Macro Theme:

Key dates ahead:

- 9/20 Huge Quarterly OPEX

Following FOMC, we see equities in a negative gamma stance, which implies upside volatility may remain. SPX 5,750 & IWM 230 are the major upside levels into 9/20 OPEX.

Into Friday/Monday OPEX may offer some price consolidation.

Key SG levels for the SPX are:

- Support: 5,700, 5,650

- Resistance: 5,725, 5,750, 5,800

- As of 9/19/24:

- Initial upside target of 5,750 remains in tact following the post-FOMC close >5,600 on 9/18

- Flat equities <5,700

- Risk-off on a break <5,650

QQQ:

- Support: 480, 474

- Resistance: 485

IWM:

- Support: 225, 220

- Resistance: 230

- As of 9/19/24:

- Models hold long while >225, with 230 the upside target

Founder’s Note:

Risk assets are up big:

- SPY +1.6%

- QQQ +1%

- IWM +2.7%

- SLV +4%

- GLD +1.5%

TLDR: As per our recent notes, the SPX held >5,600 (albeit narrowly), and we see a large bullish equity move this AM. Accordingly 5,750 is the big upside target, which is the JPM collar strike for 9/30. This current positioning reads as very “chasey” to the upside, but a giant (and now call-heavy) OPEX looms on 9/20. This OPEX could create a place for short term price consolidation.

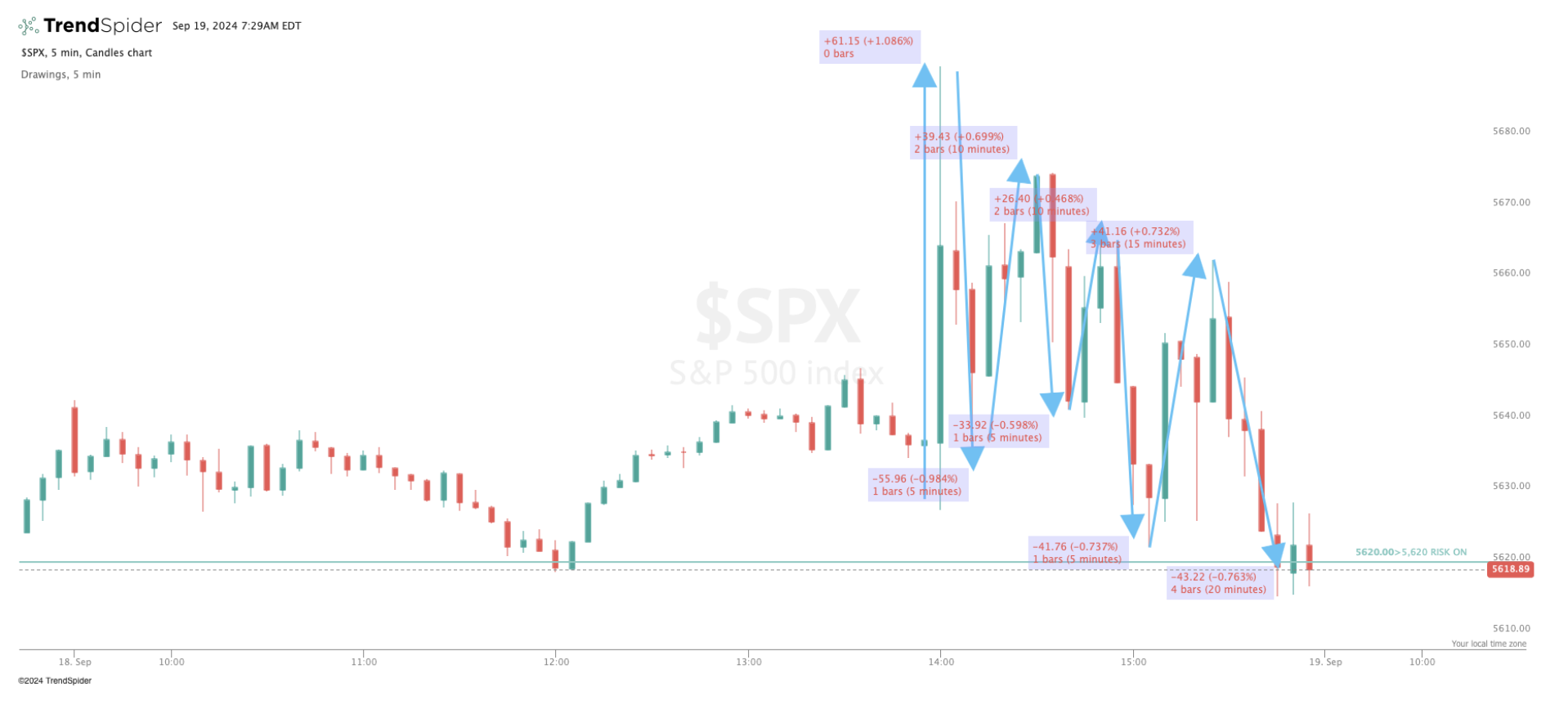

The huge AM rally comes after very confusing intraday action, yesterday. We saw some pundits commenting that lower equity vol was “priced right” because equities were only down 30bps after all the chaos. We counted 7 swings of 60-90bps yesterday – and that was only after the 2pm FOMC release!

Now we see ES/SPX +1.5% this morning, which is a realized vol of 24%.

Are 1.5% rallies likely to continue? Probably not, but we do see very little in the way of positive gamma up until 5,750. This implies that, at least as of this AM, there are very few call sellers out there. This keeps dealers in a flat-to-negative gamma stance, which in the short term, should keep volatility relatively high.

You get a sense of this negative gamma VIA our new Trace heatmaps, which shows our new proprietary SPX dealer positioning. The sea of red reflects negative gamma, and as you can see its only some end-of-day “local” positive gamma – these areas being end-of-day price targets. However, that positive gamma is only local and for today…note after 4PM the map is red which tells us that its only 0DTE offering some positive gamma. If there was material positive gamma, the map would be bright blue.

What this tells us is that traders are long SPX calls, and dealers have to buy stock if/when prices rise. This keeps volatility high.

We think traders are today likely to start selling calls into this rally at strikes >5,750/5,800, which should form some positive gamma. Going forward, that positive gamma would offer some stability to these new, all time high SPX prices. We also think traders are likely to close and/or roll some long positions into a very large 9/20 OPEX. Therefore into Friday/Monday OPEX could lead to some stalling out some of this vicious upside momentum.

There was one other sector that caught our eye in yesterday whipsaw(s): precious metals. We saw very large bullish flows in GLD, SLV & GDX. In particular was some large ~3:30PM SLV Dec Put Sales – a trade that has profited handsomely this AM as SLV is +4%.

This could be playing into a major break out for silver.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5682.06 | $5618 | $561 | $19344 | $471 | $2206 | $219 |

| SG Gamma Index™: |

| 1.007 | -0.00 |

|

|

|

|

| SG Implied 1-Day Move: | 0.47% | 0.47% | 0.47% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5659.06 | $5595 | $560 | $19190 | $473 | $2130 | $218 |

| Absolute Gamma Strike: | $5664.06 | $5600 | $570 | $19450 | $475 | $2200 | $220 |

| Call Wall: | $5814.06 | $5750 | $570 | $19450 | $480 | $2200 | $225 |

| Put Wall: | $5564.06 | $5500 | $540 | $18500 | $440 | $2000 | $210 |

| Zero Gamma Level: | $5649.06 | $5585 | $560 | $19007 | $470 | $2168 | $219 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.101 | 1.000 | 1.551 | 0.937 | 1.159 | 0.994 |

| Gamma Notional (MM): | $171.23M | ‑$104.199M | $12.386M | ‑$194.133M | $16.061M | $20.295M |

| 25 Delta Risk Reversal: | -0.047 | -0.042 | -0.052 | -0.036 | -0.025 | -0.024 |

| Call Volume: | 552.323K | 1.877M | 9.421K | 754.227K | 25.699K | 724.202K |

| Put Volume: | 1.048M | 2.411M | 8.914K | 921.175K | 25.731K | 803.071K |

| Call Open Interest: | 7.967M | 5.971M | 71.288K | 3.766M | 375.627K | 5.186M |

| Put Open Interest: | 15.391M | 15.242M | 91.129K | 6.877M | 577.544K | 9.735M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5600, 5650, 5550, 5700] |

| SPY Levels: [570, 560, 550, 565] |

| NDX Levels: [19450, 19500, 20000, 19000] |

| QQQ Levels: [475, 470, 480, 465] |

| SPX Combos: [(5877,74.01), (5849,93.86), (5837,72.32), (5826,77.92), (5798,98.21), (5781,69.79), (5776,91.06), (5770,78.94), (5753,80.22), (5747,99.78), (5742,86.95), (5736,75.17), (5731,80.23), (5725,98.34), (5719,82.23), (5714,82.89), (5708,86.21), (5703,99.84), (5697,84.73), (5691,75.49), (5686,76.25), (5680,81.74), (5674,96.71), (5669,77.70), (5663,83.58), (5658,76.74), (5652,99.03), (5551,80.41), (5523,72.68), (5506,79.94), (5500,95.95), (5478,86.65), (5450,86.78), (5427,82.65), (5405,82.61), (5399,95.94), (5377,78.82), (5349,88.21)] |

| SPY Combos: [572.55, 567.49, 563, 577.6] |

| NDX Combos: [19441, 19693, 19499, 19905] |

| QQQ Combos: [471.79, 477.92, 482.63, 457.65] |

0 comentarios