Founder’s Note: Thu, October 10, 2024 at 6:48 AM ET

Macro Theme:

Key dates ahead:

- 10/9 FOMC Mins

- 10/10 CPI

- 10/18 OPEX

Key SG levels for the SPX are:

- Support: 5,745, 5,720, 5,700

- Resistance: 5,800, 5,825

- As of 10/7/24:

- Long with close >5,720

- Risk-off on a break <5,700

QQQ:

- Support: 490

- Resistance: 495, 500

IWM:

- Support: 210

- Resistance: 218, 220

- As of 10/7/24:

- Bullish with close >220

Founder’s Note:

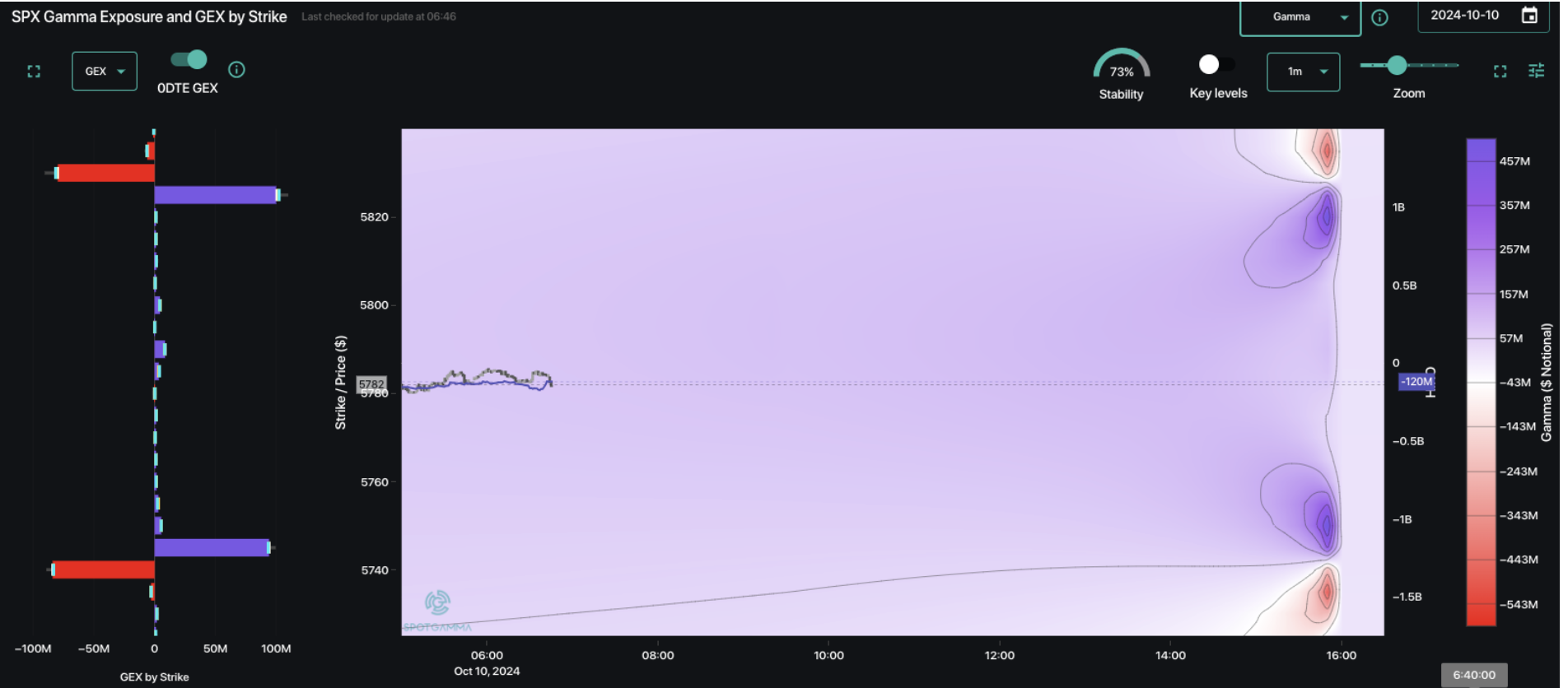

Futures are off 20bps ahead of 8:30AM CPI. The 0DTE straddle is going for “warm” $40 (70bps, ref 5,785 IV 26%). This suggests traders are watching this data point, but its not projected to have significant short term impact.

With that, we see heavy resistance in the 5,800-5,825 area. To the downside 5,745 is the area to watch, followed by 5,700. <5,700 remains “risk off”, as the SPX flips to a negative gamma position beneath that level.

“The 0DTE Condor Guy” is back, this time in 2x size. There is now a 25k lot of the 5,825/5,830 call spread vs 5,745/5,740 put spread. Yesterday we saw this sized up around ~12k contracts, with the 0DTE call spread positioned at 5,775/5,780 – which was the sticking point for SPX prices in yesterday’s session.

Accordingly, we will watch these legs as major trading levels for today.

One of our core views here is that large directional rallies will be a challenge due to sticky volatility. The idea is that equities may struggle to sustain a rally if implied volatility (i.e. VIX) can’t sharply decline. While the equity market did manage to put in some strong performance yesterday, we see that the VIX still holds near 1-month highs, and fixed strike $SPX vol is flat to down 1/3 of a vol point since Monday’s close. That’s not much.

That high implied volatility is persisting despite low realized volatility (i.e. the market is not moving much), which is the result of the SPX’s positive gamma positioning. That positive gamma positioning is heavily sourced from 0DTE call & put sales – trades which come out when the “coast is clear”. If a whiff of material risk materializes, those 0DTE players pull their short-vol/gamma offers and liquidity dries up.

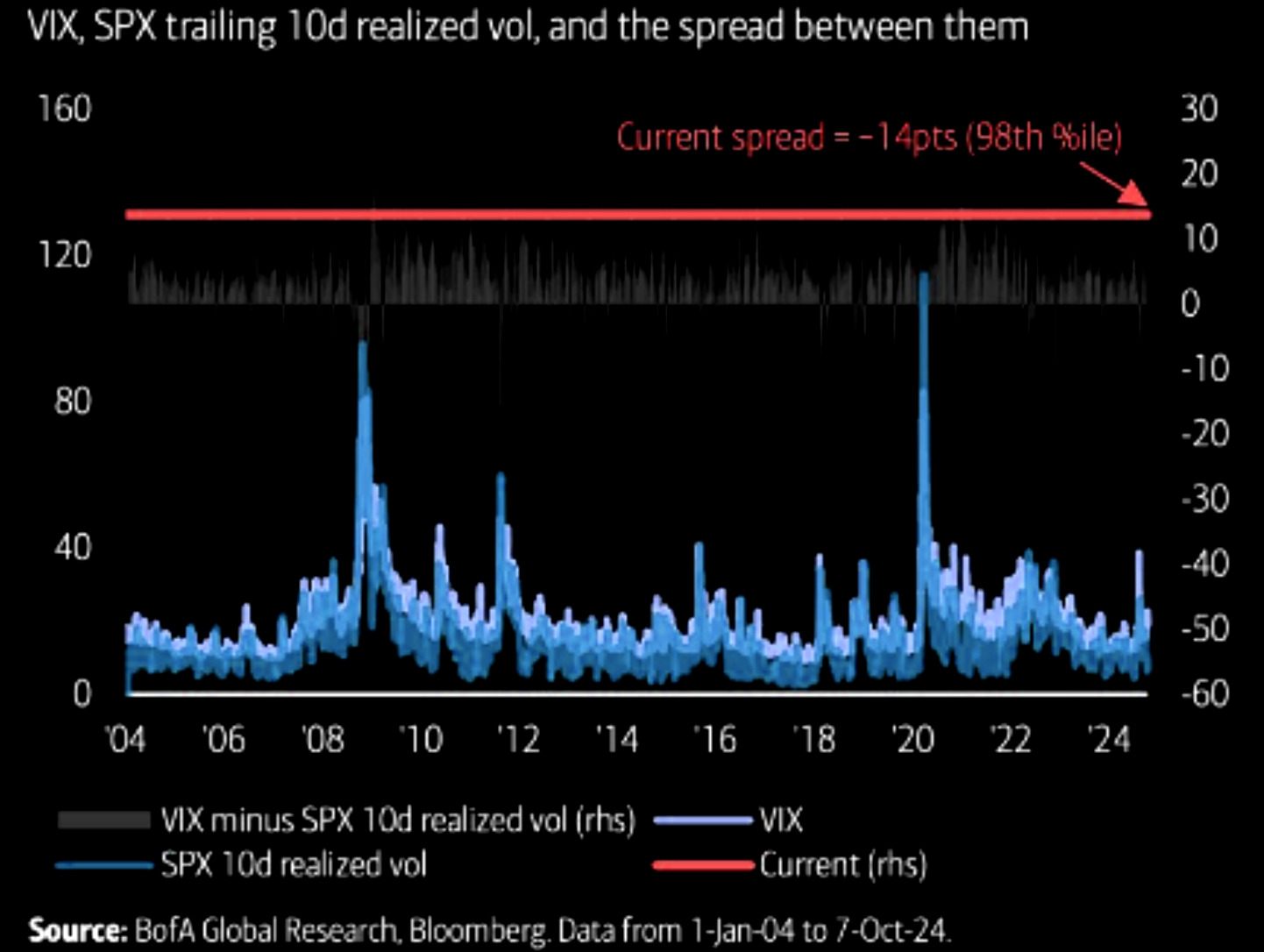

This spread between ~10% realized vol (how much the market is moving) vs implied (how much movement the market is pricing in going forward) is very unusual. The chart below from BofA (via ZH/TME) frames it well, showing its a 98th percentile difference. The takeaway is that this a well hedged market, and if those hedges prove to be not needed (with a “clean” election and/geopolitical cooling) then all that built up hedging flow will dump, which likely leads to a strong year-end equity rally.

Non-0DTE positions appear to maintain what is essentially a short call vs long tail-risk puts. These create sticky, positive gamma upside while requiring a real “punch” to flip us into a negative gamma stance. That punch doesn’t land until/unless SPX moves <5,700 SPX – at which point hedging flows could invoke a decent down trend.

Conversely, as a way to play year-end upside, we continue to look at the very low NVDA call skew. Plotted below is Jan ’25 NVDA skew, and as you can see the call wing is showing IV’s that are at their lowest in the last 90 days. This also presents as a 8th percentile skew rank (puts holding higher prices than calls).

|

| /ES | SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|---|

| Reference Price: | $5841.26 | $5792 | $577 | $20268 | $493 | $2200 | $218 |

| SG Gamma Index™: |

| 2.061 | -0.186 |

|

|

|

|

| SG Implied 1-Day Move: | 0.64% | 0.64% | 0.64% |

|

|

|

|

| SG Implied 5-Day Move: | 1.95% | 1.95% |

|

|

|

|

|

| SG Implied 1-Day Move High: | After open | After open | After open |

|

|

|

|

| SG Implied 1-Day Move Low: | After open | After open | After open |

|

|

|

|

| SG Volatility Trigger™: | $5794.26 | $5745 | $574 | $19720 | $489 | $2220 | $218 |

| Absolute Gamma Strike: | $5849.26 | $5800 | $580 | $19725 | $490 | $2200 | $220 |

| Call Wall: | $5874.26 | $5825 | $580 | $19725 | $500 | $2245 | $225 |

| Put Wall: | $5794.26 | $5745 | $560 | $18500 | $460 | $2150 | $215 |

| Zero Gamma Level: | $5764.26 | $5715 | $576 | $19617 | $488 | $2212 | $219 |

|

| SPX | SPY | NDX | QQQ | RUT | IWM |

|---|---|---|---|---|---|---|

| Gamma Tilt: | 1.313 | 0.818 | 1.863 | 1.054 | 0.804 | 0.716 |

| Gamma Notional (MM): | $776.079M | ‑$364.28M | $16.107M | $198.704M | ‑$20.825M | ‑$413.165M |

| 25 Delta Risk Reversal: | -0.062 | -0.04 | -0.062 | -0.041 | -0.042 | -0.019 |

| Call Volume: | 468.052K | 1.349M | 7.78K | 729.426K | 12.032K | 268.397K |

| Put Volume: | 858.418K | 2.03M | 9.161K | 952.60K | 14.506K | 323.183K |

| Call Open Interest: | 6.824M | 5.373M | 58.309K | 3.167M | 296.002K | 4.17M |

| Put Open Interest: | 13.818M | 14.949M | 81.427K | 6.115M | 511.125K | 8.036M |

| Key Support & Resistance Strikes |

|---|

| SPX Levels: [5800, 5750, 5700, 5000] |

| SPY Levels: [580, 575, 570, 560] |

| NDX Levels: [19725, 20000, 20500, 20200] |

| QQQ Levels: [490, 480, 485, 500] |

| SPX Combos: [(6053,94.30), (6024,75.94), (6001,98.75), (5977,70.17), (5948,94.69), (5943,78.14), (5925,84.32), (5919,85.66), (5908,69.75), (5902,99.48), (5891,77.38), (5879,85.21), (5873,97.93), (5867,87.53), (5862,89.53), (5856,70.39), (5850,99.76), (5844,83.89), (5838,94.44), (5833,99.92), (5827,99.91), (5821,97.65), (5815,87.95), (5809,90.24), (5804,87.37), (5798,99.76), (5792,90.82), (5786,70.79), (5780,88.65), (5775,92.82), (5769,71.94), (5757,80.54), (5746,99.01), (5740,98.93), (5723,85.91), (5699,74.68), (5688,72.87), (5670,78.60), (5647,83.12), (5624,84.59), (5618,86.16), (5601,89.24), (5549,75.81), (5520,75.61)] |

| SPY Combos: [577.69, 575.4, 582.85, 575.98] |

| NDX Combos: [20553, 20350, 20390, 19722] |

| QQQ Combos: [480.03, 500.1, 495.2, 489.82] |

0 comentarios