Macro Theme:

Short Term SPX Resistance: 5,565

Short Term SPX Support: 5,500

SPX Risk Pivot Level: 5,500

Major SPX Range High/Resistance: 5,600

Major SPX Range Low/Support: 5,000

Key dates ahead: 8/16 OPEX, 8/21 VIX exp, 8/22-8/24 Jackson Hole, 8/27 NVDA earnings

- Upside scenario:

- 5,600 is now Call Wall resistance (8/16)

- Downside scenario:

- <5,500 we are risk off. Below there is negative gamma territory, and a lack of price stability.

Founder’s Note:

Key SG levels for the SPX are:

- Support: 5,500, 5,500

- Resistance: 5,565, 5,600

For QQQ:

- Support: 470

- Resistance: 480

IWM:

- Support: 210, 200

- Resistance: 213, 220

Resistance is at 5,565, followed by 5,600. Support shows at 5,500, and we are “risk off” if the SPX moves below that level. As we noted on Friday AM, 68% of the time the S&P500 price reverses from the week into OPEX to the week after expiration. Obviously last week saw a markedly higher S&P500, which built up a large call vs put imbalance. This has us looking for equity consolidation over the next few sessions.

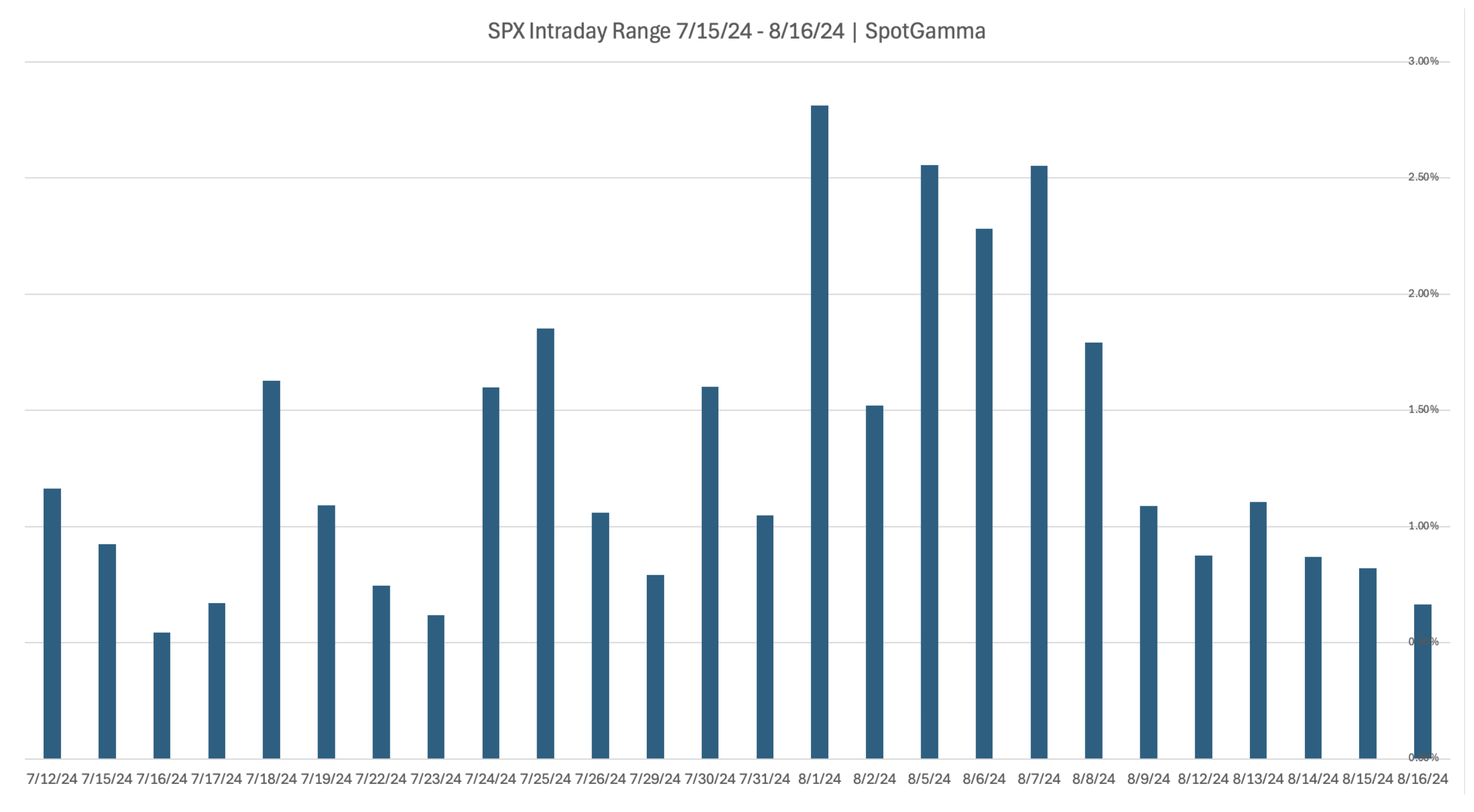

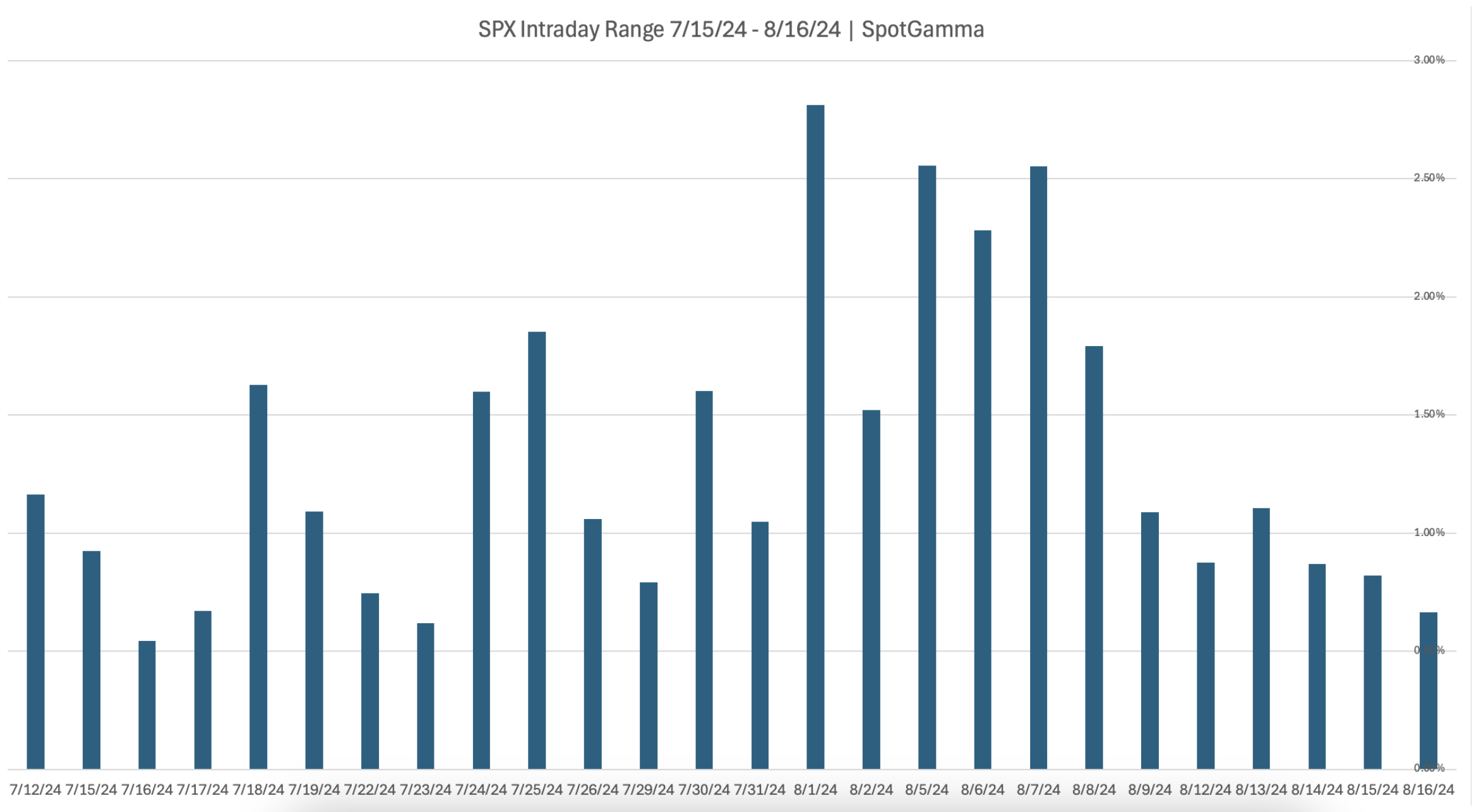

Friday’s OPEX removed the positive SPX gamma, which should allow for higher relative volatility. It was into Friday’s OPEX that volatility had finally started to subside after the violent drawdown and subsequent rally from earlier this month. This can be seen below in the daily intraday ranges over the past month.

For this week we are watching a large VIX expiration on Wednesday AM, which currently has large VIX put positions. This could be impactful to price S&P price action, as large VIX positions may have been pressing SPX vol lower.

Wednesday also has FOMC minutes, which generally carries a small amount of event volatility. This data is followed by a key Saturday panel by Powell at Jackson Hole, and then NVDA ER next week.

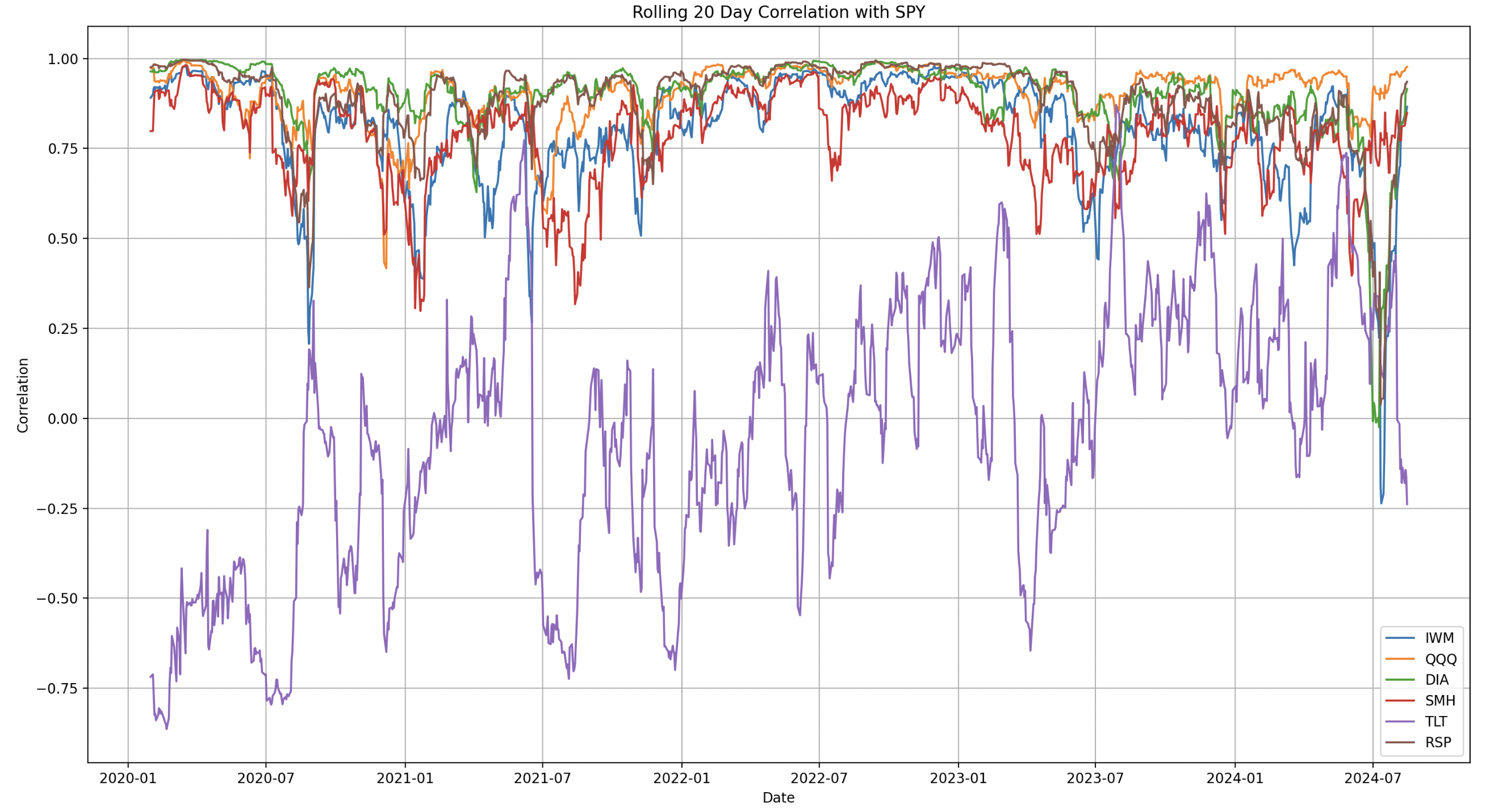

Looking back, August’s price gyrations largely forced equities back into highly correlated relationships (i.e. all stocks moving in the same direction). You can see this in the plot below of realized correlation, wherein IWM, QQQ & SPY etc all re-synced, after moving in different directions for much of ’24.

We also note that bonds, measured by TLT, returned toward a negatively correlated relationship which could continue to happen if rate cuts come with lower equity prices.

What has happened (i.e. high realized correlation) is not what traders are expecting to happen going forward.

Instead, traders are once again starting to bet on specific stock/sector outperformance. This is seen below in CBOE’s COR1M, which measures forward/implied 1 month correlation. This reveals that traders expect the volatility of the top 50 stocks in the S&P500 to decouple from the SPX index. This lower correlation view was the dominant flow for most of 2024, as stocks like NVDA/semis surged much more than other sectors.

In addition to select sector bets, this is also a signal of traders anticipating lower equity risk going forward. If traders were betting on a high risk/volatility environment, correlation would likely spike higher, as we’ve just seen in early August.

This stance is interesting because on Saturday we will likely get an important rate update from Jackson Hole, and on 8/28 we get NVDA earnings. These key updates should either bolster the re-entrenchment into low correlation bets and the “AI chase”, or flip people back into more macro-focused concerns a la owning bonds vs long equities.

The importance of this, is that if equities do reverse course we think they could do so rather violently as seen during risk-off bouts in April & August. Both of these periods saw very high S&P500 volatility, which we believe was driven by the unwinding of short volatility trades (either explicit short vol trades or correlation trades which sell SPX vol to buy single stock vol). It does seem clear that traders have immediately piled back into these short vol/low correlation bets, suggesting that the “risk off” fuel is again full.

To navigate this, we will be giving an edge to equity longs and buying dips only if the SPX is above our risk off level – currently 5,500. If this level is broken, we would be looking to play equity puts and/or long VIX call positions.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5577.34 | $5554 | $554 | $19508 | $475 | $2141 | $212 |

| SG Gamma Index™: |

| 1.218 | -0.134 |

|

|

|

|

| SG Implied 1-Day Move: | 0.55% | 0.55% | 0.55% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5518.34 | $5495 | $553 | $19190 | $474 | $2090 | $212 |

| Absolute Gamma Strike: | $5573.34 | $5550 | $550 | $19450 | $475 | $2100 | $210 |

| Call Wall: | $5623.34 | $5600 | $560 | $19450 | $480 | $2200 | $230 |

| Put Wall: | $5323.34 | $5300 | $540 | $20150 | $440 | $2070 | $200 |

| Zero Gamma Level: | $5503.34 | $5480 | $553 | $19168 | $470 | $2120 | $215 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.177 | 0.848 | 1.266 | 0.995 | 1.088 | 0.694 |

| Gamma Notional (MM): | $489.55M | ‑$122.252M | $7.116M | $109.554M | $11.512M | ‑$398.431M |

| 25 Delta Risk Reversal: | -0.035 | 0.00 | -0.029 | -0.012 | 0.00 | 0.003 |

| Call Volume: | 536.787K | 1.183M | 16.193K | 629.113K | 24.741K | 318.478K |

| Put Volume: | 1.035M | 2.349M | 19.138K | 828.575K | 40.017K | 429.569K |

| Call Open Interest: | 6.93M | 5.063M | 60.184K | 3.284M | 345.147K | 4.516M |

| Put Open Interest: | 13.058M | 13.304M | 84.384K | 5.912M | 533.252K | 8.18M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5550, 5500, 5000, 5600] |

| SPY Levels: [550, 555, 540, 554] |

| NDX Levels: [19450, 20000, 19500, 19600] |

| QQQ Levels: [475, 470, 480, 460] |

| SPX Combos: [(5799,95.50), (5776,79.61), (5749,98.28), (5726,80.74), (5699,98.37), (5676,80.10), (5660,77.41), (5649,96.18), (5638,71.00), (5632,79.69), (5626,89.94), (5621,69.82), (5610,88.40), (5604,82.95), (5599,98.64), (5593,75.43), (5588,91.07), (5582,93.21), (5576,93.14), (5571,92.35), (5565,87.81), (5560,92.65), (5554,84.16), (5549,94.07), (5410,81.65), (5399,82.58), (5349,72.89), (5327,74.50), (5310,78.28), (5299,93.81)] |

| SPY Combos: [559.78, 569.76, 574.75, 555.9] |

| NDX Combos: [19450, 19704, 19918, 19470] |

| QQQ Combos: [478.82, 480.72, 475.5, 485.47] |

0 comentarios