Macro Theme:

Short Term SPX Resistance: 5,600

Short Term SPX Support: 5,500

SPX Risk Pivot Level: 5,500

Major SPX Range High/Resistance: 5,600

Major SPX Range Low/Support: 5,400

Next week (7/29) is critical both on the earnings front (MSFT, META, AAPL, AMZN, AMD, INTC), and macro front (FOMC, PMI, NFP). We expect this data to trigger a large directional move into August OPEX.

When the SPX moves above the Vol Trigger area (currently 5,515), we look to hold a core equity long position. We shift back to risk-off <5,500.

- Upside scenario:

- SPX 5,600 is the top of our upside range

- We maintain a “risk on” with SPX >5,500

- Downside scenario:

- A break <5,500 implies a test of 5,400

Founder’s Note:

Key SG levels for the SPX are:

- Support: 5,515, 5,500, 5,460

- Resistance: 5,550, 5,560, 5,578, 5,600

- 1 Day Implied Range: 0.65%

For QQQ:

- Support: 470, 460

- Resistance: 473, 480, 485

IWM:

- Support: 221, 220

- Resistance: 225, 230

ISM PMI 10AM

META +3% after ER

Heading into the FOMC, we laid out our “risk on” view if given a move over 5,515, which has now happened.

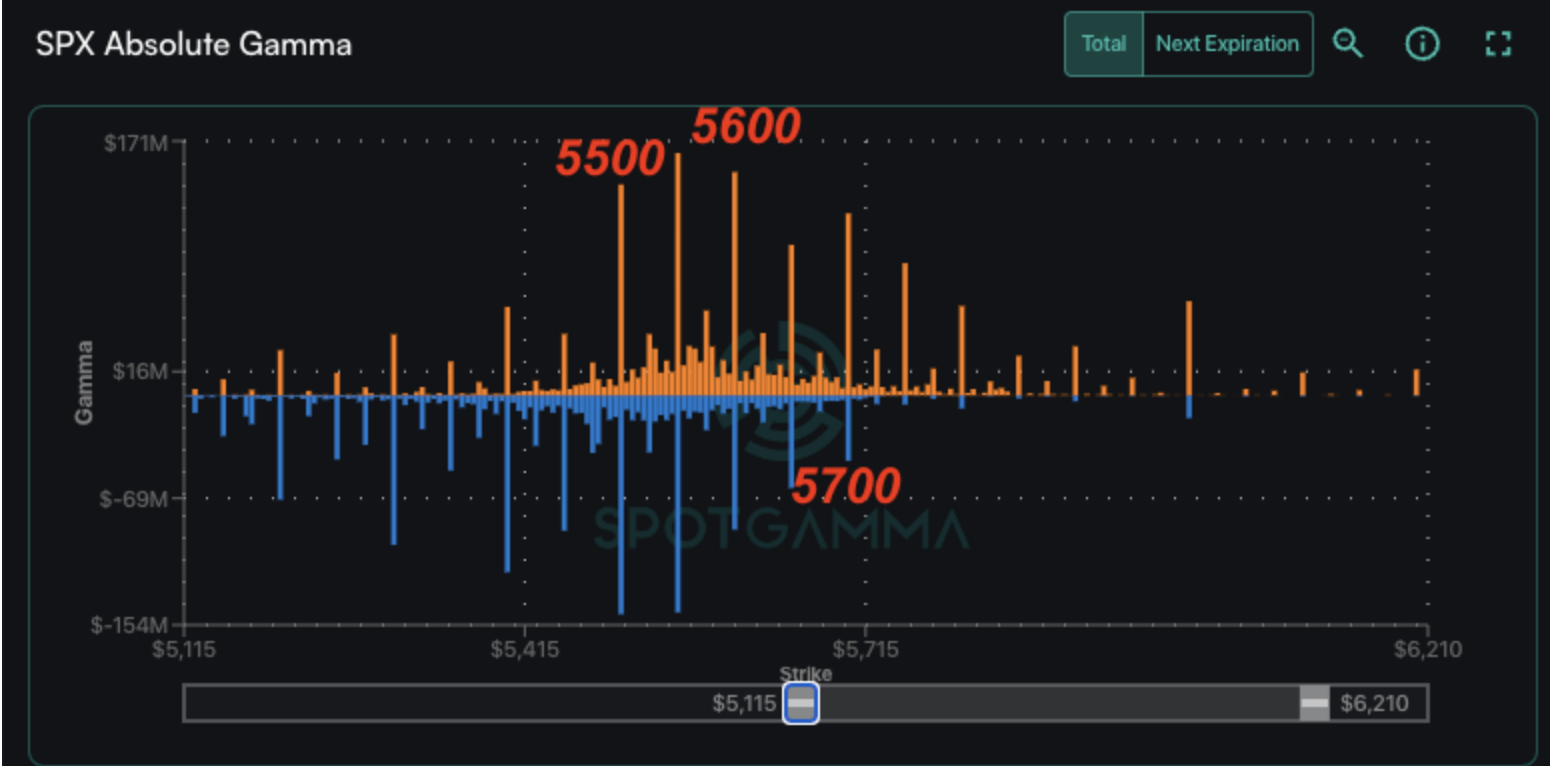

As you can see below, there are large positions at 5,550, 5,560 (SPY 555), 5,578 and 5,600. These are the upside target/resistance areas. They are both upside targets and resistance bands, because positive gamma picks up materially from 5,550-5,600, which serves to throttle volatility, which slows SPX upside but also offers downside support. Its like entering into a hug. This dynamic should remain in place through 8/16 OPEX, unless ISM/NFP are major misses – or if geopolitics flare up (now a major concern).

5,515-5,500 is now a large band of support, and if that level is broken we would flip to risk-off, looking for a test of 5,400.

What has everyone a bit less confident, was the violent end-of-day reversal in equities. This was most harsh in IWM’s, which were up 2% at the highs post-FOMC, only to gave it all back in the final hour of trading.

There were two interesting things about this reversal. First, it appeared to be triggered by news about Iran retaliating for Israeli strikes. What’s curious about that was that the headlines appeared right as the Russell (RTY) hit its

Call Wall

– at which point the rush of call flow (orange) stopped (i.e. orange line trends sideways showing no more call activity). Without that bullish leverage from call buying, the IWM’s sank.

This morning we find that RTY is down pre-market (-18bps) vs ES & NQ +50bps.

We’ve extensively laid out why we prefer SPY/QQQ over IWM if Powell proved a non-event and big-cap earnings were OK. The put-heavy tech indexes with big vanna fuel (driven by rich IV’s, read y’day’s note) was indeed on full display yesterday, with SMH (chart below) up an incredible 7%. Barring any severe earnings misses (AAPL tonight), we see plenty of fuel for SMH up into 250, and NVDA in the 125 area.

Lastly, lets turn to the SPX vol space. Our view into yesterday was that the FOMC would likely release elevated vols, and we would be comfortable betting on lower vols if the SPX closed >5,500. As you can see below, 1-month SPX IV is now (teal) lower than 1 week ago (gray). The benign passing of todays PMI & tomorrow’s NFP will likely help to drop vols further.

The issue here is that we appear to be in the midst of increasing geopolitical tensions. You therefore need to be worried about tail risk in a new way, as the “known unknown” (i.e. Iran said they’d retaliate (“known”), will they and how (“unknown”)) is a reason for traders to maintain some vol protection, particularly into and over this weekend (while the headlines are still fresh). You cannot hedge “known unknowns” with 0DTE options, and so we’d see this hedging show in longer dated options. This dynamic may warrant carrying some long vol protection in your portfolio, particularly VIX calls.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5558.54 | $5522 | $550 | $19362 | $471 | $2254 | $223 |

| SG Gamma Index™: |

| -0.099 | -0.228 |

|

|

|

|

| SG Implied 1-Day Move: | 0.65% | 0.65% | 0.65% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5541.54 | $5505 | $551 | $19440 | $470 | $2175 | $221 |

| Absolute Gamma Strike: | $5586.54 | $5550 | $540 | $19650 | $470 | $2250 | $225 |

| Call Wall: | $5786.54 | $5750 | $560 | $19650 | $485 | $2300 | $230 |

| Put Wall: | $5336.54 | $5300 | $540 | $17000 | $460 | $2175 | $200 |

| Zero Gamma Level: | $5567.54 | $5531 | $554 | $19313 | $473 | $2199 | $222 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.986 | 0.747 | 1.002 | 0.866 | 1.352 | 1.087 |

| Gamma Notional (MM): | ‑$146.457M | ‑$721.764M | ‑$806.832K | ‑$166.172M | $22.728M | $146.116M |

| 25 Delta Risk Reversal: | -0.035 | -0.008 | -0.041 | -0.015 | 0.001 | 0.027 |

| Call Volume: | 559.885K | 1.644M | 8.951K | 931.927K | 18.828K | 899.162K |

| Put Volume: | 1.041M | 2.388M | 10.371K | 913.513K | 34.545K | 800.604K |

| Call Open Interest: | 6.736M | 5.004M | 62.88K | 3.743M | 341.943K | 5.191M |

| Put Open Interest: | 13.866M | 12.227M | 113.627K | 6.135M | 528.676K | 9.245M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5550, 5500, 5000, 5600] |

| SPY Levels: [540, 550, 560, 555] |

| NDX Levels: [19650, 20000, 19000, 20200] |

| QQQ Levels: [470, 480, 485, 460] |

| SPX Combos: [(5776,79.58), (5749,98.64), (5727,88.19), (5699,98.42), (5682,76.67), (5677,82.78), (5666,71.74), (5649,93.21), (5638,70.02), (5633,80.89), (5627,89.07), (5622,69.71), (5616,79.53), (5600,96.93), (5594,71.19), (5589,70.78), (5578,96.49), (5572,74.93), (5566,88.44), (5561,81.28), (5555,73.08), (5550,80.38), (5528,75.50), (5495,71.89), (5478,85.51), (5473,89.99), (5462,77.87), (5451,95.56), (5423,90.70), (5417,82.46), (5412,91.62), (5401,96.91), (5390,71.34), (5373,86.09), (5362,79.68), (5351,90.33), (5323,82.59), (5312,82.78), (5301,97.10), (5274,90.06), (5263,71.11), (5252,89.61)] |

| SPY Combos: [536.65, 546.56, 526.74, 576.83] |

| NDX Combos: [19653, 18491, 18917, 19943] |

| QQQ Combos: [463.51, 453.15, 492.25, 473.41] |

0 comentarios