Macro Theme:

Key dates ahead:

- 10/9 FOMC Mins

- 10/10 CPI

- 10/18 OPEX

Key SG levels for the SPX are:

- Support: 5,700, 5,600

- Resistance: 5,750 5,760, 5,800

- As of 10/7/24:

- Long with close >5,720

- Risk-off on a break <5,700

QQQ:

- Support: 480, 473

- Resistance: 484

IWM:

- Support: 218, 210

- Resistance: 220

- As of 10/7/24:

- Bullish with close >220

Founder’s Note:

Futures are -50bps, bringing the SPX back into the 5,700 – 5,750 zone. Support is at 5,710 & 5,700, with our risk off signal now triggering on a break <5,700 (up from 5,675).

Initial resistance remains at the 5,750 – 5,760 zone, with large 0DTE resistance at 5,780.

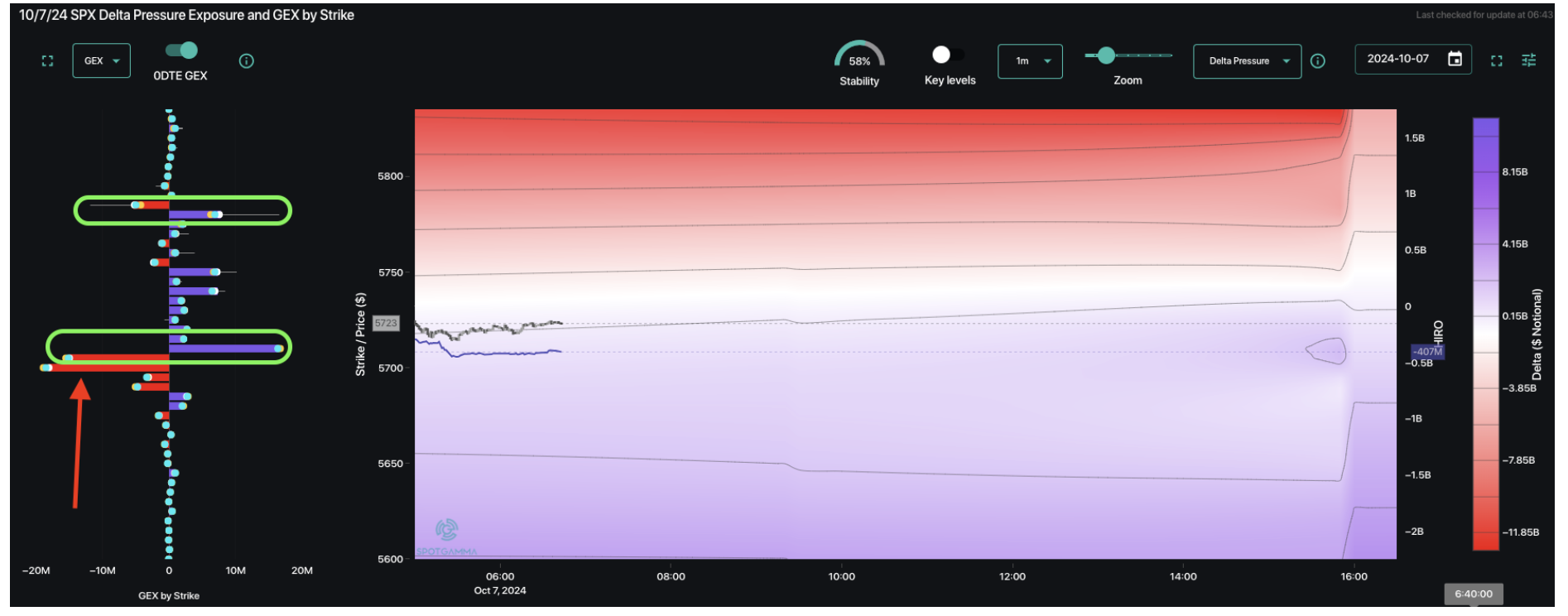

This morning we flag that the 0DTE condor trader is apparently back, this time with ~4k of the:

short 5,780/5,785 call spread vs 5,710/5,705 put spread (legs circled in green, below).

Note <5,700 we are now seeing dealers short puts (red arrow) both for 0DTE and longer dated position down into 5,650. This suggests volatility could increase if SPX <5,700.

At Friday’s close traders were feeling a bit bullish, but Friday was dominated by 0DTE trades. Those 0DTE flows are the most transient (they don’t follow through), and this morning we now see the VIX at 21 (1-month high), and US 10Y >4% (chart below). This is, quite frankly, a very risky environment.

A lot of the put flow to date has been more tail-related, which doesn’t place much pressure on equity prices. Now that we are seeing put buyers just below current SPX levels, there is something for negative gamma hedging flows to feed on <5,700.

Additionally, given the geopolitical situation, upcoming election, and murky rate picture, there isn’t a clear reason for traders to close put protection if we start to sell off. Conversely, for bulls, we’ve noted its tough to extend a rally without IV fully “releasing”, which would invoke supportive vanna flows.

At this point, with ~30 days to the election, its unlikely that IV will meaningfully decline. For these reasons, we will look to be leaning short on a break <5,700.

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5750.08 | $5700 | $572 | $19802 | $487 | $2195 | $219 |

| SG Gamma Index™: |

| 0.961 | -0.291 |

|

|

|

|

| SG Implied 1-Day Move: | 0.68% | 0.68% | 0.68% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | $104.48 | $54.4 | $575.14 |

|

|

|

|

| SG Implied 1-Day Move Low: | $103.74 | $53.66 | $567.38 |

|

|

|

|

| SG Volatility Trigger™: | $5765.08 | $5715 | $572 | $19720 | $485 | $2220 | $219 |

| Absolute Gamma Strike: | $5850.08 | $5800 | $560 | $19725 | $480 | $2200 | $220 |

| Call Wall: | $5850.08 | $5800 | $580 | $19725 | $500 | $2245 | $225 |

| Put Wall: | $5550.08 | $5500 | $560 | $18500 | $460 | $2000 | $210 |

| Zero Gamma Level: | $5759.08 | $5709 | $576 | $19456 | $486 | $2223 | $220 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.158 | 0.719 | 1.772 | 0.876 | 0.894 | 0.777 |

| Gamma Notional (MM): | ‑$171.016M | ‑$708.83M | $7.029M | ‑$82.255M | ‑$24.129M | ‑$277.41M |

| 25 Delta Risk Reversal: | -0.056 | -0.034 | -0.054 | -0.037 | -0.035 | -0.014 |

| Call Volume: | 494.625K | 1.275M | 7.078K | 687.595K | 13.202K | 262.385K |

| Put Volume: | 1.117M | 2.638M | 9.712K | 886.781K | 20.414K | 357.529K |

| Call Open Interest: | 6.553M | 5.045M | 56.705K | 2.961M | 285.577K | 3.987M |

| Put Open Interest: | 13.308M | 14.514M | 76.409K | 5.805M | 493.086K | 7.911M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5800, 5750, 5700, 5000] |

| SPY Levels: [560, 570, 550, 575] |

| NDX Levels: [19725, 20000, 20500, 20200] |

| QQQ Levels: [480, 485, 475, 490] |

| SPX Combos: [(5945,98.31), (5899,91.92), (5888,69.84), (5871,83.58), (5848,98.71), (5825,93.81), (5820,81.83), (5808,75.20), (5797,99.00), (5785,92.56), (5780,84.44), (5774,95.08), (5768,94.28), (5763,79.77), (5757,83.76), (5751,99.57), (5746,72.00), (5740,92.77), (5734,88.87), (5728,95.04), (5723,97.15), (5717,83.75), (5711,93.19), (5706,71.48), (5700,93.83), (5660,76.19), (5643,80.27), (5637,76.96), (5620,84.61), (5597,82.91), (5575,77.81), (5569,90.39), (5552,91.47), (5523,85.08), (5500,78.78), (5472,80.38), (5449,91.59), (5426,71.79)] |

| SPY Combos: [583.29, 587.88, 593.03, 562.67] |

| NDX Combos: [19505, 20317, 20099, 19901] |

| QQQ Combos: [485.91, 465.44, 475.67, 505.89] |

0 comentarios