Macro Theme:

Key dates ahead:

- 10/9 FOMC Mins

- 10/10 CPI

- 10/18 OPEX

Key SG levels for the SPX are:

- Support: 5,700, 5,600

- Resistance: 5,750, 5,760, 5,800

- As of 10/7/24:

- Long with close >5,720

- Risk-off on a break <5,700

QQQ:

- Support: 480, 473

- Resistance: 484

IWM:

- Support: 218, 210

- Resistance: 220

- As of 10/7/24:

- Bullish with close >220

Founder’s Note:

Another day – another ~5,700-5,750 pin. And, while we yesterday closed by bouncing off of 5,700, futures are 40bps higher this AM. This places the SPX squarely back in the dominant 5,700-5,750 range.

That 5,700 level is again big support for today, with resistance at 5,730 & 5,760. Our “risk-off” level is now back to 5,675 (from 5,700 yesterday), due to some positive gamma strikes added in the 5,675-5,700 range.

China is showing some vol today, as they apparently announced less stimulus than expected. As a result Chinese stocks are down as much as 10%.

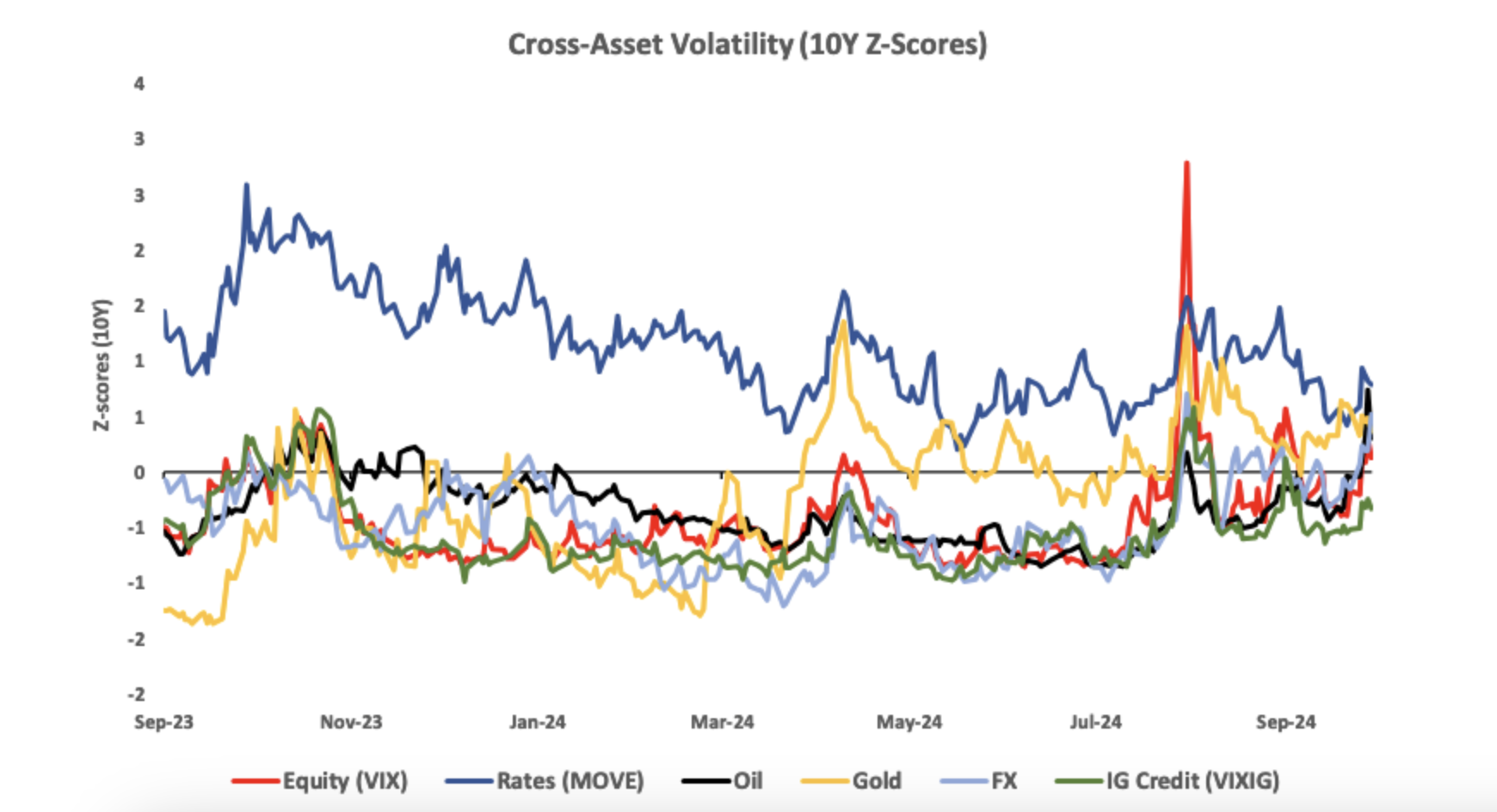

We’ve extensively covered why equity implied volatility (i.e. VIX) is elevated, and likely to remain so (here & here), but increasing vol is not an equities-only phenomenon. Rate vol is ripping (MOVE index back to 124), as is oil & FX vol. This is not always a signal that equities are going to drop sharply, but it is certainly a red flag.

What is lacking is a downside spark which would kick in reflexive downside flows (dealers needing to short into lower equity prices). That signal, we believe, is a break <5,675.

Not all is bad, as NVDA is ripping to +1-month highs. A large number of call positions were added to the 130 strike yesterday, with 125 serving as a large area of support into this Friday’s OPEX. NVDA skew continues to frame upside calls as relatively cheap, which implies NVDA upside is not a bad place to grab some end-of-year long exposure. In the short term, though, we do think that 130-135 is rather heavy upside resistance.

Zooming out, we will continue to keep a close eye on this. The most bullish thing equities could hope for is NVDA continuing to shifting higher, as that could lever up the entire equity complex (see here).

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5748.42 | $5700 | $567 | $19802 | $482 | $2195 | $217 |

| SG Gamma Index™: |

| -0.578 | -0.448 |

|

|

|

|

| SG Implied 1-Day Move: | 0.67% | 0.67% | 0.67% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5743.42 | $5695 | $570 | $19720 | $483 | $2220 | $218 |

| Absolute Gamma Strike: | $5748.42 | $5700 | $550 | $19725 | $480 | $2200 | $220 |

| Call Wall: | $5848.42 | $5800 | $580 | $19725 | $500 | $2245 | $225 |

| Put Wall: | $5548.42 | $5500 | $560 | $18500 | $460 | $2000 | $210 |

| Zero Gamma Level: | $5715.42 | $5667 | $571 | $19456 | $485 | $2206 | $220 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 0.918 | 0.616 | 1.216 | 0.735 | 0.739 | 0.660 |

| Gamma Notional (MM): | ‑$78.106M | ‑$1.217B | $5.997M | ‑$307.764M | ‑$23.302M | ‑$463.034M |

| 25 Delta Risk Reversal: | -0.073 | -0.051 | -0.071 | -0.045 | 0.00 | -0.025 |

| Call Volume: | 441.023K | 1.36M | 5.022K | 710.719K | 14.699K | 252.558K |

| Put Volume: | 813.69K | 1.942M | 8.773K | 796.966K | 27.28K | 409.634K |

| Call Open Interest: | 6.622M | 5.222M | 56.67K | 3.055M | 290.295K | 4.043M |

| Put Open Interest: | 13.379M | 14.556M | 78.499K | 5.888M | 506.447K | 7.931M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5700, 5800, 5750, 5000] |

| SPY Levels: [550, 560, 570, 565] |

| NDX Levels: [19725, 20000, 20500, 19500] |

| QQQ Levels: [480, 475, 485, 460] |

| SPX Combos: [(5956,88.50), (5905,97.43), (5877,86.49), (5871,69.86), (5854,97.79), (5842,73.65), (5837,89.10), (5831,90.83), (5825,77.20), (5820,82.75), (5814,73.73), (5803,98.33), (5797,83.46), (5791,70.24), (5785,83.64), (5780,93.21), (5774,88.21), (5763,85.22), (5751,93.89), (5706,69.78), (5694,76.59), (5683,78.44), (5672,92.43), (5666,79.80), (5660,78.27), (5654,90.37), (5643,72.13), (5632,94.31), (5626,70.35), (5620,93.47), (5614,79.58), (5609,75.35), (5603,95.18), (5592,86.59), (5580,77.58), (5569,83.58), (5563,69.42), (5552,88.00), (5529,74.92), (5523,86.16), (5506,94.49), (5478,77.55), (5472,70.07), (5455,92.12), (5426,80.21), (5421,80.69)] |

| SPY Combos: [578.02, 583.13, 588.24, 558.15] |

| NDX Combos: [19723, 18891, 19307, 20119] |

| QQQ Combos: [480.17, 459.92, 470.05, 489.81] |

0 comentarios