Macro Theme:

Key dates ahead:

- 9/11 CPI

- 9/18 FOMC/VIX Exp

- 9/20 Huge Quarterly OPEX

Key SG levels for the SPX are:

- Support: 5,400, 5,340

- Resistance: 5,500, 5,520

- As of 9/09/24:

- Models are now risk-neutral in the 5,400-5,500 range, due to the SPX testing 5,400 on 9/6

- We note SPX prices are very unstable <5,500, and so we’d currently return to a long term bullish stance only a move >5,520

- Into Sep 18th, major support shows at 5,340, a zone we’d look to play short term long positions

QQQ:

- Support: 450

- Resistance: 460, 464, 470

IWM:

- Support: 200

- Resistance: 210, 220

- As of 8/28/24:

- Price will likely remain very fluid in either direction due to negative gamma. 200 is a long term support strike, and large positive gamma strike resistance is at 230.

Founder’s Note:

Futures are mildly lower this AM post-CPI. There is little changed today from our recent views.

Resistance holds at 5,500 & 5,520. Should the SPX close >5,520 we would flip back to a risk “on stance”. We also now see very large positive gamma strikes up near 5,550, which we eye as resistance following today.

Between 5,400 & 5,500, we remain neutral, looking to play intraday swings. This stance is a reflection of our view that price is unstable in this area due to a lack of gamma (positioning is slightly negative), and elevated implied volatility.

To the downside, 5,400 remains a large negative gamma strike, with local positive gamma in the 5,350 area. This suggests that, should we re-visit 5,400, it may offer initial support, but the stronger support is down at 5,350.

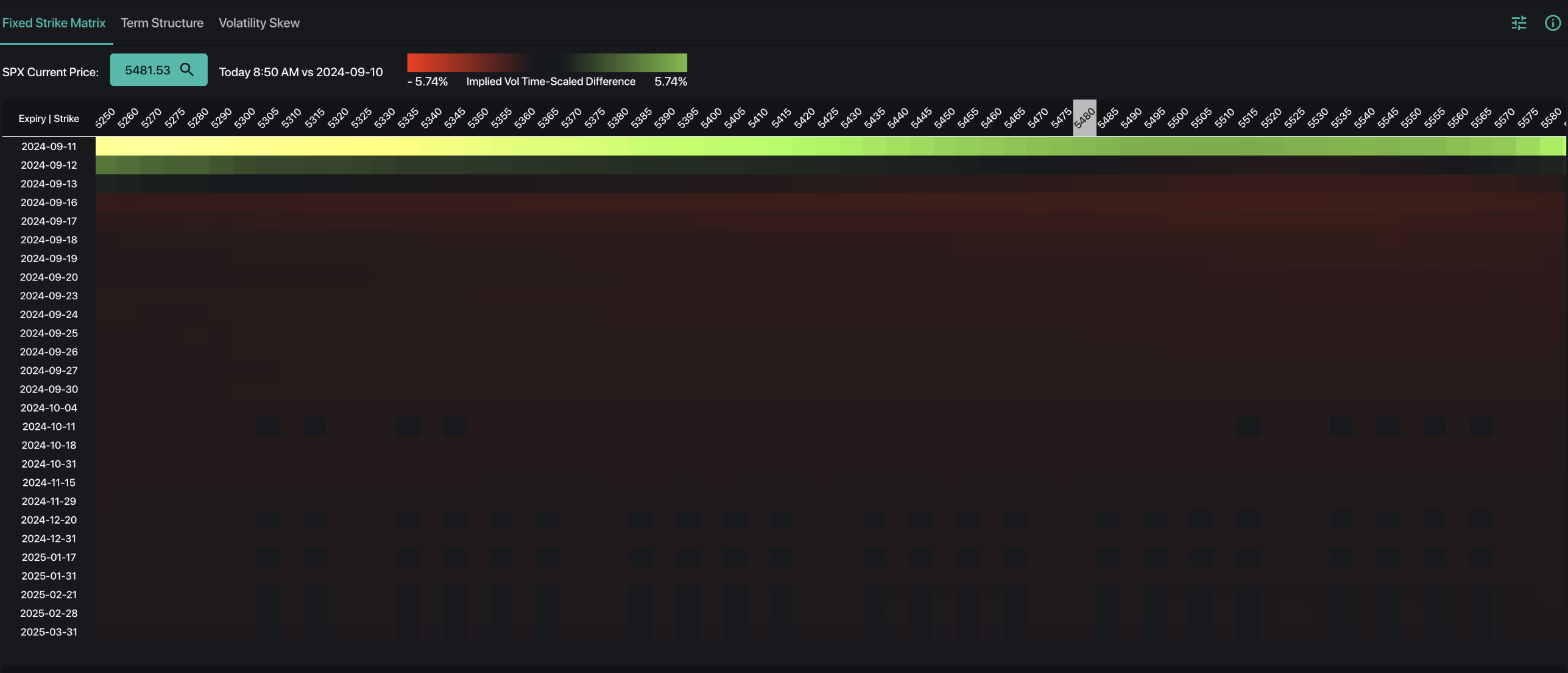

Following CPI, we are seeing implied volatility contracting, as shown below in the SPX fixed strike vol matrix. The shade of read across the matrix reflects vols down roughly 1/2 a vol point, which is not surprising given the CPI event-vol passing. These lower vols initially offer a light tailwind for equity prices, but we need to see a sharp continued contraction of IV to see a meaningful effect. We think that a positive vanna-lift would “kick in” >5,520. However, below <5,500, these IV’s likely remain elevated (as they are now) which can keep market conditions jumpy.

Following CPI, we see traders coalescing around a 25bps rate cut at the 9/18 FOMC. A consensus forming suggests less rate uncertainty, which may allow for some retraction in equity vols. As we laid out in yesterday’s AM note, we don’t think there is substantial room for an IV decline due to 9/18 FOMC and the elections. However short-dated vols could contract with an SPX move >5,520, particularly if realized volatility comes in.

The reality here is that bears have had their shot, but equity weakness seems to have been met with vol/put sellers. The flows from these types of trades help to guide the market higher. If the SPX moves back >5,520, positive gamma also comes back into play which helps to reinforce support at 5,500.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5501.89 | $5495 | $548 | $18829 | $458 | $2097 | $208 |

| SG Gamma Index™: |

| -1.088 | -0.344 |

|

|

|

|

| SG Implied 1-Day Move: | 0.60% | 0.60% | 0.60% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | $5528.06 | $5521.17 | $551.17 |

|

|

|

|

| SG Implied 1-Day Move Low: | $5462.2 | $5455.31 | $544.59 |

|

|

|

|

| SG Volatility Trigger™: | $5506.89 | $5500 | $550 | $18910 | $460 | $2130 | $213 |

| Absolute Gamma Strike: | $5506.89 | $5500 | $550 | $19450 | $460 | $2100 | $210 |

| Call Wall: | $5706.89 | $5700 | $570 | $19450 | $480 | $2200 | $220 |

| Put Wall: | $5406.89 | $5400 | $540 | $18500 | $440 | $2070 | $205 |

| Zero Gamma Level: | $5511.89 | $5505 | $552 | $18640 | $464 | $2156 | $216 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.881 | 0.666 | 1.092 | 0.676 | 0.685 | 0.502 |

| Gamma Notional (MM): | ‑$321.537M | ‑$929.688M | $2.60M | ‑$510.379M | ‑$42.688M | ‑$1.098B |

| 25 Delta Risk Reversal: | -0.059 | 0.00 | -0.062 | 0.00 | -0.039 | -0.034 |

| Call Volume: | 470.996K | 1.138M | 6.835K | 648.559K | 27.698K | 451.844K |

| Put Volume: | 787.845K | 1.658M | 6.812K | 854.534K | 48.959K | 340.30K |

| Call Open Interest: | 7.469M | 5.707M | 66.959K | 3.592M | 345.425K | 4.904M |

| Put Open Interest: | 14.383M | 14.374M | 85.256K | 6.561M | 554.033K | 9.158M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5500, 5550, 5000, 5600] |

| SPY Levels: [550, 540, 560, 545] |

| NDX Levels: [19450, 19000, 20000, 18500] |

| QQQ Levels: [460, 450, 440, 470] |

| SPX Combos: [(5748,95.28), (5726,81.82), (5710,75.41), (5699,96.15), (5677,82.89), (5649,93.86), (5627,77.86), (5600,95.16), (5578,87.71), (5550,78.70), (5539,81.48), (5523,87.19), (5501,93.18), (5474,80.46), (5457,71.79), (5452,88.80), (5430,76.30), (5424,84.21), (5419,71.87), (5408,93.01), (5402,97.90), (5375,88.99), (5358,80.15), (5353,93.01), (5325,90.67), (5309,87.27), (5298,97.14), (5276,82.85), (5259,73.50), (5248,91.47), (5226,80.77)] |

| SPY Combos: [544.43, 541.69, 531.81, 571.87] |

| NDX Combos: [19451, 18057, 18471, 18264] |

| QQQ Combos: [443.99, 454.08, 477.93, 449.04] |

0 comentarios