Macro Theme:

Short Term SPX Resistance: 5,500

Short Term SPX Support: 5,400

SPX Risk Pivot Level: 5,515

Major SPX Range High/Resistance: 5,600

Major SPX Range Low/Support: 5,300

Next week (7/29) is critical both on the earnings front (MSFT, AAPL, AMZN, AMD, INTC), and macro front (FOMC, PMI, NFP). We expect this data to trigger a large directional move into August OPEX.

When the SPX moves above the Vol Trigger area (currently 5,515), we look to hold a core equity long position.

If equities are weak (<5,400) out of next weeks events, we may look to hold a core short position with major SPX targets below at 5,300 & 5,000.

- Upside scenario:

- SPX 5,600 is the top of our upside range into 7/31 FOMC

- We are “risk on” if SPX moves back over 5,515 (SPY 550)

- Downside scenario:

- 5,500 is our major, long term support level

- A break <5,400 implies a test of 5,300

- A break <5,300 implies a test of 5,000

Founder’s Note:

Its a huge week again for equities with earnings from: MSFT & AMD (7/30), AAPL, AMZN & INTC (8/1), and macro data: FOMC (7/31), PMI, NFP.

Futures are higher this morning, indicating the S&P will open 25 bps below critical 5,500 resistance.

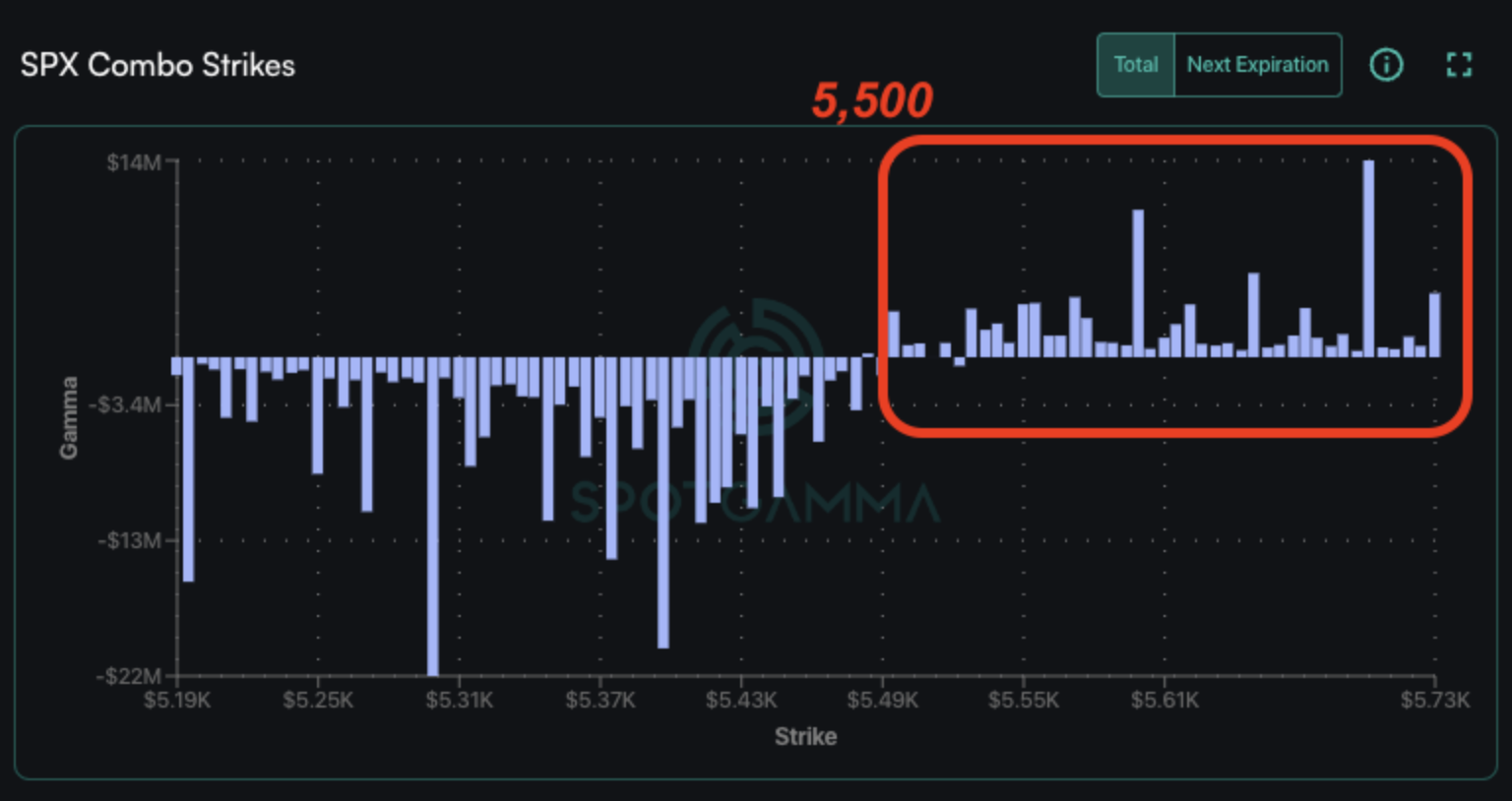

Above 5,515 (SPY 550) our models flip back to “risk on” which driven by a return in positive gamma (positive bars, shown below in the red box), which should support equities prices and reduce volatility.

The catch is that we may not see a material move >5,500 until Wednesday, with the FOMC and earnings updates from major heavyweights. With this in mind, we are looking to tactically “day trade” around key SpotGamma levels, until Thursday (post FOMC). This means leaning on 5,500-5,510 as resistance, with 5,450 as support. Should we break <5,450, it will likely lead to a test of 5,400 – a level which should be major support into FOMC.

Zooming out, we continue to believe that FOMC will spark a longer directional play into August OPEX (8/16).

This sets up as follows;

- An upside break >5,515 likely triggers a broader move into 5,600. We would then look for a reduction in volatility into 8/16 OPEX, targeting the upside

Call Wall

level (TBD).

- A downside break <5,400 likely invokes a test of the 5,300

Put Wall.

In a major risk off scenario, the longer term support line is 5,000.

8/16 OPEX forces are likely to reinforce the given move.

The more intricate part of this story is in respect to correlation – the dominant feature of this market over the past year.

We’ve labeled the weakness over the past week a “correlation spasm” as top megacap/semi stocks have plunged sharply (increasing put skews), dragging index prices lower (see this detailed note). With megap & key semi earnings this week, we will get an eye into how these key sectors will perform going forward. Blow-out earnings may well spark a re-entry into the “correlation trade”, which broke this past week (blue line, below).

If earnings are good, and if a rate cut is blessed by Powell, there is going to be a lot of fairly high megacap/semi vol that comes for sale, which could provide more relative fuel to the upside.

The other piece of this is the rotation into small caps creating large upside outperformance. We are not in favor of such strong outperformance going forward. The idea here is that small cap stocks have a hefty call skew in anticipation of a rate cut, providing an upside drag.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5497.63 | $5459 | $544 | $19023 | $462 | $2260 | $224 |

| SG Gamma Index™: |

| -1.961 | -0.467 |

|

|

|

|

| SG Implied 1-Day Move: | 0.63% | 0.63% | 0.63% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | $5549.68 | $5511.05 | $549.46 |

|

|

|

|

| SG Implied 1-Day Move Low: | $5480.68 | $5442.05 | $542.58 |

|

|

|

|

| SG Volatility Trigger™: | $5533.63 | $5495 | $545 | $19400 | $465 | $2160 | $219 |

| Absolute Gamma Strike: | $5038.63 | $5000 | $540 | $19650 | $470 | $2200 | $225 |

| Call Wall: | $5788.63 | $5750 | $575 | $19650 | $500 | $2200 | $230 |

| Put Wall: | $5338.63 | $5300 | $540 | $17000 | $460 | $2050 | $210 |

| Zero Gamma Level: | $5547.63 | $5509 | $551 | $19263 | $472 | $2171 | $220 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.758 | 0.557 | 0.664 | 0.680 | 1.497 | 1.121 |

| Gamma Notional (MM): | ‑$607.79M | ‑$1.288B | ‑$9.621M | ‑$434.309M | $38.516M | $306.627M |

| 25 Delta Risk Reversal: | -0.035 | 0.00 | -0.04 | -0.018 | -0.005 | 0.018 |

| Call Volume: | 507.782K | 1.455M | 9.969K | 888.632K | 44.428K | 722.344K |

| Put Volume: | 947.22K | 1.867M | 10.907K | 830.493K | 60.10K | 938.256K |

| Call Open Interest: | 6.703M | 4.989M | 62.373K | 3.561M | 351.451K | 5.052M |

| Put Open Interest: | 13.732M | 11.747M | 111.203K | 5.835M | 525.283K | 8.971M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 5500, 5550, 5400] |

| SPY Levels: [540, 545, 550, 530] |

| NDX Levels: [19650, 20000, 17000, 19000] |

| QQQ Levels: [470, 460, 480, 465] |

| SPX Combos: [(5727,79.59), (5699,95.59), (5672,73.26), (5650,85.00), (5623,75.08), (5601,92.87), (5574,78.15), (5557,75.70), (5552,75.16), (5530,72.82), (5497,71.31), (5481,75.27), (5465,85.13), (5448,92.30), (5443,73.30), (5437,93.10), (5432,83.41), (5426,91.51), (5421,92.75), (5415,94.05), (5405,81.62), (5399,98.16), (5388,86.51), (5383,73.17), (5377,95.80), (5372,78.29), (5366,87.84), (5355,72.43), (5350,93.94), (5323,84.05), (5317,89.22), (5301,98.58), (5273,93.34), (5263,73.65), (5252,90.14), (5224,79.75), (5213,78.37), (5197,96.64)] |

| SPY Combos: [534.47, 544.27, 542.09, 524.13] |

| NDX Combos: [19651, 18491, 18910, 18700] |

| QQQ Combos: [454.67, 483.37, 464.85, 444.48] |

0 comentarios