Macro Theme:

Short Term SPX Resistance: 5,500

Short Term SPX Support: 5,400

SPX Risk Pivot Level: 5,515

Major SPX Range High/Resistance: 5,600

Major SPX Range Low/Support: 5,300

Next week (7/29) is critical both on the earnings front (MSFT, AAPL, AMZN, AMD, INTC), and macro front (FOMC, PMI, NFP). We expect this data to trigger a large directional move into August OPEX.

When the SPX moves above the Vol Trigger area (currently 5,515), we look to hold a core equity long position.

If equities are weak (<5,400) out of next weeks events, we may look to hold a core short position with major SPX targets below at 5,300 & 5,000.

- Upside scenario:

- SPX 5,600 is the top of our upside range into 7/31 FOMC

- We are “risk on” if SPX moves back over 5,515 (SPY 550)

- Downside scenario:

- 5,500 is our major, long term support level

- A break <5,400 implies a test of 5,300

- A break <5,300 implies a test of 5,000

Founder’s Note:

Key SG levels for the SPX are:

- Support: 5,460, 5,450, 5,400

- Resistance: 5,500, 5,520

- 1 Day Implied Range: 0.64%

For QQQ:

- Support: 460

- Resistance: 465, 470

IWM:

- Support: 220

- Resistance: 225, 230

Resistance for today remains at 5,500, with 5,450 support. A break <5,450 implies a quick test of 5,400.

We have little else to offer about today’s session, with all eyes ahead on:

- MSFT & AMD earnings tonight

- Powell tomorrow, followed by Wed PM earnings from META & QCOM

- Thursday AM ISM & PM earnings from AAPL, AMZN & INTC

- Friday NFP

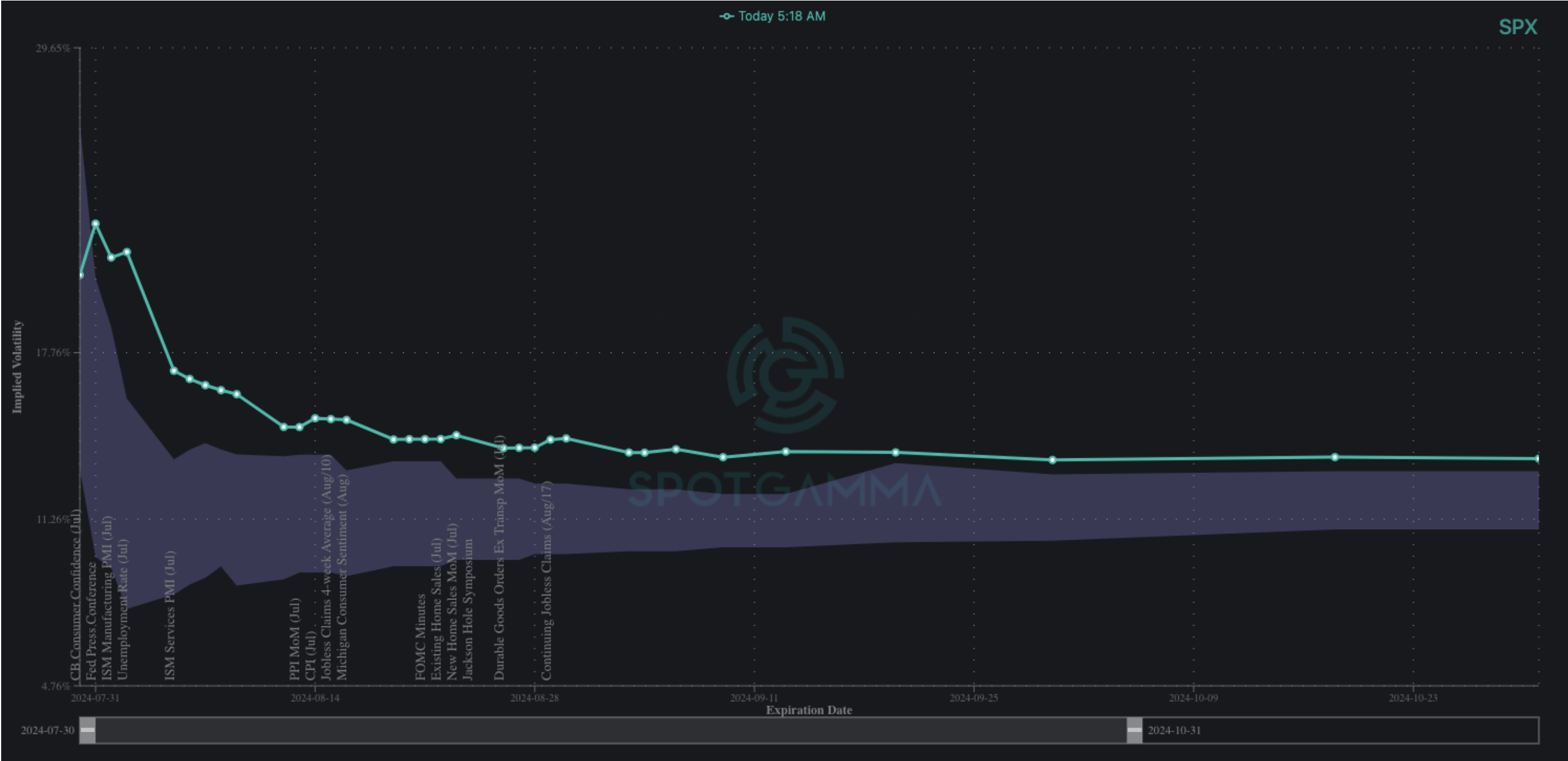

With that lineup of macro datapoints, the SPX term structure is sharply elevated as traders anticipate higher relative movement ahead.

There really is not much of a directional tilt to these expectations, based on skew. Shown below is 1-month SPX skew, which is uniformly above its 90 day range (green shaded cone). We’d note that tech (QQQ) has a very similar look.

Compare SPX skew, to 1-month IWM skew, and you see that IWM call IV is well above its 90 range, but puts are below their range. This is traders tilted towards bullish IWM expectations, and a “small cap summer”.

The CBOE notes significant divergence in 3-month skew between relatively bearish SPX/QQQ skew, and bullish IWM. This relates directly to the unusual negative correlation between higher IWM prices & lower SPX/QQQ prices that we discussed last week.

The takeaway here is that this long IWM short SPX/QQQ seems like a crowded trade, which, in our view, resolves with either:

- A rally in tech/rotation out of small caps off of good earnings

- Markets sell off sharply

Key levels for these relative moves were outlined in yesterday’s note.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5500.42 | $5463 | $544 | $19059 | $463 | $2235 | $221 |

| SG Gamma Index™: |

| -1.287 | -0.379 |

|

|

|

|

| SG Implied 1-Day Move: | 0.64% | 0.64% | 0.62% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5522.42 | $5485 | $545 | $19200 | $465 | $2160 | $219 |

| Absolute Gamma Strike: | $5537.42 | $5500 | $540 | $19650 | $470 | $2200 | $220 |

| Call Wall: | $5787.42 | $5750 | $552 | $19650 | $500 | $2225 | $230 |

| Put Wall: | $5337.42 | $5300 | $540 | $17000 | $460 | $2050 | $210 |

| Zero Gamma Level: | $5510.42 | $5473 | $552 | $19154 | $470 | $2180 | $221 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.833 | 0.624 | 0.789 | 0.713 | 1.366 | 0.958 |

| Gamma Notional (MM): | ‑$601.088M | ‑$1.35B | ‑$8.551M | ‑$469.78M | $30.583M | $25.557M |

| 25 Delta Risk Reversal: | -0.033 | 0.00 | -0.011 | -0.014 | 0.00 | 0.022 |

| Call Volume: | 363.953K | 1.12M | 7.887K | 726.402K | 16.881K | 644.886K |

| Put Volume: | 758.929K | 1.627M | 8.896K | 648.624K | 27.47K | 665.668K |

| Call Open Interest: | 6.708M | 5.023M | 63.148K | 3.602M | 353.105K | 5.12M |

| Put Open Interest: | 13.756M | 12.048M | 112.033K | 5.91M | 535.797K | 9.129M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5500, 5000, 5550, 5400] |

| SPY Levels: [540, 545, 550, 530] |

| NDX Levels: [19650, 20000, 19000, 17000] |

| QQQ Levels: [470, 460, 480, 465] |

| SPX Combos: [(5726,81.85), (5698,96.60), (5677,70.48), (5649,87.04), (5627,81.70), (5600,93.50), (5578,75.90), (5573,78.54), (5567,73.08), (5551,79.21), (5540,77.17), (5529,76.29), (5507,70.46), (5480,78.75), (5464,87.05), (5458,73.66), (5447,95.72), (5442,78.77), (5436,83.33), (5431,70.34), (5425,94.21), (5420,85.68), (5414,93.39), (5409,83.89), (5403,72.59), (5398,97.71), (5393,81.90), (5376,89.22), (5365,83.96), (5349,92.33), (5332,71.95), (5327,84.72), (5316,82.44), (5300,98.00), (5272,93.12), (5250,87.78), (5223,75.61), (5218,77.87), (5201,95.38)] |

| SPY Combos: [528.96, 538.77, 518.61, 536.59] |

| NDX Combos: [19650, 18907, 18488, 18697] |

| QQQ Combos: [478.28, 460.19, 449.98, 455.09] |

0 comentarios