Macro Theme:

Short Term SPX Resistance: 5,600

Short Term SPX Support: 5,500

SPX Risk Pivot Level: 5,620

Major SPX Range High/Resistance: 5,700

Major SPX Range Low/Support: 5,500

We look for a relief rally out of 7/19 OPEX, with a contraction in elevated IV’s (VIX ref 16.7)

With 7/17-7/19 OPEX we are looking for a pullback in IWM to 210.

- Upside scenario:

- SPX 5,600 is our upside target out of 7/19 OPEX

- Downside scenario:

- 5,500 is our major, long term support level.

- A break <5,500 implies a longer term drawdown is likely at hand

Founder’s Note:

ES are +10 bps at 5,616, NQ & RTY futures are flat at 20,002 & 2,238.

Key SG levels for the SPX are:

- Support: 5,550, 5,517, 5,500

- Resistance: 5,560, 5,592, 5,600

- 1 Day Implied Range: 0.60%

For QQQ:

- Support: 480, 470

- Resistance: 485, 490

IWM:

- Support: 220, 215, 210

- Resistance: 225, 230

Futures are quiet this morning, as we await 8:30AM GDP, and earnings from GOOGL & TSLA after the close.

Does the market care about GDP? Well, no. Options traders are pricing in the 0DTE straddle at a meek $24.5, or 43bps (ref: 5,570 IV 17.7%). This is a very tight range, and hearkens back to the pre-OPEX period of 2 weeks ago, wherein realized vol was about as low as it gets. In the short term, there is not fear. Further, as the SPX moves toward our target of 5,600, positive gamma increases which helps to support index prices.

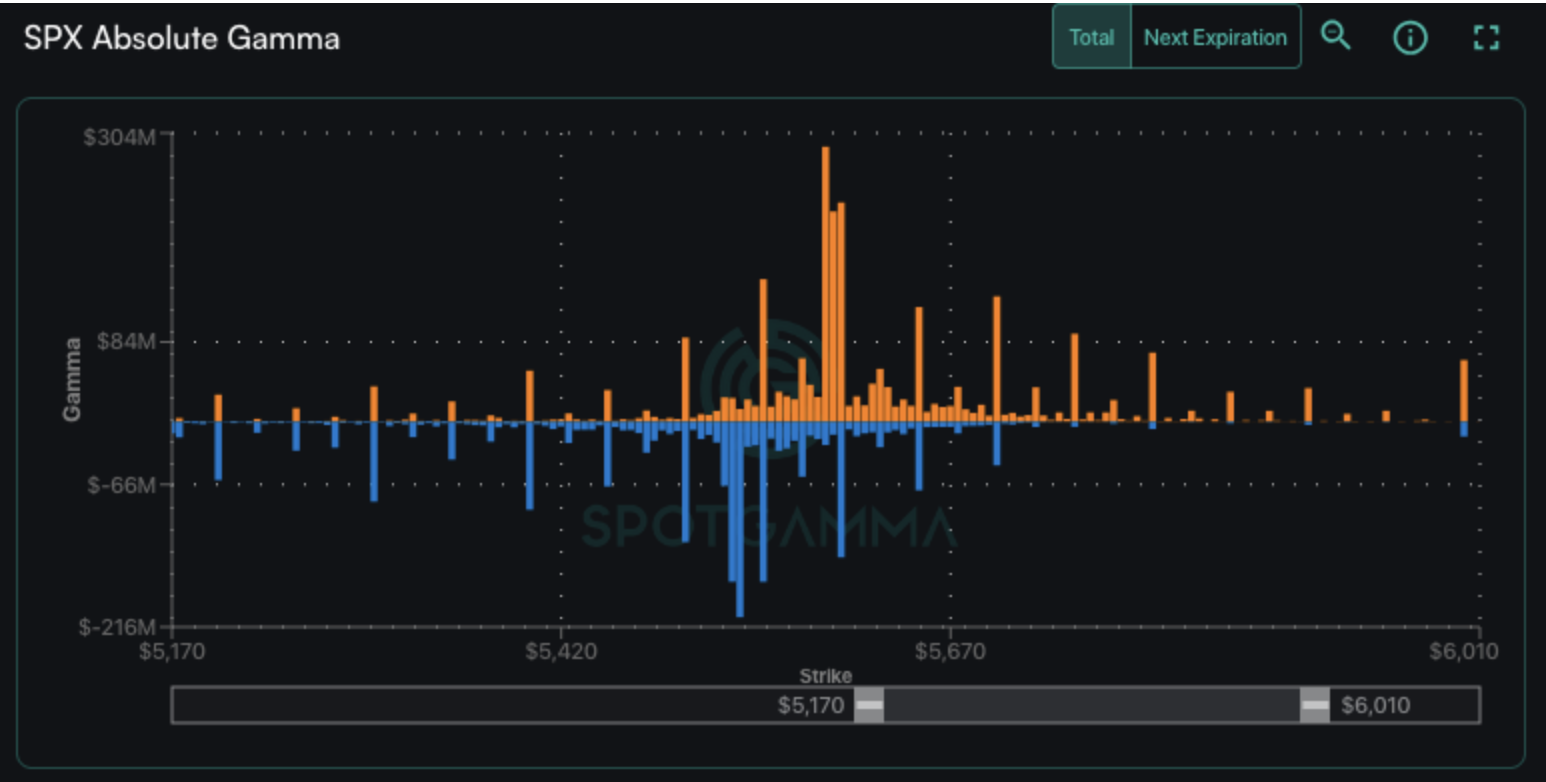

More specifically, what we see at SPX 5,600 is a cluster of big call positions (orange). This sets up as a call spread, with a trader short ~40k of the 5,590 strike, and long ~40k of the 5,595 strike. Further, there are ~10k long calls at 5,600 expiring today, too. This makes this a major upside target area for today.

This call spread is part of a short-dated/0DTE condor, which has a matching put spread of short ~40k 5,535 & long ~40k 5,530. This is quite a sizeable position, and if we are in the area of one of these spreads into the close (5,590 or 5,535) then the hedging flow tied to this spread will dominate price action, as if these positions are over the short strikes (>5,590 or <5,535) then the notional value of this position swings by $4,000,000 increments. That’s decent PNL for even the biggest of market makers, who will “win” if the position close >5,595 or <5,530.

Zooming out, the SPX IV term structure tells us that there is deflating anxiety from Friday’s SPX close near 5,500. This is seen by this mornings IV’s (green) being largely below that of Friday’s IV (gray line). We note that IV is highest for tomorrow’s CORE PCE, and then 7/31 FOMC – which is likely the next market-moving event. Yes, traders will be watching tomorrow’s PCE, but it will take a blazing-hot print to change the near 100% expectations of a rate cut by September (95% odds).

Lastly, we wanted to offer a quick view on the election.

Much of the financial news suggested that Kamala’s entry would drive volatility higher, as it introduced uncertainty. We took the opposing position, suggesting that vol would come in due to odds turning move in favor of a Trump victory. You can see that, via BetFair, Trump’s odds are a few points higher now vs Sunday when Biden stepped aside – but they are indeed off of the debate highs. And, yes, this is all fluid. Our point here is that nothing significantly changed re: Trumps odds.

So, those are betting markets. What are options traders positioning for?

Above we saw term structure, which measures at-the-money options, somewhat lower (less risk).To more accurately depict election anxiety, we show Nov SPX skew, which would reflect traders positioning for election tail risk. What we see is that this 120-day skew is indeed elevated to the downside (green line above the shaded green statistical range), but the skew is lower today vs Friday night (gray line). Recall that on Friday the SPX was down at 5,500, with VIX at 17. The SPX is now some ~70 handles higher, with VIX near 15.

The takeaway here is that there is always a fairly large event-vol premium tied to Presidential elections, and this time is no different. Strictly from a data perspective (our notes are apolitical), traders were unmoved by Biden’s decision to step aside.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5610.16 | $5564 | $554 | $19822 | $482 | $2220 | $220 |

| SG Gamma Index™: |

| 0.479 | -0.23 |

|

|

|

|

| SG Implied 1-Day Move: | 0.60% | 0.60% | 0.60% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5611.16 | $5565 | $553 | $19640 | $481 | $2160 | $219 |

| Absolute Gamma Strike: | $5646.16 | $5600 | $550 | $19650 | $480 | $2200 | $220 |

| Call Wall: | $5636.16 | $5590 | $565 | $19650 | $500 | $2200 | $230 |

| Put Wall: | $5581.16 | $5535 | $550 | $19375 | $470 | $2125 | $200 |

| Zero Gamma Level: | $5578.16 | $5532 | $553 | $19772 | $485 | $2166 | $218 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.059 | 0.763 | 1.018 | 0.840 | 1.356 | 1.063 |

| Gamma Notional (MM): | $43.145M | ‑$593.438M | ‑$902.283K | ‑$224.291M | $31.936M | $225.912M |

| 25 Delta Risk Reversal: | -0.03 | 0.00 | -0.035 | -0.01 | 0.00 | 0.021 |

| Call Volume: | 464.469K | 1.436M | 10.232K | 910.992K | 24.487K | 887.55K |

| Put Volume: | 818.222K | 1.993M | 13.002K | 914.579K | 43.233K | 582.976K |

| Call Open Interest: | 6.57M | 4.85M | 60.925K | 3.271M | 334.289K | 4.762M |

| Put Open Interest: | 13.60M | 12.065M | 111.662K | 5.916M | 519.232K | 8.21M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5600, 5550, 5590, 5000] |

| SPY Levels: [550, 555, 560, 540] |

| NDX Levels: [19650, 20000, 20100, 19900] |

| QQQ Levels: [480, 485, 490, 470] |

| SPX Combos: [(5798,97.51), (5776,84.28), (5770,79.36), (5748,98.84), (5742,71.87), (5726,91.03), (5720,75.66), (5698,98.83), (5692,79.45), (5676,88.08), (5670,88.96), (5659,81.25), (5648,95.69), (5642,82.76), (5631,87.48), (5626,91.27), (5620,93.27), (5609,79.55), (5598,99.00), (5592,100.00), (5587,74.85), (5581,86.93), (5548,91.20), (5537,99.95), (5531,99.78), (5525,94.97), (5520,89.64), (5509,78.62), (5498,95.96), (5487,74.44), (5481,78.76), (5475,87.79), (5470,88.25), (5448,94.34), (5425,80.53), (5420,83.55), (5397,94.40), (5375,79.84), (5370,70.22), (5347,86.66), (5320,76.36), (5297,95.64)] |

| SPY Combos: [550.77, 557.98, 551.32, 554.1] |

| NDX Combos: [19644, 19307, 19724, 20556] |

| QQQ Combos: [485.22, 477.02, 481.85, 471.72] |

0 comentarios