Macro Theme:

Short Term SPX Resistance: 5,600

Short Term SPX Support: 5,500

SPX Risk Pivot Level: 5,620

Major SPX Range High/Resistance: 5,700

Major SPX Range Low/Support: 5,500

Positions changes for 7/17 VIX-exp and 7/19 OPEX open a window for volatility shifts, and a break from the extreme equity calm.

With 7/17-7/19 OPEX we are looking for a pullback in IWM to 210.

- Upside scenario:

- SPX 5,600 shows as a major high into 7/19 OPEX

- Downside scenario:

- 5,600 is our major risk off level as of 7/15

- A break of 5,600 likely leads to a test of 5,550.

- 5,500 is our major, long term support level.

Founder’s Note:

ES are flat at 5,593, NQ futures are flat at 19,892 & RTY futures are flat at 2,216.

Key SG levels for the SPX are:

- Support: 5,517, 5,500

- Resistance: 5,560, 5,600

- 1 Day Implied Range: 0.58%

For QQQ:

- Support: 470

- Resistance: 480, 483, 490, 500

IWM:

- Support: 215, 210

- Resistance: 220, 225

TLDR: we are on “bounce watch” looking to play an equity bounce into month end off of either lows put in Monday/Tuesday, and or tests of SPX 5,500/QQQ 480.

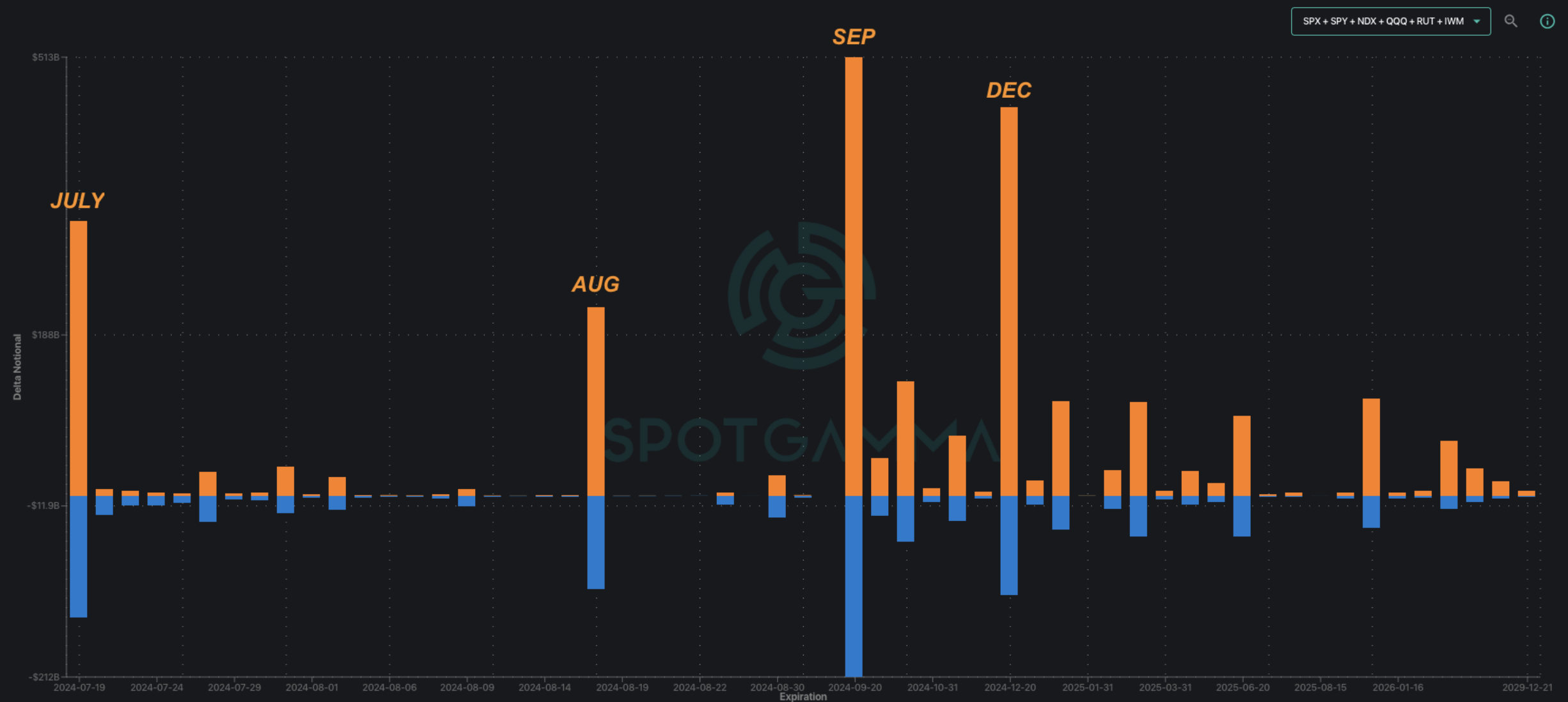

Today’s options monthly expiration is of decent size, but far less notionally than that of a quarterly expiration like last June, or the upcoming Sep expiration. You can see this in the plot below of the major indexes, which shows option delta notional for calls (orange) and puts (blue) at each OPEX.

Single stock expiration size is more idiosyncratic – some major tech names like NVDA or AMZN have large expirations (you can sort for these in EquityHub with Scanners->Other Scanners->Largest Gamma Expiring This Friday).

So, while the index expiration doesn’t appear to be all that large, this heavily-concentrated market can be swung by expiration-mechanics of large single stocks. That “ups” this OPEX importance.

To this point, this current period is reminding us of April ’24, wherein the SPX was -5% into April OPEX, but top single stocks, like NVDA, were down ~20%. It was a “correlation spasm” which reverted some of the extreme readings seen in correlation, dispersion & volatility. Recall that Apriil unwind was triggered by a flare up in geopolitics & hot CPI’s.

Below is the COR1M correlation metric (blue) vs VIX (orange), and as you can see the prior high was right at April OPEX. You may also note that a spike is COR1M corresponds with higher VIX values. That is what is happening today: correlation increases as all stocks decline, and that syncs with higher VIX/volatility.

April OPEX also had VIX expiration two days prior to Friday expiration, and our data shows that is significant: 68% of the time, when VIX exp falls before OPEX, the performance of the SPX flips from the week before, to the week after. In other words, if we are down into OPEX week, 68% of the time we rally next week. When VIX exp is after OPEX, that stat drops to 52%.

Currently, VIX exp was 2 days ago, and that expiration morning (VIX options expire at 9:30AM ET) marked a steep drop in equity prices. This week, the SPX is -2.5%, while NDVA is down -10%. This is a correlation spasm.

However, from the “macro” standpoint, the market is now all-but-certain that a rate cut is coming by Sep, and the geopolitical front is less in focus. This suggests the magnitude of the drawdown shouldn’t today be as sharp as April.

Whats interesting today, is that this drop in equity prices also syncs with key indexes hitting some major support levels: SPX 5,500, QQQ 480.

What is definitely different today vs April is the situation in small caps. We’ve been vocal about the IWM/small cap rally being overheated, and with that small caps were -2.7% yesterday, closing just below the key 220 level. We now see large positions at options-heavy 215 level, implying a range of 215-220 for IWM, today. We are still looking for a pullback to 210 into early next week based on the call skew needing to revert (see this note, and our OPEX live call, yesterday).

What could turn this current “spasm” into a full-blown “unwind” is earnings. If the semi/AI narrative falls under pressure, that would lead to a lot of pressure on large cap indexes. This is a dynamic we’ve been highlighting extensively over the past few weeks (here & here).

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5592.07 | $5544 | $552 | $19705 | $479 | $2198 | $217 |

| SG Gamma Index™: |

| -1.46 | -0.412 |

|

|

|

|

| SG Implied 1-Day Move: | 0.58% | 0.58% | 0.58% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | $5623.59 | $5575.52 | $555.57 |

|

|

|

|

| SG Implied 1-Day Move Low: | $5559.28 | $5511.22 | $549.17 |

|

|

|

|

| SG Volatility Trigger™: | $5603.07 | $5555 | $555 | $19730 | $483 | $2160 | $216 |

| Absolute Gamma Strike: | $5598.07 | $5550 | $550 | $20000 | $480 | $2200 | $215 |

| Call Wall: | $5798.07 | $5750 | $565 | $19750 | $500 | $2200 | $220 |

| Put Wall: | $5548.07 | $5500 | $550 | $17000 | $470 | $2125 | $200 |

| Zero Gamma Level: | $5602.07 | $5554 | $555 | $19803 | $486 | $2144 | $216 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.851 | 0.661 | 0.834 | 0.740 | 1.313 | 1.027 |

| Gamma Notional (MM): | ‑$520.317M | ‑$1.17B | ‑$10.067M | ‑$593.425M | $31.755M | $172.389M |

| 25 Delta Risk Reversal: | -0.036 | -0.013 | -0.043 | -0.025 | -0.009 | 0.013 |

| Call Volume: | 765.53K | 2.119M | 29.506K | 1.39M | 49.045K | 922.904K |

| Put Volume: | 1.317M | 2.602M | 22.404K | 1.548M | 47.173K | 1.344M |

| Call Open Interest: | 7.087M | 5.333M | 68.424K | 3.858M | 358.483K | 5.203M |

| Put Open Interest: | 15.177M | 13.731M | 130.029K | 6.918M | 560.255K | 9.44M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5550, 5500, 5600, 5000] |

| SPY Levels: [550, 555, 545, 560] |

| NDX Levels: [20000, 19750, 19975, 19800] |

| QQQ Levels: [480, 470, 475, 485] |

| SPX Combos: [(5800,96.87), (5772,89.22), (5750,98.69), (5722,91.63), (5716,69.95), (5700,98.40), (5689,78.94), (5672,84.68), (5667,87.76), (5661,74.33), (5650,92.53), (5639,78.49), (5628,78.18), (5622,73.49), (5617,86.38), (5600,96.38), (5583,78.05), (5578,86.58), (5561,72.92), (5556,76.65), (5550,86.35), (5545,87.89), (5539,86.44), (5534,75.75), (5528,84.52), (5522,91.76), (5517,97.76), (5511,76.96), (5506,87.94), (5500,99.05), (5495,84.81), (5489,93.62), (5484,92.38), (5478,85.87), (5473,90.96), (5467,94.99), (5456,80.84), (5450,95.07), (5439,72.81), (5423,83.19), (5417,88.79), (5400,95.34), (5373,80.23), (5367,73.29), (5351,87.81), (5317,81.84), (5301,96.33), (5273,88.41)] |

| SPY Combos: [568.73, 563.75, 558.78, 556.57] |

| NDX Combos: [19745, 19311, 19528, 20552] |

| QQQ Combos: [478.09, 477.61, 497.75, 472.82] |

0 comentarios