Macro Theme:

Short Term SPX Resistance: 5,665

Short Term SPX Support: 5,600

SPX Risk Pivot Level: 5,500

Major SPX Range High/Resistance: 5,700

Major SPX Range Low/Support: 5,000

Key dates ahead: 8/22-8/24 Jackson Hole, 8/28 NVDA earnings

- Upside scenario:

- 5,665 is major short term resistance, due to large positive dealer gamma

- 5,700 is currently our max upside level in the end of August

- Downside scenario:

- <5,500 we are risk off. Below there is negative gamma territory, and a lack of price stability.

Founder’s Note:

Key SG levels for the SPX are:

- Support: 5,600, 5,570, 5,550, 5,500

- Resistance: 5,600, 5620, 5,650, 5,665

For QQQ:

- Support: 470

- Resistance: 480, 485

IWM:

- Support: 212, 210, 200

- Resistance: 215, 220

Futures are suggesting a flat open, with the SPX just above 5,600. Powell’s Saturday Jackson Hole appearance is what traders are watching, leaving today & tomorrow without much of a catalyst. Next week is now when we expect to see larger shifts in equity prices.

We continue to see significant positive gamma into the 5,650 & 5,665 strikes which should act as resistance. First support shows at the big positive gamma strike of 5,600, with 5,565 & 5,550 support below there. The positive gamma dynamics suggests dips should mean revert on an intraday basis until/unless we break <5,500.

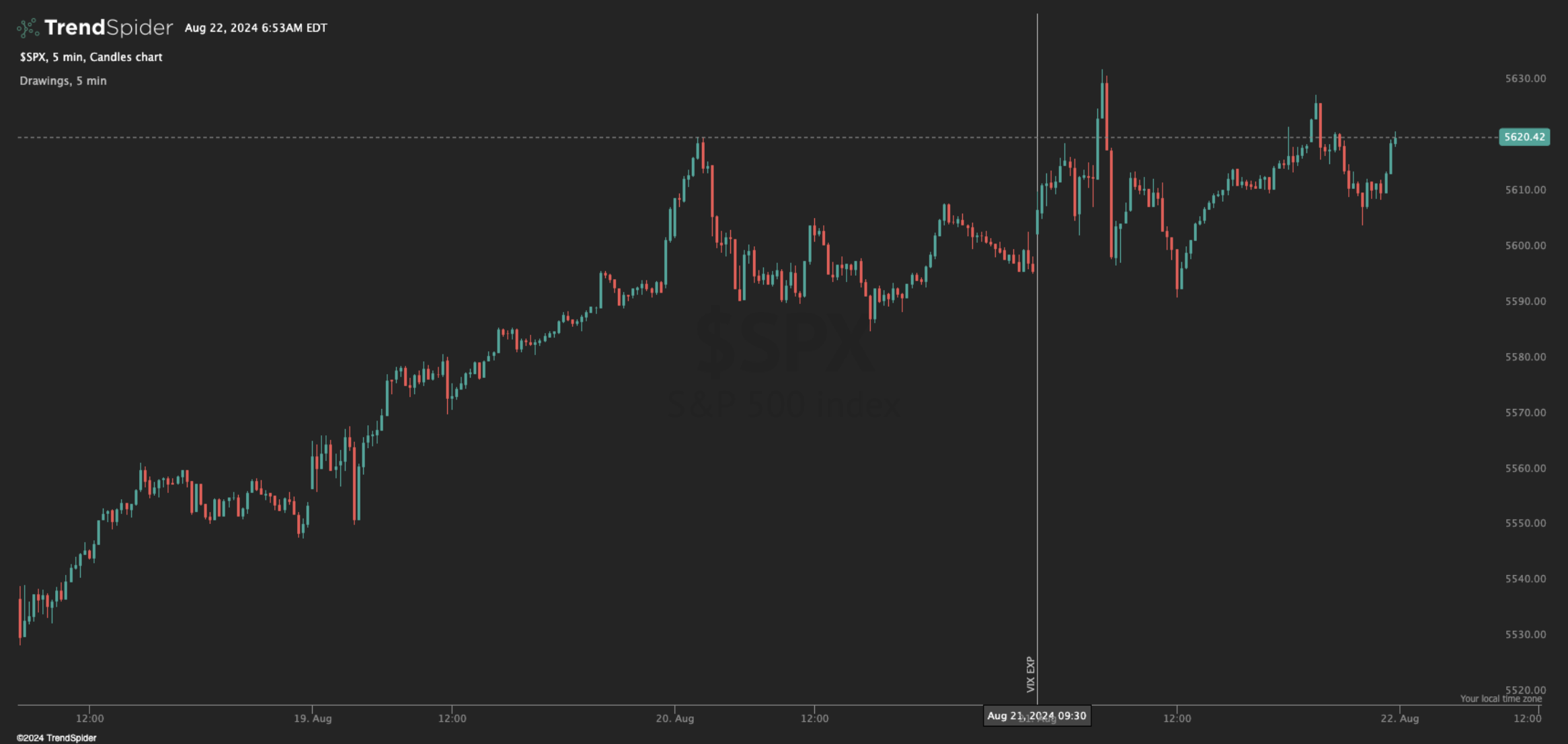

In regards to the VIX, and volatility in general, yesterday’s 9:30 AM VIX expiration did indeed appear to release VIX higher, as the VIX expiration matched the low of the day and went to a high of 17. The SPX index however held its ground, and this morning we see the VIX back to 16.

This higher VIX is corresponding with sticky implied vols. Shown below is our fixed strike matrix, showing the change in SPX IV from Monday vs today. As you can see, the matrix is green, suggesting IV’s are higher despite the SPX being up >1% since Monday. This corresponds with VIX slumping <15 for a few hours on Monday afternoon, before shifting back toward 16.

We think this shorter term higher/sticky vol is due to Powell’s appearance on Saturday, and then we have the VIX starting to price in Sep FOMC (Sep FOMC is ~30 days out).

A Sep rate cut is being 100% priced in. How much of a cut is still up for debate, and this element is likely a key catalyst looking forward. Shown below, traders are pricing a 2/3 chance of 25bps, and 1/3 chance of 50 bps. We’d imagine these odds will all shift after Saturday, and equities likely shift along with rate expectations.

These expectations will converge with NVDA earnings on 8/28 making next week a critical period for market expectations. While we wait for a catalyst you may want to review our 8/28 NVDA earnings plays here: https://youtu.be/f2hS5qbRz7s

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5642.67 | $5620 | $560 | $19824 | $482 | $2170 | $215 |

| SG Gamma Index™: |

| 1.31 | -0.071 |

|

|

|

|

| SG Implied 1-Day Move: | 0.59% | 0.59% | 0.59% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5567.67 | $5545 | $559 | $19440 | $479 | $2090 | $213 |

| Absolute Gamma Strike: | $5622.67 | $5600 | $560 | $20000 | $480 | $2100 | $210 |

| Call Wall: | $5772.67 | $5750 | $565 | $19450 | $485 | $2215 | $220 |

| Put Wall: | $5322.67 | $5300 | $540 | $20150 | $440 | $2070 | $205 |

| Zero Gamma Level: | $5568.67 | $5546 | $559 | $19479 | $478 | $2133 | $217 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.188 | 0.915 | 1.274 | 1.075 | 1.277 | 0.787 |

| Gamma Notional (MM): | $609.396M | $203.573M | $8.13M | $280.766M | $30.539M | ‑$223.03M |

| 25 Delta Risk Reversal: | -0.043 | -0.028 | -0.04 | -0.016 | -0.025 | 0.000 |

| Call Volume: | 475.489K | 1.428M | 6.783K | 726.466K | 24.88K | 483.401K |

| Put Volume: | 814.232K | 1.514M | 8.442K | 731.875K | 15.537K | 422.326K |

| Call Open Interest: | 7.096M | 5.313M | 61.653K | 3.45M | 362.511K | 4.729M |

| Put Open Interest: | 13.599M | 13.682M | 86.242K | 6.14M | 552.449K | 8.468M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5600, 5550, 5500, 5000] |

| SPY Levels: [560, 550, 555, 540] |

| NDX Levels: [20000, 19450, 20200, 19500] |

| QQQ Levels: [480, 470, 485, 475] |

| SPX Combos: [(5874,70.40), (5851,91.40), (5823,80.26), (5801,97.90), (5778,87.16), (5773,70.50), (5767,74.41), (5750,99.32), (5733,73.28), (5728,90.31), (5716,80.32), (5711,73.43), (5700,99.31), (5694,70.53), (5688,90.64), (5683,85.63), (5677,90.54), (5671,84.63), (5666,92.41), (5660,80.07), (5655,83.31), (5649,98.71), (5643,92.36), (5638,71.09), (5632,86.38), (5626,92.34), (5615,74.48), (5598,92.89), (5576,73.06), (5514,70.85), (5503,79.93), (5424,78.45), (5413,84.64), (5402,89.77), (5351,78.10)] |

| SPY Combos: [575.76, 571.27, 566.23, 580.8] |

| NDX Combos: [19924, 19448, 20539, 20003] |

| QQQ Combos: [475.77, 487.36, 502.31, 484.46] |

0 comentarios