Macro Theme:

Short Term SPX Resistance: 5,360

Short Term SPX Support: 5,300

SPX Risk

Pivot

Level: 5,315

Major SPX Range High/Resistance: 5,400

Major SPX Range Low/Support: 5,000

Key dates ahead: 8/13 PPI, 8/14 CPI, 8/16 OPEX, 8/22-8/24 Jackson Hole, 8/27 NVDA earnings

Elevated implied vols are unlikely to fully retreat due to the geopolitical situation, upcoming Fed dates, and the election. (i.e. VIX is sticky >20)

- Upside scenario:

- We flip back to “risk on” with a close >5,315, which implies a retest of 5,400

- With a close >5,315, our upside max target into 8/22 is 5,400, as any declines in implied vol wane due to key data

- Downside scenario:

- <5,300 is negative gamma territory, and a lack of price stability, with price fluid down to 5,200 support

- <5,200 is “risk-off” as it implies a test of 5,000

- Ultimately, we eye a 5,000 low into 8/16 OPEX

Founder’s Note:

Key SG levels for the SPX are:

- Support: 5,300, 5,277, 5,250, 5,200

- Resistance: 5,320, 5,350, 5,400

For QQQ:

- Support: 440, 430

- Resistance: 450, 457

IWM:

- Support: 200, 190

- Resistance: 210, 216

Futures are flat after the SPX recaptured our key “risk on” level of 5,315. With that, we are looking for a move up to 5,400 into next week as very short term IV contracts, and positive gamma peaks. Should the SPX break <5,300, we would stop out any equity longs/vol shorts, and be on watch for a quick retest of 5,200 due to the onset of negative gamma <5,300.

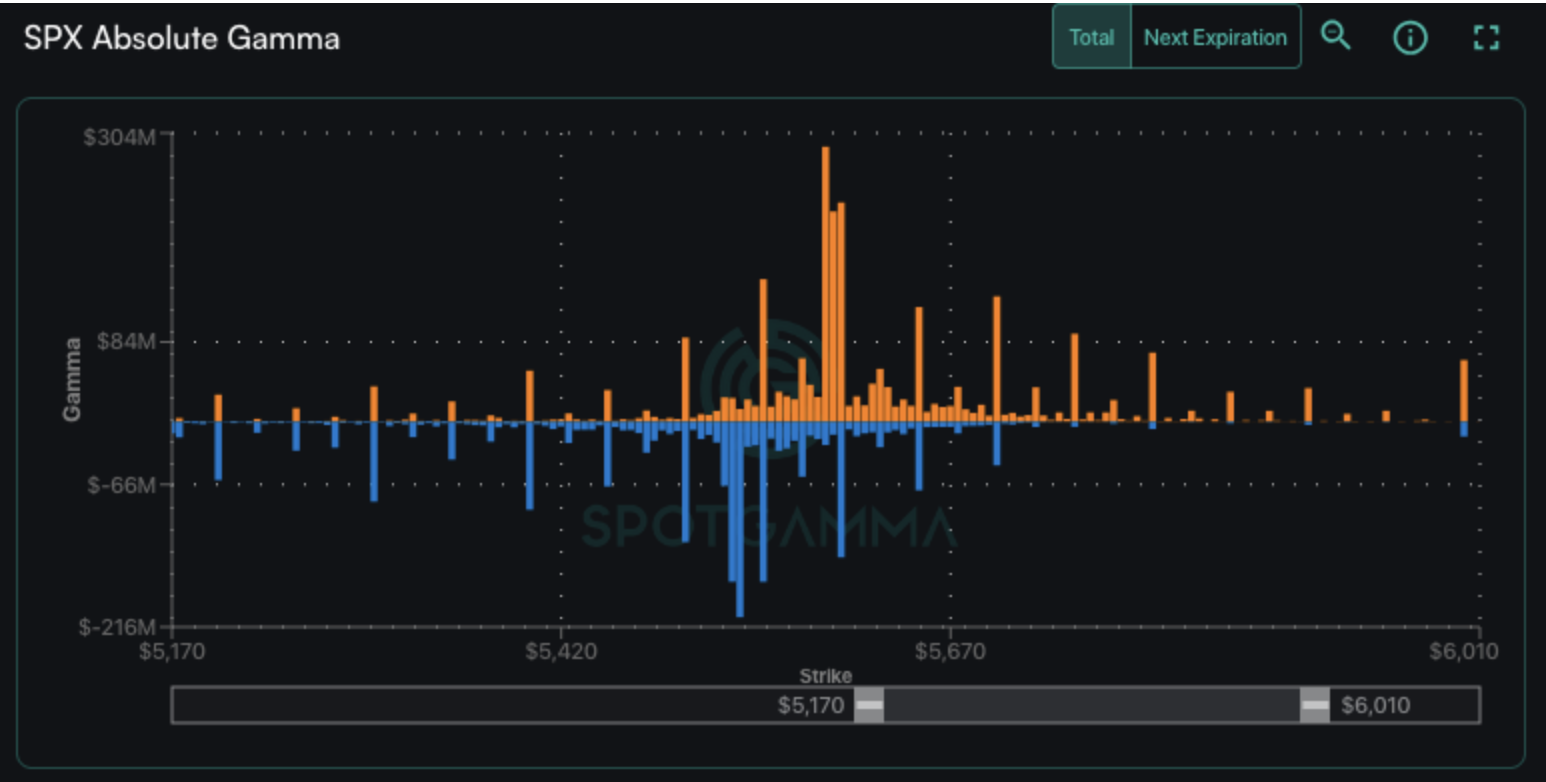

The reality here is that positioning is overall very light, as traders monetized put positions earlier this week. The result is that the “peak” of positive gamma is a mere ~$800mm (vs 2-4x that into July market highs) due to a lack of call positioning, and negative gamma appears to wane <5,000 as traders seem to have been slow to add to new puts positions. Zooming out beyond the short term positioning dynamics (outlined below), this overall very much feels like a “wait and see” environment.

In yesterday’s note we highlighted that implied vol had come down since Monday’s highs (gray), but was likely to stay “sticky” near current levels (ex: VIX staying in the 20’s). This morning (teal) we see SPX term structure perched just atop its statistical 90-day range (blue shaded cone). Yes, we may be able to bet on some weekend decay, but vol is likely to hold a bit of a bid into 8/13 PPI & 8/14 CPI. Then we turn to the main events of Jackson Hole 8/24 & NVDA ER 8/27 (which hold event-vol premium, too).

What this may mean for equity longs is that we may see a fairly quick lift into 5,400, but that level is where we are likely to catch some positive gamma resistance (which leads to “pinning”), and run out of vanna-fuel (i.e. IV’s stop their rapid decline).

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5345.89 | $5319 | $530 | $18413 | $448 | $2084 | $206 |

| SG Gamma Index™: |

| -2.279 | -0.525 |

|

|

|

|

| SG Implied 1-Day Move: | 0.74% | 0.74% | 0.74% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5426.89 | $5400 | $541 | $18625 | $450 | $2125 | $216 |

| Absolute Gamma Strike: | $5026.89 | $5000 | $530 | $17000 | $440 | $2050 | $210 |

| Call Wall: | $6026.89 | $6000 | $550 | $19650 | $485 | $2200 | $230 |

| Put Wall: | $5326.89 | $5300 | $520 | $17000 | $440 | $2050 | $200 |

| Zero Gamma Level: | $5435.89 | $5409 | $541 | $18645 | $457 | $2143 | $218 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.717 | 0.494 | 0.671 | 0.640 | 0.635 | 0.495 |

| Gamma Notional (MM): | ‑$795.713M | ‑$1.691B | ‑$8.241M | ‑$553.437M | ‑$47.361M | ‑$1.137B |

| 25 Delta Risk Reversal: | -0.069 | -0.045 | -0.072 | -0.047 | -0.048 | -0.029 |

| Call Volume: | 526.283K | 1.387M | 7.666K | 812.093K | 24.73K | 334.06K |

| Put Volume: | 1.008M | 2.337M | 8.271K | 1.264M | 43.876K | 571.927K |

| Call Open Interest: | 7.297M | 5.728M | 69.218K | 4.092M | 352.18K | 5.339M |

| Put Open Interest: | 13.996M | 12.599M | 105.531K | 6.499M | 556.549K | 9.484M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 5300, 5400, 5500] |

| SPY Levels: [530, 540, 520, 525] |

| NDX Levels: [17000, 18000, 18500, 16900] |

| QQQ Levels: [440, 450, 460, 470] |

| SPX Combos: [(5553,78.09), (5500,77.88), (5325,80.73), (5314,82.77), (5303,98.62), (5293,78.33), (5277,95.41), (5271,79.42), (5261,82.93), (5250,93.72), (5234,69.97), (5224,82.17), (5218,76.34), (5213,90.01), (5202,98.48), (5176,91.64), (5170,88.35), (5165,78.36), (5149,92.78), (5128,79.33), (5112,80.40), (5101,93.64)] |

| SPY Combos: [530.62, 510.46, 540.7, 520.54] |

| NDX Combos: [18082, 17659, 17880, 18487] |

| QQQ Combos: [453.45, 426.11, 443.14, 463.75] |

SPX gamma Model

Strike: $6,010

- Next Expiration: $630,428,054

- Current: $658,622,387

View All Indices Charts

0 comentarios