Macro Theme:

Key dates ahead:

- 9/27 Core PCE 8:30AM

- 9/30 Quarter End OPEX

TLDR: We continue to maintain long positions >5,700, and would flip to neutral if the SPX goes <5,700. We expect more chop today, with eyes remaining on time & price: 5,750 & Monday 9/30. 9/30, being quarter end, likely unlocks market movement.

Key SG levels for the SPX are:

- Support: 5,720, 5,700

- Resistance: 5,750, 5,780, 5,800

- As of 9/20/24:

- We are long >5,700, with 5,750 key upside target (9/30 JPM collar strike)

- We position flat equities <5,700

- Risk-off on a break <5,650

QQQ:

- Support: 490, 487

- Resistance: 495

IWM:

- Support: 220, 218

- Resistance: 225, 230

- As of 9/20/24:

- 225 failed yesterday, we now eye very large gamma at 220 implies major support

- A break <218 implies a test of 210

Founder’s Note:

Core PCE 8:30AM ET.

Futures are flat, indicating a SPX cash open is back near the very large 5,750 strike. That strike has been in focus this past week, as its providing a lot of positive dealer gamma through its expiration this Monday (9/30).

As far as this AM’s Core PCE goes – no one cares. The 0DTE SPX ATM straddle is a paltry $25.5 (45bps), with an IV of just 16.8% (ref: 5,745). This is as low as it gets, reflecting traders bets that today is rather boring. Quite frankly, its hard to argue that point, due to that massive gamma position.

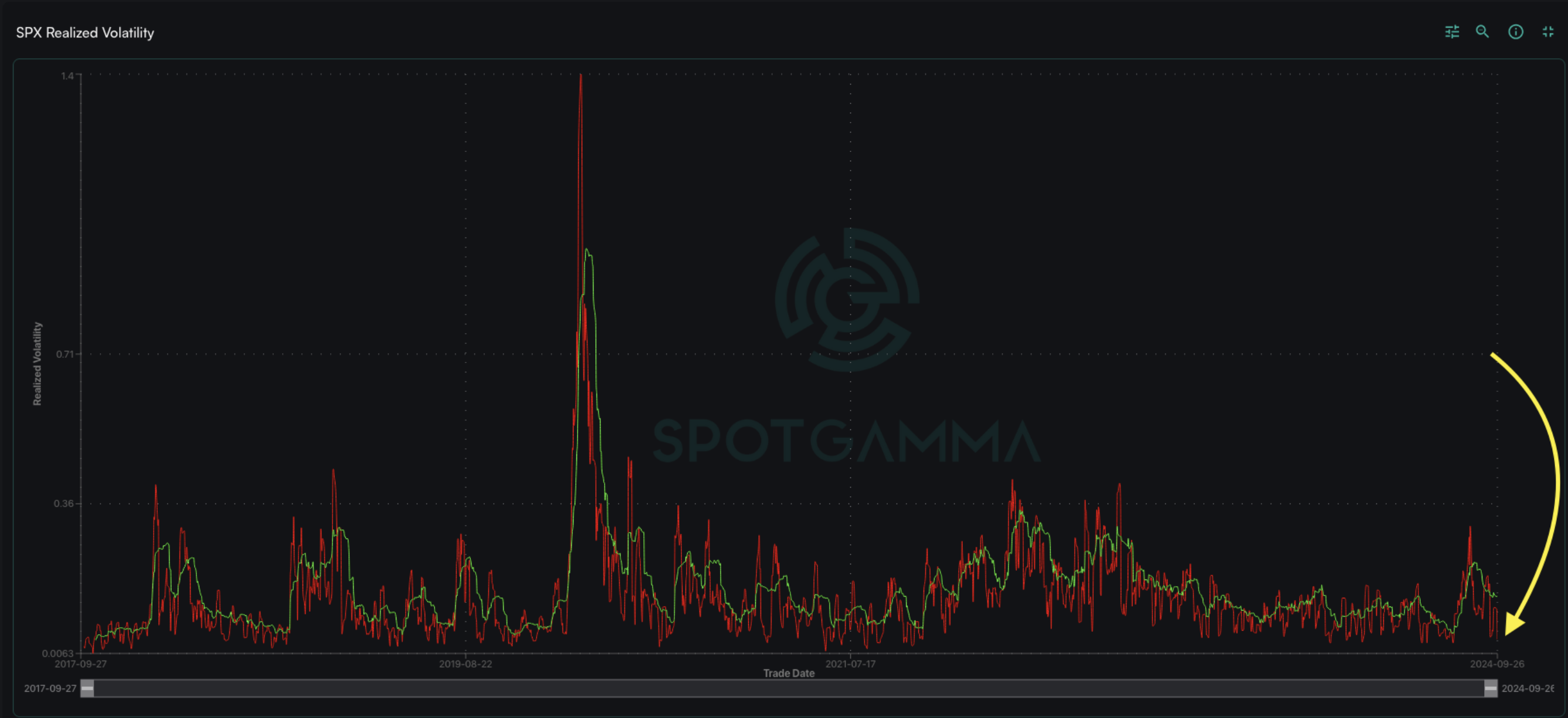

To get a visual on this lack of movement, below is a 5-day view of SPX realized volatility. Its about as low as we can go, which is a simple reflection of the fact that the SPX has held a ~75bps range over the past 6 sessions. Realized vol can’t go to 0, there is a lower bound, and we are essentially staged on that lower bound.

This is where things get interesting.

If one believes that positive gamma is linked to low volatility (we do), then the removal of a giant blanket of positive gamma should open the door for volatility. Obviously this is set to happen on Monday, as the current JPM collar strike (the fund is short 40k 9/30 exp 5,750 calls) are going to be closed and “rolled up and out”. What does that mean? The new call is going to be changed to a ~5% higher strike, out in Dec ’24. That is a lot less positive gamma, vs the ATM position expiring in 1 day.

Therefore, this expiration should allow for volatility (i.e. market movement) to expand.

What strengthens this argument is that we are at a volatility floor. That 0DTE straddle is about as low as it can get, and short term realized vol is on the floor, too.

This suggests that, starting Monday, the SPX is about to start moving and so we likely want to long options. We default to looking to be in ~1-month long SPY/SPX call positions due to the fact that the SPX, even without the JPM position, should hold a mild positive gamma position. However, if 5,700 were to break, we would be looking to flip into Nov or Dec SPX puts/VIX calls.

We also think that today is when you want to consider enter those positions/closing vol shorts. In the past we’ve tried to get “to cute” with these types of views, and the rolling of positions (or the JPM brokers game-theory moves) happen a bit earlier than expected (i.e. Monday AM).

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5802.81 | $5745 | $572 | $20115 | $489 | $2209 | $218 |

| SG Gamma Index™: |

| 2.417 | -0.01 |

|

|

|

|

| SG Implied 1-Day Move: | 0.65% | 0.65% | 0.65% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5742.81 | $5685 | $569 | $19490 | $487 | $2210 | $219 |

| Absolute Gamma Strike: | $5807.81 | $5750 | $570 | $20000 | $490 | $2200 | $220 |

| Call Wall: | $5807.81 | $5750 | $575 | $19725 | $500 | $2245 | $225 |

| Put Wall: | $5357.81 | $5300 | $560 | $18500 | $450 | $2145 | $210 |

| Zero Gamma Level: | $5726.81 | $5669 | $571 | $19469 | $485 | $2204 | $220 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.388 | 0.990 | 1.81 | 1.113 | 0.971 | 0.781 |

| Gamma Notional (MM): | $886.361M | $317.145M | $14.908M | $234.797M | ‑$4.643M | ‑$305.889M |

| 25 Delta Risk Reversal: | -0.037 | -0.015 | -0.034 | -0.011 | -0.021 | 0.000 |

| Call Volume: | 585.253K | 1.602M | 9.657K | 1.011M | 12.886K | 355.615K |

| Put Volume: | 815.659K | 2.075M | 10.195K | 843.181K | 13.978K | 435.732K |

| Call Open Interest: | 6.532M | 5.155M | 57.519K | 2.979M | 289.522K | 4.094M |

| Put Open Interest: | 13.304M | 14.565M | 76.349K | 5.958M | 497.337K | 7.915M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5750, 5700, 5800, 5000] |

| SPY Levels: [570, 572, 575, 571] |

| NDX Levels: [20000, 19725, 20500, 20200] |

| QQQ Levels: [490, 480, 500, 485] |

| SPX Combos: [(5998,98.14), (5952,89.83), (5923,84.18), (5900,98.49), (5878,91.51), (5872,78.54), (5849,98.62), (5837,90.19), (5832,80.04), (5826,93.95), (5820,93.66), (5814,71.39), (5809,79.25), (5803,99.67), (5797,79.29), (5791,93.74), (5786,83.16), (5780,96.89), (5774,99.17), (5768,97.94), (5763,96.99), (5757,87.36), (5751,99.99), (5745,79.60), (5740,89.41), (5722,86.82), (5699,88.49), (5682,86.70), (5671,75.50), (5625,90.40), (5602,84.09), (5573,77.34), (5550,78.65), (5521,76.03), (5498,89.04)] |

| SPY Combos: [575.15, 580.3, 572.29, 574.01] |

| NDX Combos: [19733, 20558, 20337, 20136] |

| QQQ Combos: [493.84, 483.57, 503.63, 489.93] |

0 comentarios