230 (orange bars).

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5637.18 | $5588 | $556 | $19799 | $481 | $2239 | $222 |

| SG Gamma Index™: |

| -0.007 | -0.183 |

|

|

|

|

| SG Implied 1-Day Move: | 0.59% | 0.59% | 0.59% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5644.18 | $5595 | $557 | $19740 | $484 | $2125 | $208 |

| Absolute Gamma Strike: | $5599.18 | $5550 | $560 | $19750 | $480 | $2200 | $220 |

| Call Wall: | $5799.18 | $5750 | $565 | $19750 | $500 | $2200 | $225 |

| Put Wall: | $5549.18 | $5500 | $550 | $19550 | $480 | $2125 | $200 |

| Zero Gamma Level: | $5604.18 | $5555 | $556 | $19898 | $484 | $2135 | $215 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.999 | 0.831 | 0.875 | 0.788 | 1.642 | 1.345 |

| Gamma Notional (MM): | ‑$79.617M | ‑$404.62M | ‑$10.079M | ‑$487.968M | $46.642M | $561.691M |

| 25 Delta Risk Reversal: | -0.027 | -0.003 | -0.034 | -0.01 | 0.001 | 0.024 |

| Call Volume: | 600.636K | 1.601M | 30.522K | 1.492M | 42.715K | 1.142M |

| Put Volume: | 1.179M | 1.921M | 21.722K | 1.571M | 39.952K | 1.297M |

| Call Open Interest: | 6.973M | 5.246M | 69.726K | 3.828M | 343.165K | 5.152M |

| Put Open Interest: | 14.933M | 13.706M | 130.10K | 6.874M | 541.85K | 9.211M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5550, 5600, 5650, 5500] |

| SPY Levels: [560, 550, 555, 565] |

| NDX Levels: [19750, 20000, 19975, 19800] |

| QQQ Levels: [480, 485, 490, 470] |

| SPX Combos: [(5851,90.44), (5823,72.94), (5801,97.80), (5773,90.80), (5750,99.26), (5739,73.16), (5722,94.02), (5717,80.67), (5711,77.87), (5700,99.12), (5689,86.34), (5678,95.19), (5672,76.78), (5667,90.84), (5661,88.60), (5650,98.33), (5639,89.53), (5627,98.21), (5622,92.75), (5616,85.13), (5599,96.49), (5588,83.78), (5583,90.35), (5566,85.53), (5560,92.77), (5555,89.84), (5549,93.68), (5544,88.40), (5538,89.87), (5532,81.02), (5527,88.64), (5521,87.73), (5516,70.73), (5499,96.66), (5488,91.34), (5482,72.95), (5477,83.63), (5471,82.72), (5449,89.36), (5421,78.34), (5398,89.77), (5376,74.57), (5348,82.86), (5320,76.46)] |

| SPY Combos: [560.33, 565.34, 569.8, 555.32] |

| NDX Combos: [19740, 19720, 20552, 19522] |

| QQQ Combos: [477.46, 485.17, 489.99, 475.54] |

0 comentarios