Macro Theme:

Short Term SPX Resistance: 5,300

Short Term SPX Support: 5,100

SPX Risk Pivot Level: 5,4

Major SPX Range High/Resistance: 5,600

Major SPX Range Low/Support: 5,000

- Upside scenario:

- A close >5,415 the week of 8/5 implies a retest of 5,500

- Downside scenario:

- The move <5,400 implies a test of 5,300, wherein we’d look for a short term equity bounce

- Ultimately, we eye a 5,000 low into 8/16 OPEX

Founder’s Note:

Key SG levels for the SPX are:

- Support: 5,200, 5,175, 5,150, 5,100, 5,000

- Resistance: 5,250, 5,300

For QQQ:

- Support: 440

Put Wall

- Resistance: 4,50, 460, 465, 475

IWM:

- Support: 200

- Resistance: 210

Global markets are in free-fall this morning:

ES futures: -2.5% to 5,238

NQ futures: -4.2% to 17,776

RTY futures: -4% to 2,033

VIX: +23 to 46

US10Y: 3.7% (from 4.05% on Aug 1)

The SPX 0DTE straddle is $80 or 1.5% (ref 5,195) IV 146% (we’ve never see the 0DTE here before, we were recently in the 20%’s)

Equity markets in Japan & Korea were both halted limit down, continuing their drops from late last week. Japan’s TOPIX Index is down a staggering 21% in 3 days.

A few things about this market:

- Liquidity is likely to be terrible. This means wide bid/ask spreads, along with possible trading halts. Wider bid/ask spreads also widens volatility markets, exacerbating PNL’s.

- Relatedly, there will be a lot of forced trading into this poor liquidity: Hedging, margin calls, emotional responses, etc.

- In this new era, brokers &/or exchanges may just decide to turn off access. Robinhood already shut off 24 hour access earlier this AM.

- Price moves are inherently unstable until negative gamma is greatly reduced (currently >5,400). The biggest rallies come during bear market moves, but those gains can be erased in an instant.

Therefore, you may well be able to get into a trade, but maybe not get out of it at a price you’re happy about, or when you want (or have to). Our recommendation here is to size trades down & extend time horizons.

The prevailing question is: “When will this selling stop?”

TLDR, our downside targets are either: 8/16 OPEX or 5,000 SPX.

Over the past few days we outlined that the options market would be a major driver of volatility until there was something to bring put/long vol holders to close positions. Put closing relieves downside pressure, and can even force a bid into the equity markets, as market makers unwind short hedges. Because this is a massive negative gamma regime, the reflexive flows that have been selling, will have to chase a bid if the market starts to buy the dip.

The obvious date for put closures is Aug 16th OPEX (~2 weeks from now), because OPEX forces puts to be closed.

Our second area of support is generally at

Put Walls

. While the 5,300 SPX Put Wall was tested Friday, and held on the day, things are now a bit too traumatic for standard SPX

Put Walls

to hold up.

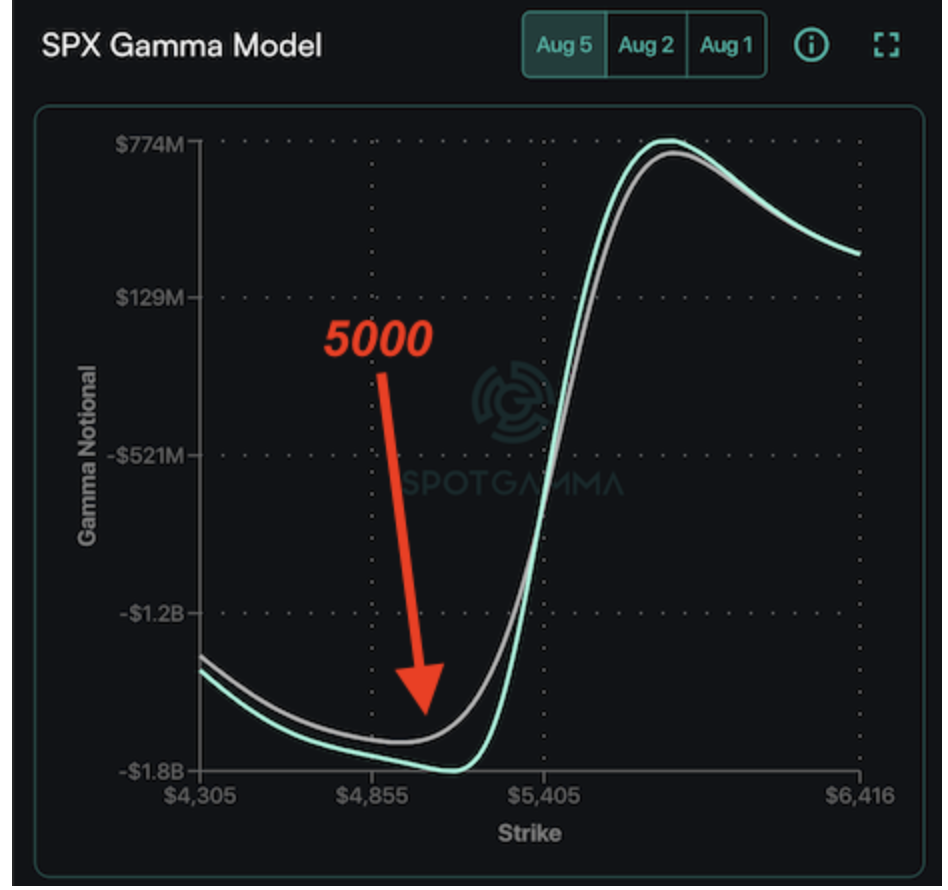

If you look at our standard gamma model, below, you will note that the gamma curves trough and turn higher under 5,000. This suggests an area wherein market makers (MM) downside hedging pressure should subside. Those of you that also track the

SpotGamma Gamma Index

also know that volatility tends to contract at the extreme levels of negative gamma (vs expand during “normal” negative gamma).

MM’s carry risk like any other trading entity. Each night they have Risk Officers looking at their books, making sure the MM’s aren’t holding exposures that could bring down the MM’s firm, or the firms clearing partners.

In order to prevent catastrophic PNL failures during tumultuous moves like todays, MM’s have to essentially be net long of puts. Most of these puts are way out of the money – tiny insurance policies that 999/1000 expire worthless. But, during times like this, these puts start to accrue a lot of value. The value comes from the underlying market dropping (providing delta gains), but also because volatility is ripping (vega gains).

These gains, we believe, allow market makers to start providing better liquidity to the market, which in turns helps to stabilize underling price. Our current models suggest this comes in near the 5,000 SPX price level, which is where we would start looking to buying the dip. Until then, we have nothing in our models that suggests support, particularly given the global-macro picture.

The second thing we wanted to remind Members of, was the incredibly bizarre environment that we had coming into July. Things like: record low correlation, broken correlation (ex: IWM or SMH inversely correlated vs SPY), major lows in realized volatility, VIX/SPX beta in the 0th percentile (meaning VIX fully decoupled from SPX). We covered these topics extensively here.

While many may be rightfully blaming JPY carry trades as a trigger (we have no opinion), we are fully confident that the US selling is/was being exacerbated by the unwind of flows which brought on the aforementioned anomalies.

What does this mean?

It means that things are likely worse then they seem because of these positional flows. “Positional” flows being forced unwinds of flows that produced things like record low correlation.

Lets put this into context. This is the 1-day change in VIX vs 1-day change in SPX. For today’s mark (red X), we took the current VIX level and assumed the SPX would close today where its currently trading, near 5,200 (it likely won’t). The point here is to illustrate how large this vol move is relative to the SPX underlying move. This is vol “re-coupling”. Along these same lines we are seeing correlation rip higher as all stocks sync up in the same direction: down.

Our takeaway here is that there are a lot of hyperbolic “world’s end” statements flying around, but we are not yet ready to head into our bunker. That being said, we are not looking to aggressively stick our necks out, either, until we see clear signs of hedges being closed. On an intraday basis we will be watching shifts in volatility surfaces, put covering in

HIRO,

and less put interest at lower strikes. Outside of that it will be a downside test of 5,000 or 8/16 OPEX.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5375.94 | $5346 | $532 | $18440 | $448 | $2109 | $208 |

| SG Gamma Index™: |

| -3.314 | -0.522 |

|

|

|

|

| SG Implied 1-Day Move: | 0.65% | 0.65% | 0.67% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5509.94 | $5480 | $545 | $19400 | $470 | $2175 | $216 |

| Absolute Gamma Strike: | $5029.94 | $5000 | $540 | $17000 | $460 | $2000 | $210 |

| Call Wall: | $5729.94 | $5700 | $575 | $19650 | $485 | $2200 | $230 |

| Put Wall: | $5329.94 | $5300 | $520 | $17000 | $440 | $2000 | $200 |

| Zero Gamma Level: | $5507.94 | $5478 | $548 | $19099 | $468 | $2185 | $220 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.602 | 0.469 | 0.472 | 0.539 | 0.631 | 0.526 |

| Gamma Notional (MM): | ‑$1.099B | ‑$1.678B | ‑$15.011M | ‑$669.452M | ‑$45.368M | ‑$980.696M |

| 25 Delta Risk Reversal: | -0.065 | -0.042 | -0.062 | -0.042 | -0.043 | -0.02 |

| Call Volume: | 652.102K | 1.956M | 9.95K | 985.633K | 35.477K | 706.533K |

| Put Volume: | 1.903M | 3.293M | 22.089K | 1.31M | 103.504K | 1.333M |

| Call Open Interest: | 6.881M | 5.424M | 62.359K | 3.679M | 338.356K | 5.192M |

| Put Open Interest: | 14.038M | 12.049M | 107.065K | 6.104M | 541.503K | 9.317M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 5500, 5300, 5400] |

| SPY Levels: [540, 530, 520, 500] |

| NDX Levels: [17000, 16900, 19650, 20000] |

| QQQ Levels: [460, 440, 450, 470] |

| SPX Combos: [(5598,87.62), (5550,78.09), (5448,90.70), (5427,80.58), (5416,87.50), (5400,96.89), (5373,79.59), (5368,71.71), (5363,80.36), (5352,91.42), (5325,90.79), (5320,87.91), (5314,73.36), (5309,79.93), (5298,99.41), (5288,77.48), (5282,86.77), (5277,97.65), (5272,88.59), (5266,84.14), (5250,97.25), (5245,75.79), (5240,79.54), (5229,77.88), (5224,86.73), (5218,88.94), (5208,73.75), (5202,98.79), (5186,73.52), (5175,92.90), (5170,84.81), (5165,72.48), (5149,93.97), (5127,87.10), (5101,93.33)] |

| SPY Combos: [528.1, 518.51, 525.97, 523.31] |

| NDX Combos: [18090, 18496, 17666, 18293] |

| QQQ Combos: [440.22, 450.1, 429.9, 445.16] |

0 comentarios