Macro Theme:

Short Term SPX Resistance: 5,450

Short Term SPX Support: 5,300

SPX Risk Pivot Level: 5,500

Major SPX Range High/Resistance: 5,600

Major SPX Range Low/Support: 5,300

- Upside scenario:

- A close >5,415 the week of 8/5 implies a retest of 5,500

- Downside scenario:

- The move <5,400 implies a test of 5,300, wherein we’d look for a short term equity bounce

- Ultimately, we eye a 5,000 low into 8/16 OPEX

Founder’s Note:

Key SG levels for the SPX are:

- Support: 5,350, 5,327, 5,300

Put Wall

- Resistance: 5,400, 5,418, 5,450, 5,460

- 1 Day Implied Range: 0.65%

For QQQ:

- Support: 450, 440

Put Wall

- Resistance: 460, 465, 475

IWM:

- Support: 210

- Resistance: 220

NFP 8:30 AM ET

AAPL flat after ER, $218

AMZN -8% after ER, $165

TLDR: As laid out in yesterday’s Member Q&A, outside of a “day trade” we see no reason to hold long stocks and/or be short vol. This is a nasty setup, and an environment wherein we try to protect capital.

5,400 – 5,415 then 5,450 is resistance for today. Given the geopolitical situation, we do not think traders will want to cover short volatility positions before the weekend, which mitigates how lasting any equity bounce today could be. Remember: rallies in bear market trends can be violent, but reverse just as quickly as they came. Therefore we are looking to short rallies today, particularly if SPX gets up into 5,450.

5,300 is the

Put Wall

& major support. Further, we ultimately see no reason to hold a core equity long position into this weekend. Our stance on long equities would change if SPX closes >5,415 next week, and/or if markets are weak into 8/16 OPEX.

Equity futures are all <-1% lower, with AMZN plunging 8% pre-market. There are macro concerns, geopolitical angst, international markets under pressure (Japan -10% in 2 sessions), and an options market poised to push stocks lower.

From our chair, we see the influence of the options market grows as prices decrease & volatility increases, compounded by reflexive flows – a “Gamma Trap“.

Its no coincidence that many of the most severe equity drawdowns have bottomed at expiration. This is because expiration forces the removal of large put positions, and their related hedging flows.

That is the issue here – what is going to trigger put covering before 8/16 OPEX?

Our

Put Wall

remains at 5,300, where we often see positive forward returns if/when that level is tested. This is because, we believe, traders roll puts down in strike and/or out in time, which relieves downside pressure.

What about NFP, today? We’re unsure of any NFP number that will flip-the-script. What we can say is that IV is “jacked up”, with the 0DTE straddle priced at $60, or a 1.1% move (ref 5,390, IV 40%). That’s a big expectation & something we have not seen in a long time.

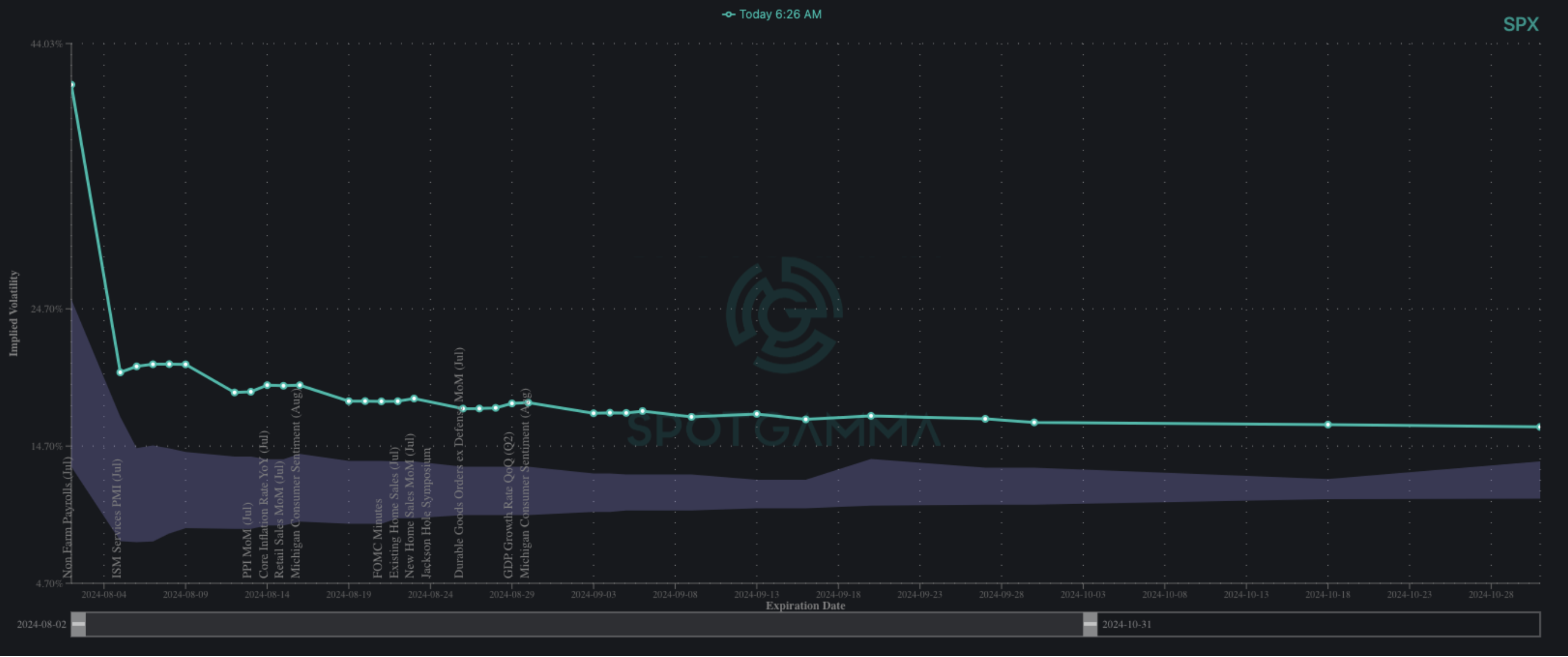

However, implied volatility is at major highs across the SPX term structure, as you can see below (teal line well above shaded cone). NFP is unlikely to deflate these vols, even if its the number stocks want.

Illustrating this long vol demand, we have Dec SPX skew posted below. As you can see, we are today (teal) well elevated from Dec skew 1 week ago (gray), and there is a noticeable pick up in put demand (red arrow) vs call demand (green). People are hedging in a way we have not seen for some time, and to our points above, we don’t see a short term reason for them to cover.

Finally, we wanted to flag this move in Japanese equities, which are -10% over 2 days. We have nothing to offer on “why” they’re down, but we do know that volatility can be contagious.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5481.81 | $5446 | $543 | $18890 | $459 | $2186 | $216 |

| SG Gamma Index™: |

| -2.529 | -0.522 |

|

|

|

|

| SG Implied 1-Day Move: | 0.64% | 0.64% | 0.64% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | $5446.85 | $5411.04 | $538.93 |

|

|

|

|

| SG Implied 1-Day Move Low: | $5378.02 | $5342.22 | $532.07 |

|

|

|

|

| SG Volatility Trigger™: | $5535.81 | $5500 | $547 | $19275 | $470 | $2180 | $218 |

| Absolute Gamma Strike: | $5035.81 | $5000 | $540 | $19650 | $460 | $2200 | $210 |

| Call Wall: | $5785.81 | $5750 | $565 | $19650 | $500 | $2190 | $230 |

| Put Wall: | $5335.81 | $5300 | $540 | $17000 | $440 | $2175 | $210 |

| Zero Gamma Level: | $5532.81 | $5497 | $550 | $19273 | $469 | $2197 | $219 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.696 | 0.526 | 0.567 | 0.616 | 0.842 | 0.693 |

| Gamma Notional (MM): | ‑$748.804M | ‑$1.432B | ‑$13.127M | ‑$564.961M | ‑$13.296M | ‑$471.415M |

| 25 Delta Risk Reversal: | -0.04 | -0.014 | -0.045 | -0.022 | -0.022 | 0.004 |

| Call Volume: | 613.449K | 2.314M | 9.793K | 1.262M | 34.894K | 1.011M |

| Put Volume: | 1.218M | 2.947M | 13.698K | 1.238M | 72.076K | 1.758M |

| Call Open Interest: | 6.814M | 5.429M | 64.174K | 3.905M | 340.644K | 5.348M |

| Put Open Interest: | 14.075M | 12.372M | 115.878K | 6.194M | 544.635K | 9.377M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 5500, 5550, 5400] |

| SPY Levels: [540, 550, 545, 530] |

| NDX Levels: [19650, 17000, 20000, 16900] |

| QQQ Levels: [460, 470, 450, 465] |

| SPX Combos: [(5697,95.80), (5648,86.69), (5626,72.46), (5599,92.14), (5577,83.87), (5567,71.22), (5550,85.25), (5528,72.65), (5479,79.43), (5468,70.24), (5458,71.11), (5452,95.59), (5447,70.10), (5425,93.66), (5414,96.41), (5409,83.54), (5398,98.93), (5392,90.86), (5387,72.74), (5376,93.14), (5370,72.68), (5365,88.65), (5360,81.18), (5354,71.25), (5349,96.91), (5338,78.00), (5332,77.77), (5327,92.86), (5316,88.52), (5311,74.11), (5300,99.20), (5272,95.86), (5267,78.40), (5251,94.95), (5223,83.10), (5218,82.76), (5202,97.17)] |

| SPY Combos: [565.27, 560.39, 521.29, 550.61] |

| NDX Combos: [19665, 18078, 18494, 18701] |

| QQQ Combos: [466.7, 439.11, 449.22, 473.59] |

0 comentarios