Macro Theme:

Short Term SPX Resistance: 5,400

Short Term SPX Support: 5,300

SPX Risk Pivot Level: 5,300

Major SPX Range High/Resistance: 5,400

Major SPX Range Low/Support: 5,000

Key dates ahead: 8/13 PPI, 8/14 CPI, 8/15 Retail Sales, 8/16 OPEX, 8/22-8/24 Jackson Hole, 8/27 NVDA earnings

Elevated implied vols are unlikely to fully retreat due to the geopolitical situation, upcoming Fed dates, and the election. (i.e. VIX is sticky >20)

- Upside scenario:

- We flipped back to “risk on” with a close >5,315, which implies a retest of 5,400

- With the close >5,315, our upside max target into 8/22 is 5,400, as any declines in implied vol wane due to key data

- Downside scenario:

- <5,300 is negative gamma territory, and a lack of price stability, with price fluid down to 5,200 support

- <5,200 is “risk-off” as it implies a test of 5,000

Founder’s Note:

Key SG levels for the SPX are:

- Support: 5,350, 5,320, 5,300

- Resistance: 5,365, 5,400

For QQQ:

- Support: 450, 440

- Resistance: 460

IWM:

- Support: 200, 190

- Resistance: 210, 216

Futures are mildly higher, with the VIX holding 20 ahead of PPI at 8:30 AM ET. We don’t want to overstate the importance of this mornings data, as the 0DTE straddle is priced at just $40 or 75bps (ref 5,365 IV 25%). This straddle range ($40) from current SPX levels (5,365) lines up a positive reaction to the PPI into heavy 5,400 resistance, and a negative reaction down at 5,320 (SPY 530) support. Below there we are still watching 5,300 as the critical support line, and would shift to a risk-off stance <5,300 due to the onset of negative gamma.

<5,300 price action is likely to be very volatile, leading us to look for a quick test of 5,200.

With that said, selling calls into a move >5,400, and/or looking to short the market on a break <5,300 are our only views with conviction. While we wait for the upcoming data to clear this week, price action in the 5,300-5,400 range is likely to be rather meaningless outside of intraday scalps.

In yesterday’s note we had commented that the “mean reversion trade” from last weeks big vol spike had completed, as both the SPX price, and IV’s (i.e. VIX) had returned to where they were on August 2nd.

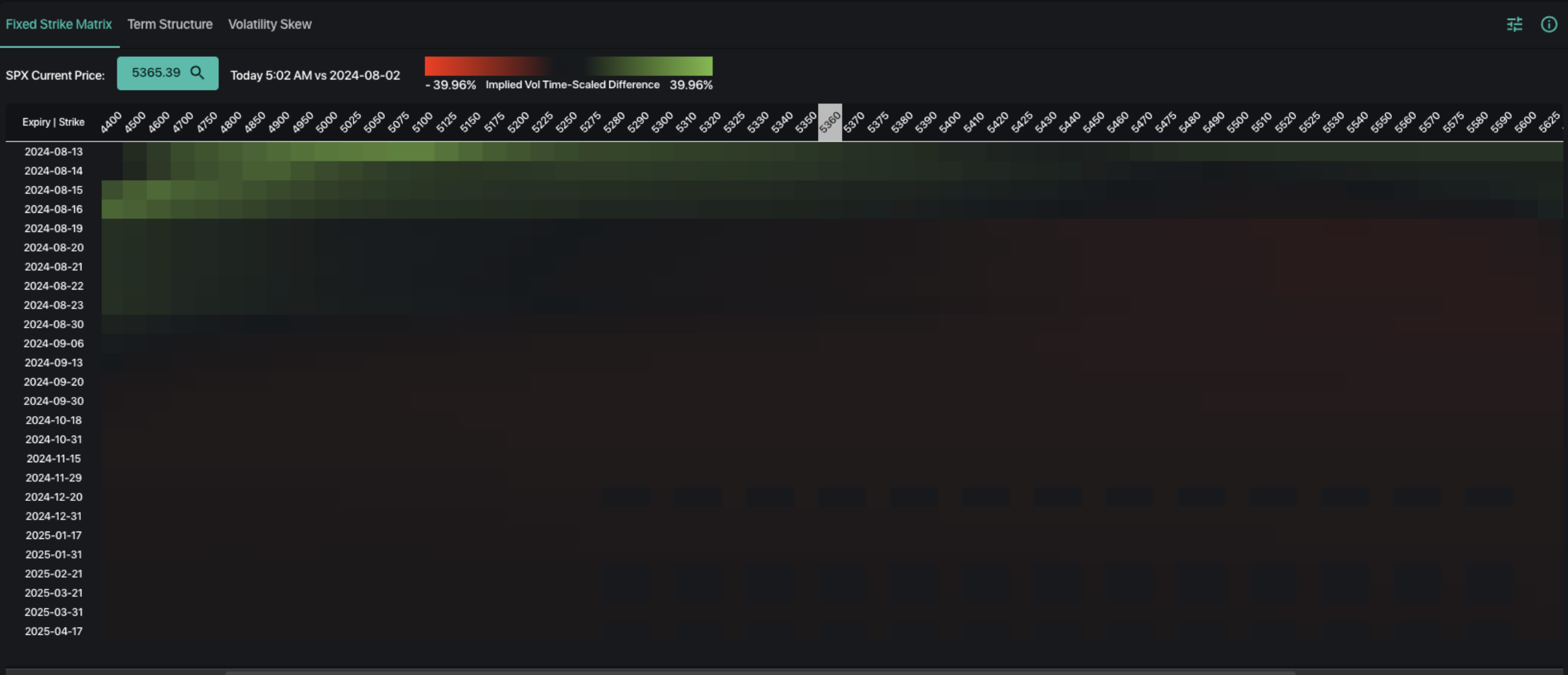

Reiterating that point, we present our SPX Fixed Strike Matrix below, which shows the change in SPX IV’s from Friday 8/2 to today. Looking at fixed strike vol here is interesting given that SPX prices are unchanged from 8/2, with our matrix accounting for the change in time, making this a fair comparison of IV’s between dates.

What’s reflected is that downside strike IV’s for expiration before Jackson Hole (8/24) are mildly higher than on 8/2, as seen in the green shading. Obviously there are PPI, CPI, & retail sales data also baked into these elevated short term vols.

Zooming out in time, we see longer dated IV’s are only about 1 vol point lower now vs 8/2, suggesting that the market remains uneasy about the path going forward. Given the rate situation, election, and murky geopolitical situation, these sticky vols are not surprising.

Looking back, we all forget about the ugly market position into Friday 8/2, which featured the SPX down more than -3.5% over 2 sessions, bringing the VIX to 20. So, while vols have cooled off a lot since last Monday (1 week ago), the current level of IV’s remains rather elevated vs just 2 weeks ago.

Should we get clean data out of PPI, tomorrow’s CPI, and Thursday’s retail sales, then IV’s should further contract (i.e. VIX <20) which pushes the SPX into 5,400-5,450. However, we’re unlikely to get a full release of IV’s (i.e. VIX 15) until, at best, the passing of Jackson Hole on 8/24.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5368.73 | $5344 | $532 | $18513 | $450 | $2080 | $206 |

| SG Gamma Index™: |

| -1.861 | -0.464 |

|

|

|

|

| SG Implied 1-Day Move: | 0.67% | 0.67% | 0.67% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | $5412.47 | $5387.74 | $537.79 |

|

|

|

|

| SG Implied 1-Day Move Low: | $5340.75 | $5316.02 | $530.63 |

|

|

|

|

| SG Volatility Trigger™: | $5374.73 | $5350 | $541 | $18625 | $460 | $2090 | $216 |

| Absolute Gamma Strike: | $5024.73 | $5000 | $540 | $18500 | $460 | $2050 | $210 |

| Call Wall: | $5724.73 | $5700 | $550 | $19650 | $485 | $2200 | $230 |

| Put Wall: | $5224.73 | $5200 | $520 | $17000 | $440 | $2000 | $200 |

| Zero Gamma Level: | $5417.73 | $5393 | $544 | $18605 | $463 | $2123 | $217 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.768 | 0.536 | 0.764 | 0.650 | 0.661 | 0.491 |

| Gamma Notional (MM): | ‑$636.236M | ‑$1.514B | ‑$6.02M | ‑$555.34M | ‑$42.551M | ‑$1.165B |

| 25 Delta Risk Reversal: | -0.056 | -0.035 | -0.05 | 0.00 | -0.041 | -0.018 |

| Call Volume: | 528.997K | 1.253M | 6.978K | 560.178K | 10.565K | 255.116K |

| Put Volume: | 967.273K | 2.028M | 7.958K | 891.951K | 20.369K | 443.63K |

| Call Open Interest: | 7.278M | 5.412M | 66.129K | 3.884M | 344.983K | 5.205M |

| Put Open Interest: | 13.865M | 12.531M | 102.711K | 6.372M | 541.782K | 9.36M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5000, 5300, 5400, 5500] |

| SPY Levels: [540, 530, 520, 535] |

| NDX Levels: [18500, 19000, 18000, 20000] |

| QQQ Levels: [460, 450, 440, 470] |

| SPX Combos: [(5601,89.73), (5553,80.53), (5499,84.57), (5366,75.42), (5323,84.00), (5312,85.00), (5301,98.18), (5275,95.66), (5264,82.16), (5248,94.36), (5232,79.77), (5227,82.20), (5216,88.44), (5200,98.28), (5173,90.90), (5168,86.51), (5162,81.96), (5152,92.35), (5125,77.17), (5114,73.17), (5098,92.61)] |

| SPY Combos: [531.31, 521.19, 528.65, 525.98] |

| NDX Combos: [18087, 18495, 18291, 17680] |

| QQQ Combos: [442.42, 432.06, 437.46, 452.33] |

0 comentarios